Okay, let's talk about Andrew the Homebuyer. He's just like your average Joe, but with a slightly more complicated spreadsheet. We've all got that friend, right? The one obsessed with real estate listings, constantly muttering about mortgage rates, and smelling faintly of fresh paint samples. That's Andrew.

Andrew's Acquisition: The House Hunt Hustle

So, Andrew's on the hunt. Think of it like this: dating, but with less heartbreak (maybe) and a lot more paperwork. He's swiping left and right on Zillow, comparing square footage like it's the most important thing in the world. He's attending open houses, trying to look nonchalant while secretly inspecting every nook and cranny. "Is that mold in the bathroom?" he probably thinks, while nodding politely at the realtor.

And let's be honest, the real estate agent always looks like they've just stepped out of a TV commercial, right? Perfect hair, blindingly white teeth, and an uncanny ability to make a dilapidated shed sound like a "rustic, charming retreat."

But seriously, the house hunt is a serious game. It's a financial marathon, a test of patience, and a crash course in plumbing, electrical systems, and the subtle art of negotiating with people who know way more about property values than you do. It's like trying to decipher a secret code written in mortgage jargon and home inspection reports. Fun times!

Imagine Andrew, late at night, squinting at a blurry photo of a cracked foundation, muttering, "Is that a dealbreaker or just character?" We've all been there. It's the "Will I regret this decision for the next 30 years?" phase.

Andrew's Net Worth: The Great Balancing Act

Now, let's dive into the net worth question. It's the elephant in the room, the financial tightrope walk that everyone pretends isn't terrifying. But it is. Let's not sugarcoat it.

Think of Andrew's net worth like a seesaw. On one side, you've got his assets: savings accounts, investments (hopefully not just meme stocks), that baseball card collection he swears is going to be worth millions someday. On the other side, you've got liabilities: student loans, car payments, and, of course, the looming mortgage. The goal is to keep the asset side heavier than the liability side. Easier said than done, right?

And adding a house to the mix? That's like dropping a bowling ball onto the liabilities side of the seesaw. Suddenly, things get a lot more…intense. Now, Andrew has property taxes, homeowner's insurance, potential repairs (because something always breaks), and the ever-present fear of the roof caving in during a thunderstorm.

It's a constant juggling act. He's clipping coupons, brown-bagging his lunch, and seriously considering cancelling his Netflix subscription (gasp!). Every penny counts. He starts looking at everything with new eyes. "Do I really need that extra-large latte?" "Could I walk to work instead of driving?" It's a lifestyle change, folks.

But hey, owning a home is also an investment, right? It's like planting a financial seed and hoping it grows into a giant money tree. (Although, let's be real, it's more like planting a seed and spending the next 30 years watering it with your hard-earned cash.)

Ultimately, Andrew's net worth isn't just about the numbers. It's about security, stability, and the feeling of having a place to call his own. It's about building a future, one mortgage payment at a time.

Meet the Mrs.: Andrew's Rock (and Financial Advisor)

