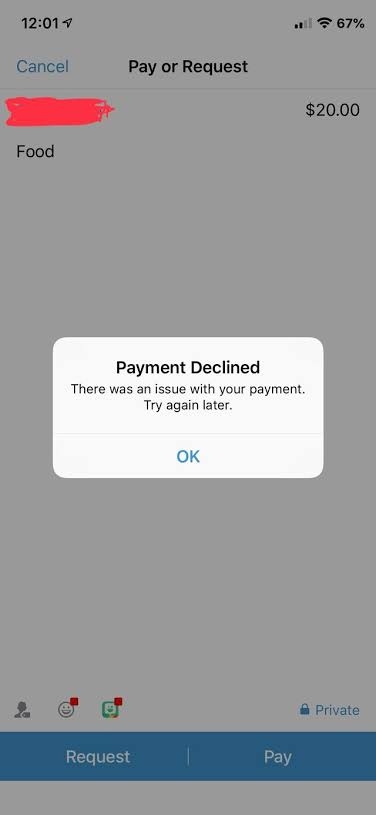

Oh, Venmo. You're the best friend who sometimes forgets to pay their share of the pizza. We love you, but sometimes, that little notification pops up: "Venmo: There Was An Issue With Your Payment Credit Card." Dun dun DUN!

Don't panic! It's not the end of the world, though it might feel like it when you're trying to split that brunch bill. Let's face it, that avocado toast was expensive, and Sarah’s glaring at you.

Decoding the Venmo Drama

Think of this error message as Venmo's slightly dramatic way of saying, "Hold on a sec, something's not quite right." It's like when your car makes a weird noise – probably nothing major, but you still get that little flutter of anxiety.

So, what could be causing this digital hiccup? Let's explore the likely culprits, shall we? Prepare for some seriously scintillating detective work (okay, maybe just a quick checklist).

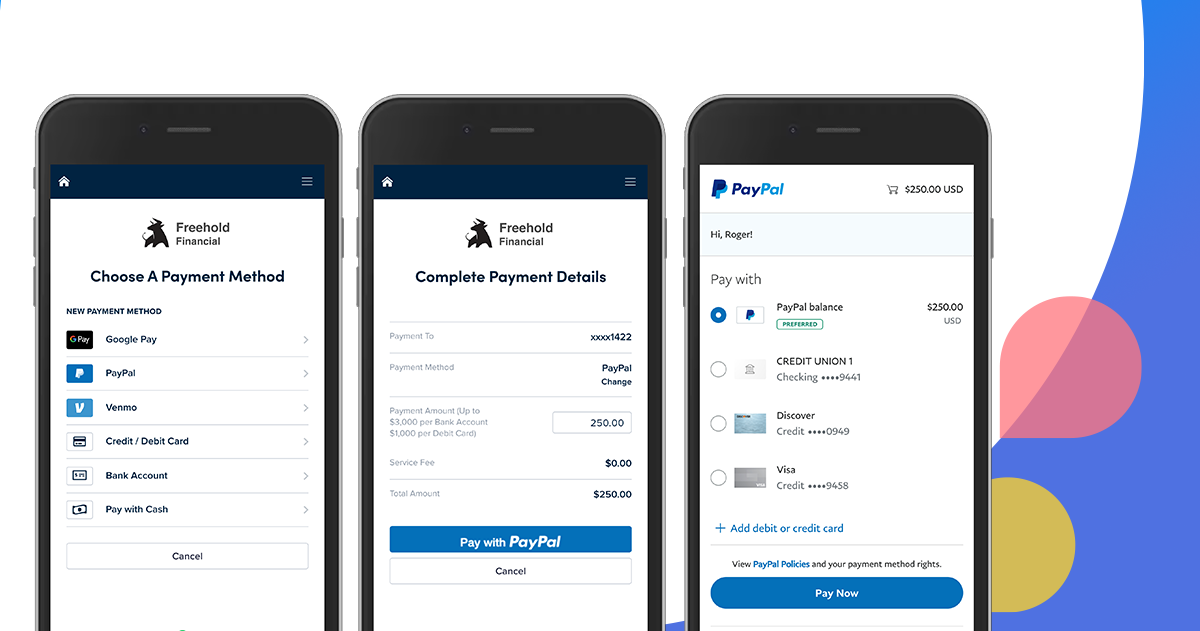

The Usual Suspects: Card Edition

First, the most common offender: your card info. Is your credit card still valid? I know, Captain Obvious here, but hear me out!

