Hey, wanna talk gold? No, not like, "should I wear gold or silver today?" More like...Agnico Eagle Mines Ltd. Gold. Investments. You know, the stuff that keeps the world turning (or at least, some very specific parts of the world).

I know, I know. Investor Relations. It sounds *thrilling*, right? Like watching paint dry… but with spreadsheets. But hear me out! It's actually super important. Imagine trying to build a Lego castle without instructions. That's what investing in a company without understanding its Investor Relations is like. Utter chaos!

What's the Deal with Investor Relations (IR)?

Okay, so what *is* Investor Relations anyway? It's basically the bridge between Agnico Eagle and its investors (that could be you!). Think of it as the company's way of saying, "Hey, we're doing cool stuff with shiny rocks, wanna come along for the ride?"

They provide all the information you need to make informed decisions. And by "all the information," I mean *a lot*. Reports, presentations, webcasts...the whole shebang. You could get lost in it all, honestly. But that's why we're here, right? To sift through the gold (pun intended!) and find the valuable nuggets.

Why Should *You* Care About Agnico Eagle's IR?

Great question! Why *should* you care about a mining company's Investor Relations department? Well, if you're thinking about investing in Agnico Eagle (or already have!), you absolutely should. It's like checking the engine before buying a car. You wouldn't just drive off the lot without knowing if it's going to explode, would you? (Please say no.)

Their IR team gives you the inside scoop on how the company is performing. Are they digging up more gold than Scrooge McDuck has in his vault? Are they managing their finances responsibly? Are they, you know, not destroying the planet in the process? These are important things to know!

Think of it this way: you're basically getting a VIP pass to the company's inner workings. It's like having a secret decoder ring that unlocks all the financial secrets (okay, maybe not *that* dramatic, but close!).

And let's be honest, nobody wants to invest in a company that's about to go belly up. Unless you're into that sort of thing (no judgement!). Good IR helps you avoid those kinds of…*unpleasant* surprises.

Diving Deeper: What to Look For

So, you're ready to explore Agnico Eagle's Investor Relations resources. Awesome! But where do you even start? Don't worry, I've got you covered.

First Stop: The Website. Usually, a company's IR information is easily found somewhere on their website. Look for a section labeled "Investors," "Investor Relations," or something similar. It shouldn't be too hard to find...unless they're intentionally hiding it (which would be a red flag in itself!).

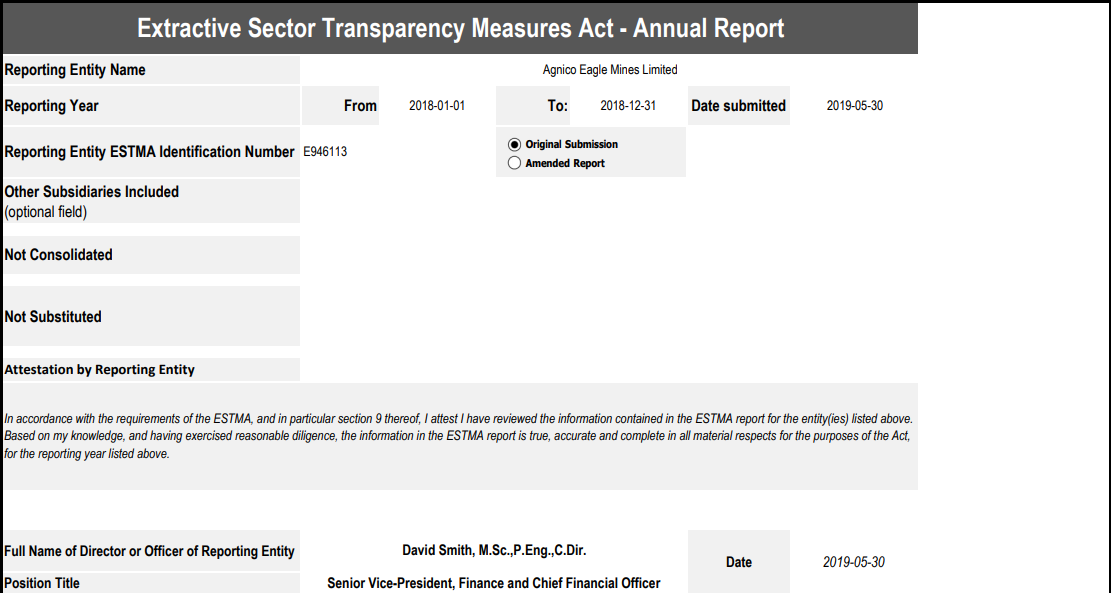

Annual Reports. These are like the company's yearly report card. They tell you everything you need to know about their performance over the past year. Revenue, profits, expenses, challenges, future plans...it's all in there. It might sound dry, but it's essential reading if you're serious about investing.

