Okay, let's talk about something that sounds kinda boring but is actually super important: Plan G! You might be thinking, "Plan G? Sounds like a secret government operation!" But trust me, it's way less cloak-and-dagger and way more "peace of mind" when it comes to your health.

Now, the big question everyone asks: How much does this magical Plan G cost a month? Buckle up, because the answer is... it depends! Don't worry, I'm not going to leave you hanging. Think of it like pricing out a delicious pizza. The toppings (your specific health needs) and where you get it (your location) all play a part.

Factors That Shake Up the Price of Plan G

Location, location, location! Just like buying a house, where you live can seriously impact the price of Plan G. Living in a bustling city might mean a slightly higher premium than chilling in a quiet rural town. Go figure!

Your age also plays a role. The older you are, generally the more you'll pay. Think of it as paying your dues for all those years of wisdom and awesome life experiences.

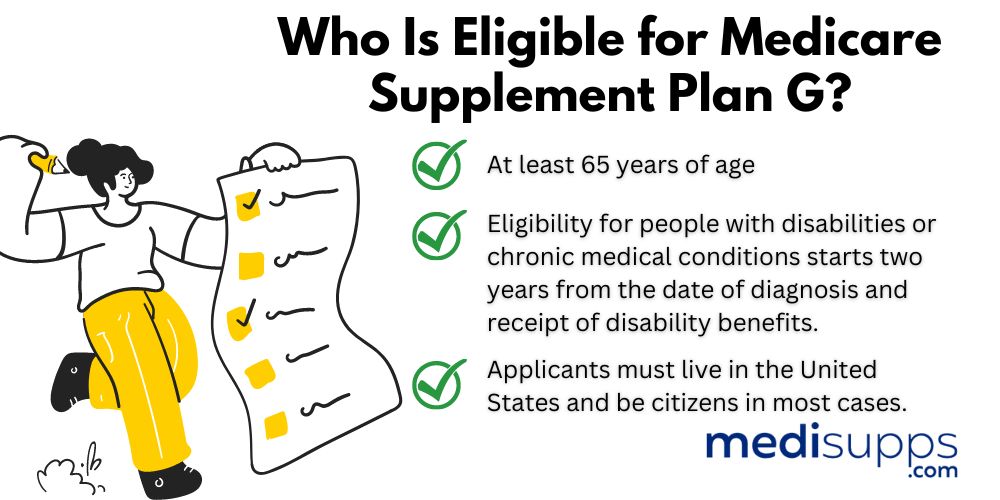

Then there's your health. While Plan G doesn't usually require medical underwriting (meaning they won't deny you coverage based on pre-existing conditions), the price can still be influenced by your overall health profile when you initially enroll.

So, What's a Realistic Price Range?

Alright, let's get down to brass tacks. While it's impossible to give an exact number without knowing your specific situation, Plan G generally ranges from around $100 to $250 (or more) per month. That’s a pretty wide range, I know!

But remember, this is an investment in your health and well-being. Think of it as a safety net that catches you when unexpected medical bills try to take a tumble.

Consider it a worthwhile expense in the long run to secure good health and have access to excellent care. It could save you from a huge financial headache down the road.

Why is Plan G so Popular? (Spoiler: It's Awesome)

