A company's cost of capital is a fundamental concept in corporate finance. It represents the minimum rate of return that a company must earn on its investments to satisfy its investors, including both debt holders and equity shareholders. Think of it as the price a company pays for the funds it uses to finance its operations and growth.

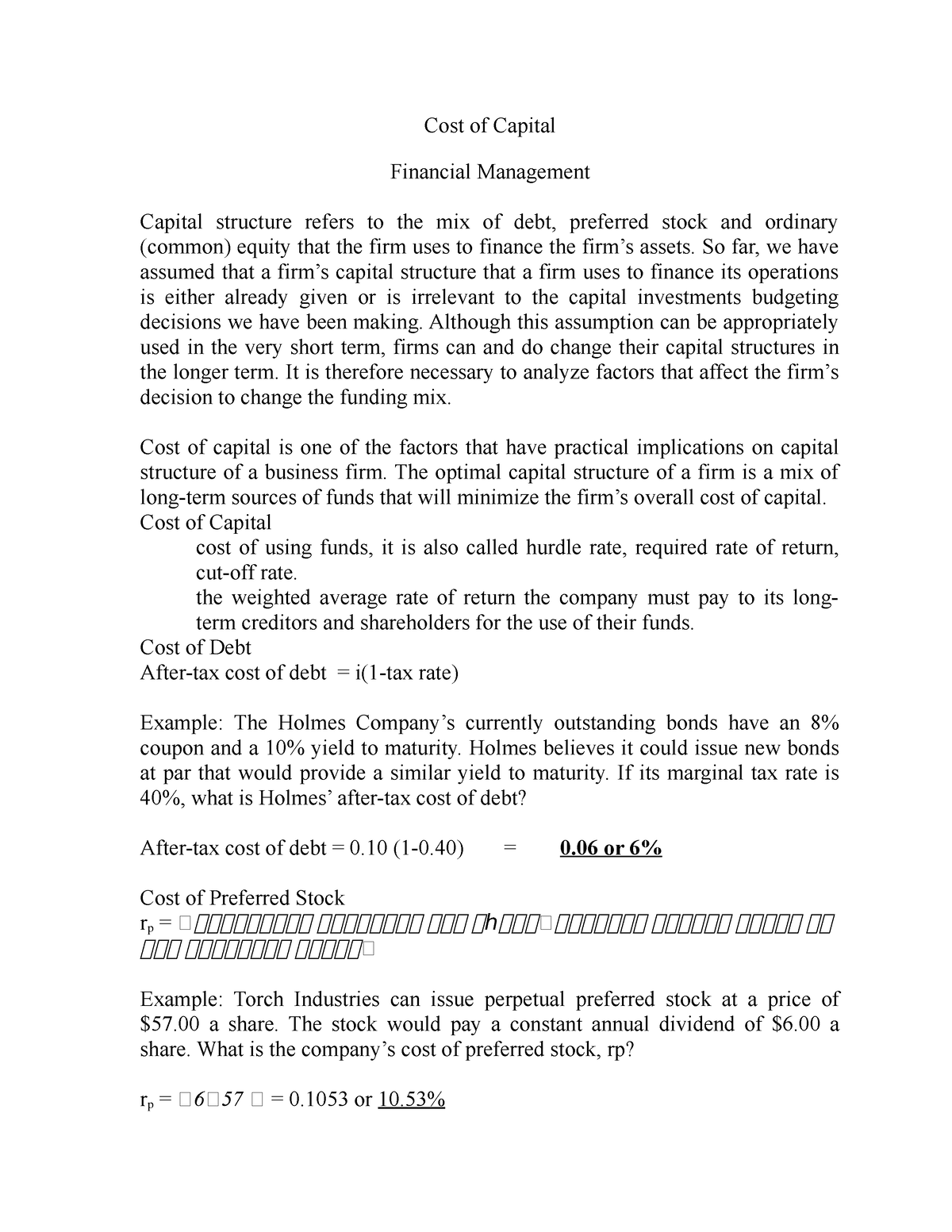

Understanding the Components

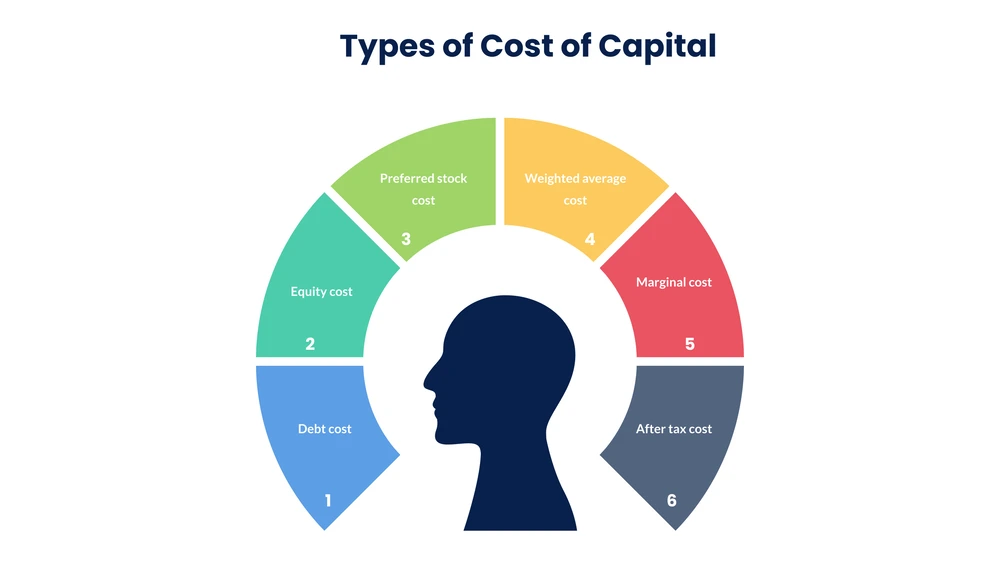

The cost of capital isn't a single number; it's a composite derived from the various sources of funding a company employs. The two primary components are the cost of debt and the cost of equity. Understanding each of these is crucial for calculating the overall cost of capital.

Cost of Debt

The cost of debt is the return that a company must pay to its creditors, such as banks and bondholders, for borrowing money. This is typically expressed as an interest rate. However, it’s not simply the stated interest rate on a loan or bond. A key factor in calculating the cost of debt is the impact of taxes. Interest payments are typically tax-deductible, which reduces the company's taxable income and, consequently, its tax liability. Therefore, the after-tax cost of debt is calculated as:

After-Tax Cost of Debt = (Interest Rate) * (1 - Tax Rate)

For example, if a company borrows money at an interest rate of 8% and its corporate tax rate is 25%, the after-tax cost of debt is 8% * (1 - 0.25) = 6%. This lower figure reflects the true economic cost of borrowing.

Cost of Equity

The cost of equity is the return that a company must provide to its shareholders to compensate them for the risk of investing in its stock. Unlike debt, there is no explicit contractual obligation to pay a specific return to equity holders. Therefore, the cost of equity is an *implicit* cost, representing the opportunity cost of investing in the company's stock versus other investments with similar risk profiles. Estimating the cost of equity is more complex than calculating the cost of debt, as it relies on models and assumptions about investor expectations.

Several methods are used to estimate the cost of equity, with the most common being:

