Should I Pay Tithes On Social Security

Okay, let's talk about something that can feel a little... spicy. Tithing on Social Security. Yep, that's right. The age-old question of whether or not to give 10% of that government check to your church. It's a real head-scratcher for a lot of folks, and honestly, there's no single, easy answer. But let's dive in and see if we can make sense of it together, shall we?

The Heart of the Matter: What is Tithing Anyway?

First, a quick refresher. Tithing, at its core, is about giving back a portion of what you receive. Traditionally, it's 10% – a tenth – of your income. The idea is to acknowledge God as the source of all blessings and to support the work of the church (or whatever religious organization you're affiliated with). Think of it as a way to say, "Hey, I appreciate everything I have, and I want to share it." It's an act of faith, gratitude, and commitment.

Now, the *burning* question: Does Social Security count as something you should tithe on? That's where things get a bit… blurry.

Arguments For Tithing on Social Security

Some people feel strongly that *all* income should be tithed, regardless of its source. Their reasoning is pretty straightforward: if you're receiving money, and it's helping you live, then it's a blessing and should be tithed. They see Social Security as just another form of income, like a paycheck, a pension, or even winning the lottery (hey, a girl can dream!).

Think of it this way: You plant a garden. You work hard, you water it, you weed it, and eventually, you harvest a beautiful crop of tomatoes. You feel grateful for the harvest, right? Some folks see tithing on Social Security in a similar light. They might say, "I worked for this, I paid into the system, and now I'm receiving benefits. It's a blessing, and I want to give back."

Another angle is that tithing demonstrates faithfulness and trust in God. It's a way of saying, "I trust that you will provide for me, even as I give back a portion of what I receive." It's about prioritizing spiritual values over material possessions. Consider a farmer who diligently sows seeds each season, trusting that the land will yield a harvest. Similarly, some view tithing as an act of planting seeds of faith, believing that God will bless their faithfulness.

Arguments Against Tithing on Social Security

On the other hand, many argue that Social Security is *different*. They see it as a return on investment, not necessarily a blessing in the same way as a job or a gift. After all, you (or your employer) paid into Social Security your entire working life. It's money you earned and contributed, now being returned to you during retirement. It's like withdrawing from a savings account you've diligently funded over the years.

Imagine you've saved up for a rainy day. When that rainy day finally comes, and you use your savings to fix a leaky roof, would you tithe on that money? Some people would say no, because it's money you already set aside. The same logic applies here. They might say, "I already tithed on the income I earned while working. Social Security is just a return of those funds."

Furthermore, some individuals on Social Security are barely making ends meet. They may struggle to cover basic necessities like housing, food, and healthcare. For them, tithing 10% of their Social Security check would create a significant hardship. In these cases, compassion and practicality might outweigh the perceived obligation to tithe. It's like trying to squeeze water from a stone – sometimes, there's just not enough to give.

It is important to consider that some pastors and religious leaders suggest that giving should be joyful and not burdensome. If tithing on Social Security causes undue stress or hardship, it might be more appropriate to explore other ways to give back, such as volunteering time or donating goods.

What Does the Bible Say? (Spoiler Alert: It's Not Specific)

Here's the tricky part: the Bible doesn't explicitly address tithing on Social Security. Most biblical passages about tithing refer to agricultural products, livestock, or earned income. So, we're left to interpret the principles behind tithing and apply them to our own situations.

It is worthwhile to read Malachi 3:10, which is often cited in discussions about tithing. However, consider its historical context and application to modern financial situations.

So, What's a Person to Do?

Ultimately, the decision of whether or not to tithe on Social Security is a personal one. There's no right or wrong answer. Here are a few things to consider as you wrestle with this question:

* Your Financial Situation: Can you *afford* to tithe on Social Security without sacrificing your basic needs? Be honest with yourself about your financial realities. If you are struggling to make ends meet, it is more important to focus on meeting your basic needs. * Your Beliefs: What does your faith tradition teach about tithing? How do *you* interpret those teachings? Do you believe that all income should be tithed, regardless of its source? Are there any specific circumstances that would change your mind? * Your Heart: Is your decision motivated by guilt, obligation, or genuine gratitude? Are you giving out of a joyful and willing heart, or are you feeling pressured to do so? Remember, God cares about the motives behind our actions. * Your Church's Stance: Talk to your pastor or spiritual advisor. What's their perspective on tithing on Social Security? While their opinion shouldn't be the *only* factor, it can be helpful to get their guidance.Remember that tithing is a matter between you and God. There is no one-size-fits-all answer to this question. Take time to pray, reflect on your beliefs, and consider your financial situation. Make a decision that aligns with your conscience and brings you peace.

