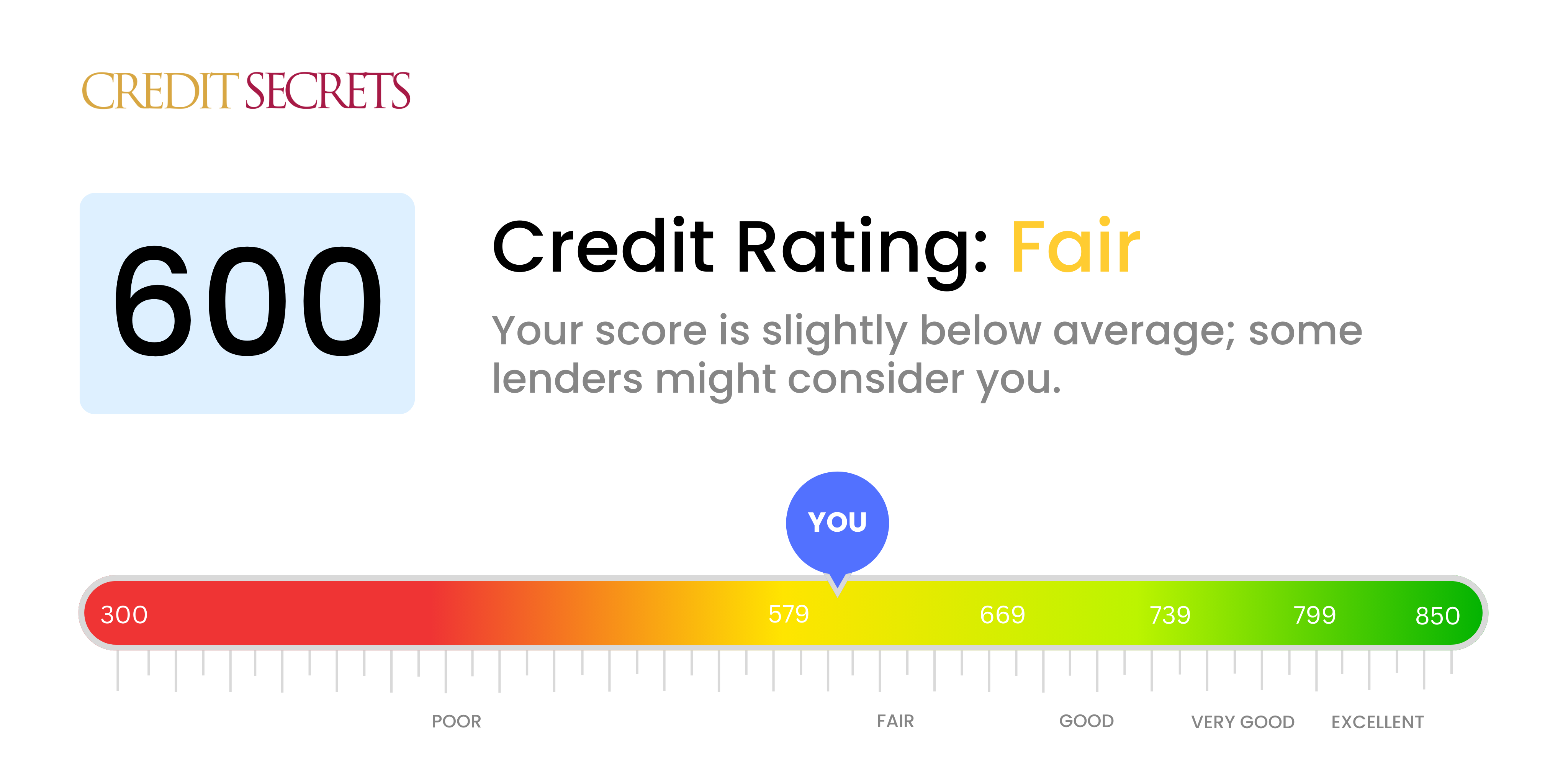

Accessing financial products with a credit score of 600 in Kansas, particularly installment loans, presents a unique set of challenges and opportunities. A credit score of 600 falls within the "fair" range, according to most credit scoring models. This placement directly impacts the availability, terms, and overall cost of borrowing.

Causes of a 600 Credit Score

Several factors can contribute to a credit score of around 600. Understanding these underlying causes is crucial for those seeking to improve their creditworthiness and access more favorable loan terms. Common causes include:

Payment History: Missed or late payments are a significant drag on credit scores. Even a few instances of delinquency can negatively impact a score, particularly if they are recent.

Credit Utilization: This refers to the amount of credit being used compared to the total credit available. High credit utilization (using a large percentage of available credit) signals higher risk to lenders.

Length of Credit History: A shorter credit history, especially without consistent positive activity, can result in a lower score. Lenders prefer to see a proven track record of responsible credit management.

Credit Mix: Having a variety of credit accounts (e.g., credit cards, installment loans, mortgages) can positively influence a credit score, demonstrating an ability to manage different types of debt. However, opening too many accounts in a short period can have the opposite effect.

