Okay, picture this: I'm frantically searching for my keys, late for a meeting (again!). I finally find them... in the fridge. Yep, right next to the yogurt. That's pretty much how my finances *felt* before I started religiously doing bank reconciliations. A total mess where important things were hiding in plain sight, but I was too busy rushing to notice.

So, what does my bizarre key-hiding habit have to do with your bank account? More than you think! Just like I needed to slow down and organize my life (and maybe get more sleep), you need to slow down and reconcile your bank statements. Trust me, it's way less stressful than finding car keys in a dairy aisle.

What even *is* a Bank Reconciliation?

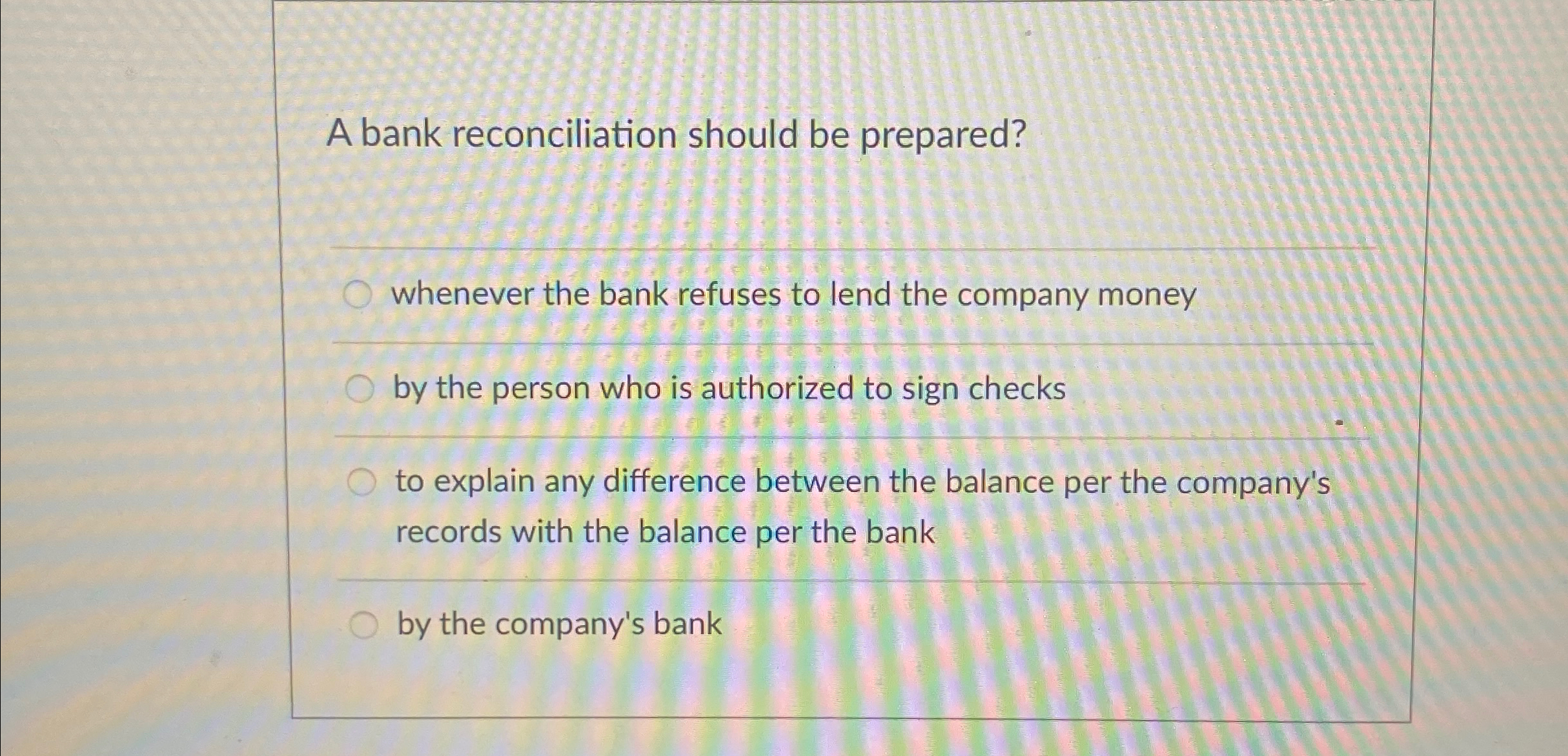

Alright, let's break this down. A bank reconciliation is basically like comparing your financial notes with the bank's notes. It's the process of comparing your company's cash balance in your accounting records to the corresponding information on your bank statement. Think of it as a financial "spot the difference" game.

