Remember that time you lent your friend, let's call him Dave, twenty bucks for pizza? He promised to pay you back "next week, for sure!" Next week rolled around, then another, and another... Suddenly, twenty dollars felt like a distant memory, a forgotten dream. You were essentially running a very small, and very informal, accounts receivable department for Dave. (Don't worry, we've all been there.) That, in its simplest form, is what we're diving into today. So, what *are* Accounts Receivable, really?

What ARE Accounts Receivable? The Pizza Analogy Explained.

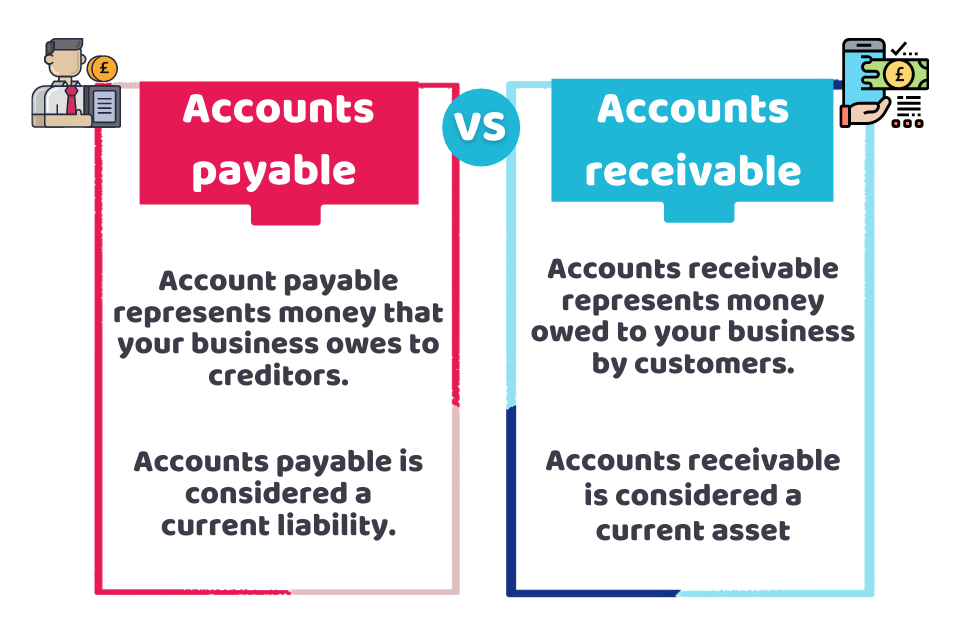

Accounts Receivable (often shortened to A/R) are best described as the money owed to your business by customers who have purchased your goods or services on credit. Think of it like a tab at a bar. You order drinks, enjoy the atmosphere, and then *promise* to pay before you leave. The bar has provided you with something of value, and you have an outstanding obligation to pay for it. A/R are just the formal, business version of that "I owe you one" situation.

Let's break that down a bit further, using Dave and the pizza as our example:

- Your Business (You): You provided a service (funding Dave's pizza).

- Customer (Dave): Dave received the service (delicious, cheesy pizza).

- Goods/Services: The intangible "loan" of twenty dollars.

- Credit: Dave didn't pay you upfront; he promised to pay later.

- Accounts Receivable: That twenty dollars Dave owes you is your A/R.

Pretty straightforward, right? But understanding the basic definition is just the starting point. The real fun (and potential headaches) begin when you start managing A/R at a larger scale. (Like, way more than just one pizza's worth of debt.)

Why Are Accounts Receivable Important? More Than Just Getting Paid Back

Okay, so you know what A/R are. But why should you care? Well, managing your A/R effectively is crucial for your business's financial health. Think of it like this: you can't pay your own bills (rent, salaries, inventory) if your customers aren't paying *you*. A/R directly impact your cash flow, profitability, and overall stability. So, while it might seem like a purely accounting function, it's really a vital part of your business strategy.

