So, you're thinking about diving into the swirling vortex that is credit cards, eh? And you've probably, like any sane person in the 21st century, Googled something along the lines of: "Does applying for a credit card hurt my credit? Reddit."

Welcome to the club! It's a question that haunts us all, like the persistent feeling that you've forgotten something important when you leave the house.

The Dreaded Credit Card Application: Friend or Foe?

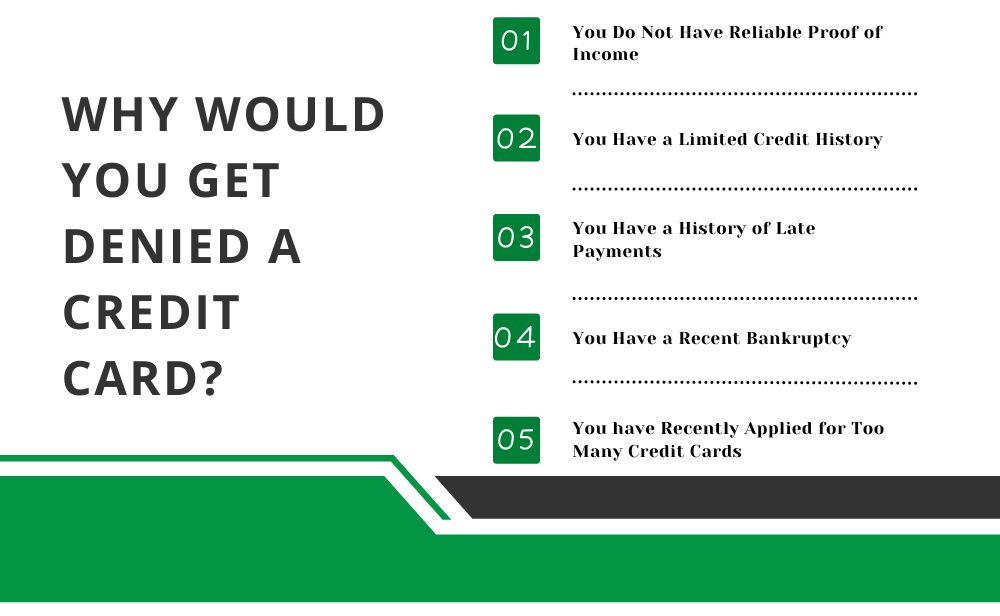

Let's cut to the chase: applying for a credit card can ding your credit score. But it's usually not as dramatic as you might fear.

Think of it like asking someone out on a date. A little nerve-wracking, maybe a bit of temporary self-doubt, but rarely catastrophic. Unless you're asking out, like, ten people at once.

The "Hard Inquiry" Monster

Here's where the scary term "hard inquiry" comes in. When you apply for a credit card, the lender checks your credit report. This leaves a little mark, a temporary blip, on your credit history.

Each inquiry usually drops your score by a few points. It’s usually a small dip, and nothing to lose sleep over.

Imagine it's like a tiny mosquito bite. Annoying for a bit, but it fades away relatively quickly.

The Reddit Rabbit Hole: Tales from the Credit Card Trenches

Now, if you've actually spent time on Reddit searching for answers, you've probably seen everything from calm, rational explanations to full-blown credit score apocalypse scenarios.

Some folks will tell you that applying for even one card will ruin your financial life forever. Others will scoff and say they apply for cards like they're collecting stamps.

The truth, as always, lies somewhere in the middle. Don't believe everything you read online, even this article!

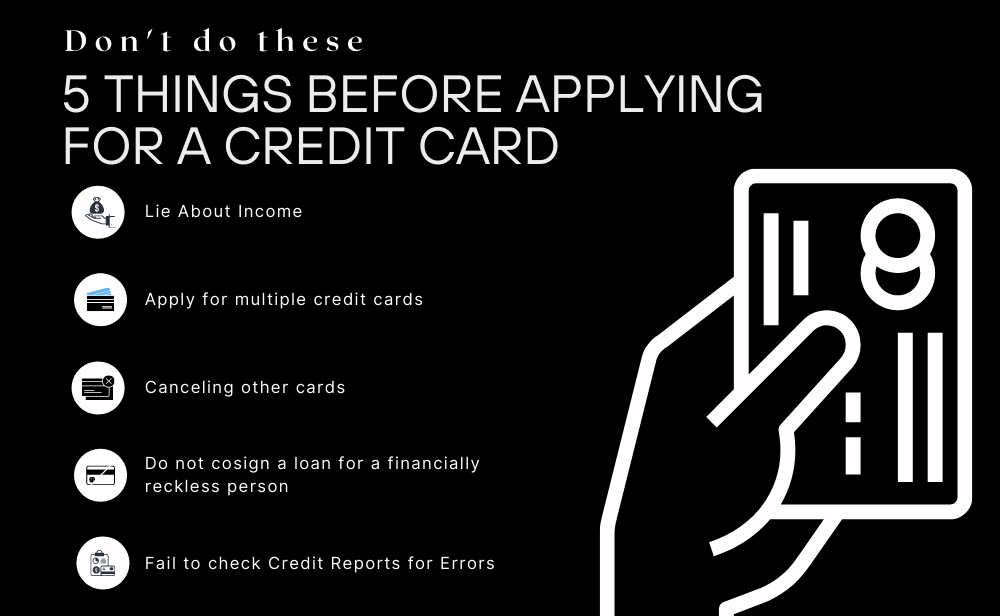

The Art of the Strategic Application

Here’s a secret: smart credit card management isn’t about avoiding applications altogether. It's about being strategic.