Public Records and Derogatory Marks: Bankruptcies, foreclosures, and judgments have a severe negative impact on credit scores and can remain on credit reports for several years.

In Kansas, the financial landscape mirrors national trends. Data from Experian indicates that the average credit score in Kansas is slightly above the national average. However, a significant portion of the population still falls within the fair or poor credit score ranges, highlighting the widespread need for access to credit-building resources and responsible lending practices.

Effects on Installment Loan Access in Kansas

A 600 credit score significantly affects the availability and terms of installment loans in Kansas. The primary effects are:

Limited Lender Options: Traditional banks and credit unions may be hesitant to offer installment loans to borrowers with fair credit. These institutions typically cater to individuals with good to excellent credit scores.

Higher Interest Rates: Lenders perceive borrowers with lower credit scores as higher risk. To compensate for this increased risk, they charge significantly higher interest rates. This can substantially increase the total cost of the loan over its lifetime.

Stricter Loan Terms: Lenders may impose stricter loan terms, such as shorter repayment periods or collateral requirements, to mitigate their risk. This can make the loan less affordable and increase the pressure on borrowers to repay on time.

Fees and Charges: Borrowers with fair credit may face higher origination fees, application fees, or prepayment penalties. These fees can further increase the overall cost of the loan.

Kansas law regulates certain aspects of lending, including interest rate caps on some types of loans. However, these regulations may not apply to all types of installment loans, leaving borrowers vulnerable to predatory lending practices. Payday loans and title loans, often marketed to individuals with poor credit, can carry extremely high interest rates and fees, trapping borrowers in a cycle of debt. According to the Kansas Attorney General's office, complaints related to predatory lending remain a persistent concern, emphasizing the need for consumer education and stronger regulatory oversight.

Implications of Obtaining an Installment Loan with a 600 Credit Score

The implications of taking out an installment loan with a 600 credit score extend beyond the immediate financial transaction. These implications can impact a borrower's long-term financial health and well-being.

Potential for Debt Cycle: High interest rates and fees can make it difficult to repay the loan on time, leading to late fees and further damage to the credit score. This can trap borrowers in a cycle of debt, making it even harder to access affordable credit in the future.

Impact on Future Borrowing: A negative experience with an installment loan, such as missed payments or default, can further lower the credit score and make it even more difficult to obtain loans, mortgages, or even rent an apartment in the future.

Financial Stress: The burden of high-interest debt can lead to significant financial stress, impacting mental and physical health. This stress can also affect relationships and overall quality of life.

Limited Financial Opportunities: A poor credit score can limit access to various financial opportunities, such as starting a business, investing in education, or purchasing a home. This can hinder long-term financial growth and stability.

However, it is also important to note that responsibly managing an installment loan, even with a 600 credit score, can have positive implications. Consistent on-time payments can help rebuild credit and demonstrate responsible financial behavior to lenders. This can lead to improved credit scores and access to more favorable loan terms in the future. Furthermore, an installment loan can provide access to funds needed for essential expenses, such as car repairs or medical bills, that would otherwise be difficult to cover.

Strategies for Improvement

For individuals in Kansas with a 600 credit score seeking installment loans, focusing on credit improvement is paramount. Practical steps include:

Review Credit Reports: Obtain free credit reports from the three major credit bureaus (Equifax, Experian, and TransUnion) and dispute any errors or inaccuracies.

Pay Bills on Time: Set up automatic payments or reminders to ensure that all bills are paid on time, every time.

Reduce Credit Utilization: Pay down credit card balances to reduce credit utilization to below 30% of the available credit limit.

Consider Secured Credit Cards: Secured credit cards are easier to obtain for individuals with fair credit and can help rebuild credit with responsible use.

Explore Credit-Builder Loans: Credit-builder loans are specifically designed to help individuals with poor credit establish a positive credit history.

Broader Significance

The challenges faced by individuals with a 600 credit score in accessing affordable installment loans in Kansas reflect a broader societal issue of financial inclusion and access to credit. A fair credit score, while not ideal, shouldn't be an insurmountable barrier to accessing necessary financial products. Addressing this issue requires a multi-faceted approach that includes:

Financial Literacy Education: Providing comprehensive financial literacy education to empower individuals with the knowledge and skills to manage their finances responsibly and build credit.

Responsible Lending Practices: Promoting responsible lending practices among financial institutions to ensure that borrowers are not subjected to predatory lending practices.

Credit Counseling Services: Expanding access to affordable credit counseling services to help individuals develop personalized plans for improving their credit and managing their debt.

Regulatory Oversight: Strengthening regulatory oversight of the lending industry to protect borrowers from unfair or deceptive practices.

By addressing these issues, Kansas can create a more equitable financial environment where all residents have the opportunity to access affordable credit and build a secure financial future. The ability to obtain a reasonable installment loan can be a crucial stepping stone for individuals seeking to improve their financial well-being, purchase essential goods or services, or overcome unexpected financial challenges. Ensuring fair access to these loans is not only a matter of individual opportunity but also a matter of broader economic prosperity and social justice.

:max_bytes(150000):strip_icc()/GettyImages-1421136847-1f38a3894e954cac841cd49654539132.jpg)