Amplify Cwp Enhanced Dividend Income Etf

Let's talk about something that might sound a bit dry at first: the Amplify CWP Enhanced Dividend Income ETF. I know, I know, already your eyes are glazing over. But trust me, this isn't about memorizing complicated formulas or turning into a Wall Street wolf. Think of it more like... deciding how to spice up your usual ramen dinner. Stay with me, it'll make sense.

See, most of us, whether we're actively trading stocks or just stashing money in a savings account, are trying to make our financial lives a little tastier. We want our money to grow. And one way to do that, a way that provides a little "flavor" along the way, is through dividends.

Dividends: The Financial Equivalent of Finding a Twenty in Your Old Jeans

Imagine this: You're doing laundry (because adulting, am I right?), and you reach into the pocket of your favorite jeans and BAM! A crisp twenty-dollar bill. You totally forgot it was there. That's kind of what dividends are like. They're regular payouts from a company you've invested in – like a little thank-you note for being a shareholder. Companies share a portion of their profits with you! It's free money! (Okay, it's *earned* money, but it *feels* free, doesn't it?).

Now, some companies are more generous with these "found money" moments than others. Some are like that friend who always covers the tip, and others are... well, let's just say they're a little more frugal. And that’s where dividend ETFs come into play.

What's an ETF, Anyway? (Besides a Jumble of Letters)

ETF stands for Exchange Traded Fund. Basically, it's like a pre-made financial smoothie. Instead of you having to carefully select and buy individual ingredients (aka, individual stocks) to achieve a certain "flavor profile" (like high dividends), an ETF does it for you. It's a basket of stocks, bonds, or other assets that tracks a particular index or investment strategy. It's like having a chef whip up a delicious and nutritious meal, so you don't have to spend hours in the kitchen figuring it out yourself.

Think of it like this: you love tacos but don't want to buy all the ingredients individually. An ETF is like a pre-made taco kit with all the fixings.

Enter the Amplify CWP Enhanced Dividend Income ETF (DIVO)

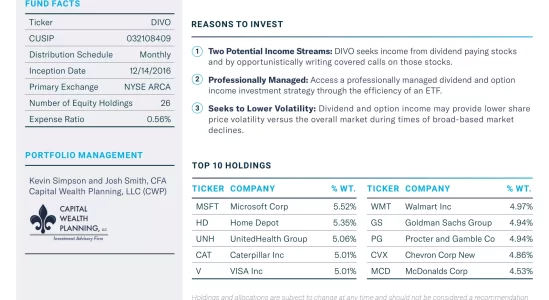

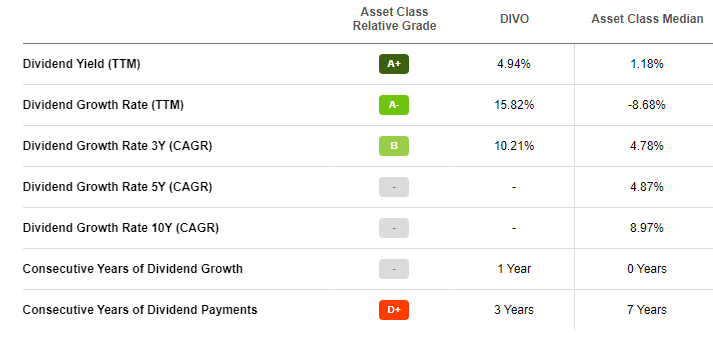

Okay, now we get to the star of our show: the Amplify CWP Enhanced Dividend Income ETF, ticker symbol DIVO. This ETF is specifically designed to generate higher-than-average dividend income. It’s trying to give you a bigger, tastier ramen dinner... more spice, more flavor, more *zing*.

