Anavex Life Sciences Corp. (AVXL) recently released its fiscal year 2024 financial results, providing a snapshot of the company's financial standing and progress in its clinical development programs. This analysis will dissect the company's performance, examining the causes of observed financial outcomes, their effects on operations, and the broader implications for stakeholders and the biopharmaceutical landscape. We will provide context for understanding the company’s progress and challenges.

Financial Performance: Causes and Effects

The primary cause driving Anavex's financial results is its stage as a clinical-stage biopharmaceutical company. Such companies, by their nature, incur substantial research and development (R&D) expenses while typically generating minimal revenue. Anavex's fiscal 2024 reflects this pattern. The company is heavily invested in clinical trials for its lead compound, ANAVEX®2-73 (blarcamesine), and other pipeline assets. These trials, targeting conditions like Alzheimer's disease, Rett syndrome, and Parkinson's disease, demand significant capital investment.

The absence of product revenue is a direct effect of the company not having any commercially approved drugs. Revenue primarily comes from collaborative agreements, government grants, and potentially milestone payments tied to specific clinical development achievements, if any. The actual amounts realized from these sources can vary significantly year to year. A consequence of limited revenue and large R&D expenditures is a net loss. This loss is a key metric watched by investors and analysts, as it reflects the cash burn rate and indicates the company's reliance on external funding.

A crucial indicator is the company's cash position. This figure determines the runway Anavex has to continue funding its operations before needing to raise additional capital. A healthy cash balance allows the company to progress its clinical programs without the immediate pressure of seeking funding, potentially on unfavorable terms. It can also provide negotiating leverage in potential partnerships or acquisitions.

For instance, if Anavex's R&D expenses increased significantly compared to the previous year, this could be attributed to several factors: the initiation of new clinical trials, the expansion of existing trials to larger patient populations, or increased manufacturing costs for clinical trial materials. Such increases are a cause of a higher net loss. Conversely, if R&D expenses decreased, it might signify a strategic decision to prioritize certain programs, delay others, or achieve greater efficiencies in research operations. A substantial government grant received would partially offset R&D costs, positively impacting the bottom line.

Specific Financial Metrics and Their Implications

To understand the implications, let's consider hypothetical figures:

Hypothetical Scenario: Suppose Anavex reported R&D expenses of $50 million for fiscal 2024, compared to $40 million in fiscal 2023. This 25% increase could indicate a ramp-up in clinical trial activity. If, concurrently, general and administrative (G&A) expenses remained relatively stable, it suggests that the company is primarily focusing its resources on its core scientific endeavors. A net loss of $60 million, versus $50 million in the previous year, reflects the increased investment in R&D. If the company's cash position at the end of the fiscal year is $150 million, this might provide sufficient runway for approximately 2-3 years, depending on the projected burn rate.

These financial results have several implications. First, they influence investor sentiment. A strong cash position and promising clinical trial data can attract investors, potentially leading to an increase in the company's stock price. Conversely, disappointing trial results or a rapidly depleting cash reserve could trigger a sell-off. Second, the financial performance affects Anavex's ability to attract and retain talent. A financially stable company is more likely to attract experienced scientists, clinicians, and management personnel. Third, the financial results impact the company's strategic options. A solid financial foundation allows Anavex to pursue multiple clinical programs simultaneously, explore potential acquisitions, or negotiate favorable licensing agreements.

