Como Llenar Un Money Order Para El Irs

Okay, friend, so you gotta pay the IRS? Don't we all, eventually? Ugh. But hey, at least you're tackling it head-on! And you're using a money order – smart move! It's like sending cash, but, you know, without the actual cash disappearing en route. We've all seen enough movies to know that's a real possibility!

Now, filling out a money order for the IRS? It sounds intimidating, right? Like some kind of tax-related dark art? Fear not! It's actually pretty straightforward. Think of it as filling out a particularly boring form. We've all been there. And trust me, once you've done it once, you'll be a pro. You could even teach a class! (Okay, maybe not, but you'll *feel* like you could.)

Gather Your Arsenal (aka Stuff You'll Need)

Before we dive into the nitty-gritty, let's make sure you have everything you need. You wouldn’t want to get halfway through and realize you're missing a crucial piece, right? That’s happened to me more times than I care to admit. "Oh, you mean I needed *that* form? Yesterday?!"

Here’s the checklist:

- The money order itself: Obviously! From the post office, your bank, a grocery store – wherever you snagged it. Make sure it’s blank and yearning for your details.

- A black or dark blue pen: Because clarity is key! And those fun, sparkly gel pens? Save 'em for your journal, not your taxes. Trust me on this.

- Your IRS payment voucher (Form 1040-V): This little guy is your secret weapon. It has all the magic numbers and codes the IRS craves. Don’t have one? You can download it from the IRS website. Seriously, the IRS website is surprisingly helpful… sometimes.

- Your Social Security Number (SSN) or Employer Identification Number (EIN): Depends on whether you're paying personal or business taxes, naturally. Keep that info handy!

- The tax year for which you're paying: Don't accidentally pay for 2020 when you meant 2023! That would be a *major* headache.

- The specific tax form you're paying for: 1040? 4868? Something else entirely? This will be on your payment voucher.

Decoding the Money Order: A Field Guide

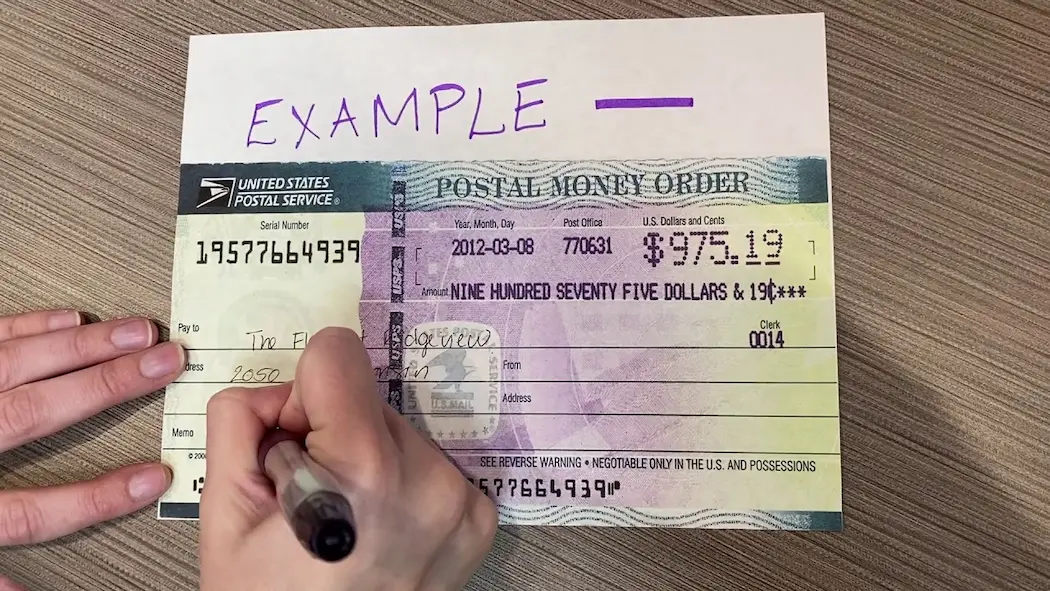

Okay, so you’re staring at this little piece of paper, and it’s got all these blank lines… What do they all *mean*? Don't panic! Let’s break it down section by section. Think of it as an archaeological dig, but instead of fossils, you're unearthing… financial responsibility. Fun, right?

"Pay to the Order Of": The IRS's Royal Title

This is the most important part! This is where you write "United States Treasury" or "U.S. Treasury". No abbreviations, no nicknames ("Uncle Sam" is cute, but not accepted here). This tells the bank who's getting the money. Write it clearly and legibly. You don’t want your payment ending up in the hands of some random guy named “United.”

"From": That's You, Rockstar!

This is where you write your name and address. Pretty simple, right? Make sure it matches the name and address on your tax return. Consistency is key with the IRS. They're not big fans of surprises. Use the same name as your tax return, if you filed under a specific name.