You're essentially checking if your records and the bank's records agree. If they don't (and they usually don't at first glance), you need to figure out why. It's about finding those pesky discrepancies that can lead to serious headaches down the road.

Think of it as a detective game, but instead of solving a crime, you're solving a financial mystery. And believe me, financial mysteries can be just as thrilling (okay, maybe not thrilling, but definitely important!).

Why Bother Reconciling? (The "Seriously, Do I HAVE To?" Section)

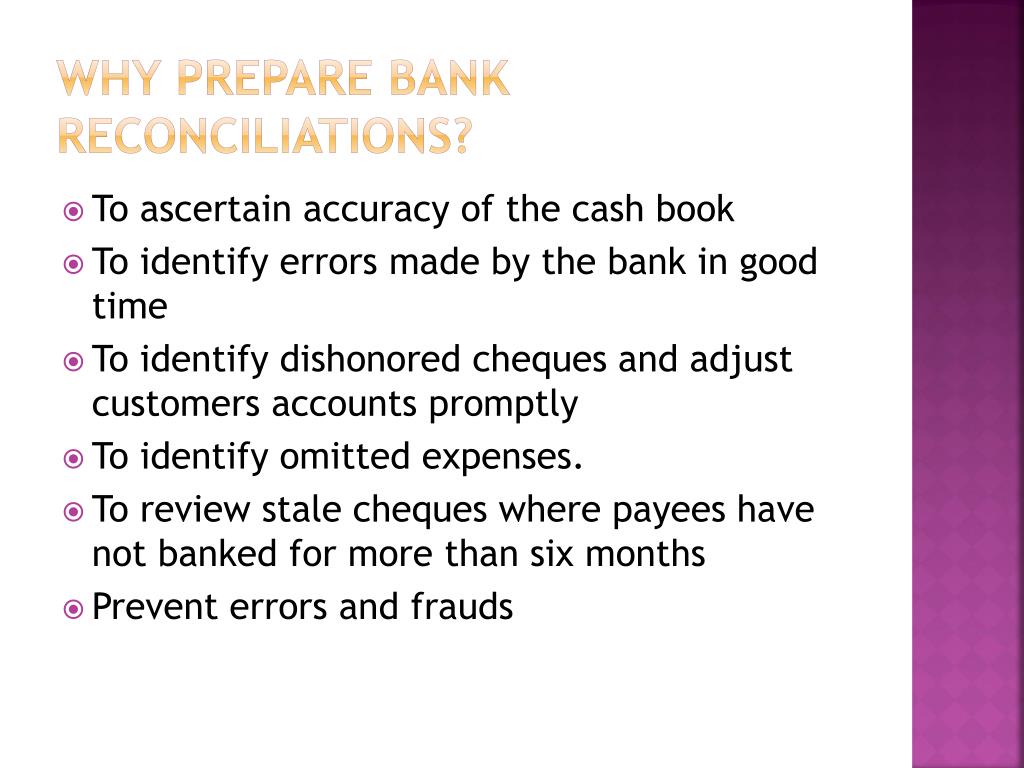

I get it. Reconciliations sound boring. They sound tedious. They sound like something your accountant should be doing. But here's the thing: reconciling your bank account is one of the most important things you can do to protect your business (or even your personal finances, for that matter!). Here’s why:

Catching Errors (Before They Catch You)

Banks make mistakes. You make mistakes. I make mistakes (re: keys in the fridge). It's a fact of life. A bank reconciliation helps you identify these errors early on, before they snowball into bigger problems.

Imagine this: the bank accidentally charges you twice for a wire transfer. Without a reconciliation, you might not notice for weeks, or even months! That's money you could be using for, well, anything other than overpaying the bank.

Or, maybe you accidentally entered a payment for $100 as $1,000 in your accounting software. Ouch! A reconciliation will help you catch that typo and correct it before your financial reports are completely out of whack.

Detecting Fraud (Because Sadly, It Happens)

Okay, this is a big one. Bank reconciliations are a crucial tool for detecting fraud. If someone is stealing from your business, a reconciliation can help you uncover it quickly.

Think about it: if an employee is writing unauthorized checks or making fraudulent withdrawals, the reconciliation will highlight the discrepancies between your books and the bank's records. It's like a financial alarm system that goes off when something isn't right.

Even seemingly small discrepancies can be red flags. A missing check number, an unexplained withdrawal, or a slightly altered payee name – these could all be signs of fraudulent activity. Better safe than sorry, right?

Maintaining Accurate Financial Records (For a Clearer Picture)

Accurate financial records are essential for making informed business decisions. You need to know exactly how much cash you have on hand, how much you owe, and how much you're earning. A bank reconciliation ensures that your financial statements are a true and accurate reflection of your financial position.