Clinical Development Programs: Progress and Potential Impact

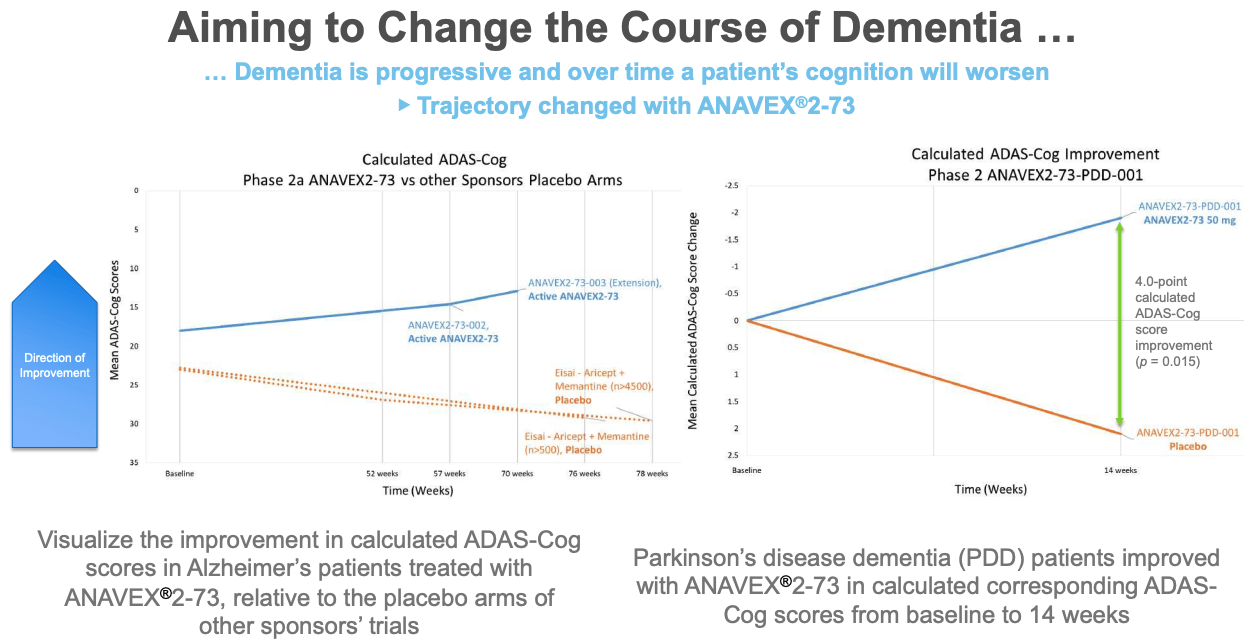

The financial results are intrinsically linked to the progress of Anavex's clinical development programs. ANAVEX®2-73 (blarcamesine) is the company's flagship compound. Positive data from clinical trials in Alzheimer's disease and Rett syndrome are crucial for attracting investment and potentially securing partnerships. The success of these trials would be a major cause for stock appreciation and future revenue prospects.

Specifically, Anavex's focus on precision medicine and targeting the sigma-1 receptor holds both promise and risk. The sigma-1 receptor is implicated in various neurodegenerative and neurodevelopmental disorders. Demonstrating that ANAVEX®2-73 effectively modulates this receptor and translates into clinical benefits is paramount. The lack of success from other Alzheimer's drug candidates highlights the risk involved in drug development, however the unique mode of action of blarcamesine offers hope.

Consider the implications of a successful Phase 3 trial of ANAVEX®2-73 in Alzheimer's disease. Such a result would not only be a major scientific breakthrough but would also have a profound financial impact on Anavex. It could pave the way for regulatory approval, commercialization, and significant revenue generation. In contrast, a failed Phase 3 trial would be a major setback, potentially jeopardizing the company's future. Smaller, positive results could lead to accelerated approval pathways or orphan drug designations which bring financial rewards and reduce development risks.

Regulatory and Market Landscape

The regulatory landscape plays a critical role in shaping Anavex's future. Obtaining regulatory approvals from agencies like the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) is essential for commercializing its drugs. These agencies review clinical trial data to assess the safety and efficacy of new therapies. The rigorous regulatory process is both a challenge and an opportunity. While it can be time-consuming and expensive, successful navigation leads to market exclusivity and potential blockbuster status.

The market landscape for Alzheimer's disease and other neurodegenerative disorders is vast and underserved. With an aging global population, the prevalence of these conditions is expected to increase dramatically in the coming decades. This represents a significant market opportunity for companies like Anavex that are developing innovative therapies. However, the market is also highly competitive, with numerous companies vying to develop effective treatments. Anavex must differentiate its products through superior efficacy, safety, or unique mechanisms of action. The recent approval of aducanumab (Aduhelm) and lecanemab (Leqembi) demonstrates the renewed focus and regulatory willingness to approve new Alzheimer's treatments, though with caveats regarding efficacy and safety profiles. These approvals provide both opportunities and challenges for Anavex, demonstrating a path to market but also raising the bar for efficacy.

Broader Significance and Reflection

Anavex Life Sciences' fiscal 2024 results are more than just numbers on a balance sheet. They represent the culmination of years of research, development, and investment in the pursuit of novel therapies for debilitating diseases. The company's progress, or lack thereof, has far-reaching implications for patients, investors, and the broader scientific community.

The broader significance lies in the potential to address unmet medical needs. Alzheimer's disease, Rett syndrome, and Parkinson's disease are devastating conditions that affect millions of people worldwide. Effective treatments for these diseases would not only improve the quality of life for patients and their families but also alleviate the significant economic burden associated with their care.

Anavex's story also highlights the inherent risks and rewards of investing in biotechnology. Drug development is a long, complex, and expensive process with a high rate of failure. However, the potential rewards – both financial and societal – are enormous. Companies like Anavex are pushing the boundaries of science and innovation, and their efforts have the potential to transform healthcare.

Ultimately, the success or failure of Anavex Life Sciences will depend on the strength of its science, the execution of its clinical development programs, and its ability to navigate the complex regulatory and market landscape. The fiscal 2024 results provide a snapshot of the company's current position, but the future remains uncertain. However, the pursuit of innovative therapies for devastating diseases is a worthy endeavor, and Anavex's efforts deserve attention and support.