Alright folks, let's talk about something that might sound dry – government borrowing. But trust me, it's like understanding why you shouldn't max out your credit card every month. It affects you, even if you don't realize it!

Why Should *You* Care About Government Borrowing?

Think of the government as one giant household. It needs money to pay for things like roads, schools, hospitals, and even that fancy new park down the street. Now, sometimes it doesn't have enough money coming in (through taxes) to cover all these expenses. So, what does it do? It borrows! Just like you might take out a loan to buy a house or a car. This borrowing is what we call government debt.

Now, borrowing isn't inherently bad. Sometimes, it's necessary to invest in things that benefit everyone in the long run. But just like with your own finances, too much borrowing can lead to problems. And that's where a reduction in government borrowing comes in – it's like hitting the brakes on that spending spree before you get yourself into trouble.

The Ripple Effect: Lower Borrowing, Better Economy

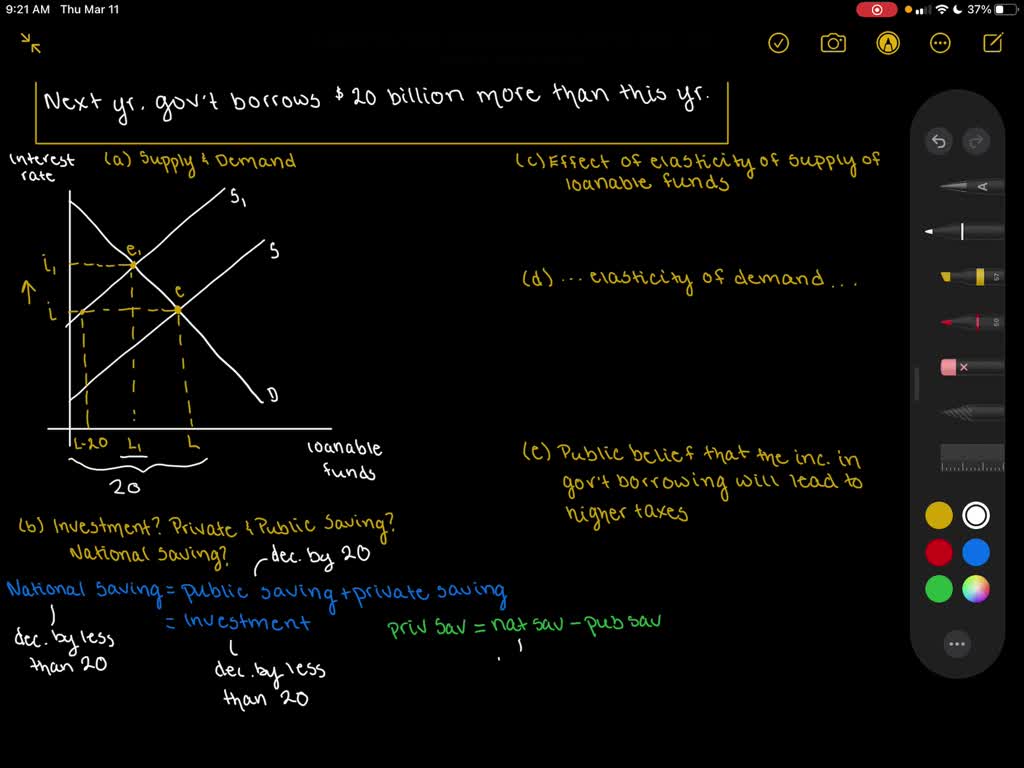

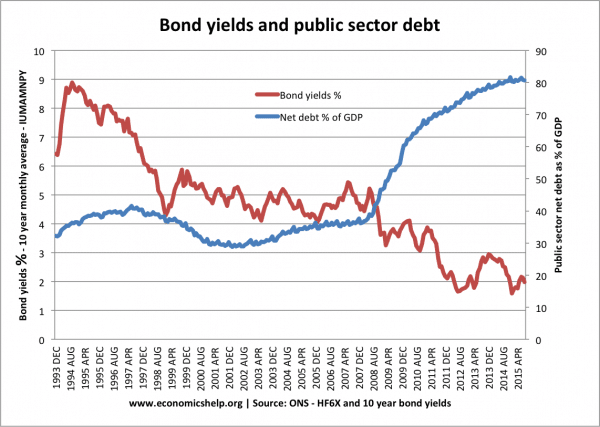

So, what good does a reduction in government borrowing actually *do*? Well, imagine you're at a crowded concert, and everyone's trying to buy snacks and drinks at the same time. Prices go up because there's so much demand. Government borrowing works similarly, only on a much larger scale. When the government borrows a lot, it's like a giant whale swimming in the ocean, sucking up all the available credit. This can drive up interest rates for everyone – even you!

Lower borrowing means less pressure on interest rates. Think about it: if the government isn't competing so fiercely for loans, banks can offer better rates to individuals and businesses. That could mean:

- Lower mortgage rates: Making it easier to buy a home. Imagine saving hundreds of dollars a month on your mortgage!

- Cheaper car loans: Getting that new ride without breaking the bank. Finally, the car of your dreams is within reach!

