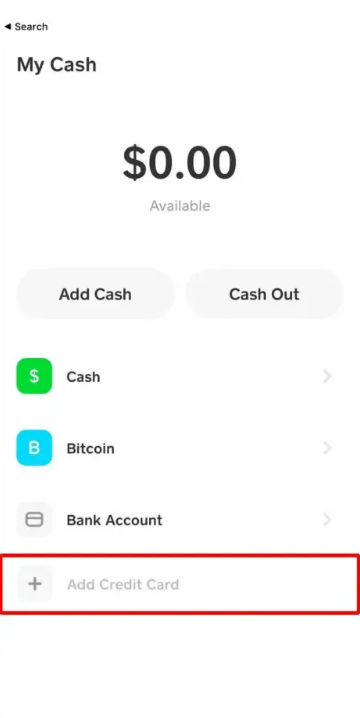

So, you're staring at your phone, brow furrowed. Cash App, usually your trusty sidekick for splitting pizza and paying back Brenda for those concert tickets, is giving you the cold shoulder. You try to add your credit card, and… nothing. Just an error message, mocking your attempt at digital financial wizardry.

It feels a bit like being denied entry to a club you usually waltz right into. The bouncer (in this case, the Cash App algorithm) is saying, "Not tonight, friend."

The Credit Card Caper

Let's be honest, the first reaction is usually mild panic. Did I max it out? Is my identity stolen? Did I anger the digital gods of fintech? Don't worry, most of the time it is none of the above.

Sometimes, it's as simple as a typo. You know, those moments when your fingers betray you and turn your perfectly good card number into a string of gibberish only understandable to a highly advanced AI. Double-check those digits, folks!

The Address Mystery

Then there's the address conundrum. Apparently, the address you used to create your Cash App account needs to be a perfect match for the address on your credit card statement. It is like a digital fingerprint for your finances.

It sounds simple, until you realize you've moved three times in the last five years and have absolutely no idea which address you used for which account. This is where the real fun begins – digging through old mail and remembering forgotten apartments.

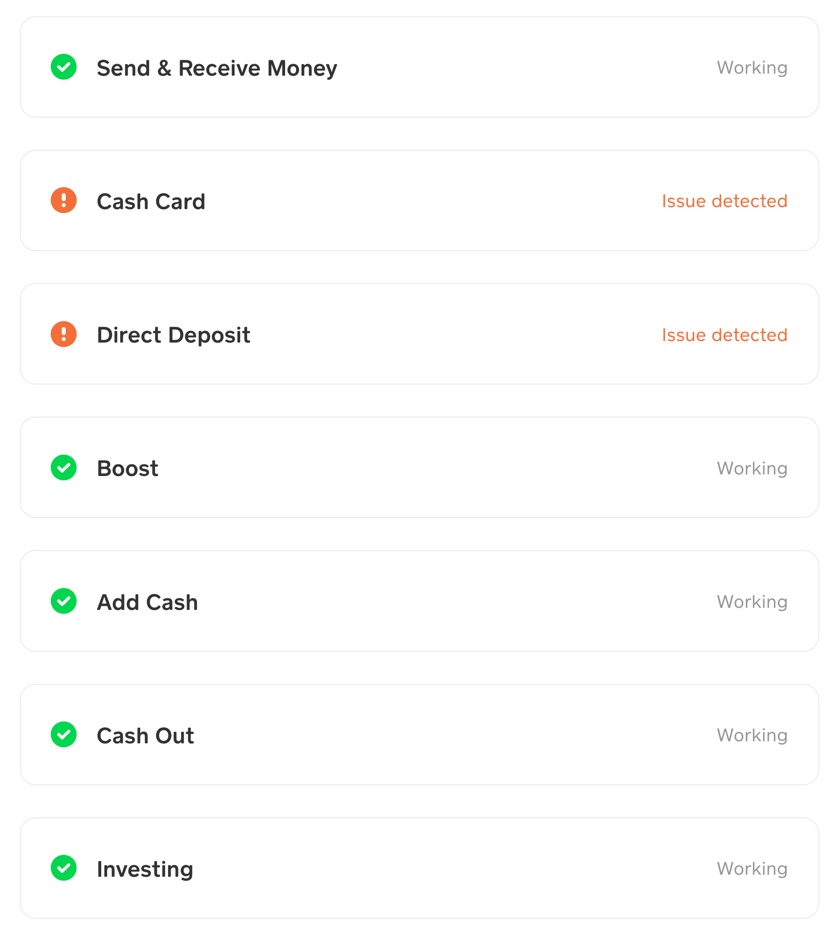

The Bank Knows Best

But sometimes, the issue isn't you at all. It could be your bank. They might be blocking the transaction as a security measure. Maybe they thought your attempt to buy your friend Brenda her concert tickets was suspicious.

Imagine your bank as an overprotective parent, always worried about their child's (your money's) safety. A quick call can usually clear things up. Just prepare to answer a few questions that might make you feel like you are being interrogated.

The Unexpected Silver Linings

Now, before you throw your phone across the room, let’s look at the bright side. This little roadblock can actually be a blessing in disguise.

Perhaps this is a sign to finally organize that messy pile of financial documents. Or maybe it's a cosmic nudge to re-evaluate your spending habits (do you *really* need another pair of shoes?).

"This happened to my mom," laughs Sarah. "She spent an hour on the phone with Cash App support, only to realize she was trying to use a debit card, not a credit card. We still tease her about it."

And let's not forget the heartwarming possibilities. Maybe this hiccup will lead you to a genuine connection with a customer service representative. Imagine, amidst the robotic responses and automated systems, finding a real person who actually helps and makes you smile.

The Digital Detox

In this hyper-connected world, it's easy to get stressed when technology doesn't cooperate. "It was so frustrating," John confessed, "but then I realized I needed a break from my phone anyway. I ended up going for a walk and actually enjoying the sunshine!"

The inability to add your credit card might be the universe's way of saying, "Step away from the screen. Breathe. Remember what it's like to live in the real world."

So, next time Cash App throws you a curveball and refuses to accept your credit card, don't despair. Embrace the absurdity, learn from the experience, and remember that sometimes, the biggest frustrations can lead to the most unexpected, and even enjoyable, moments.

After all, life is too short to be angry at an app. Unless, of course, it keeps happening. Then, maybe it's time to consider a new pizza-splitting strategy!