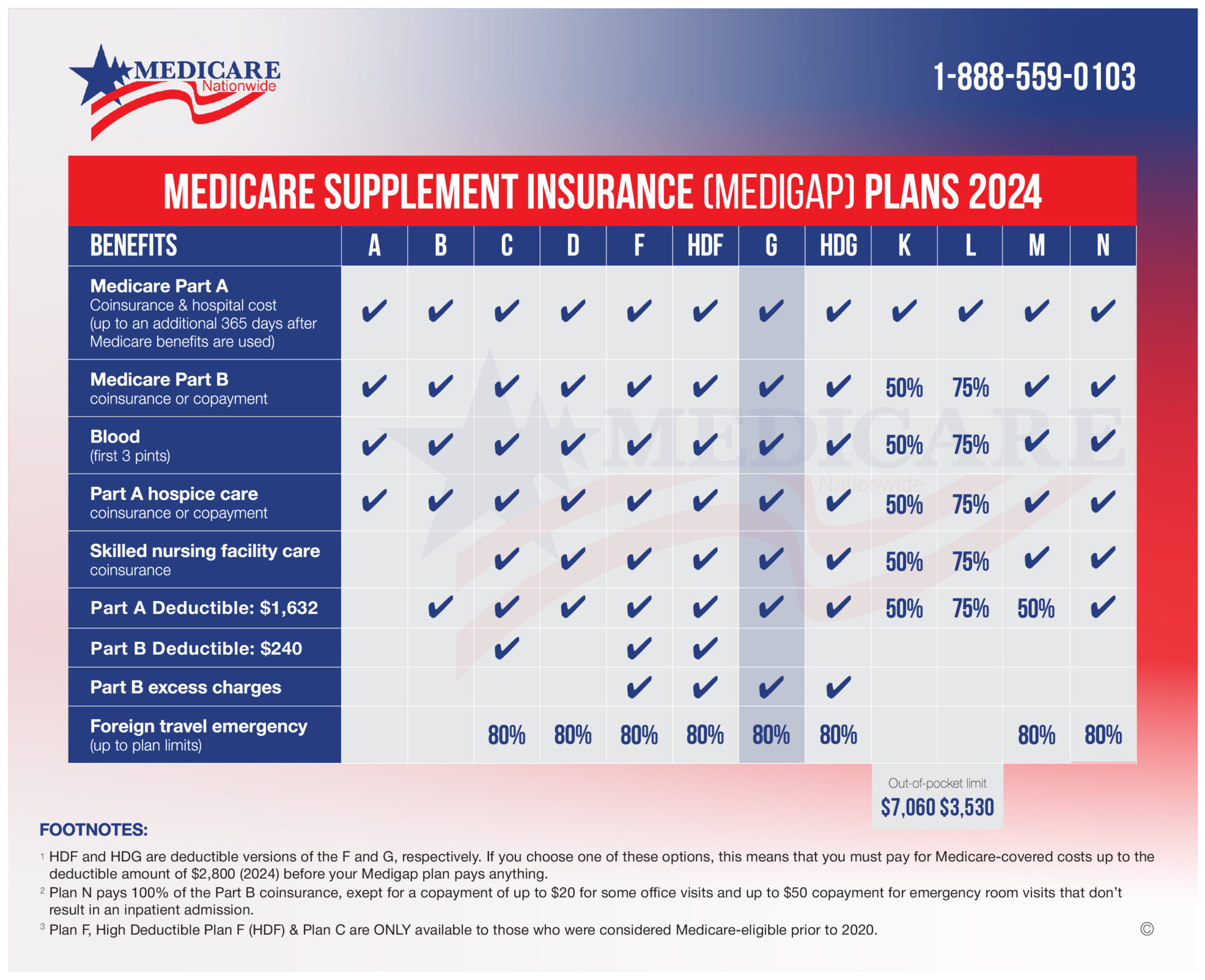

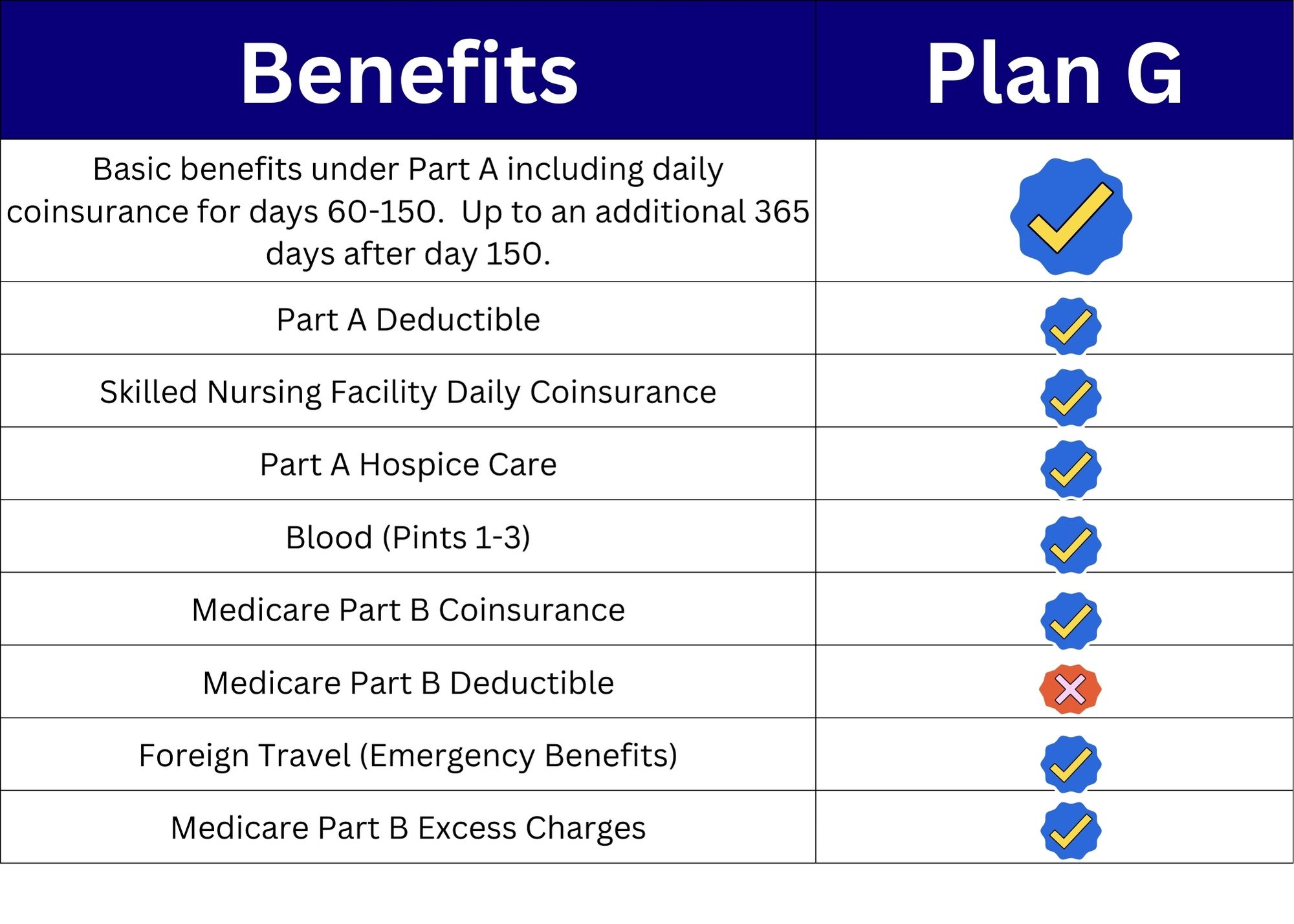

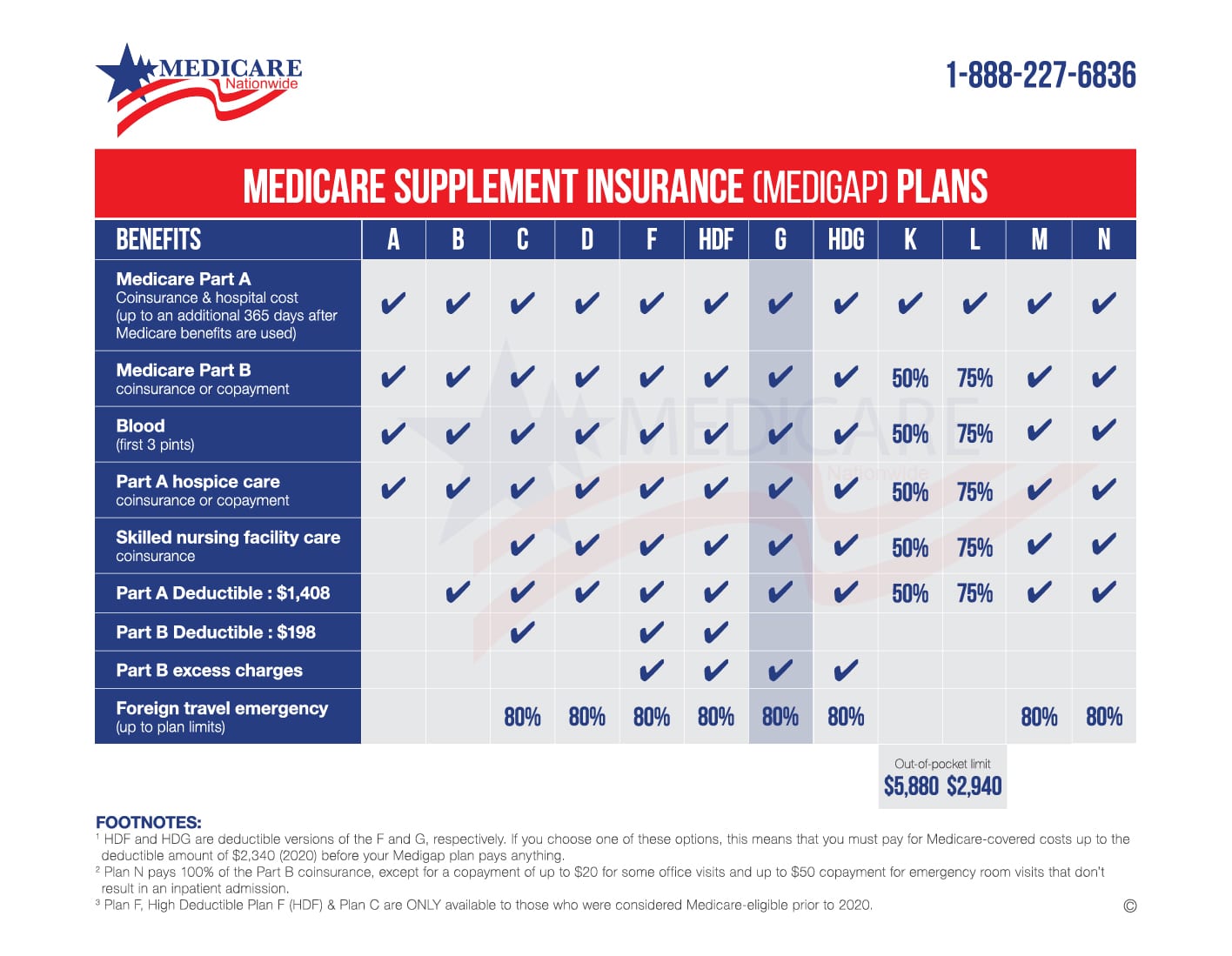

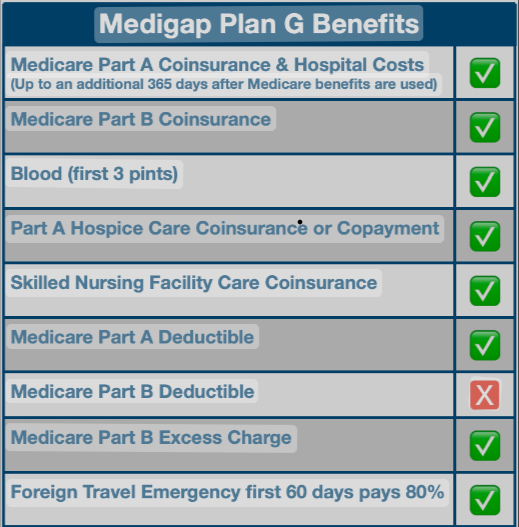

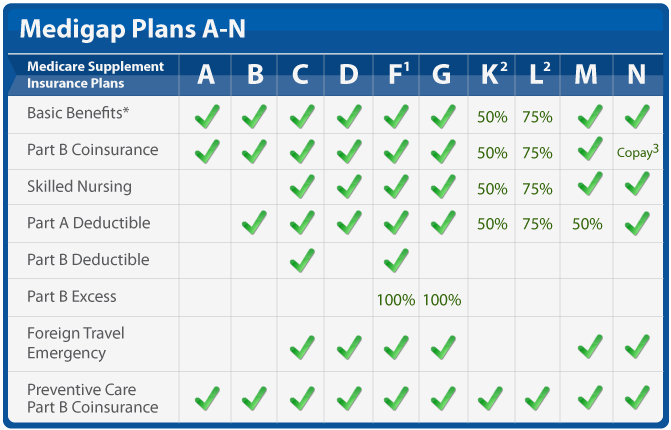

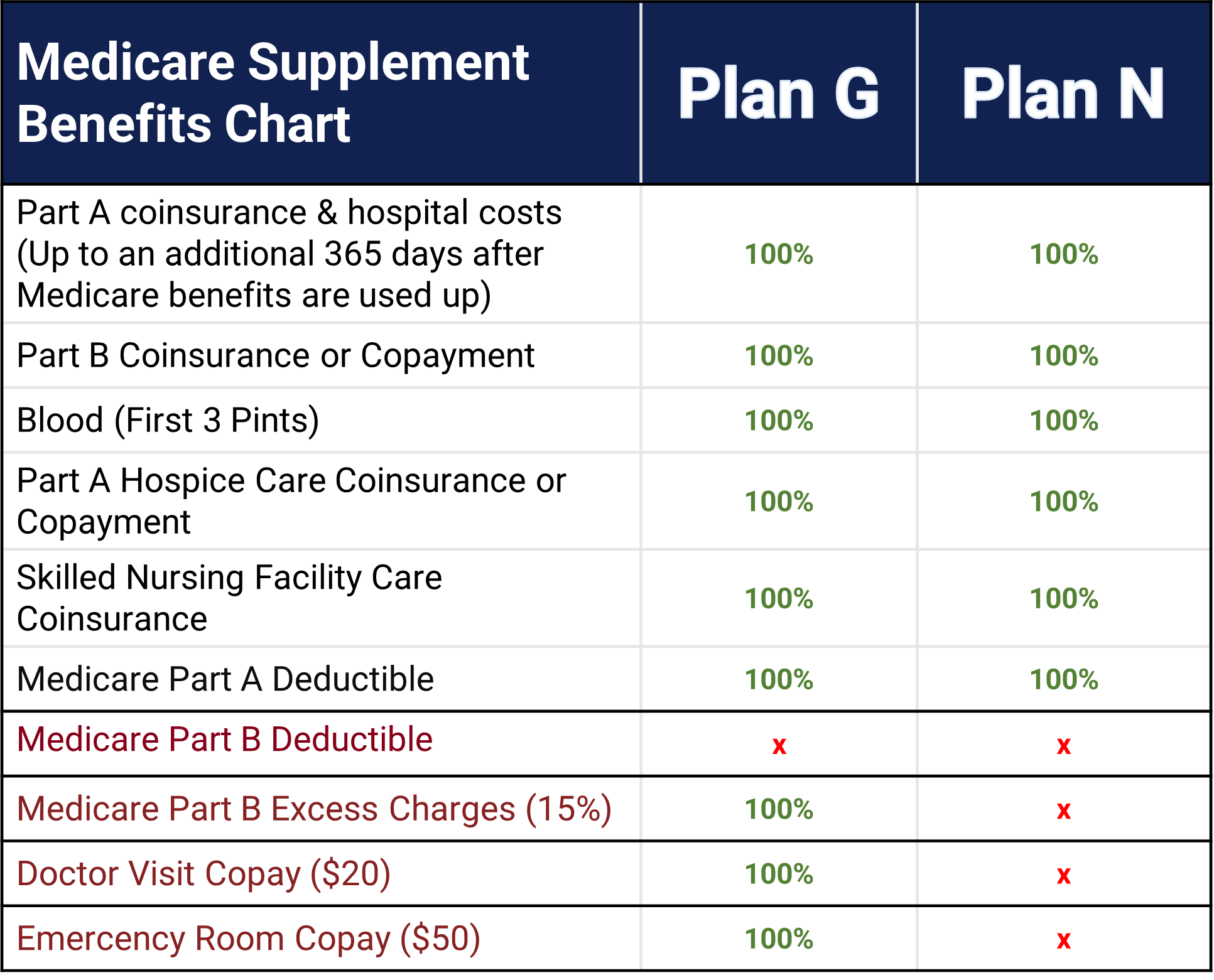

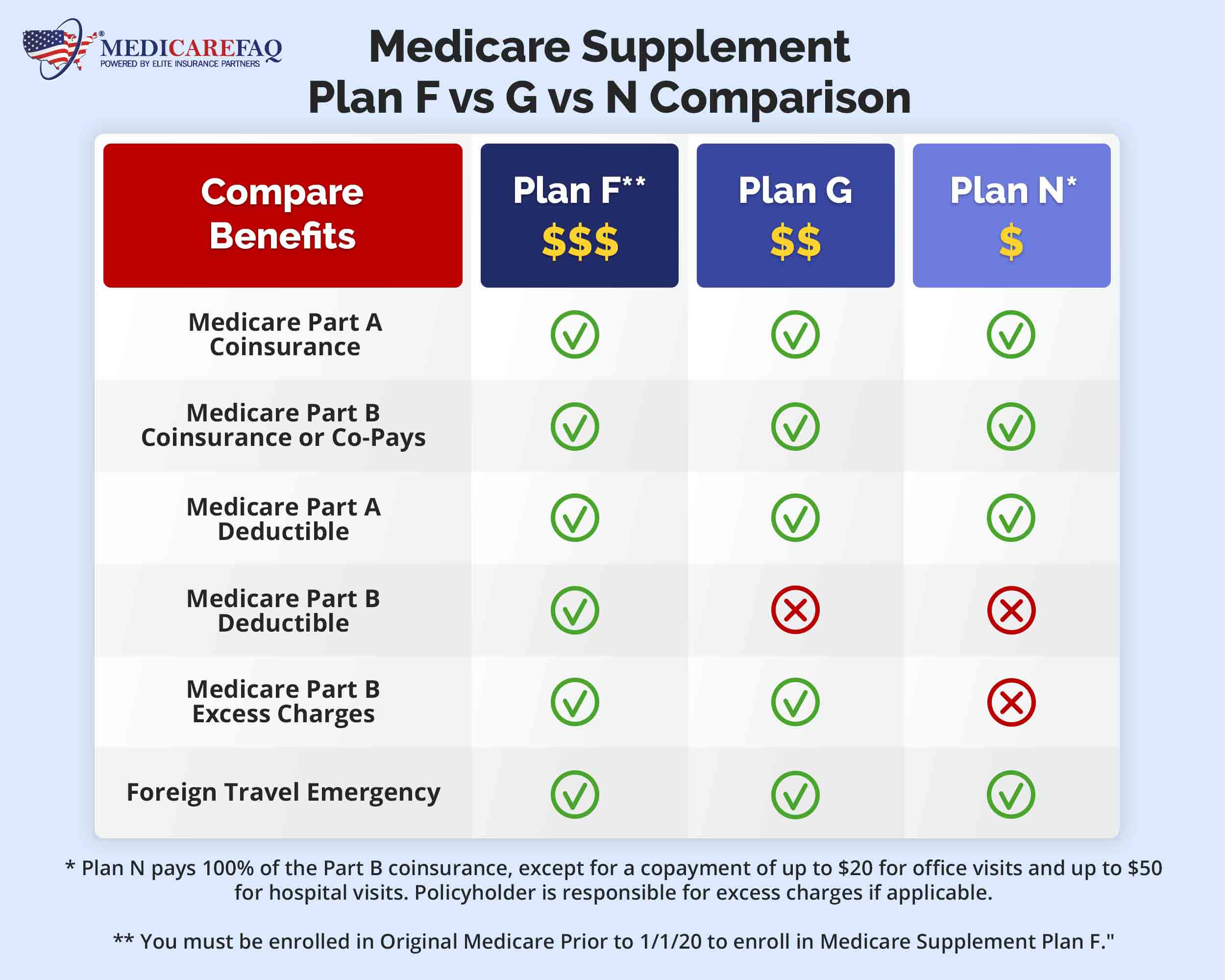

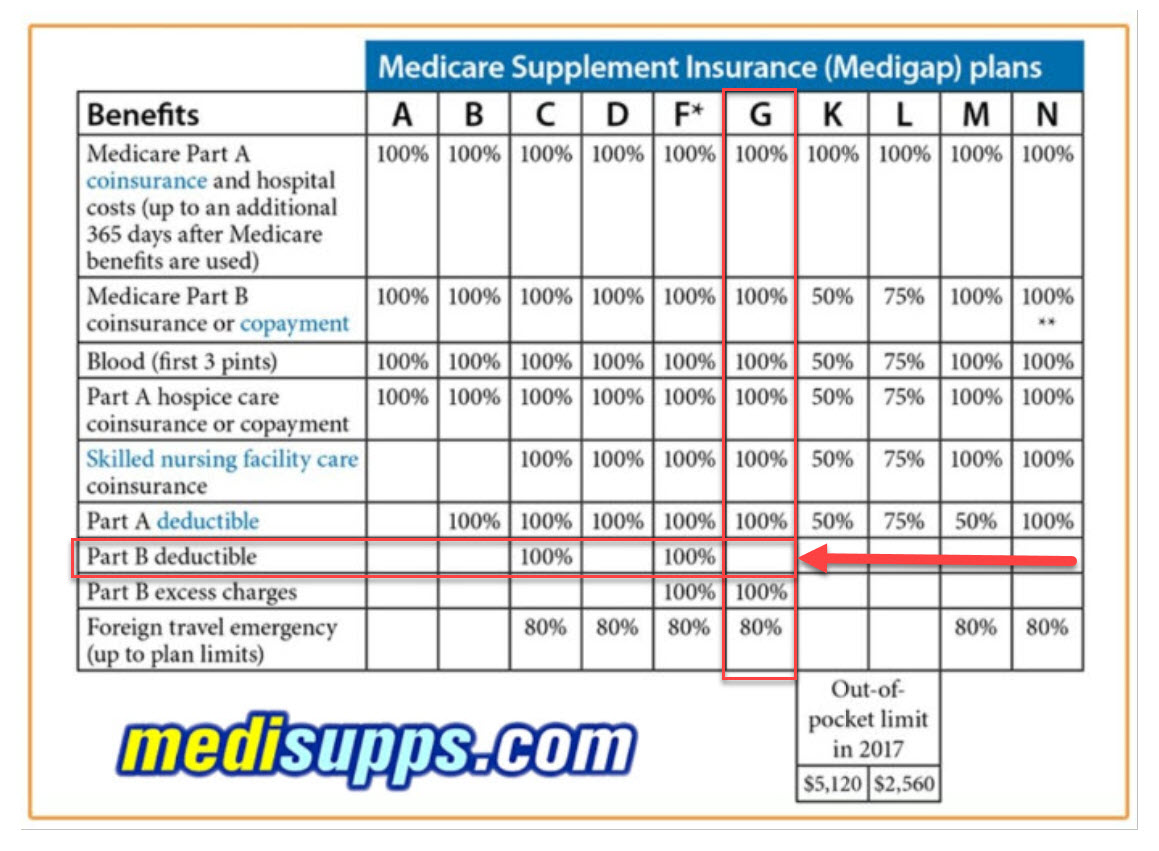