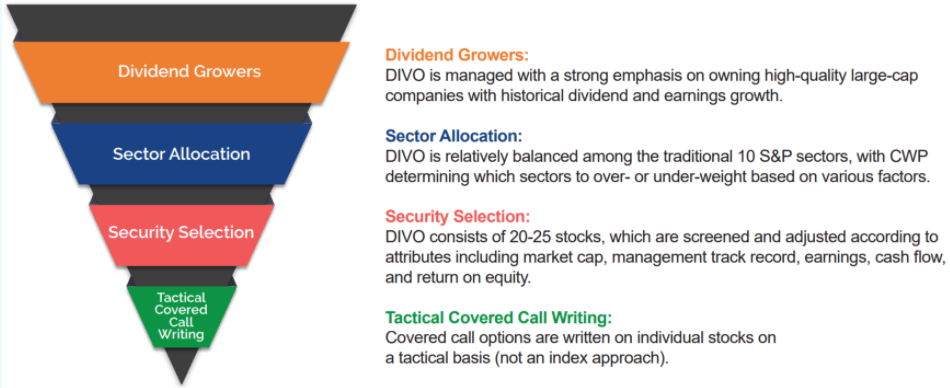

DIVO isn't just throwing darts at a board and hoping for the best. It uses a specific strategy to select the companies it invests in. Think of it like carefully choosing your taco ingredients: high-quality ground beef, fresh tomatoes, perfectly ripe avocados.

This ETF generally looks for companies that:

- Have a history of paying dividends: These are the reliable friends who *always* pay you back when you spot them lunch.

- Are financially healthy: These companies aren't living paycheck to paycheck. They're in a good position to *continue* paying dividends in the future.

- Offer the potential for growth: They are companies that have a good future.

So, DIVO isn’t just chasing after the highest dividend yields (which can sometimes be a red flag, like a "free" car that requires constant repairs). It's looking for sustainable, reliable income streams. It's the difference between winning the lottery and building a successful business.

The "Enhanced" Part: Covered Calls – Not as Scary as They Sound

Now, here's where things get a *little* more technical, but don't run away! The "enhanced" part of this ETF's name refers to its use of covered calls. This is a strategy to generate even *more* income, kind of like adding a secret ingredient to your ramen recipe that makes it even more addictive.

Essentially, DIVO "rents out" the potential upside of some of its holdings. Think of it like this: you own a really nice lawnmower. You could just let it sit in your garage, or you could rent it out to your neighbor for a small fee. The neighbor gets to use the lawnmower, and you get some extra cash. Everyone wins!

Covered calls can seem complicated, but the basic idea is that DIVO is selling the *right* (but not the obligation) for someone else to buy their shares at a specific price in the future. If the stock price stays below that price, the option expires worthless, and DIVO keeps the money it received for selling the option. If the stock price goes above that price, the shares get called away and DIVO gets the profit from selling them at the agreed price and the money it received for selling the option.

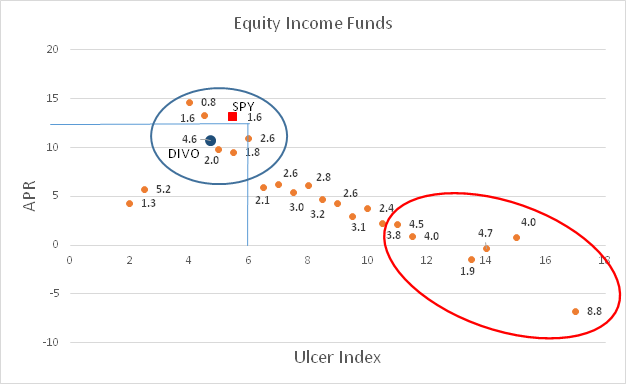

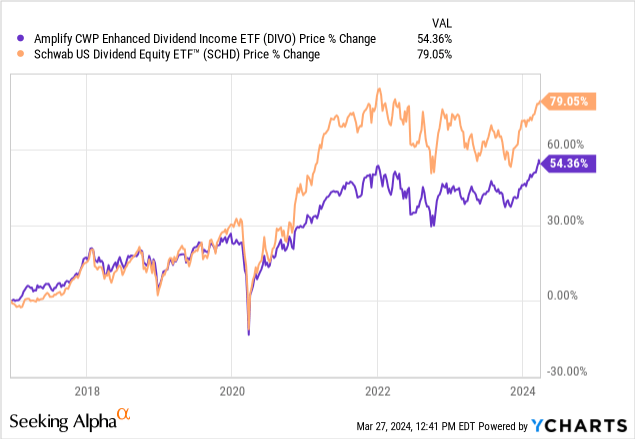

This strategy can *boost* the ETF's income, but it can also limit its potential upside if the underlying stocks really take off. It's a trade-off. It's like choosing between a guaranteed extra $10 for selling your old baseball cards and the *possibility* that they might be worth $1,000 someday.