Without accurate records, you're flying blind. You might think you have more cash than you actually do, leading you to make poor investment decisions or overspend. Or, you might underestimate your cash flow, causing you to miss out on opportunities or struggle to meet your obligations.

Plus, accurate records are crucial for tax time. Trying to file your taxes with messy, unreconciled accounts? Trust me, you do NOT want that headache. The IRS tends to frown upon guessing.

Improving Internal Controls (Setting Up Safeguards)

Reconciling your bank account regularly can also help you identify weaknesses in your internal controls. For example, you might discover that you don't have a clear process for approving payments or that your employees aren't following proper procedures for handling cash.

By identifying these weaknesses, you can implement stronger internal controls to prevent errors and fraud in the future. Think of it as building a financial fortress around your business.

This could involve things like requiring dual signatures on checks, implementing a clear segregation of duties, or conducting regular audits of your cash handling procedures.

How to Actually *Do* a Bank Reconciliation (The Practical Steps)

Okay, enough with the theory. Let's get down to the nitty-gritty. Here's a simplified guide to performing a bank reconciliation:

- Gather Your Documents: You'll need your bank statement, your general ledger cash account, and any previous bank reconciliations. The more organized you are, the easier this will be. (Yes, I know, organization is the arch-nemesis of creativity, but trust me, it pays off here!)

- Compare Deposits: Compare the deposits listed on your bank statement to the deposits recorded in your general ledger. Identify any deposits that are listed in one place but not the other. These are called "deposits in transit."

- Compare Withdrawals/Payments: Do the same thing with withdrawals and payments. Compare the withdrawals and payments listed on your bank statement to the withdrawals and payments recorded in your general ledger. Identify any items that are listed in one place but not the other. These could be outstanding checks, bank service charges, or NSF checks (bounced checks).

- Identify Bank Errors: Review your bank statement carefully for any errors. Did the bank charge you incorrectly for a fee? Did they credit your account with the wrong amount? Contact the bank immediately to correct any errors.

- Identify Book Errors: Review your general ledger for any errors. Did you record a payment for the wrong amount? Did you forget to record a deposit? Correct any errors in your general ledger.

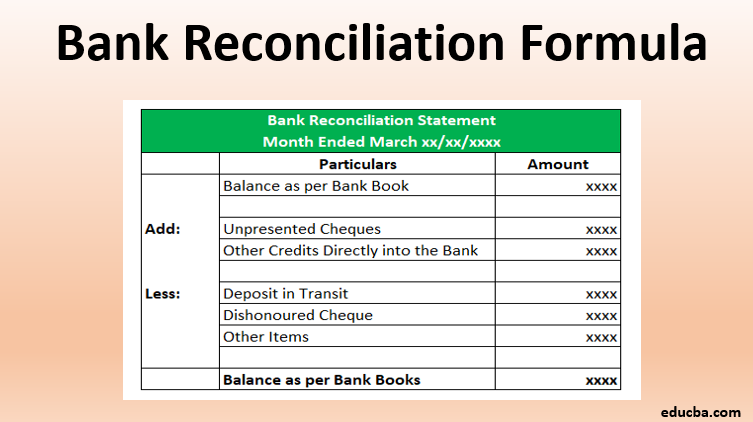

- Prepare the Reconciliation: Now, it's time to put it all together. Start with the bank balance per the bank statement and adjust for any outstanding deposits and outstanding checks. Then, start with the book balance per your general ledger and adjust for any bank service charges, NSF checks, and any other items that are not yet reflected in your books.

- Verify: Check that your adjusted bank balance and your adjusted book balance are equal. If they are, congratulations! You've successfully reconciled your bank account. If they're not, you'll need to go back and double-check your work. (Don't worry, it happens to the best of us!)

Pro-Tip: Many accounting software programs (like QuickBooks, Xero, etc.) have built-in bank reconciliation features that can automate much of this process. Definitely worth checking out!

Common Reconciliation Items (The Usual Suspects)

Here are some common items that often cause discrepancies between your bank statement and your general ledger:

- Outstanding Checks: Checks that you've written but haven't yet been cashed by the recipient. They're in your books, but not yet on the bank statement.

- Deposits in Transit: Deposits that you've made but haven't yet been processed by the bank. They're in your books, but not yet on the bank statement.

- Bank Service Charges: Fees charged by the bank for things like account maintenance, wire transfers, or overdrafts. They're on the bank statement, but not yet in your books.

- NSF Checks: Checks that you've deposited but were returned by the bank because the payer didn't have sufficient funds. They're on the bank statement (as a deduction), but not yet in your books.

