So, you're thinking about starting your own business in the Bay State? Awesome! Creating an LLC in Massachusetts is a fantastic way to protect your personal assets while you chase your entrepreneurial dreams. But before you start picturing yourself as the next Mark Zuckerberg of artisanal donut shops, let's talk about the nitty-gritty: how much is this whole shebang gonna cost?

The Main Event: Filing Fees

Think of the filing fee as your entry ticket to the LLC party. In Massachusetts, the main cost is the fee to file your Articles of Organization with the Secretary of the Commonwealth. This is the document that officially creates your LLC.

Here's the big reveal: It's currently $500. Okay, maybe not pocket change, but think of it as an investment in your amazing future! You could probably blow that on a weekend trip to Salem...or you could build a business!

Paying the Piper (Electronically!)

Massachusetts prefers you file and pay electronically, which honestly, is just easier for everyone. Imagine trying to mail a check these days? So last century. They even accept major credit cards.

The Not-So-Scary Publication Requirement

Massachusetts is a bit of a stickler for making sure the world knows you're officially in business. That's why they require you to publish a notice of your LLC's formation. Don't worry, it’s not as intimidating as it sounds!

Within three months of forming your LLC, you need to publish a notice in a newspaper that circulates in the city or town where your LLC has its principal place of business. Think of it as shouting your business from the rooftops… except you’re paying a newspaper to do it.

The cost of this publication can vary wildly, depending on the newspaper. You might be looking at anywhere from $50 to $500, depending on the paper's rates and the length of your notice. Call around and compare prices! Seriously, negotiate. Pretend you're buying a used car from a guy named Vinny. Every dollar counts!

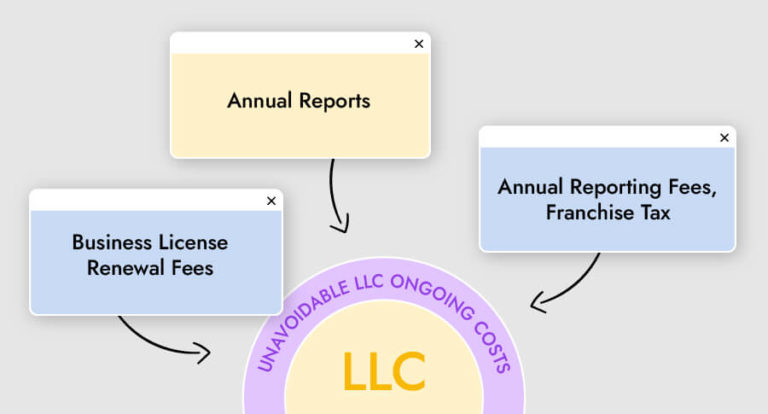

Annual Report Antics (aka, Keeping it Legal)

Once your LLC is up and running, you'll need to file an annual report with the Secretary of the Commonwealth. This is basically a quick update to confirm your LLC's information is still accurate.

The good news? The filing fee for the annual report is a much more reasonable $500. Think of it as paying your dues to the Massachusetts entrepreneurial club. You gotta stay current to keep those benefits!

Optional Expenses: Because Life Happens

While the above are the main costs, there are a few other potential expenses to consider. These are more "it depends" situations.

For example, you might want to hire a lawyer to help you draft your Operating Agreement. This document outlines the rules and responsibilities of the LLC members. A lawyer's fees can vary widely, so shop around and get quotes.

You might also need to register a trade name (also known as a "doing business as" or DBA name) if you're operating your LLC under a name that's different from its official name. The filing fee for a trade name registration is relatively small, usually around $30.

The Grand Total: Not as Scary as You Thought!

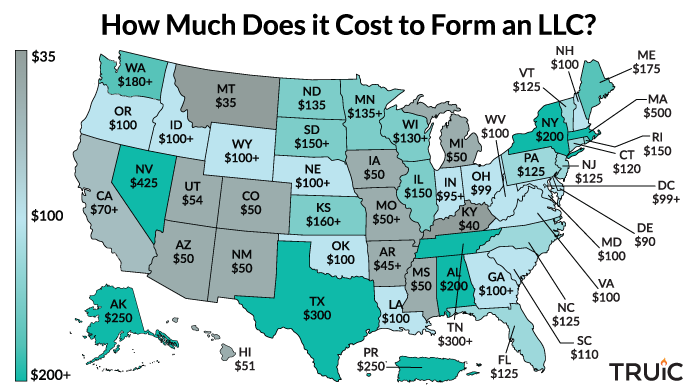

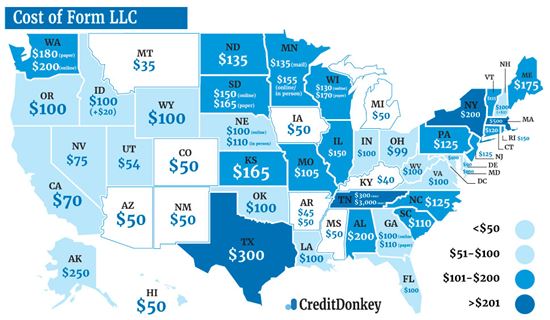

So, how much does an LLC cost in Massachusetts? Let's break it down:

- Articles of Organization Filing Fee: $500

- Publication Requirement: $50 - $500 (variable)

- Annual Report Filing Fee: $500 (annually)

- Optional Expenses (Lawyer, DBA, etc.): Varies

In a perfect world, you could get started for around $550 (assuming you snag a super cheap newspaper ad). More realistically, budget for around $1000 to cover all your bases for the first year, including that publication fee.

Starting an LLC in Massachusetts is an investment in yourself and your dreams. It's not free, but it's also not going to break the bank. Now go out there and build something amazing! Massachusetts (and your bank account) awaits!

![How Much Does It Cost to Start An LLC in Massachusetts? [2025] - How Much Does An Llc Cost In Ma](https://www.i1.creditdonkey.com/image/1/550w/how-much-does-an-llc-cost-in-massachusetts.png)

![How Much Does an LLC Cost Per Year? [2025] - How Much Does An Llc Cost In Ma](https://www.i1.creditdonkey.com/image/1/550w/how-much-does-an-llc-cost-per-year.jpg)