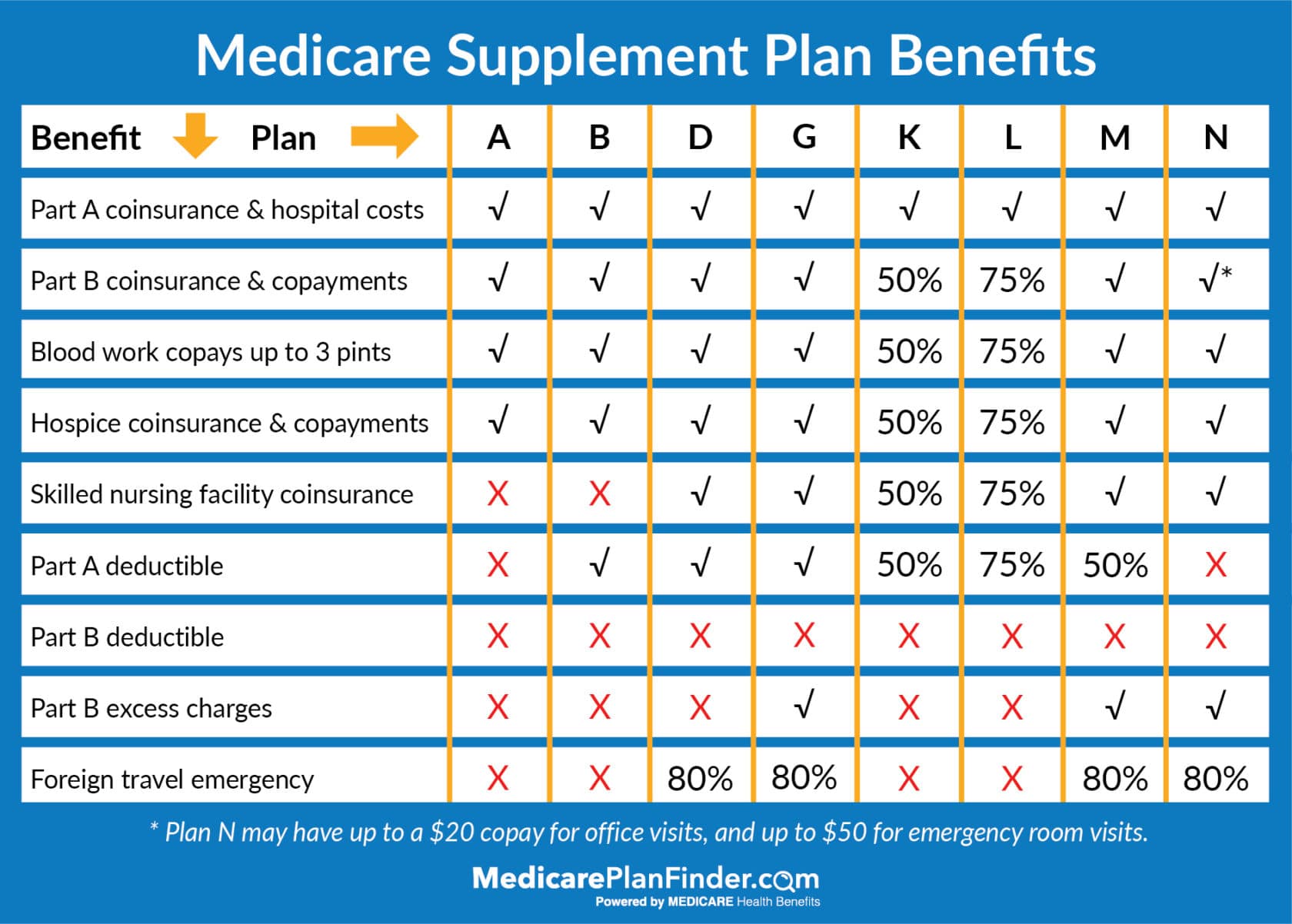

So, why all the fuss about Plan G? Well, it's pretty darn comprehensive. It covers a lot of those pesky out-of-pocket costs that Medicare doesn't, like deductibles, copays, and coinsurance for many services.

Basically, it fills in the gaps in your Medicare coverage. No more surprise bills showing up in your mailbox! (Okay, maybe fewer