Here’s why A/R are so important:

- Cash Flow Management: Efficient A/R management ensures a steady stream of cash flowing into your business. This is essential for covering operating expenses, investing in growth, and avoiding financial crises. (No one wants to be struggling to make payroll because customers are slow to pay!)

- Profitability: A/R tied up in unpaid invoices represent money that could be used elsewhere to generate more profit. The longer invoices remain unpaid, the more it eats into your profitability.

- Financial Stability: A healthy A/R balance indicates a healthy business. It shows that you're effectively managing your credit policies and collecting payments on time. This can improve your credit rating and make it easier to secure loans or investments.

- Decision Making: Analyzing your A/R data can provide valuable insights into customer payment patterns, sales trends, and the effectiveness of your credit policies. This information can help you make informed decisions about pricing, marketing, and other aspects of your business.

Essentially, good A/R management is like having a well-oiled machine that constantly feeds your business with the resources it needs to thrive. Bad A/R management? Well, that's like trying to run a marathon with a flat tire.

Digging Deeper: The Different Types of Accounts Receivable

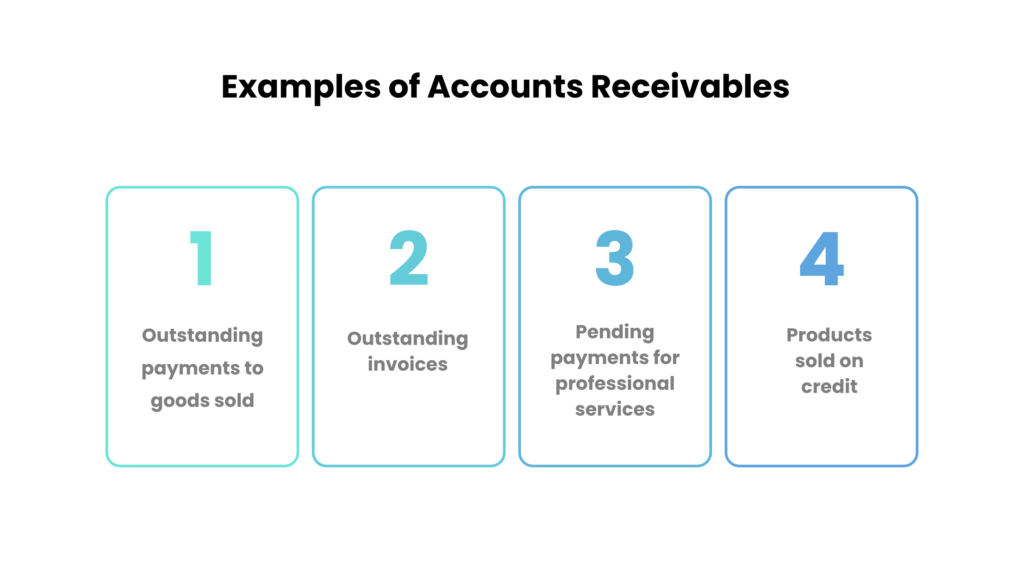

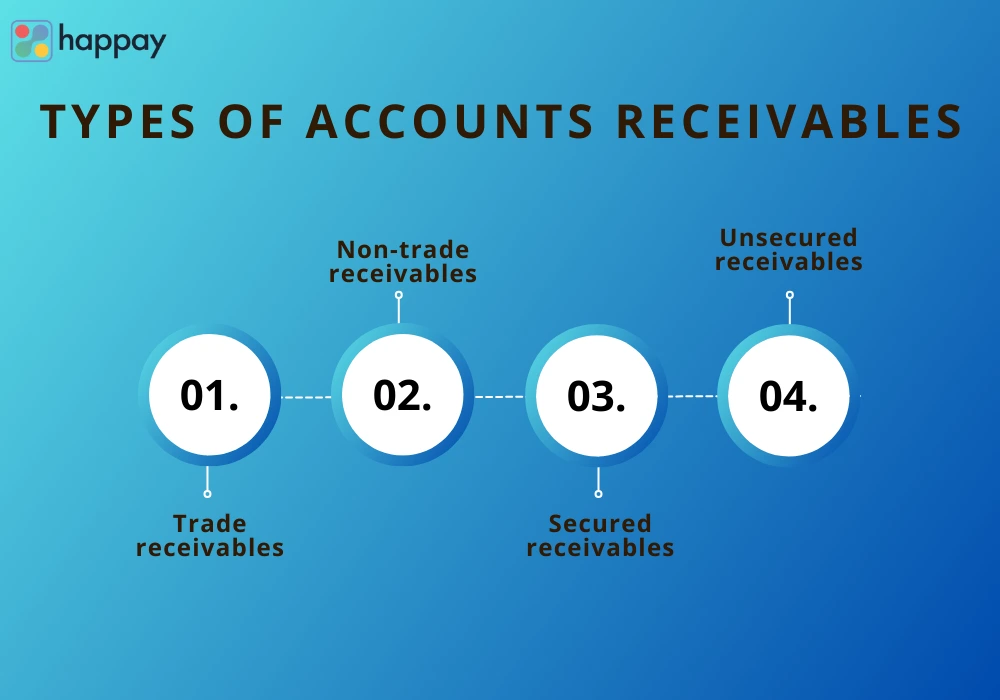

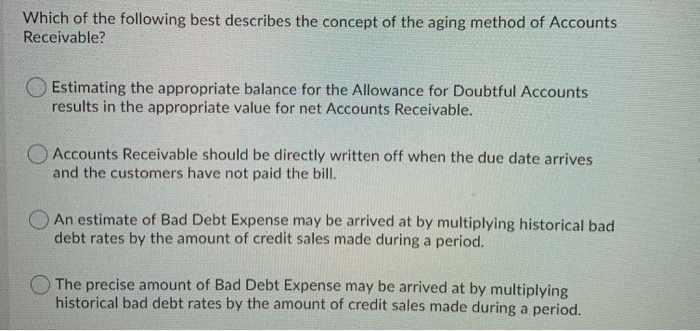