"Address": More of You!

This should be your current mailing address. The one the IRS knows and loves (or at least tolerates). If you've moved recently, make sure you've updated your address with the IRS! Seriously, do it. Future you will thank you. Otherwise, you'll get frantic calls from a friend with your mail, two states away.

"Amount": Show Me the Money!

Write the amount you're paying in both numbers and words. This is crucial! If there's a discrepancy between the two, the bank might reject the money order. And nobody wants that kind of drama. For example, if you're paying $123.45, write "$123.45" and "One hundred twenty-three dollars and forty-five cents." Make sure they *match*! Double-check! Triple-check! I cannot stress this enough. Imagine the horror of writing 'One hundred dollars' when you meant to write 'Two hundred'?

"Memo" or "For": The IRS Secret Code Zone

This is where things get a little more specific, and your Form 1040-V comes into play. This is super, super important. This is where you provide the IRS with the information they need to properly credit your payment. The payment voucher, you see, is the key.

Here's what you need to include, carefully and accurately:

- Your Social Security Number (SSN) or Employer Identification Number (EIN): Whichever is applicable to the taxes you're paying. Don’t mix them up! That'd be like wearing socks with sandals – a tax faux pas!

- The tax year: For example, "2023" or "2024."

- The tax form number: For example, "1040" or "4868." Use the abbreviation if it is very long.

It might look something like this: "SSN: 123-45-6789, 2023, 1040" or "EIN: 98-7654321, 2024, 941." You get the idea. Follow the instructions on your payment voucher *exactly*. This is not the time for creative interpretation. Play it safe!

"Purchaser's Signature" or "Sign Here": Your John Hancock Moment

Don't forget to sign your name! This is your official declaration that you're, you know, you. Use the same signature you normally use. Nothing fancy required. Unless your normal signature *is* fancy, in which case, go for it! Just make sure it's legible enough to be, you know, identified as yours.

Double-Check, Triple-Check, and Then Check Again!

Seriously, before you send that money order off into the bureaucratic abyss, review *everything*. Did you write the correct amount? Did you spell "Treasury" correctly? Did you include all the necessary information in the "Memo" section? Did you sign it? It's better to spend an extra five minutes checking your work than to deal with the hassle of a rejected payment (or worse, an audit!). And an audit is, shall we say, *not* a fun experience. So, take a deep breath and check.

Making Copies: Your Insurance Policy

Before you send anything to the IRS, make a copy of the completed money order. Both sides! This is your proof of payment. You never know when you might need it. It's like having an insurance policy against bureaucratic mishaps. You hope you never have to use it, but you're really glad you have it if you do. Keep the copy in a safe place with your other tax documents. Preferably not under your mattress. (Unless you *want* to attract the attention of the tax man... just kidding! Mostly.)

Sending It Off: Bon Voyage, Money!

Now, for the grand finale: mailing your money order. The address you need to send it to will be on your payment voucher (Form 1040-V) or the instructions for the specific tax form you're paying. Make sure you use the correct address! The IRS has different processing centers for different types of payments. Sending it to the wrong address could delay your payment or, worse, cause it to get lost in the system. And nobody wants that. Use the address associated with the state/region for which you pay the tax.

Use regular mail. There's no need to pay extra for certified mail or tracking. Unless you're feeling particularly paranoid, in which case, go for it. But regular mail is usually sufficient. Just make sure you mail it well before the deadline to avoid any late payment penalties. Nobody likes those. Especially not the IRS.

A Few Extra Tips (Because Why Not?)

- Don't fold the money order excessively. The machines that process them can be finicky.

- Use a sturdy envelope. You don't want your money order getting damaged in transit.

- Keep your money order receipt! This is the little stub you get when you buy the money order. It's proof that you purchased it.

- If you have any questions, call the IRS. Yes, I know, the thought of calling the IRS is terrifying. But they're actually pretty helpful… sometimes. Be prepared to wait on hold for a while, though. Maybe put on some relaxing music and grab a cup of coffee.

You Did It! Now Celebrate!

Congratulations! You've successfully filled out a money order for the IRS. You've navigated the bureaucratic maze and emerged victorious! Now, go treat yourself to something nice. You deserve it! Maybe a massage? A fancy coffee? A new pair of socks? Whatever makes you happy. Just don't spend all your tax refund in one place. (If you're getting a refund, that is. If not, well, at least you're done with this part!) You got this! Filing a money order is a tough task, and now you can relax knowing that you've done it correctly.

See? It wasn't so bad after all, right? Okay, maybe it was a *little* bad. But you survived! And now you're armed with the knowledge and confidence to tackle any tax-related task that comes your way. Go forth and conquer! Just, you know, maybe not the IRS. They tend to frown upon that.