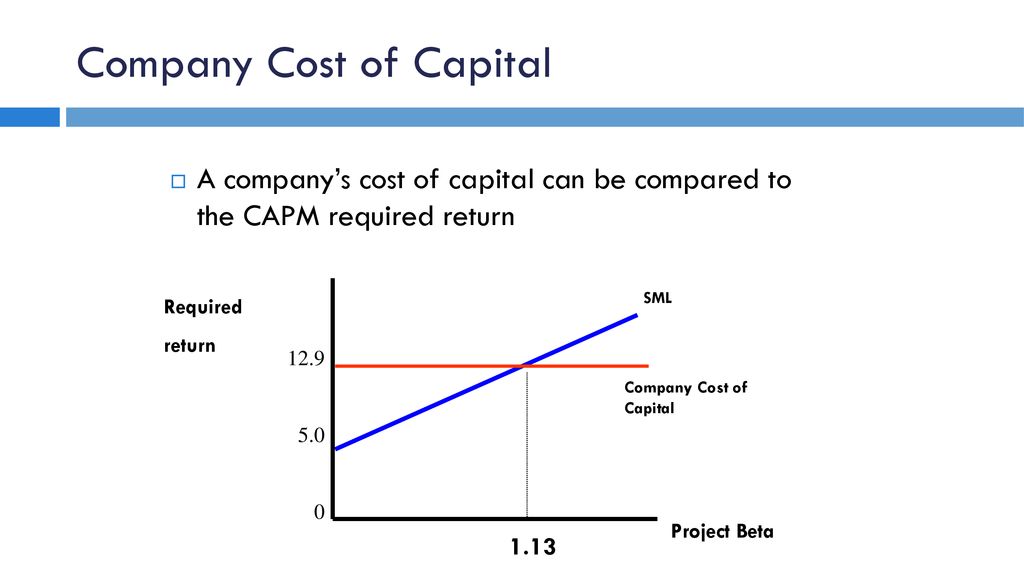

- Capital Asset Pricing Model (CAPM): This model links the cost of equity to the risk-free rate (e.g., the yield on government bonds), the company's beta (a measure of its volatility relative to the market), and the market risk premium (the expected return on the market above the risk-free rate). The formula is:

Cost of Equity = Risk-Free Rate + Beta * (Market Risk Premium)

- Dividend Discount Model (DDM): This model values a stock based on the present value of its expected future dividends. The formula is:

Cost of Equity = (Expected Dividend per Share / Current Stock Price) + Dividend Growth Rate

- Bond Yield Plus Risk Premium: This approach adds a risk premium to the company's cost of debt to arrive at the cost of equity. This method is based on the idea that equity investors require a higher return than debt holders due to the greater risk they bear.

Each method has its strengths and weaknesses, and analysts often use multiple methods to arrive at a reasonable estimate of the cost of equity.

Weighted Average Cost of Capital (WACC)

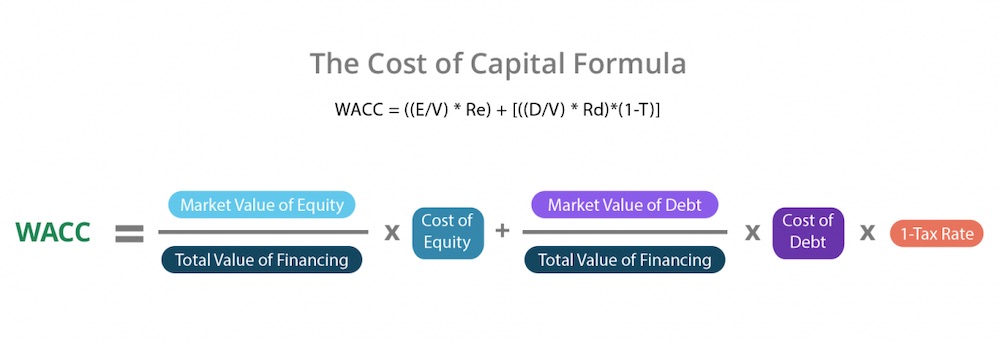

The Weighted Average Cost of Capital (WACC) is the overall cost of capital for a company, taking into account the proportion of each funding source in the company's capital structure. It represents the average rate of return a company must earn on its investments to satisfy all its investors. WACC is calculated as follows:

WACC = (Weight of Debt * Cost of Debt * (1 - Tax Rate)) + (Weight of Equity * Cost of Equity)

Where:

- Weight of Debt = (Market Value of Debt) / (Market Value of Debt + Market Value of Equity)

- Weight of Equity = (Market Value of Equity) / (Market Value of Debt + Market Value of Equity)

For example, suppose a company has a market value of debt of $50 million and a market value of equity of $100 million. Its cost of debt is 6% (after-tax), and its cost of equity is 12%. The WACC would be calculated as:

Weight of Debt = $50 million / ($50 million + $100 million) = 0.333

Weight of Equity = $100 million / ($50 million + $100 million) = 0.667

WACC = (0.333 * 6%) + (0.667 * 12%) = 2% + 8% = 10%

Therefore, the company's WACC is 10%. This means that the company must earn a return of at least 10% on its investments to satisfy its investors.