- More affordable business loans: Helping small businesses grow and create jobs. Your local coffee shop might be able to expand, or that cool tech startup could hire more people from your community.

Essentially, a reduction in government borrowing can free up money for everyday people and businesses, leading to a stronger and more vibrant economy.

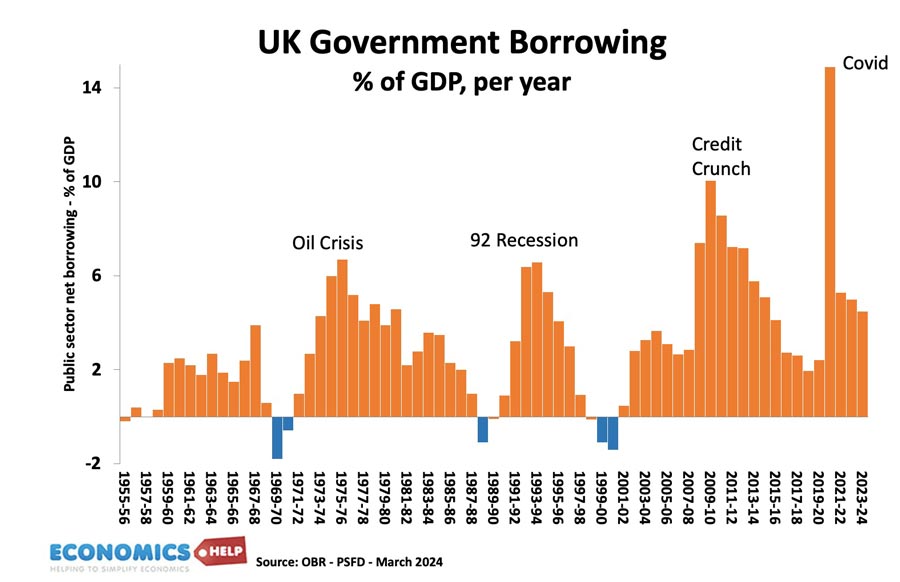

Taming Inflation: A Real-World Example

Let’s talk about inflation. Remember when a gallon of gas suddenly cost an arm and a leg? Or when your favorite cereal seemed to magically shrink while the price stayed the same? That’s inflation hitting you right in the wallet! High government borrowing can sometimes contribute to inflation. When the government spends a lot, it can increase demand in the economy, leading to higher prices.

A reduction in government borrowing can help to curb inflation. It's like turning down the heat on a boiling pot. By reducing its spending, the government can help to cool down the economy and prevent prices from rising too quickly. That means your hard-earned money will go further, and you won't have to worry as much about the rising cost of living.

Building a Stronger Safety Net: Investing in the Future

Now, you might be thinking, "Okay, lower borrowing is good, but what about important programs like social security and Medicare?" That's a valid question! A responsible approach to government borrowing actually *helps* ensure the long-term sustainability of these programs. Think of it like saving for retirement: you need to make sure you're not spending all your money now so that you have enough for later.

By reducing its debt, the government can free up resources to invest in the programs that matter most. That could mean:

- A stronger social security system: Ensuring that retirees have a secure income. Peace of mind knowing your parents and grandparents are taken care of.

- Better healthcare for seniors: Providing access to quality medical care. A healthy and happy older generation contributes so much to our communities.

- Investments in education: Preparing the next generation for success. Giving kids the tools they need to build a brighter future.

Essentially, lower borrowing allows the government to invest in the future, ensuring that important programs are there for you and your family when you need them.

Leaving a Legacy: A Less Burdened Future

Imagine leaving a mountain of debt to your children or grandchildren. Not a pleasant thought, right? Excessive government borrowing can do just that – it can burden future generations with the responsibility of paying off the debt. A reduction in government borrowing is like leaving a cleaner and healthier planet to your kids. It’s about being responsible and thinking about the long-term consequences of our actions.

By reducing the national debt, we can:

- Give future generations more opportunities: They won't be saddled with a huge debt burden. A level playing field for our children and grandchildren.

- Strengthen the economy for the long haul: A more stable and prosperous future for everyone. A brighter outlook for the next generation.

- Invest in things that really matter: Education, infrastructure, and scientific research. Building a better world for tomorrow.

In short, a reduction in government borrowing is about leaving a legacy of responsibility and opportunity for future generations.

The Takeaway: Smart Borrowing, Brighter Future

So, there you have it! A reduction in government borrowing isn't just some abstract economic concept. It can have a real and positive impact on your life, from lower interest rates to a stronger economy and a more secure future for your family. It's about being smart with our money, just like you are with your own budget. And while it might not be the most exciting topic in the world, understanding the basics can help you make informed decisions and advocate for policies that benefit you and your community.

Think of it this way: a responsible government budget is like a well-maintained home. It might require some effort and discipline, but it’s worth it in the long run. A little bit of attention to the details can make a big difference in the overall health and well-being of our society. So, the next time you hear about government borrowing, remember that it's not just about numbers on a spreadsheet. It's about your life, your future, and the future of generations to come.