Ever stared longingly at that stack of gift cards burning a hole in your wallet? You know, the ones you got last Christmas, or for your birthday, or maybe even won in a raffle? And a little voice whispers, "Could these magically erase my credit card bill?"

Well, buckle up, buttercup, because we're about to dive into the wonderful, slightly disappointing, but ultimately practical world of gift cards and credit card payments!

The Dream: Paying Bills with Gift Cards

Imagine this: You waltz into your bank, armed with a hefty stack of gift cards to your favorite stores. You confidently tell the teller, "I'd like to pay off my Visa bill with these, please!"

Think of the possibilities! You could be decluttering your wallet and simultaneously conquering your debt! Talk about a win-win!

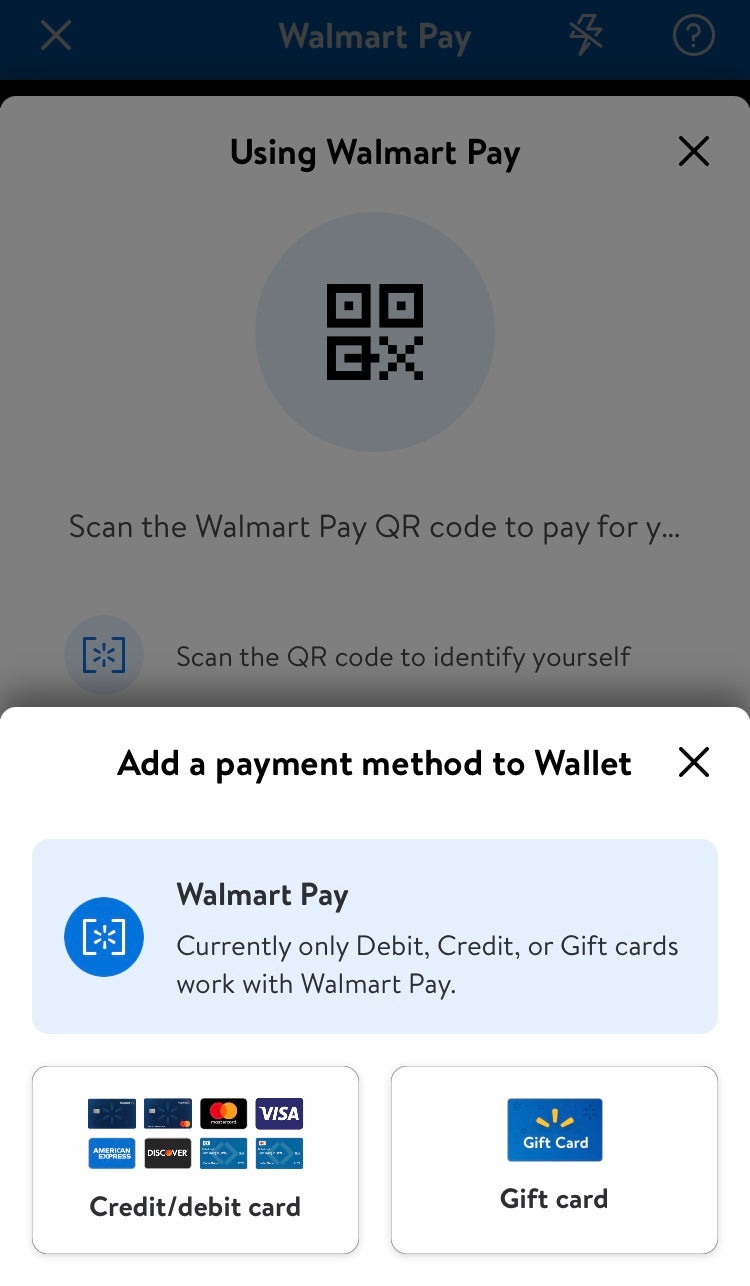

Or maybe you envisioned some sort of online wizardry? Uploading photos of your gift cards into a mystical payment portal and watching your credit card balance vanish into thin air? Pure bliss, right?