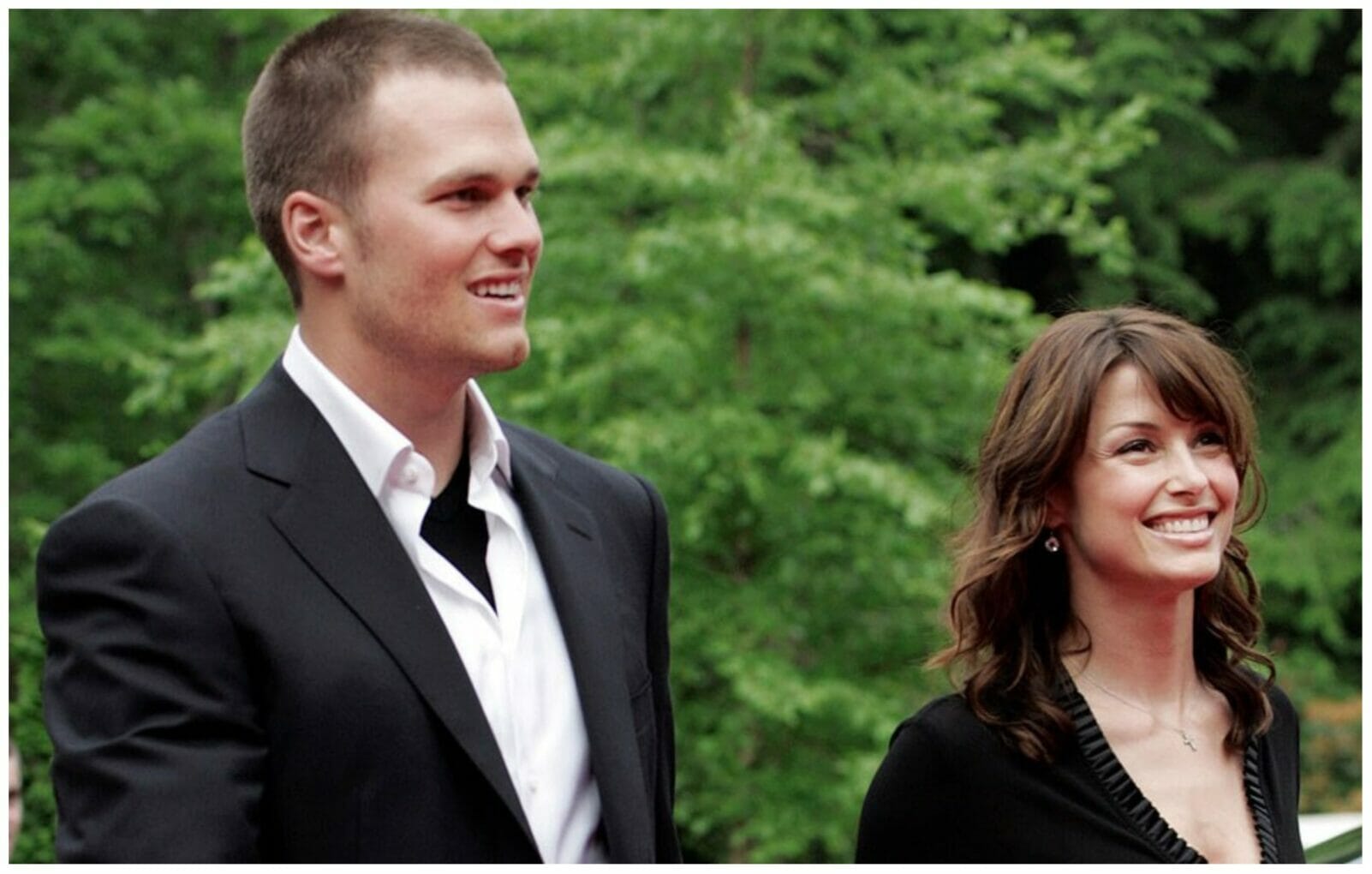

Now, let's talk about Andrew's wife. Every good homebuyer has a partner in crime, a voice of reason (or, sometimes, a voice of panic), and someone to blame when the toilet overflows at 3 AM. In Andrew's case, that's his wife. (We'll call her Sarah, because why not?)

Sarah is the yin to Andrew's yang, the salt to his pepper, the Excel spreadsheet to his daydreaming. She's the one who keeps him grounded, reminds him to eat vegetables, and prevents him from buying that vintage jukebox he saw on Craigslist (tempting as it may be).

And let's be honest, she's probably the one who's really managing the household finances. While Andrew is busy obsessing over square footage and paint colors, Sarah is carefully tracking expenses, negotiating with contractors, and making sure they don't accidentally buy a house with a hidden sinkhole.

She's also the emotional support system. The house hunt can be stressful, and Sarah is there to offer a shoulder to cry on (or, more likely, a strong cup of coffee and a pep talk). She's the one who celebrates the small victories (like getting a slightly lower interest rate) and helps him navigate the inevitable setbacks (like discovering the previous owner painted over a swarm of termites).

Think of Sarah as the Chief Financial Officer of the Homebuying Corporation. She's got the spreadsheets, the budget, and the steely gaze that can intimidate even the most seasoned real estate agent. She's the unsung hero of the whole operation. She's the real MVP of this home buying story.

