So, you've already filed your taxes! The confetti's settled, the paperwork's (hopefully) organized, and you're dreaming of that sweet, sweet refund. But wait! A little hiccup might have occurred.

Maybe you wanted it direct deposited. But you accidentally put in the wrong account number? Or perhaps you've decided a paper check would be much more fun?

Oops! Can I Redirect My Refund River?

Don't panic! The tax refund process doesn't have to be a nail-biting experience. The IRS isn't some unmovable mountain.

It *might* feel that way sometimes, but there are options available. Let's explore what steps we can take after you already filed your taxes.

First Things First: Did It Bounce?

Here's a little secret: the easiest fix is often if your refund bounces back. If the direct deposit fails due to incorrect information, the IRS will usually issue a paper check.

Keep an eye on your mailbox! This could be a no-effort win for changing that payment method.

The Form 8822: A Change of Address Adventure

If you've moved since filing, this is super important! Form 8822, Change of Address, is your new best friend.

Submit this form to ensure your paper check, if issued, doesn't end up at your old digs. Imagine the suspense of your refund going to a stranger!

Trace That Check! (If It's Lost)

What if the IRS says a check was issued, but it never showed up? This is where things get a little more adventurous. You can initiate a refund trace!

You’ll need to complete and submit Form 3911, Taxpayer Statement Regarding Refund. Think of it as a treasure hunt for your missing money.

Amending Your Return: The Ultimate Redo

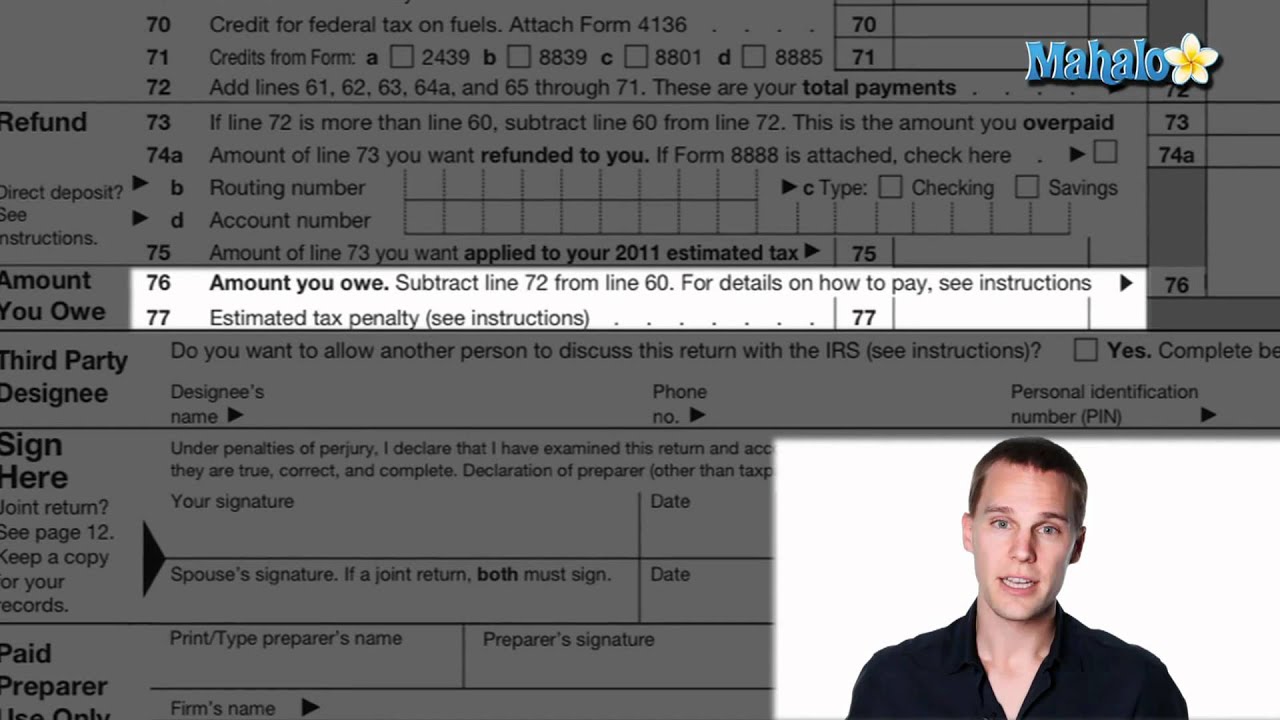

Okay, this is the most involved option. If you really messed up the bank details, amending your return might be necessary.

You'll use Form 1040-X, Amended U.S. Individual Income Tax Return. It’s like hitting the "undo" button on your taxes. But remember, it takes time!

Amendments are like watching paint dry, but with tax implications. Prepare for a waiting game.

Important Considerations: Patience, Grasshopper

Amending or tracing a refund takes time. The IRS isn't known for its lightning speed.

