Okay, let's talk about Arbor Realty Trust and its next declaration date. Now, I know what you might be thinking: "Ugh, finance stuff. Snoozeville!" But trust me, this isn't as boring as watching paint dry, I promise. Think of it like this: Arbor Realty Trust is like your super-organized friend who’s always on top of their bills, and the declaration date is when they announce, "Hey everyone, I'm paying out dividends!" Dividends, in turn, are like little money bonuses for investors. Who doesn't like money bonuses, right?

So, what’s all the fuss about a declaration date? It's basically the official announcement from Arbor Realty Trust about when they plan to give out those sweet, sweet dividends. It's like when your favorite bakery announces a free donut day – you need to know when to line up! It’s not just a random guess; it’s a calculated decision influenced by a whole bunch of factors, which we’ll get into. Think of it as the company's way of saying, "We're doing well, and we're sharing the love!"

Why should you care? Well, if you're an investor in Arbor Realty Trust (or thinking about becoming one), the declaration date is crucial. It tells you when you can expect that extra cash to hit your account. It helps you plan your budget, maybe treat yourself to that fancy coffee you've been eyeing, or reinvest it and watch your money grow even more. It's all about informed decisions, my friend.

Decoding the Declaration Date: It's Not Rocket Science (But Almost!)

Alright, let's break down the key components of the dividend declaration. There are three dates to keep in mind, and they are like the holy trinity of dividend investing. Okay, holy trinity might be a bit too much, but they are certainly important. These dates can affect whether or not you are eligible for the dividend payout. It would be like getting your hopes up for a donut on free donut day, then being told you aren’t eligible because you’re wearing the wrong colored socks! You don’t want that!

The Ex-Dividend Date

This is where things get a little technical, but bear with me. The ex-dividend date is the date *after* which you need to own the stock to receive the dividend. If you buy the stock *on* or *after* this date, you're not eligible for the dividend payout. Think of it as the cutoff time for entering a contest. If you miss the deadline, no prize for you!

Imagine you're trying to get into a super exclusive club. The ex-dividend date is like the last day you can sign up and still get a special welcome gift. If you sign up the day after, you're still in the club, but you miss out on the free swag. That's essentially how it works with dividends.

The Record Date

The record date is the date the company checks its records to see who owns the stock and is entitled to the dividend. It's like the school taking attendance to see who gets a participation award. If your name is on the list, congrats! You're getting that dividend.

Think of it as a VIP list for a party. The record date is when they finalize that list. If you’re on the list, you are golden. Usually, the record date follows the ex-dividend date by a day or two, so don't get confused. As long as you owned the shares before the ex-dividend date, you are good.

The Payment Date

This is the fun one! The payment date is when the dividend actually hits your account. It's like payday! This is the day you've been waiting for. The cash flows in, and you can celebrate (responsibly, of course!).

Think of it like receiving your paycheck. All that hard work (investing) finally pays off! You can now use that money to splurge on something you’ve been wanting, or better yet, reinvest it and make more money! The key is to understand that the payment date comes after the declaration, ex-dividend, and record dates.

What Influences Arbor Realty Trust's Declaration Date?

So, what makes Arbor Realty Trust decide when to declare its dividends? It's not just pulling a date out of a hat! Several factors come into play. It is like baking a cake; you need all the ingredients and the right oven temperature to get a perfect result.

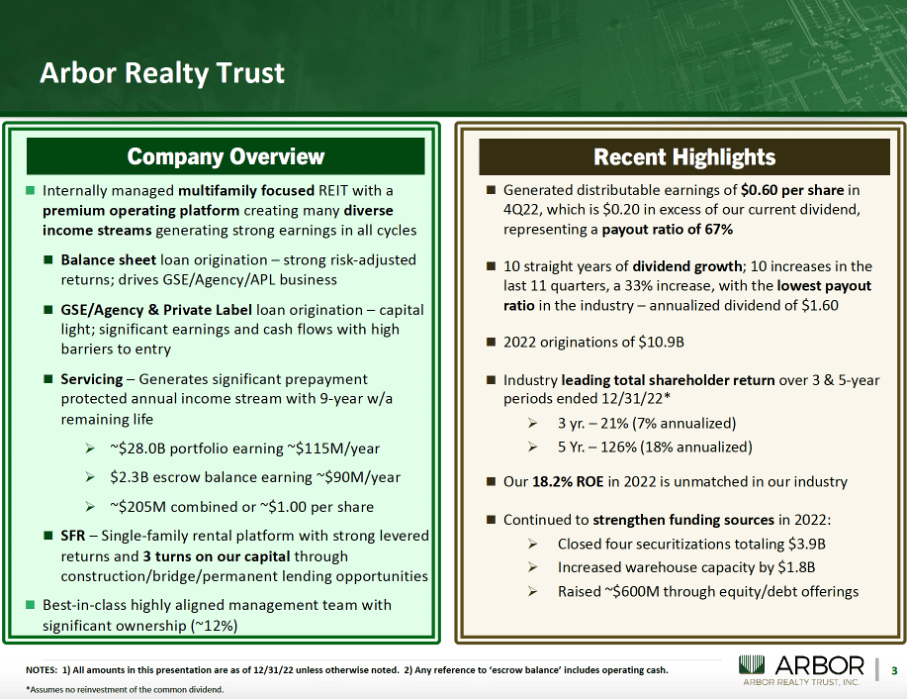

Financial Performance

This is a big one. If Arbor Realty Trust is doing well, making profits, and generally crushing it, they're more likely to declare a dividend. Strong financial performance is like a green light for dividend payouts. It’s like a restaurant having a really busy and profitable month. They’re more likely to give the staff a bonus if sales are up!