While the basic definition of A/R is straightforward, there are actually a few different types you should be aware of. These distinctions primarily relate to the likelihood of collection:

- Current Accounts Receivable: These are amounts owed by customers that are expected to be collected within one year. This is your standard, bread-and-butter A/R. You sold something, sent an invoice, and expect to get paid relatively soon.

- Long-Term Accounts Receivable: These are amounts owed by customers that are not expected to be collected within one year. This could be due to extended payment terms or other special arrangements. (Maybe you sold a very expensive piece of equipment with a long-term payment plan.)

- Doubtful Accounts (Allowance for Doubtful Accounts): These are accounts that you believe may not be collected in full. This is where things get a little less optimistic. Maybe a customer is facing financial difficulties, or they've disputed an invoice. You'll set aside an "allowance" to account for the possibility of these bad debts.

That last one, Doubtful Accounts, is a critical concept. It's an acknowledgement that, realistically, not *every* customer will pay you. Life happens. Businesses fail. Disputes arise. Setting aside an allowance for doubtful accounts is a prudent way to ensure your financial statements accurately reflect the true value of your A/R. (Think of it as your "rainy day" fund for unpaid invoices.)

Managing Your Accounts Receivable: Practical Tips and Strategies

Okay, enough theory. Let's get down to brass tacks. How do you actually *manage* your A/R effectively? Here are a few key strategies to keep in mind:

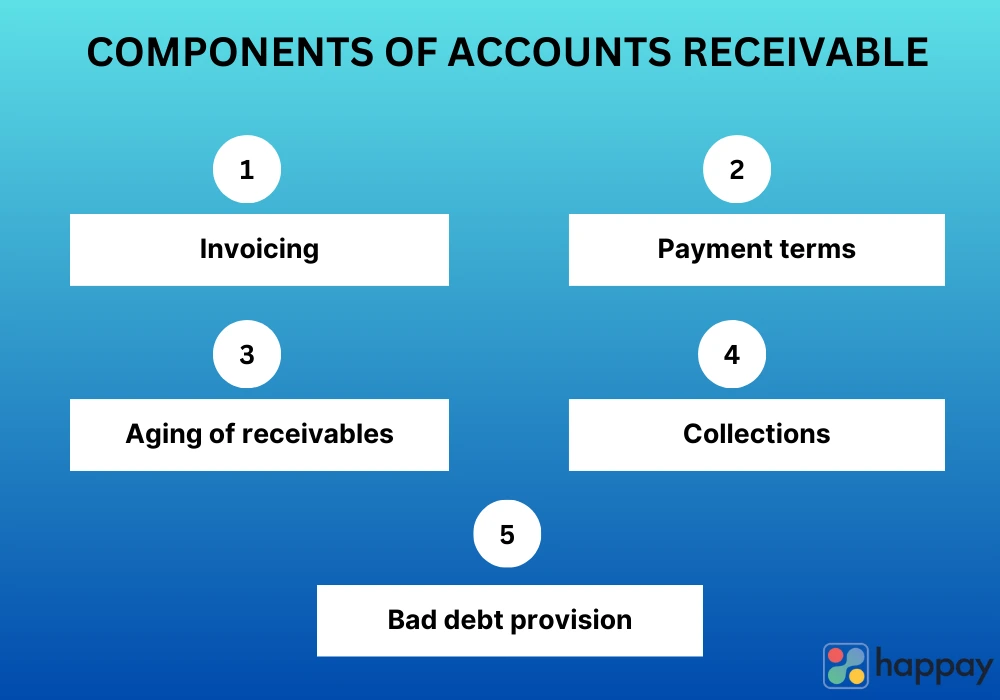

- Establish Clear Credit Policies: Before extending credit to any customer, define your credit terms clearly and consistently. This includes payment deadlines, late payment penalties, and any other relevant information. Make sure these policies are communicated clearly to all customers. (Think of it as setting the ground rules for the game.)

- Invoice Promptly and Accurately: Send out invoices as soon as possible after providing your goods or services. Ensure that all invoices are accurate, professional-looking, and easy to understand. Include all relevant information, such as invoice date, due date, purchase order number, and a detailed description of the goods or services provided.

- Implement a System for Tracking Invoices: Use accounting software or a spreadsheet to track all outstanding invoices and their due dates. This will help you identify overdue invoices quickly and take appropriate action. (You can't chase payments if you don't know who owes you what!)

- Follow Up on Overdue Invoices: Don't be afraid to follow up on overdue invoices. Send reminder emails, make phone calls, or even send a formal demand letter if necessary. The sooner you address overdue invoices, the higher the chances of getting paid.

- Offer Incentives for Early Payment: Consider offering discounts or other incentives to customers who pay their invoices early. This can encourage prompt payment and improve your cash flow. (A little "thank you" goes a long way.)

- Consider Factoring or Invoice Financing: If you need access to cash quickly, you may consider factoring or invoice financing. This involves selling your invoices to a third party at a discount in exchange for immediate payment. While this can be a useful solution in some cases, it's important to understand the costs and risks involved.

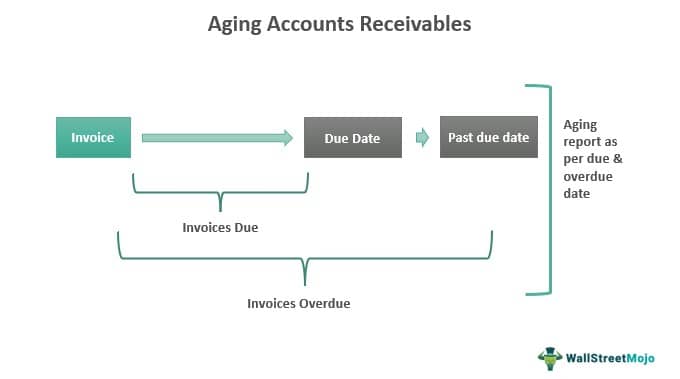

- Regularly Review Your A/R Aging Report: An A/R aging report categorizes your outstanding invoices based on how long they've been overdue. This report can help you identify potential problem accounts and prioritize your collection efforts. (Think of it as a health check for your A/R.)