Beyond the 10%: Giving Back in Other Ways

Let's not forget that giving back isn't *only* about tithing money. There are countless ways to support your community and live out your faith. Consider these alternatives or additions to monetary tithing:

* Volunteering Your Time: Offer your time and skills to organizations that are making a difference. Whether it's serving meals at a soup kitchen, tutoring children, or visiting the elderly, your time is a valuable gift. * Donating Goods: Clear out your closet and donate gently used clothing, furniture, or household items to charities that can distribute them to those in need. * Supporting Missions: Contribute to organizations that are working to spread the gospel and provide humanitarian aid around the world. * Helping Your Neighbors: Offer a helping hand to those in your own community. Whether it's mowing a lawn, running errands, or providing transportation, small acts of kindness can make a big difference.Giving back is not just about *money*; it's about using your resources, talents, and time to make a positive impact on the world around you. Find ways to give that are meaningful and fulfilling, and that align with your passions and values.

So, should you tithe on Social Security? The answer, my friend, is up to you. But hopefully, this has given you some food for thought (pun intended!). Whatever you decide, remember that giving should be an act of love, joy, and gratitude. Happy giving!

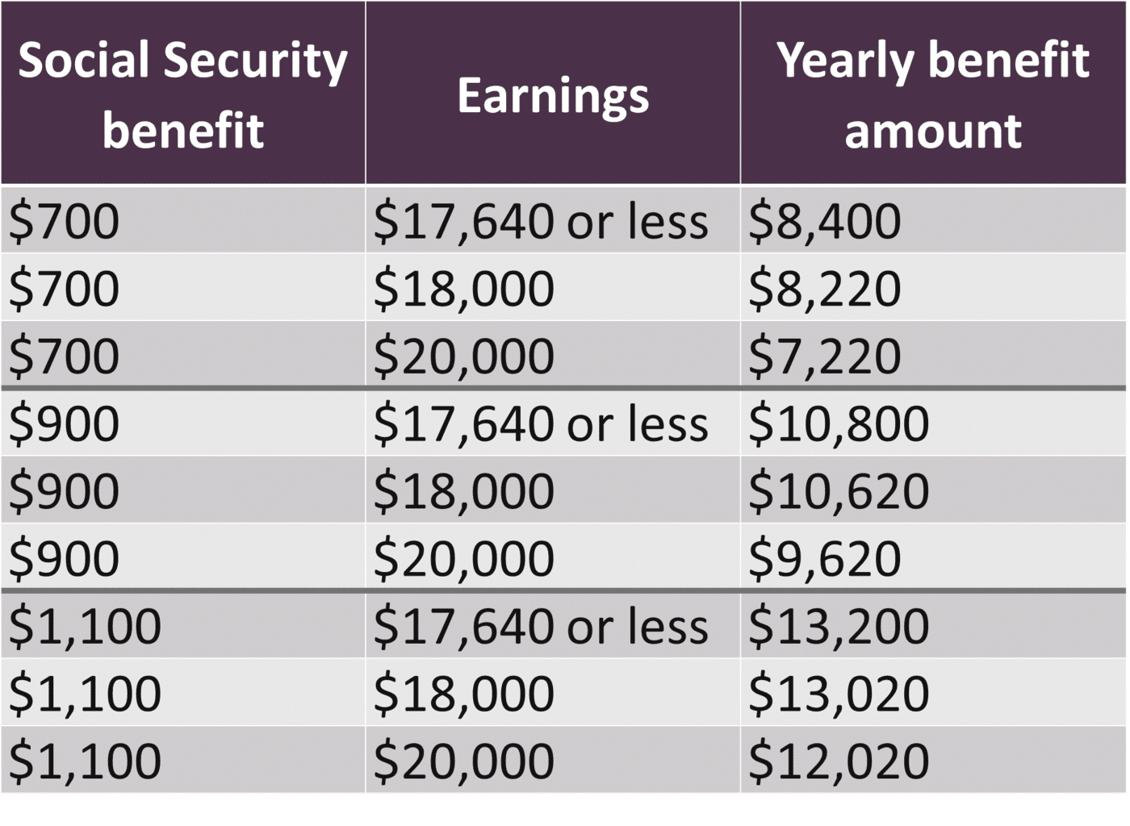

:max_bytes(150000):strip_icc()/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)