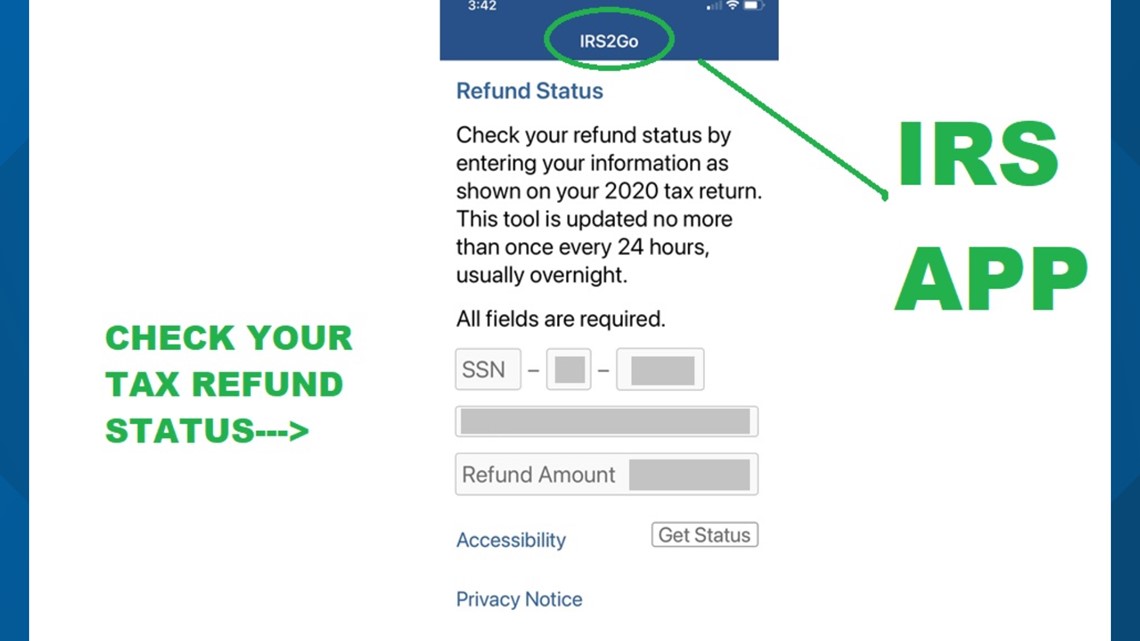

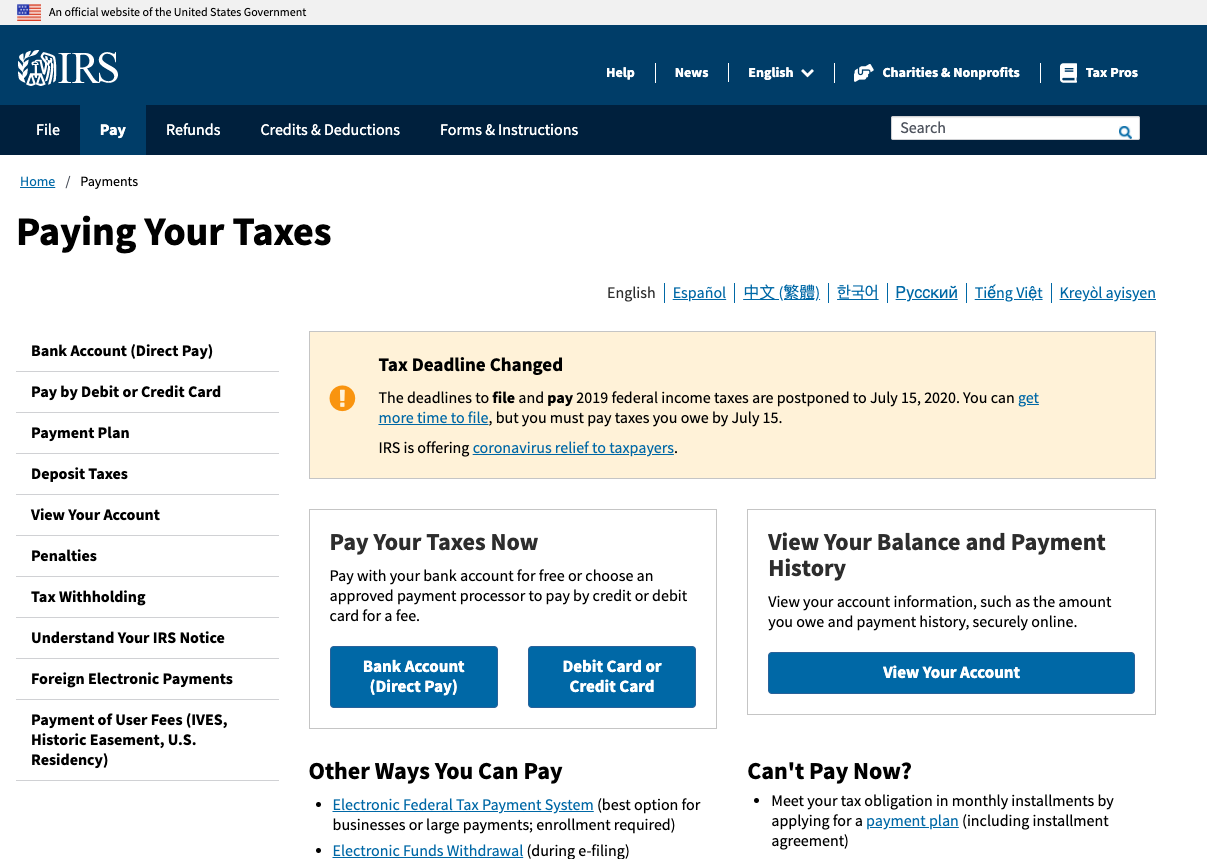

Check the IRS website for current processing times. Don't call them every five minutes. Deep breaths.

The Thrill of the (Tax Refund) Chase

Changing your tax refund payment method after filing isn't exactly a walk in the park. But it’s also not impossible.

With a little patience, the right forms, and perhaps a dash of humor, you can navigate the process. Remember, you're not alone!

And hey, think of the story you'll have to tell at your next dinner party. "Remember that time I accidentally sent my tax refund to a random bank account? Good times!"

Keep copies of everything. Stay organized. And remember to consult a tax professional if you're feeling truly lost in the tax wilderness. Happy refund hunting!

-online.jpg)