Financial Statements. Get ready to put on your accountant hat! These documents (like the balance sheet, income statement, and cash flow statement) provide a detailed look at the company's financial health. Don't worry if you don't understand everything at first. There are plenty of resources online to help you decipher them. Besides, the main thing here is to know where the company stands financially. Is it making progress? Is it losing money?

Presentations and Webcasts. These are often more digestible than the formal reports. Companies use them to communicate their strategy and results in a more engaging way. Plus, you might even get to hear from the CEO or other executives. It's like getting a sneak peek behind the curtain.

Press Releases. Stay up-to-date on the latest news from Agnico Eagle. Press releases announce everything from new discoveries to acquisitions to changes in leadership. They're a good way to keep your finger on the pulse of the company.

Analyst Coverage. Financial analysts are professionals who research companies and provide recommendations to investors. Their reports can be a valuable source of information, but remember that they're just opinions. Do your own research and form your own conclusions.

Key Things to Consider When Analyzing Agnico Eagle's IR

Okay, you've got all this information. Now what? How do you actually *use* it to make investment decisions? Here are a few key things to think about:

Financial Performance. Is Agnico Eagle making money? Is their revenue growing? Are they managing their expenses effectively? These are all important indicators of the company's financial health.

Production and Reserves. How much gold are they actually digging up? What are their proven and probable reserves? The more gold they have in the ground, the better (usually!).

Costs. Mining is an expensive business. How much does it cost Agnico Eagle to produce an ounce of gold? Lower costs mean higher profits.

Debt. Is the company carrying a lot of debt? Too much debt can be a sign of financial trouble.

Management. Who's running the show? Do they have a track record of success? A strong management team is essential for any company.

Risk Factors. What are the risks associated with investing in Agnico Eagle? Changes in gold prices, political instability, environmental regulations...there are a lot of things that could go wrong. Be aware of the potential downsides before you invest.

Environmental, Social, and Governance (ESG) Factors. This is becoming increasingly important for investors. Is Agnico Eagle operating in a responsible and sustainable way? Are they treating their employees fairly? Are they minimizing their environmental impact?

Remember, no investment is guaranteed to be a winner. But by doing your homework and carefully analyzing Agnico Eagle's Investor Relations information, you can increase your chances of making a smart investment decision. Or, at least, avoid making a really dumb one. 😉

Agnico Eagle: Beyond the Numbers

So, it's not all about the numbers and financial jargon! Understanding Agnico Eagle goes beyond balance sheets and income statements. What kind of company are they, really?

Their Culture: Does Agnico Eagle seem like a good place to work? Are they known for treating their employees well? A happy workforce often translates to a more productive (and profitable) company. You can usually get a sense of this through their corporate social responsibility reports and by searching for employee reviews online.

Their Sustainability Efforts: Mining can have a significant impact on the environment. Is Agnico Eagle committed to minimizing its impact? Do they have programs in place to protect the environment and support local communities? Again, their sustainability reports and website should provide some insight here.

Their Innovation: Are they embracing new technologies and approaches? The mining industry isn't exactly known for being cutting-edge, but companies that are willing to innovate are more likely to thrive in the long run. Is Agnico Eagle exploring new ways to extract gold more efficiently and sustainably?

Their Community Involvement: Are they giving back to the communities where they operate? Do they support local initiatives and charities? A company that's invested in its communities is more likely to be a good corporate citizen. And that's something worth investing in, right?

Final Thoughts: Investing is a Marathon, Not a Sprint

Investing in a mining company like Agnico Eagle isn't a get-rich-quick scheme (sorry!). It's a long-term game that requires patience, discipline, and a healthy dose of skepticism. Don't get caught up in the hype or the short-term fluctuations in the market. Focus on the fundamentals and make informed decisions based on solid research.

And remember, you don't have to go it alone! There are plenty of resources available to help you along the way. Talk to a financial advisor, read industry publications, and stay informed about the latest developments in the mining sector.

By taking the time to understand Agnico Eagle's Investor Relations information, you'll be well-equipped to make sound investment decisions and potentially profit from the golden opportunities that lie ahead. Just remember to do your own research, be patient, and don't put all your eggs in one golden basket!

So, ready to get digging? Good luck, and happy investing! And maybe, just maybe, you'll strike gold. 😉

Disclaimer: This is not financial advice. Always consult with a qualified financial advisor before making any investment decisions. I'm just a friendly voice on the internet offering my perspective. Think of me as a slightly caffeinated tour guide through the world of Investor Relations.