Reviews Of Motley Fool Wealth Management

Okay, so you're thinking about getting some help with your finances? Maybe you've heard the name Motley Fool tossed around? They're kind of like the cool uncle of the investing world, always cracking jokes and seemingly knowing a thing or two about where to put your money. But, like any "cool uncle," you want to make sure they're actually, you know, good at what they do. So, let's dive into the world of Motley Fool Wealth Management and see what the buzz is all about, shall we?

What is Motley Fool Wealth Management, Anyway?

First things first: what exactly do they do? Think of them as a concierge service for your financial future. They offer a range of services designed to help you manage your money, from figuring out how to allocate your investments to planning for retirement. It’s not just stock picks (like some of their other services offer), it's a more holistic approach. Imagine it like this: Motley Fool Stock Advisor is like getting a recipe for a specific dish, while Motley Fool Wealth Management is like hiring a personal chef to create a whole menu tailored to your taste and nutritional needs.

Basically, they want to help you build a portfolio that aligns with your goals and risk tolerance. Sounds pretty good, right? But, of course, the devil is always in the details.

The Good Stuff: What People Love

So, what are people actually saying about their experience with Motley Fool Wealth Management? Let's break down some of the common praises:

- Personalized Advice: This is a big one. They don't just throw you into a generic investment model. They take the time to understand your specific situation, your goals (like buying a house, early retirement, or funding your kids' education), and how much risk you're comfortable taking. It's like having a financial advisor who actually listens.

- Holistic Approach: As mentioned, it's not just about stocks. They look at the bigger picture, considering things like your taxes, your insurance, and your overall financial plan. Think of it as getting a complete financial check-up instead of just treating one symptom.

- Transparency: Many users appreciate the clear communication and straightforward explanations. No confusing jargon or hidden fees (supposedly!). It’s like having someone translate the complicated language of finance into plain English.

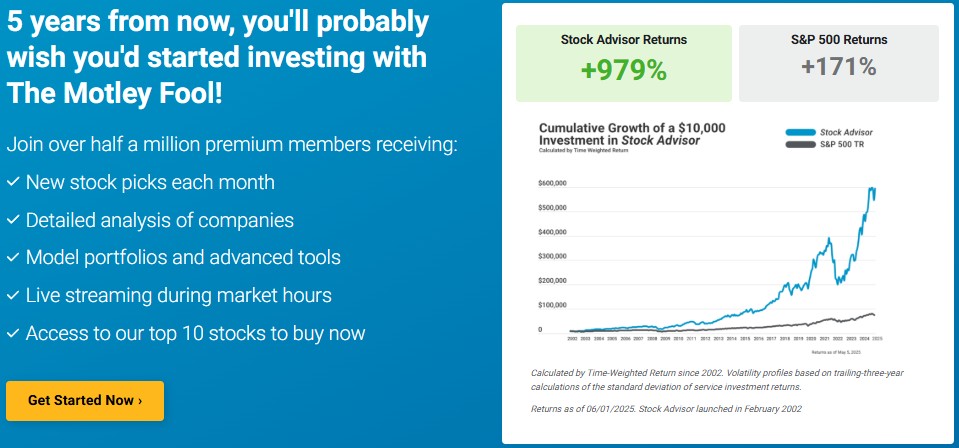

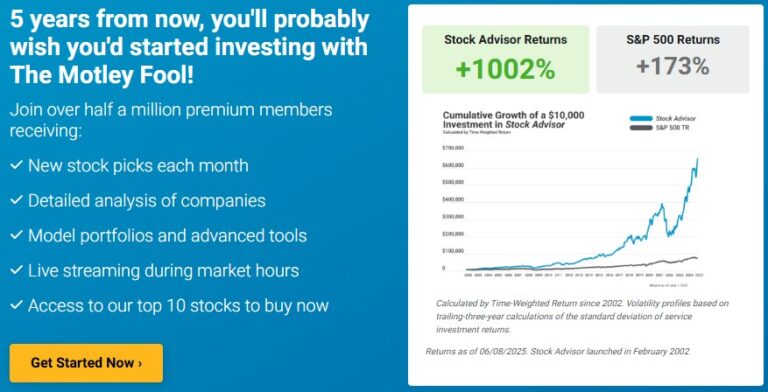

- Foolish Philosophy: For those familiar with The Motley Fool's overall investing philosophy, they appreciate that Wealth Management applies those same principles – long-term investing, diversification, and focusing on quality companies. It's a consistent approach that resonates with many investors.

Imagine it like this: it's like hiring a personal trainer who not only creates a workout plan but also helps you with your diet and sleep schedule. It's a complete wellness package, but for your finances.

The Not-So-Good Stuff: Potential Downsides

Of course, no service is perfect. Let's take a peek at some of the criticisms and potential drawbacks:

- Fees: Wealth management services aren't cheap, and Motley Fool Wealth Management is no exception. Their fees are typically a percentage of the assets they manage, which can eat into your returns. It’s like paying for premium gas; you get better performance, but it costs you more. Is it worth it? That's the million-dollar question (literally, depending on your portfolio size!).

- Minimum Investment: They typically require a minimum amount of assets to manage, which can be a barrier for some investors. It's like needing a certain amount of points to join an exclusive club. If you don't have the funds, you can't play.

- Performance: While many users are happy with their investment returns, past performance is never a guarantee of future results. It's crucial to remember that investing always involves risk, and there's no magic formula for getting rich quick. Just because your neighbor made a killing on Dogecoin doesn't mean you will, either.

- Personal Connection: Some users have mentioned that they felt a bit disconnected from their advisor, especially compared to working with a local, independent financial planner. This can be a challenge with any large company – it's harder to build that personal rapport. It's like ordering takeout versus having your grandma cook for you – both can be good, but the experience is different.

So, Is It Worth It? The Million-Dollar Question

That's the question, isn't it? Whether Motley Fool Wealth Management is right for you depends entirely on your individual circumstances, your financial goals, and your tolerance for risk. Ask yourself these questions:

- How much do I value personalized financial advice? If you're comfortable managing your own investments and doing your own research, you might not need a wealth management service.

- Am I willing to pay the fees? Consider whether the potential benefits outweigh the costs. Think of it as a cost-benefit analysis for your financial future.

- Do I have the minimum investment amount? If not, you'll need to explore other options.

- Am I comfortable working with a remote advisor? If you prefer a face-to-face relationship, a local financial planner might be a better fit.

Don't Forget to Do Your Homework!

Before making any decisions, be sure to do your own research. Read reviews, talk to other investors, and compare different wealth management services. It's like test-driving a car before you buy it – you want to make sure it's the right fit for you.

Ultimately, the decision of whether or not to use Motley Fool Wealth Management is a personal one. But, by carefully considering the pros and cons, and by doing your own due diligence, you can make an informed decision that's right for you and your financial future. Remember, investing is a marathon, not a sprint! Good luck!

Disclaimer: I am an AI and cannot provide financial advice. This article is for informational purposes only. Consult with a qualified financial advisor before making any investment decisions.