surprise bills. We can't promise a completely bill-free existence.)

That freedom from unexpected expenses is a huge relief for many people. It allows them to budget more easily and avoid having to make difficult choices about their health based on cost.

Shopping Around for the Best Deal

Here's a pro tip: Don't just settle for the first Plan G policy you find! Compare quotes from different insurance companies. Think of it as finding the perfect pair of shoes – you want something that fits your needs and budget just right.

There are plenty of independent agents and brokers who can help you navigate the sometimes-confusing world of Medicare Supplement plans. They can shop around for you and find the best rates and coverage options. These agents are often *free* to use because they are paid by the insurance companies. It's like having a personal shopper for your health insurance!

Don't be afraid to ask questions. It's your health, your money, and your peace of mind. Make sure you understand what you're getting before you sign on the dotted line.

Plan G: More Than Just a Price Tag

Ultimately, the cost of Plan G is about more than just a monthly premium. It's about security. It's about peace of mind. It's about knowing that you can access the healthcare you need without breaking the bank.

So, while it's important to consider the cost, don't forget to weigh the benefits. A little research and comparison shopping can go a long way in finding the right Plan G policy for you. It's worth the effort, trust me! You want to be able to truly enjoy that hard earned retirement!

Because when it comes to your health, you deserve the best. And sometimes, the best things in life (or at least, the best health insurance plans) do come with a price tag worth paying.