Why Consider DIVO? (Or, Why You Might Want to Add This ETF to Your Portfolio)

So, why would you even bother with DIVO? Here are a few reasons:

- Income Generation: This is the big one. DIVO is designed to generate a higher-than-average dividend yield. If you're looking for a steady stream of income from your investments, this could be a good option. Maybe you want some extra cash for that dream vacation, or to pay for that fancy coffee you secretly crave.

- Diversification: DIVO holds a basket of different stocks. This means you're not putting all your eggs in one basket (a financial no-no). If one company performs poorly, it won't sink your entire investment.

- Professional Management: You don't have to spend hours researching individual companies and picking stocks. The ETF is managed by professionals who are doing the heavy lifting for you. They're like the sous chefs in the kitchen, making sure everything runs smoothly.

- Relatively Low Cost: ETFs generally have lower expense ratios than actively managed mutual funds. This means you're keeping more of your investment returns. It's like getting a coupon for your favorite store.

Things to Keep in Mind (The Fine Print, But Not *Too* Fine)

Of course, no investment is perfect, and DIVO has its own set of considerations:

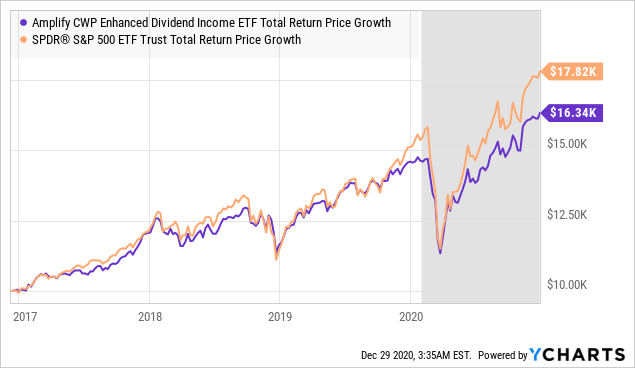

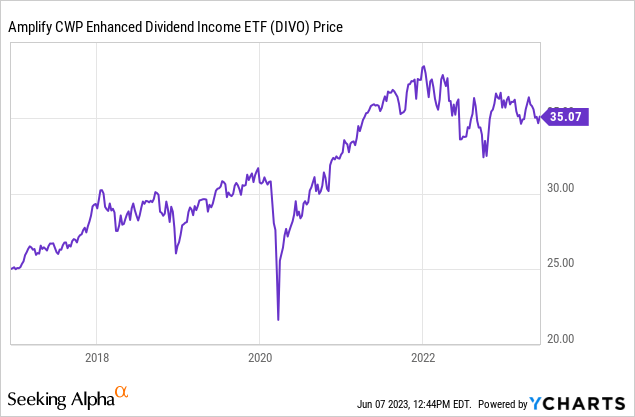

- Market Risk: Like all stocks, the value of DIVO can go up or down depending on market conditions. If the stock market tanks, your investment could lose value. This is just a fact of investing life.

- Interest Rate Risk: Rising interest rates can sometimes put pressure on dividend-paying stocks. It's like when gas prices go up – it can impact your overall budget.

- Covered Call Limitations: As mentioned earlier, the covered call strategy can limit the ETF's potential upside if the underlying stocks perform extremely well.

- Not a Get-Rich-Quick Scheme: DIVO is designed to provide a steady stream of income, not to make you a millionaire overnight. It's a long-term investment strategy, like planting a tree that will bear fruit for years to come.

Is DIVO Right for You? (The Million-Dollar Question… Or at Least the Twenty-Dollar Question)

Ultimately, the decision of whether or not to invest in DIVO depends on your individual circumstances, risk tolerance, and investment goals. It's like deciding what kind of ramen you want. Do you want spicy? Mild? Vegetarian? The choice is yours.

If you're looking for a reliable income stream, want the benefits of diversification, and are comfortable with the covered call strategy, DIVO might be worth considering. However, it's *always* a good idea to do your own research and talk to a financial advisor before making any investment decisions. They can help you determine if DIVO aligns with your overall financial plan.

Think of it like this: before you try a new ramen recipe, you probably want to read some reviews and maybe even ask a friend for their opinion. Investing is the same way. Do your homework, get some advice, and then make a decision that you're comfortable with.

So, there you have it: a (hopefully) easy-going explanation of the Amplify CWP Enhanced Dividend Income ETF. Hopefully, now you understand that it's not some scary, complicated financial product, but rather a potential tool for adding a little more "flavor" to your investment portfolio. Now, go forth and conquer your financial goals... and maybe treat yourself to some fancy ramen while you're at it!