Understanding finance charges is crucial for managing your personal finances effectively, whether you're using credit cards, taking out loans, or financing purchases. Knowing what constitutes a finance charge empowers you to make informed decisions, avoid unnecessary expenses, and negotiate better terms.

Deconstructing the Finance Charge

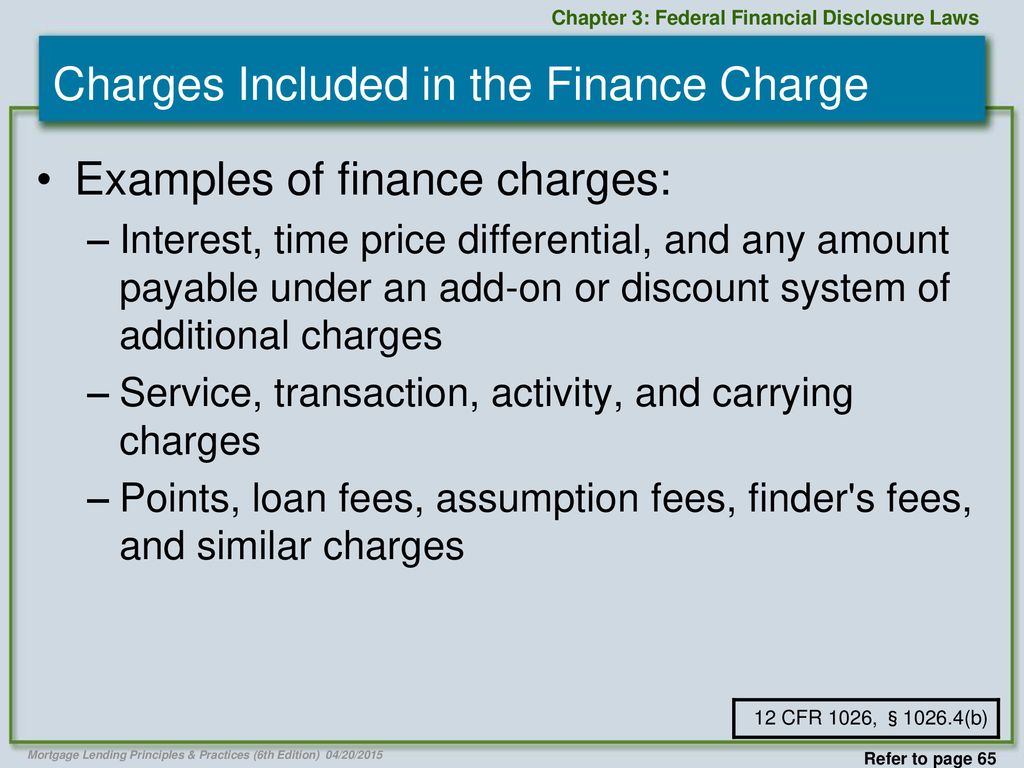

A finance charge is essentially the cost of credit. It represents the total dollar amount you pay to use credit, encompassing various components beyond just the interest rate. Let's break down the key elements typically included in a finance charge:

1. Interest

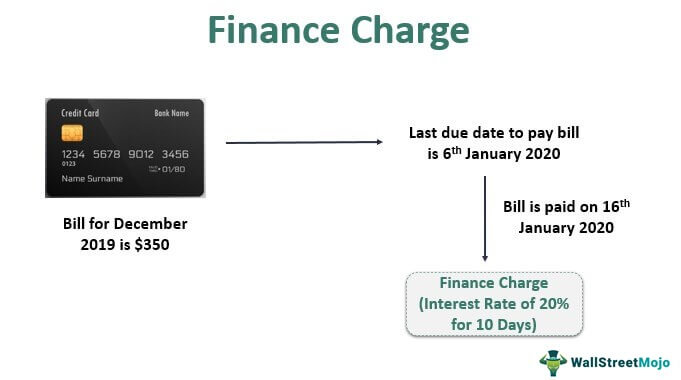

Interest is the most common and often largest component of a finance charge. It's the fee a lender charges you for borrowing money. The interest rate, typically expressed as an annual percentage rate (APR), directly impacts the amount of interest you accrue over time.

Practical Tip: Compare APRs carefully when considering different credit cards or loans. Even a small difference in the APR can result in significant savings over the life of the debt. Use online calculators to estimate the total interest you'll pay based on different APRs and repayment schedules.

2. Transaction Fees

Transaction fees are charges associated with specific uses of your credit. Common examples include:

- Cash Advance Fees: Fees charged when you withdraw cash using your credit card. These fees are typically a percentage of the cash advance amount and often come with a higher APR than regular purchases.

- Balance Transfer Fees: Fees charged when you transfer a balance from one credit card to another. These are usually a percentage of the transferred balance.

- Foreign Transaction Fees: Fees charged when you use your credit card for purchases made in a foreign currency.

Practical Tip: Avoid cash advances whenever possible, as they incur high fees and interest rates. When transferring balances, carefully consider whether the transfer fee is offset by the lower interest rate offered by the new card. If you travel internationally frequently, look for credit cards with no foreign transaction fees.