Cards expire faster than you can say "rewards points," and sometimes we forget to update them in the app. It’s like trying to use a library card from 1998 to check out the latest bestseller – it's just not gonna work.

Also, double-check you've typed everything correctly. Typos are the gremlins of the internet, messing with us at the worst possible moments. Imagine accidentally entering your card number as your PIN. Yikes!

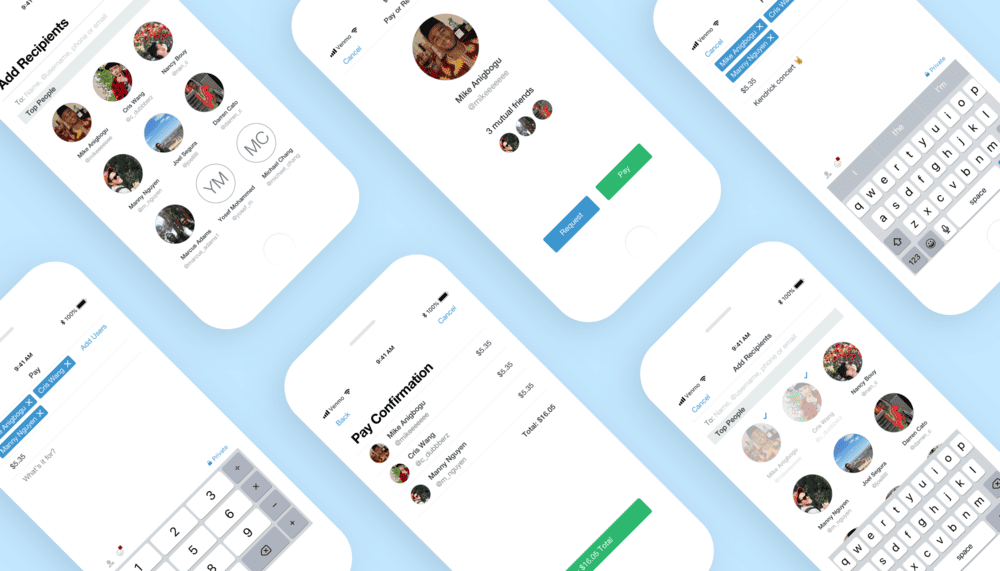

The Limits: Not Just a Dance

Next up: credit limits and daily spending limits! You might think you're swimming in available credit, but maybe you just bought that limited-edition Funko Pop collection and forgot.

Venmo also has its own daily sending limits. It's like a bouncer at a club – they’re there to keep things safe (and prevent fraud). If you're trying to send your roommate $500 for rent, Venmo might be like, "Whoa there, slow down, buddy!"

Call your bank or credit card company to check your available credit or daily limit. And while you're at it, ask about those sweet travel rewards deals.

The Mysterious World of Security Holds

Sometimes, Venmo flags transactions for security reasons. It's like having a super-vigilant bodyguard who occasionally tackles the wrong person.

If you're sending a large amount of money or sending it to someone you don't usually interact with, Venmo might put a hold on the payment just to make sure everything's legit. They’re just looking out for you! It's also possible the issue is on the receiver's side. In this case, ask them to double-check their account.

The Last Resort: Venmo Support to the Rescue

If you've tried everything and you're still seeing that dreaded error message, it's time to call in the reinforcements. That's right, it's time to contact Venmo support.

Don't be afraid! They're actually pretty helpful, and they've probably seen it all before. Think of them as the tech support superheroes, ready to swoop in and save the day. You can find contact information on the Venmo website or app.

"Remember, a little patience and troubleshooting can go a long way. And if all else fails, maybe just offer to do the dishes instead of splitting the bill. Just kidding... mostly!"

So, next time you see "Venmo: There Was An Issue With Your Payment Credit Card," don't despair. Take a deep breath, run through this checklist, and get back to splitting those bills – and maybe even buying another round of avocado toast. You deserve it!

![[Fix]Venmo: There was an issue with your payment Error | TechLatest - Venmo There Was An Issue With Your Payment Credit Card](https://media.tech-latest.com/wp-content/uploads/2023/05/11151334/Venmo.jpg)