Factors Influencing the Cost of Capital

Several factors can influence a company's cost of capital, both internal and external. These include:

- Interest Rates: Changes in prevailing interest rates directly affect the cost of debt. Higher interest rates increase the cost of borrowing, while lower rates decrease it.

- Tax Rates: Corporate tax rates influence the after-tax cost of debt. Higher tax rates reduce the after-tax cost of debt, making debt financing more attractive.

- Company Risk: The perceived risk of a company affects both its cost of debt and its cost of equity. Riskier companies typically face higher borrowing costs and require a higher return to attract equity investors. Factors contributing to company risk include its financial leverage, industry volatility, and competitive landscape.

- Market Conditions: Overall market conditions, such as economic growth, investor sentiment, and market volatility, can influence the cost of capital. In periods of economic uncertainty, investors may demand higher returns, increasing the cost of equity.

- Capital Structure: A company's capital structure, the mix of debt and equity it uses to finance its operations, can affect its WACC. A higher proportion of debt can lower the WACC (due to the tax deductibility of interest), but it also increases financial risk.

Using the Cost of Capital in Decision-Making

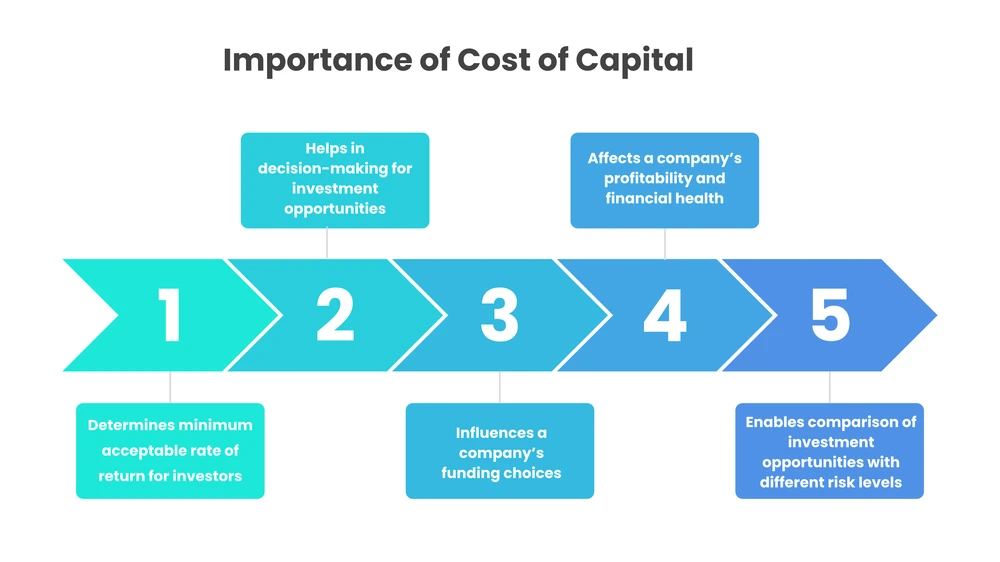

The cost of capital is a critical input in various financial decisions, including:

- Capital Budgeting: Companies use the cost of capital as a discount rate to evaluate potential investment projects. If the expected return on a project exceeds the cost of capital, the project is considered worthwhile and should be undertaken.

- Valuation: The cost of capital is used to discount future cash flows in valuation models to determine the present value of a company or asset.

- Performance Measurement: The cost of capital can be used to assess a company's financial performance. For example, Economic Value Added (EVA) measures the difference between a company's operating profit and its cost of capital.

- Capital Structure Decisions: Companies use the cost of capital to evaluate different capital structure options and determine the optimal mix of debt and equity.

Why the Cost of Capital Matters

The cost of capital is a vital concept because it provides a benchmark for investment decisions and helps companies allocate capital efficiently. A company that consistently invests in projects with returns below its cost of capital will destroy shareholder value. Conversely, a company that consistently invests in projects with returns above its cost of capital will create shareholder value. Understanding and managing the cost of capital is, therefore, crucial for maximizing shareholder wealth and ensuring long-term financial success.

:max_bytes(150000):strip_icc()/COST-OF-CAPITAL-FINAL-HR-f3d41d21c66a494ea77eec360a6a3857.jpg)