The Reality Check (A Gentle Nudge Back to Earth)

Okay, deep breaths. The truth is, paying your credit card directly with gift cards is generally a no-go.

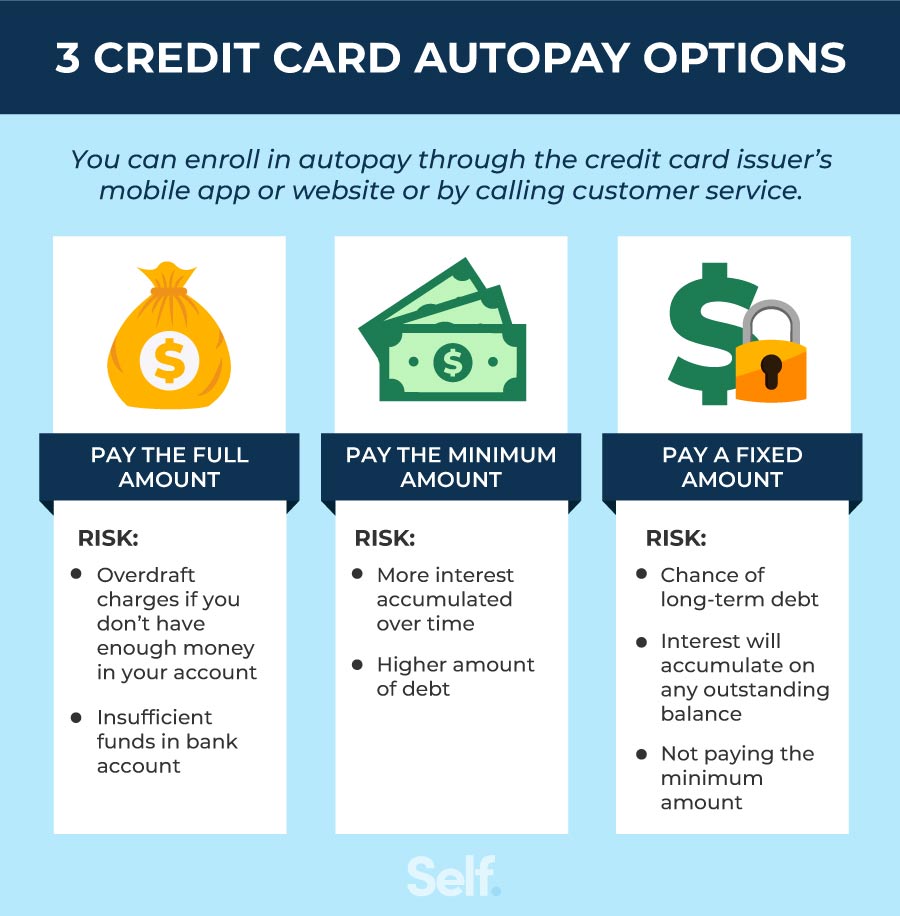

Think of it this way: credit card companies want, well, cash. Or something that can be easily turned into cash, like a check or an electronic transfer.

A gift card is basically a pre-paid voucher specifically for a particular store or business. It's like saying, "I give you this for goods from The Coffee Bean, not for paying your bills."

But Wait! There's a Slight Twist!

Don't throw those gift cards into the abyss just yet! There are still ways you can strategically deploy them in your financial battle.

