In The Third Party Payment System The Provider Is The

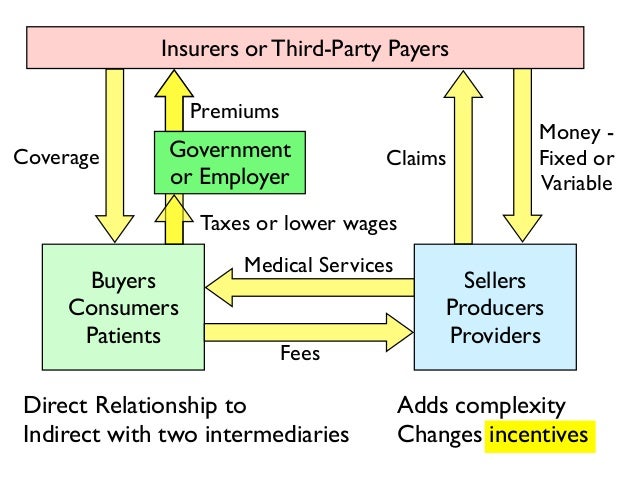

Ever swiped your card at your favorite coffee shop and wondered about the magic happening behind the scenes? It's more than just a simple transaction, folks! There's a whole ecosystem at play, and at the heart of it all, stands the provider.

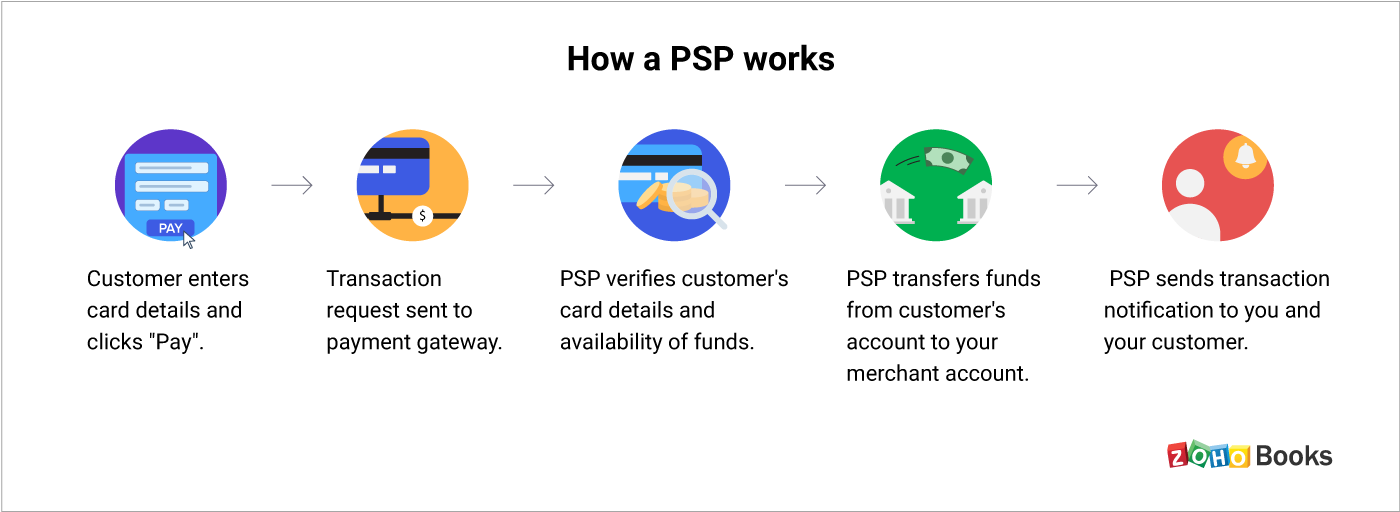

Think of it like this: you're buying a latte, and the coffee shop is happily receiving your payment. But where does that payment actually *go* before landing safely in the coffee shop's bank account? That's where our hero, the provider, steps in!

Who Are These Providers, Anyway?

These aren't just random people in a back office crunching numbers (though some of that *does* happen!). They're the companies that make the whole digital payment process smooth and secure.

They're like the reliable postal service for your money, making sure it gets from point A (your bank) to point B (the coffee shop's bank) without any hiccups. Companies like PayPal, Stripe, and Square are some of the big names you've probably heard of.

They are the silent guardians of your online and in-person transactions!