They probably have those late-night talks, you know the ones. Talking about whether or not the interest rate is too high, and wether or not there is going to be enough money in the long run. “But if we rent it we are losing money!” Andrew probably says. “But what if it does not rent and we are paying two mortgages?” Sarah probably retorts. This is the part where they will start to feel like the average couple.

The Aftermath: Life as a Homeowner

So, Andrew and Sarah finally got the keys. They are now homeowners. Cue the celebratory pizza, the awkward photo op with the realtor, and the realization that they now have a lot of unpacking to do.

But that's not the end of the story, folks. That's just the beginning. Now comes the real fun: painting, decorating, furnishing, and discovering all the quirks and imperfections of their new home.

They'll probably spend weekends at Home Depot, arguing over paint colors and debating the merits of different types of lightbulbs. They'll learn how to unclog a drain, fix a leaky faucet, and mow the lawn without accidentally scalping the grass. They'll become experts in all things home-related.

And yes, there will be challenges. There will be unexpected expenses, frustrating repairs, and moments when they question their sanity. But there will also be moments of pure joy: hosting their first barbecue, decorating for the holidays, and simply enjoying the feeling of being at home.

Andrew and Sarah will learn that homeownership is not just about owning a house. It's about building a community, creating memories, and putting down roots. It's about making a house a home.

And who knows, maybe someday Andrew will even start a real estate blog, sharing his wisdom (and his mistakes) with other aspiring homebuyers. He'll become the guru, the expert, the voice of reason in a world of confusing mortgage rates and questionable home inspection reports. Until then, he's just Andrew, the Homebuyer, navigating the wild and wonderful world of real estate, one spreadsheet and one leaky faucet at a time.

The moral of the story? Buying a home is a journey, not a destination. It's a rollercoaster of emotions, a financial commitment, and a life-changing experience. But with a little bit of planning, a lot of patience, and a good sense of humor, anyone can do it. Even Andrew. And if Andrew can do it, so can you!

And let’s not forget that Andrew’s home is also his greatest asset. In the long run, the home might make Andrew quite wealthy. However, it will be quite the sacrifice at the beginning.

The Importance of Keeping Up on Maintenance

Remember that little drip under the sink? Yeah, that one you’ve been ignoring for the past six months? Well, it’s not going to magically fix itself. In fact, it’s probably getting worse. Neglecting home maintenance is like neglecting your teeth; a small cavity can turn into a root canal if you don’t take care of it. So, bite the bullet (pun intended!) and address those minor issues before they become major headaches. Think of it as an investment in your future happiness and your wallet.

Andrew quickly learned this when the small drip turned into a full-blown flood while he was on vacation. He came back to a house that smelled like a swamp and a hefty bill from the water damage restoration company. Ouch!

Building Equity, Brick by Brick

Equity is like the secret sauce of homeownership. It’s the difference between what your house is worth and what you still owe on your mortgage. The more equity you have, the more financial flexibility you have. Think of it as building a safety net for yourself. As you pay down your mortgage and your home’s value increases, your equity grows, giving you options like taking out a home equity loan for renovations or even using it as a down payment on another property down the road.

Andrew is now obsessed with checking Zillow estimates and comparing them to his mortgage balance. He even started a spreadsheet to track his equity growth. Nerd alert!

The Neighbors: Your New Best Friends (Maybe)

Your neighbors can be your allies, your adversaries, or somewhere in between. Building good relationships with your neighbors can make your life a lot easier and more enjoyable. They can keep an eye on your house when you’re away, lend you a cup of sugar when you’re in a pinch, and even become lifelong friends. But beware of the neighbor with the constantly barking dog or the overgrown lawn. Sometimes, a friendly wave is all you need.

Andrew lucked out with his neighbors. They’re a friendly bunch who are always up for a barbecue or a game of cornhole. They even helped him jump-start his car when the battery died. Score!

:max_bytes(150000):strip_icc():focal(951x861:953x863)/Who-Is-Andrew-Schulzs-Wife-All-About-Emma-Turner-tout-24b73d0e33d04b03bc2f4a7157341eae.jpg)