3. Service Fees

Service fees cover various administrative or operational costs associated with your credit account or loan. Examples include:

- Annual Fees: Some credit cards charge an annual fee for the privilege of using the card. These fees can range from a few dollars to several hundred dollars.

- Late Payment Fees: Fees charged when you fail to make your payment by the due date.

- Over-the-Credit-Limit Fees: Fees charged when you exceed your credit limit.

Practical Tip: Evaluate whether the benefits of a credit card with an annual fee (e.g., rewards, travel perks) outweigh the cost. Always pay your bills on time and stay within your credit limit to avoid late payment and over-the-limit fees. Consider setting up automatic payments to ensure timely payments.

4. Other Charges

Depending on the specific loan or credit agreement, other charges might be included in the finance charge. These could include:

- Loan Origination Fees: Fees charged by a lender to process a new loan.

- Appraisal Fees: Fees charged for appraising the value of property, often associated with mortgage loans.

- Credit Insurance Premiums: Premiums for insurance that pays off your debt in case of death, disability, or unemployment (note: these are often optional).

Practical Tip: Carefully review all loan documents and credit agreements to identify any fees beyond interest, transaction fees, and service fees. Ask the lender or creditor to explain any charges you don't understand. Be wary of pressure to purchase optional credit insurance, as it may not be in your best interest.Applying This Knowledge

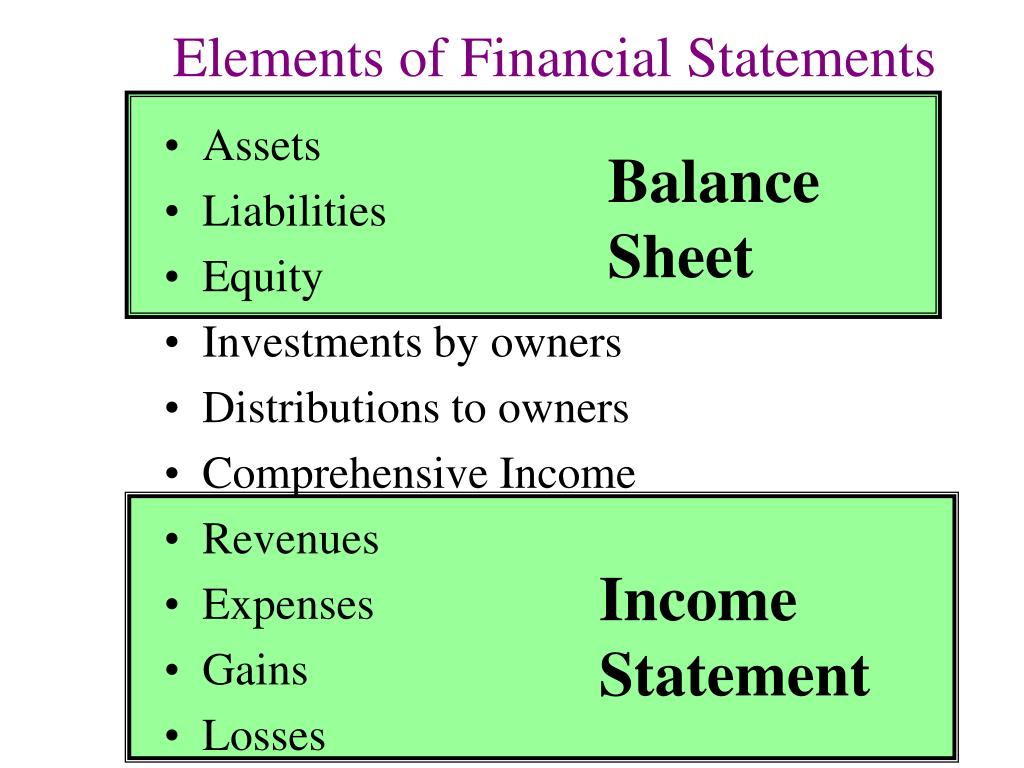

Understanding the components of a finance charge allows you to:

- Compare Credit Offers Effectively: Don't just focus on the interest rate. Consider all fees and charges when comparing different credit cards or loan options. The total finance charge provides a more accurate picture of the overall cost.

- Minimize Credit Costs: By avoiding unnecessary fees (e.g., cash advances, late payments), you can significantly reduce your finance charges and save money.

- Negotiate Better Terms: Armed with knowledge of the various fees involved, you may be able to negotiate lower fees or better interest rates with lenders or creditors.

- Budget Accurately: Including finance charges in your budget allows you to plan for the true cost of credit and avoid surprises.

- Identify Predatory Lending Practices: Be wary of lenders who charge exorbitant fees or hide them in the fine print. Understanding finance charge components helps you spot potentially predatory lending practices.