- Maintain Good Customer Relationships: Building strong relationships with your customers can make it easier to resolve payment issues and improve your chances of getting paid on time. Be polite, professional, and understanding when communicating with customers about overdue invoices. (People are generally more willing to work with those they like.)

These are just a few of the strategies you can use to manage your A/R effectively. The specific tactics you employ will depend on the nature of your business, your industry, and your customer base. But the key is to be proactive, organized, and persistent.

Common Mistakes to Avoid in Accounts Receivable Management

Even with the best intentions, it's easy to make mistakes when managing A/R. Here are a few common pitfalls to avoid:

- Ignoring A/R: This is the biggest mistake of all. Ignoring your A/R is like ignoring a leaky faucet – the problem will only get worse over time.

- Inconsistent Credit Policies: Applying different credit terms to different customers can lead to confusion and resentment. Be consistent and fair in your credit policies.

- Poor Invoicing Practices: Inaccurate, incomplete, or unprofessional-looking invoices can delay payment. Make sure your invoices are clear, accurate, and easy to understand.

- Failure to Follow Up: Letting overdue invoices slide is a surefire way to lose money. Be proactive in following up with customers who are late on their payments.

- Not Setting an Allowance for Doubtful Accounts: Overestimating the collectability of your A/R can lead to an inaccurate financial picture. Set aside an appropriate allowance for doubtful accounts to reflect the risk of non-payment.

- Being Afraid to Ask for Payment: Some business owners are hesitant to ask customers for payment, fearing it will damage the relationship. However, it's important to remember that you're running a business, and you deserve to be paid for your goods or services. Be assertive but respectful in your collection efforts.

Avoiding these common mistakes can save you time, money, and a lot of headaches in the long run. Remember, A/R management is an ongoing process, not a one-time event. Stay vigilant, stay organized, and stay on top of your invoices.

Accounts Receivable and Your Accounting Software

Luckily, you don't have to manage your A/R with just spreadsheets and sticky notes (although some people still do!). Modern accounting software, like QuickBooks, Xero, and NetSuite, can automate many aspects of A/R management, making your life much easier.

These software programs typically offer features such as:

- Invoice Creation and Management: Easily create and send professional-looking invoices, track payment status, and send automated reminders.

- A/R Aging Reports: Generate A/R aging reports to identify overdue invoices and prioritize collection efforts.

- Payment Processing: Accept online payments directly from your customers, making it easier for them to pay you.

- Integration with Bank Accounts: Automatically reconcile payments with your bank accounts, saving you time and effort.

- Reporting and Analytics: Generate reports on your A/R performance, providing valuable insights into customer payment patterns and sales trends.

Investing in accounting software can significantly streamline your A/R management process and improve your overall financial efficiency. It's an investment that will pay off in the long run, saving you time, money, and stress. (Plus, you'll have more time to focus on other aspects of your business, like, you know, actually *selling* things.)

Final Thoughts: Mastering Accounts Receivable for Business Success

Accounts Receivable are a critical component of your business's financial health. Effective A/R management is not just about getting paid; it's about ensuring a steady cash flow, maximizing profitability, and building a financially stable business. By understanding the principles of A/R management, implementing best practices, and leveraging the power of accounting software, you can take control of your finances and achieve your business goals.

And remember Dave? Eventually, he *did* pay me back. (With interest! Just kidding…mostly.) But the experience taught me a valuable lesson about the importance of managing A/R, even on a small scale. So, learn from my (minor) pizza-related woes, and take your A/R seriously. Your business will thank you for it.

Now go forth and conquer your invoices!