- Errors: As mentioned earlier, both you and the bank can make errors. It's important to identify and correct these errors promptly.

- Electronic Funds Transfers (EFTs): Direct deposits or payments that you've made or received electronically. Sometimes, there can be delays in processing EFTs, leading to discrepancies.

- Interest Earned: Interest earned on your bank account. It's on the bank statement, but not yet in your books.

How Often Should You Reconcile? (The Frequency Question)

The general rule of thumb is to reconcile your bank account at least monthly. This gives you a chance to catch errors and fraud early on and maintain accurate financial records. Think of it as a monthly checkup for your financial health.

However, if you have a high volume of transactions, you might want to reconcile more frequently, such as weekly or even daily. The more often you reconcile, the easier it will be to identify and correct any discrepancies.

Seriously, if you have tons of transactions, daily reconciliation might sound crazy, but it can save you a HUGE headache later on. Imagine sifting through hundreds of transactions trying to find a small error weeks later? Ugh.

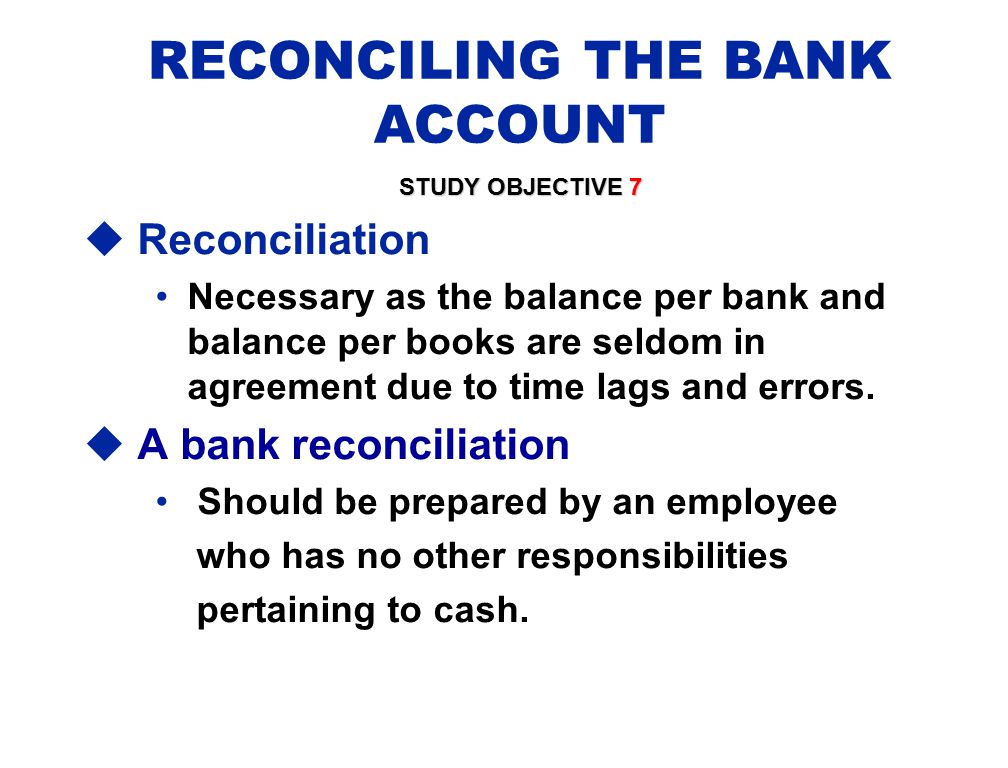

Who Should Be Doing the Reconciling? (The Responsibility Game)

Ideally, the person who reconciles the bank account should be someone who is independent of the cash handling process. This helps to prevent fraud and errors. You don't want the person writing the checks also reconciling the bank account. That's just asking for trouble.

In a small business, this might be the owner or a trusted employee who doesn't have direct access to cash. In a larger organization, it should be someone in the accounting department who is not involved in cash receipts or disbursements.

If you're not comfortable doing the reconciliation yourself, you can always hire a bookkeeper or accountant to do it for you. Just make sure you choose someone you trust and who has experience with bank reconciliations.

The Bottom Line (The Grand Finale)

Bank reconciliations are not the most exciting task in the world, but they are absolutely essential for maintaining accurate financial records, detecting fraud, and improving internal controls. By taking the time to reconcile your bank account regularly, you can protect your business and make better-informed financial decisions. Plus, you'll avoid finding your keys in the fridge. Metaphorically speaking, of course.

So, take a deep breath, grab your bank statement, and get to reconciling! Your finances (and your peace of mind) will thank you for it.

And remember, if I can figure this stuff out, anyone can!