Think of it like this: applying for a bunch of cards in a short period is like trying to win the lottery by buying hundreds of tickets at once. It might work, but it's probably not the best strategy.

Instead, focus on applying for cards that you actually need and that align with your financial goals. It might even improve your credit in the long run.

Beyond the Score: The Bigger Picture

Ultimately, your credit score is just a number. A tool, not a prison sentence.

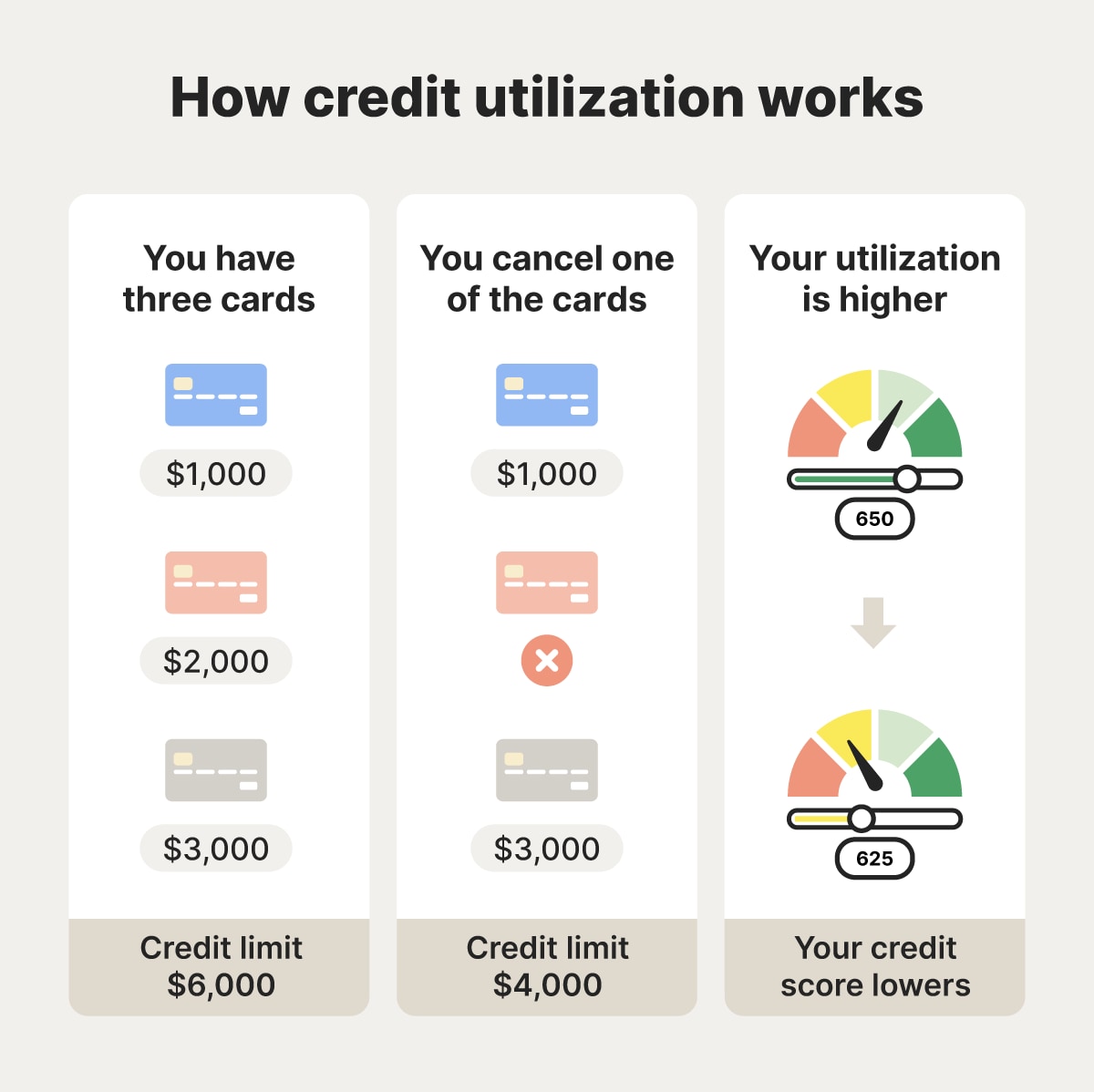

Building good credit habits, like paying your bills on time and keeping your balances low, is far more important than obsessing over a few points.

So, take a deep breath, do your research, and apply for that credit card (or don't!). Just remember that it's all part of the financial journey.

And maybe, just maybe, avoid reading too much about it on Reddit late at night. Your sanity will thank you.

Remember the story of Amy on a Reddit forum. She went from fearing credit cards to using them responsibly to earn rewards and build her credit score. She's a prime example of that it is possible.

So don't be scared. Go out there and conquer your financial fears!