Understanding the Truth in Lending Act (TILA)

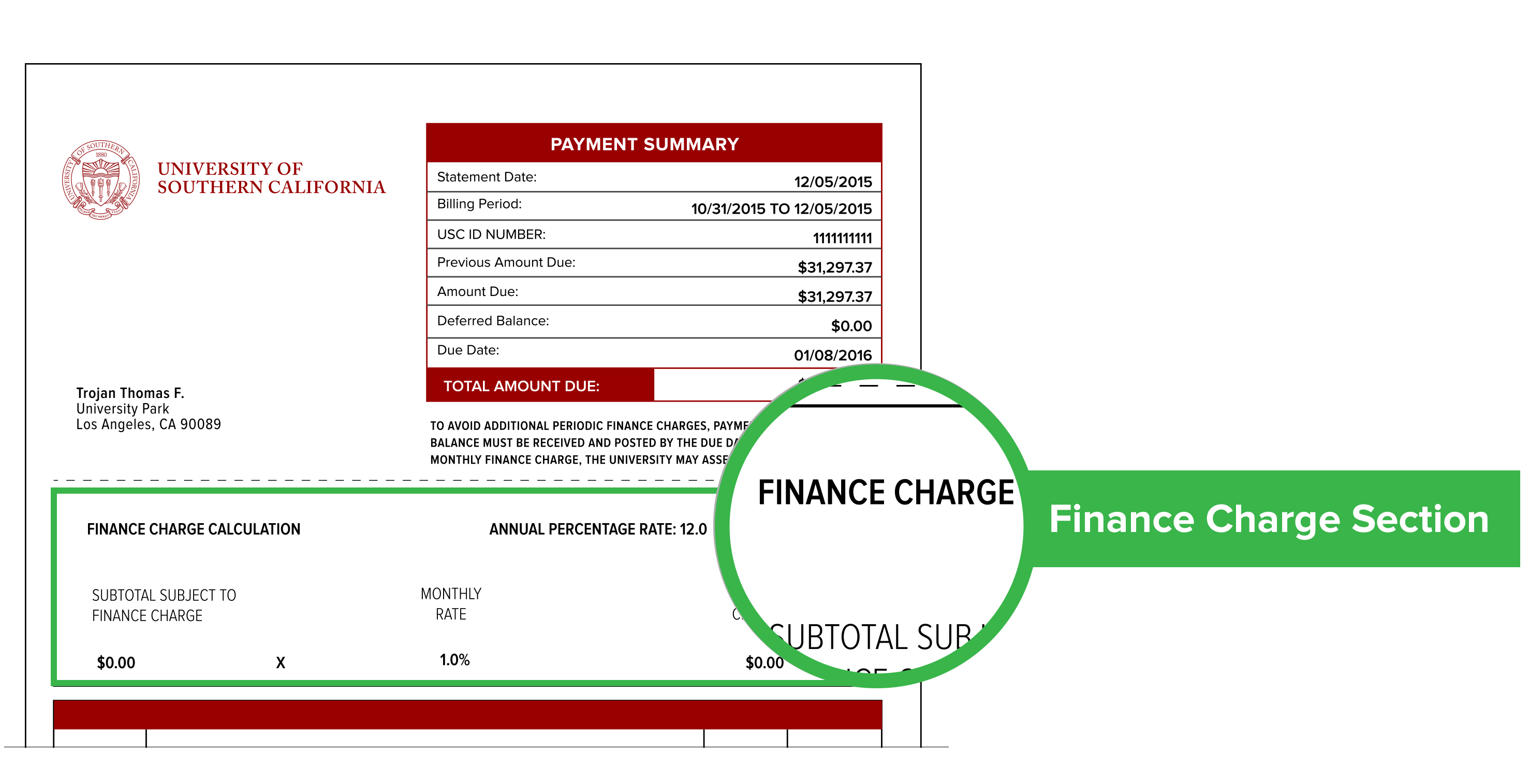

The Truth in Lending Act (TILA) is a federal law that requires lenders to clearly disclose the terms and costs of credit to consumers. This includes providing information about the APR, finance charge, amount financed, and total payments. TILA aims to protect consumers by promoting informed use of credit. This allows consumers to compare credit terms from different lenders. It is crucial to carefully read the TILA disclosure form that you receive from any lender, as it provides a comprehensive overview of the costs associated with the loan.

Checklist for Managing Finance Charges:

- Review Credit Agreements: Carefully read all credit card agreements and loan documents to understand the fees and charges involved.

- Compare APRs: Compare annual percentage rates (APRs) from different lenders to find the lowest interest rate.

- Avoid Unnecessary Fees: Avoid cash advances, late payments, and over-the-credit-limit fees.

- Negotiate Terms: Negotiate lower fees or better interest rates with lenders or creditors.

- Pay Bills On Time: Set up automatic payments to ensure timely payments.

- Track Spending: Monitor your credit card spending to stay within your credit limit.

- Read TILA Disclosures: Carefully review the Truth in Lending Act (TILA) disclosure form to understand the terms and costs of credit.

- Question Unfamiliar Charges: Immediately contact your lender or creditor if you notice any unfamiliar charges on your statement.