The Provider's Role: More Than Just Moving Money

The provider does more than just shuffle digits around. They're like the bodyguards of your financial information, ensuring that your credit card details don't fall into the wrong hands.

They implement complex security measures, like encryption, to keep your data safe and sound. It's like sending your money in a locked briefcase with a super-secret code only the provider and the coffee shop know!

They also handle the nitty-gritty details of processing the payment, like verifying your card information and making sure you have enough funds. Basically, they're the unsung heroes making sure your caffeine fix doesn't cause a financial crisis.

A (Slightly) Humorous Analogy

Imagine you're sending a love letter across the country. You wouldn't just chuck it out the window and hope it arrives, would you? You'd trust the postal service to deliver it safely and efficiently.

The provider is like the postal service for your money. They ensure your payment arrives at its destination without getting lost in the digital ether.

And sometimes, just like the postal service, they might face unexpected challenges like a rogue flock of pigeons (cyberattacks!) or a snowstorm (system outage!). But they always strive to get the job done!

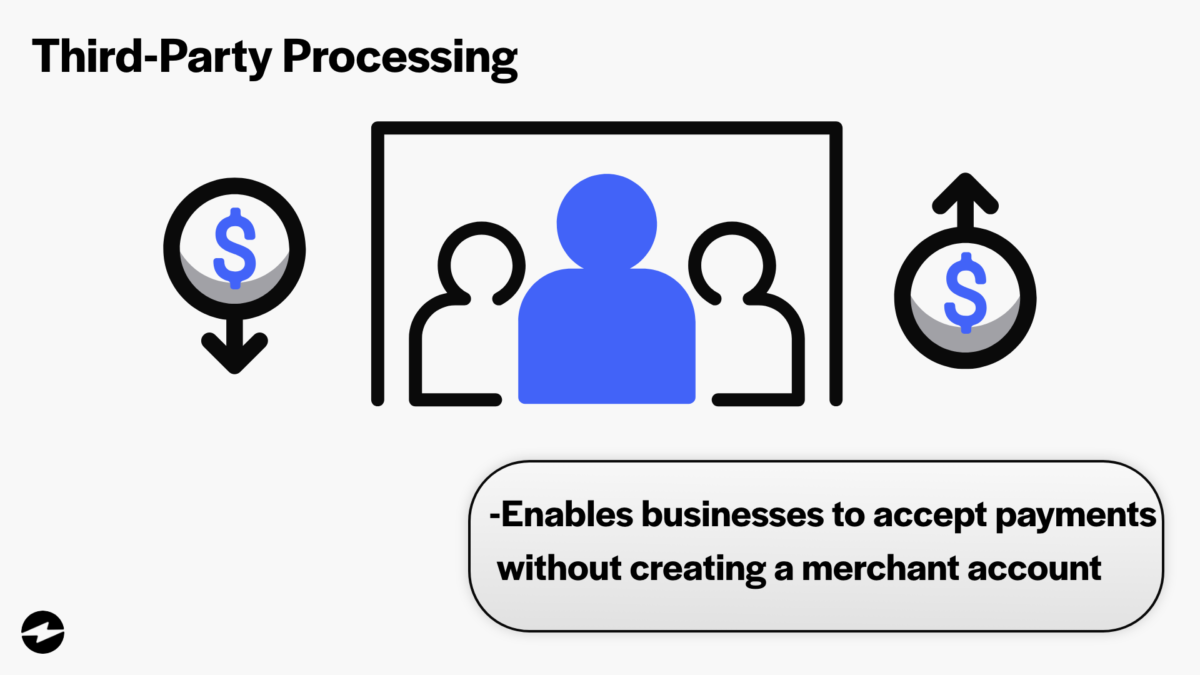

The Importance of a Good Provider

A reliable provider is crucial for both businesses and consumers. For businesses, it means getting paid on time and avoiding fraud. Imagine a small bakery trying to run a bustling Saturday morning without a functioning payment system – chaos!

For consumers, it means a smooth and secure shopping experience. You can confidently swipe your card knowing that your information is protected and your payment will go through without a hitch.

So, next time you use a third-party payment system, take a moment to appreciate the provider. They’re the silent force enabling the seamless transactions we often take for granted.

A Final Thought

Without the provider, we'd be stuck bartering with chickens and seashells. Let's be grateful for the invisible hand that keeps our modern economy humming!

The provider enables modern economy.