Conversely, if they're struggling, facing financial difficulties, or dealing with unexpected expenses, they might postpone or even reduce the dividend. Nobody wants to hand out money when they're barely keeping their own head above water. Companies want to show investors that they are responsible and financially secure.

Market Conditions

The overall state of the market plays a role too. If the market is booming, and everyone is feeling optimistic, Arbor Realty Trust might be more inclined to declare a dividend. A rising tide lifts all boats, right?

But if the market is volatile, uncertain, or heading for a downturn, they might be more cautious. They might want to hold onto their cash in case things get tough. It’s like when there’s a hurricane warning. You want to stock up on supplies and be prepared for anything.

Regulatory Requirements

Companies have to follow the rules! Regulatory requirements can influence when and how much they can pay out in dividends. Think of it as having to get a permit before you can build a deck on your house. You can't just do whatever you want!

These regulations are in place to protect investors and ensure that companies are not being reckless with their finances. They want to make sure that Arbor Realty Trust will continue to succeed.

Past Practices

Arbor Realty Trust, like many companies, often has a history of declaring dividends on a specific schedule. They might have a pattern of declaring dividends quarterly, semi-annually, or annually. This predictability can be helpful for investors, who can then plan their finances accordingly. It’s like knowing that your favorite TV show always airs on the same day and time. You can schedule your life around it!

However, past performance is not always indicative of future results. Just because they declared a dividend on a certain date in the past doesn't guarantee they'll do the same this time around. Things can change, and companies need to adapt. This is why it’s important to know the declaration date so you are never caught by surprise.

Finding Arbor Realty Trust's Next Declaration Date: Detective Work!

So, how do you find out Arbor Realty Trust's next declaration date? Luckily, it's not like searching for buried treasure. There are several reliable sources you can check. Remember, finding the information you seek is like finding the right tool in a toolbox. You need to know where to look!

Company Website

The first place you should always check is Arbor Realty Trust's official website. Most companies have an investor relations section where they post important information about dividends, earnings releases, and other corporate announcements. It’s like going straight to the source. If you need information, go to the website. It is almost like getting your news straight from the horse’s mouth!

Look for a section labeled "Investor Relations," "Dividends," or "News & Events." The declaration date, along with other relevant details, should be posted there. This is the most reliable source of information, so always start here.

Financial News Websites

Websites like Yahoo Finance, Google Finance, and Bloomberg are great resources for tracking dividend declarations. They often publish news articles and press releases about dividend announcements from various companies. It’s like having a financial news ticker at your fingertips!

Just search for Arbor Realty Trust (ABR) and look for any recent news related to dividends. These websites usually aggregate information from various sources, so you can get a comprehensive overview.

SEC Filings

Companies are required to file certain documents with the Securities and Exchange Commission (SEC). These filings, such as 8-K forms, often contain information about dividend declarations. This is a bit more technical, but it's a reliable source of information. It’s like going straight to the legal documents!

You can access these filings through the SEC's EDGAR database. While it might take some time to navigate, you'll find all the official documents and announcements related to Arbor Realty Trust.

Financial Professionals

If you're working with a financial advisor or broker, they can provide you with information about Arbor Realty Trust's dividend declarations. They often have access to real-time data and can help you interpret the information. It's like having a personal guide through the financial jungle!

Don't hesitate to ask your financial professional for assistance. They can help you understand the implications of the declaration date and how it might affect your investment strategy.

Why Knowing the Declaration Date Matters

Knowing the declaration date isn't just about getting that extra cash in your account. It's about being an informed investor and making smart decisions. It's like knowing the weather forecast before you plan a picnic. You want to be prepared!

Planning Your Investments

The declaration date helps you plan your investments. Knowing when you can expect to receive a dividend allows you to budget and make informed decisions about how to use that money. You can reinvest it, pay off debt, or treat yourself to something nice. It's all about having a plan!

Consider using the dividend income to diversify your portfolio or increase your holdings in Arbor Realty Trust. The possibilities are endless! You want to put your money to work for you!

Making Informed Decisions

Understanding the factors that influence the declaration date can help you make more informed decisions about whether to invest in Arbor Realty Trust. If you see that the company is consistently declaring dividends, and its financial performance is strong, it might be a good investment opportunity. You can see if the company consistently has a good record and you can make decisions from there.

On the other hand, if you see that the company is struggling, and its dividend payouts are inconsistent, you might want to reconsider. It's all about doing your research and making smart choices. No one likes to make choices that lead to negative results.

Staying Ahead of the Game

By staying informed about Arbor Realty Trust's dividend declarations, you can stay ahead of the game and be prepared for any changes. If the company announces a dividend cut, you'll be aware of it and can adjust your investment strategy accordingly. It's like knowing the score of a game before it ends.

Being proactive and staying informed is key to successful investing. The more you know, the better equipped you'll be to make smart decisions and achieve your financial goals.

In conclusion, while the whole dividend declaration process might seem complicated at first, it's actually quite simple once you break it down. It’s like learning to ride a bike; it is tough in the beginning but easy once you get the hang of it! So, keep an eye out for Arbor Realty Trust's next declaration date, stay informed, and happy investing!