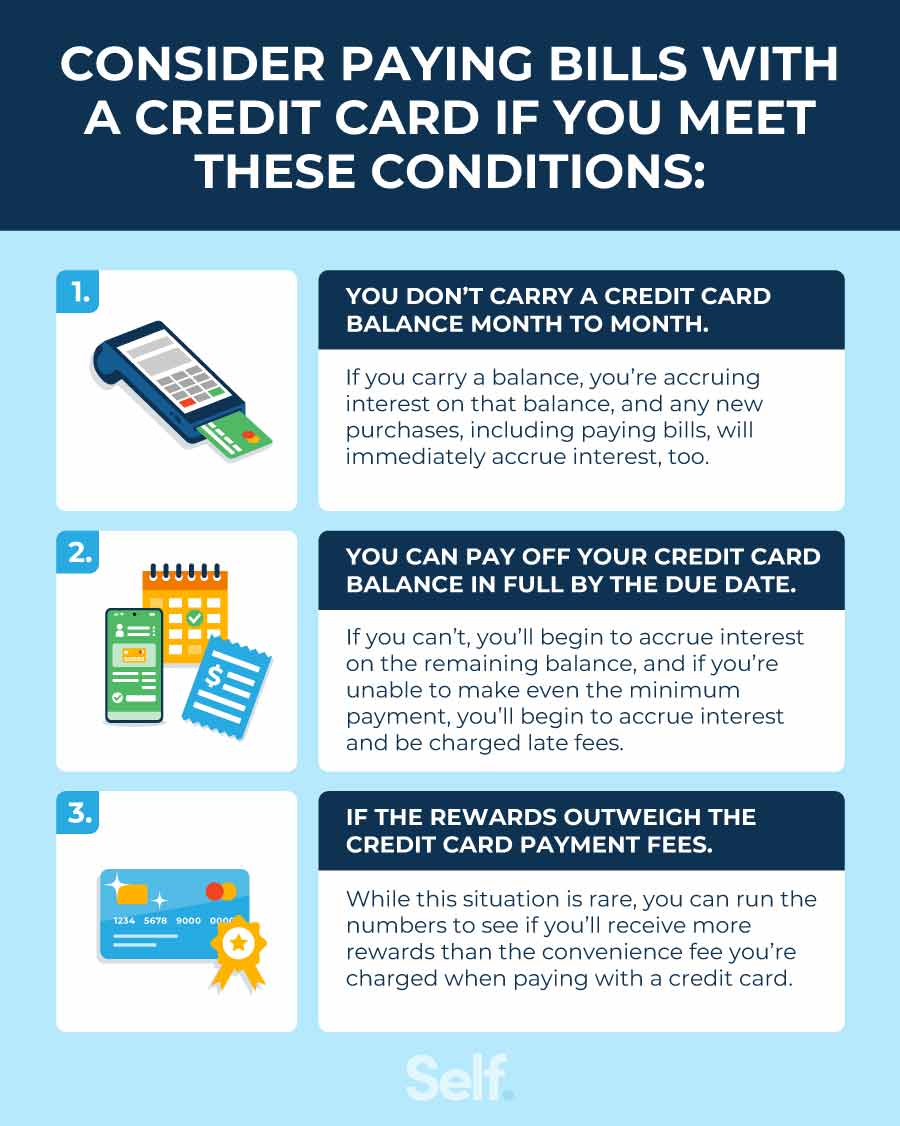

Here's the clever bit: use the gift cards to buy things you normally would have charged to your credit card. This frees up cash that you can then use to pay down your balance.

For example, if you have a gift card to Target and you usually buy your groceries with your credit card, use the gift card to pay for your groceries instead! Then, take the cash you *would* have spent on groceries and apply it to your credit card payment.

Other Smart Strategies

Consider reselling unwanted gift cards. Sites like Raise or CardCash let you sell them for a slightly reduced value. Then, you can use that cash to make a payment!

Think of it as turning your unwanted gift cards into little debt-fighting ninjas! They may not directly attack your credit card balance, but they're definitely helping in the overall financial war.

Another option? Regift them! Okay, maybe not the *most* exciting solution, but if you have a gift card someone else would genuinely love, you could save yourself from buying them a gift later and use that money for a credit card payment!

The Moral of the Story

While you can't usually wave a gift card like a magic wand and make your credit card debt disappear, you *can* use them strategically to your advantage.

Think of them as little financial allies, helping you chip away at your balance one purchase at a time.

So, dust off those gift cards, strategize your spending, and get ready to conquer your credit card debt like a boss! You got this!