Ever been in a situation where you scratch someone's back, and they mysteriously come back with a slightly-too-generous favor? Like, your neighbor "recommends" a specific lawn service that just happens to leave a suspiciously green patch on *their* lawn, even during a drought? That feeling you get – the one that screams, "Something's fishy!" – well, that's kind of the vibe we're diving into when we talk about kickbacks in the private business world.

What's the Deal with Kickbacks? Think Birthday Presents, But Sketchier

Let’s break it down. Imagine it's your birthday. You get presents, right? Cool. Now, imagine your boss tells you, "Hey, I need you to buy office supplies. This 'Super-Duper Supply Co.' is *amazing*." Turns out, Super-Duper Supply Co. is charging way more than other places, but your boss gets a little… "thank you" gift from them for sending business their way. That "thank you" gift? That's potentially a kickback.

In a nutshell, a kickback is a secret payment or benefit someone receives for influencing a decision that benefits the person giving the kickback. It's like saying, "Hey, help me out, and I'll make it worth your while… discreetly." Think of it as the business world’s version of a shady backroom deal. And just like that slightly-too-green lawn, it's often about as transparent as mud.

But, Are They Actually Illegal? The Gray Area Dance

Here's where it gets interesting. Unlike those clearly illegal activities like, say, robbing a bank (don't do that!), kickbacks in private businesses operate in a bit of a gray area. The simple answer is: it depends.

See, the legality of a kickback hinges on a few key factors. Is it hidden? Does it create a conflict of interest? Does it *harm* the company or its stakeholders? Think of it this way: if you're getting a "bonus" for sending business somewhere, and your employer *knows* about it and *approves* it, and everyone's happy, it might just be a really weird bonus structure. But if it's a hush-hush deal happening behind closed doors, things get much more complicated.

Let’s say you're a project manager. A contractor offers you a free vacation to the Bahamas if you choose them for a big construction project. You don't tell your company. You choose them, even though their bid is slightly higher and their reputation is… questionable. This is a classic, textbook example of an illegal kickback. Why? Because it's secret, it creates a conflict of interest (your loyalty is to the contractor, not your company), and it potentially harms the company by costing them more money or exposing them to a less reliable contractor.

What Makes a Kickback Illegal? The Nitty-Gritty Details

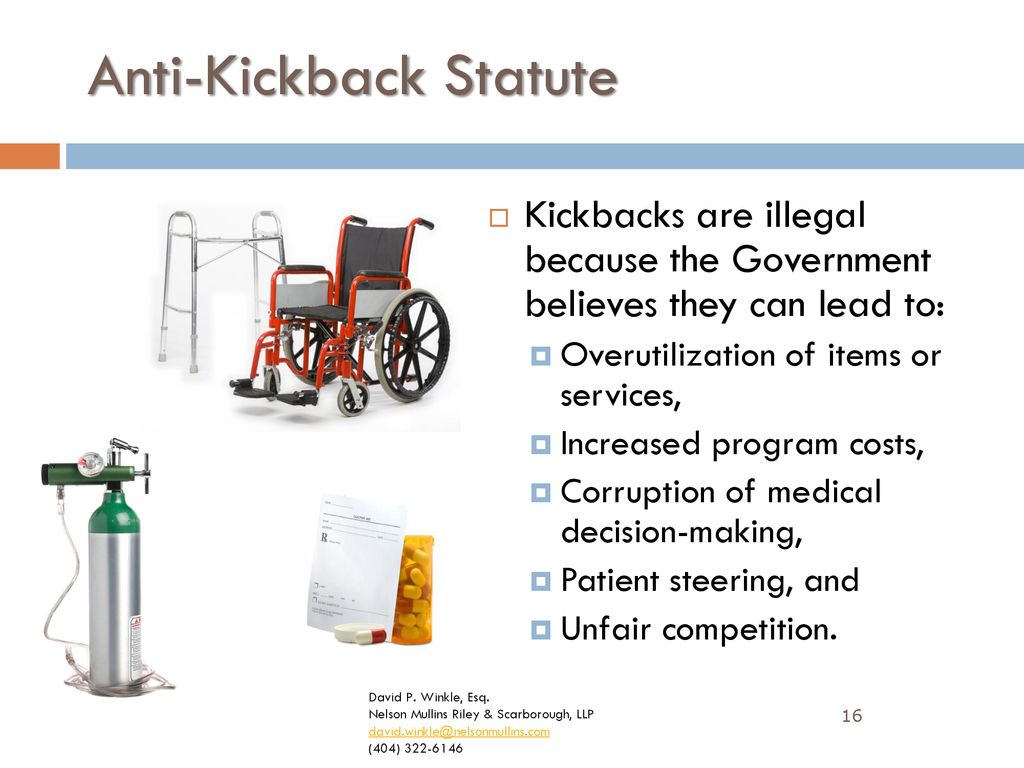

To really understand the boundaries, let's delve deeper into the factors that can turn a friendly favor into a full-blown legal nightmare:

* Secrecy is Key: If everyone knows about the arrangement, it’s much less likely to be considered an illegal kickback. Think of it like this: a surprise party is fun, but a surprise accounting audit? Not so much. Transparency is *crucial*. * Breach of Fiduciary Duty: This is a fancy way of saying "you're not acting in the best interest of the company." If you're putting your own gain ahead of your employer's, you're likely treading on thin ice. It's like a doctor prescribing a medicine because they get a kickback from the pharmaceutical company, even though it's not the best medicine for the patient. Bad doctor! * Conflict of Interest: If the kickback creates a situation where your personal interests clash with your professional obligations, that's a major red flag. It's like a judge ruling on a case involving their own family. It just doesn’t look right. * Intent to Defraud: If the kickback is part of a larger scheme to deceive or cheat the company, it's definitely illegal. This is when things go from "oops" to "federal offense" pretty quickly. * Violation of Company Policy: Many companies have strict policies against accepting gifts or favors from vendors. Violating these policies can have serious consequences, even if the kickback itself isn't technically illegal under the law. Think of it as breaking the house rules – even if the house rules aren’t laws, you’re still gonna be in trouble.Okay, But What About Rewards Programs and Incentives? Are Those Kickbacks?

Good question! This is where things get a bit murky. What about those rewards programs where you get points for using a certain credit card, or those referral bonuses your company offers? Are those secret backroom deals?

The answer, thankfully, is generally no. Rewards programs and incentives are usually above board. They're publicly disclosed, available to everyone, and don't involve any hidden payments or conflicts of interest. Think of it like this: a rewards program is like getting a coupon at the grocery store. A kickback is like slipping the cashier a twenty to secretly mark up the price of your competitor’s product. Big difference!

The key difference is that legitimate rewards programs are transparent and available to all. They are not designed to incentivize employees to make decisions that are detrimental to the company. If your company openly offers bonuses for bringing in new clients, that's probably fine. If your company *secretly* pays you to steer clients towards a particular vendor, that's a whole different ball game.

Real-World Examples: From Minor Mishaps to Major Scandals

To really hammer this home, let’s look at some examples:

* The Shady Supplier: A purchasing manager accepts lavish gifts from a supplier in exchange for awarding them a lucrative contract, even though other suppliers offer better prices and quality. Illegal kickback. * The Backdoor Referral: A real estate agent secretly pays an apartment manager a "referral fee" for sending them new tenants, without disclosing this arrangement to the tenants or the real estate company. Likely illegal kickback. * The Questionable Consultant: A company hires a consultant who just happens to be a close friend of the CEO, and pays them an exorbitant fee for questionable services. Potentially illegal kickback, depending on the facts. * The Openly Advertised Commission: A sales representative receives a commission on every sale they make, which is disclosed to the company and the customer. Not a kickback.The line between a legitimate business practice and an illegal kickback can be blurry, and often depends on the specific circumstances. A good rule of thumb? If something feels shady, it probably is.

The Consequences: From Fines to Jail Time (Yikes!)

So, what happens if you get caught engaging in kickback schemes? Well, the consequences can be pretty severe. Depending on the specific laws involved and the severity of the offense, you could be facing:

* Fines: Hefty financial penalties that can wipe out your savings. Think of it as the taxman, but angrier. * Civil Lawsuits: The company you defrauded (or their shareholders) could sue you for damages. Ouch. * Criminal Charges: In some cases, kickbacks can lead to criminal charges, which could mean jail time. Double ouch. * Reputational Damage: Even if you avoid legal penalties, your reputation could be ruined, making it difficult to find future employment. This can be more painful than a fine, because it follows you everywhere. * Loss of Job: At the very least, you'll likely lose your job. And probably won't get a glowing reference.In short, the risks of engaging in kickbacks far outweigh any potential rewards. It's simply not worth it.

How to Protect Yourself (and Your Company)

So, what can you do to avoid getting caught up in a kickback scheme, either as a participant or as a victim?

* Know Your Company's Policies: Familiarize yourself with your company's policies on gifts, conflicts of interest, and ethical conduct. It’s like knowing the rules of the road – it helps you avoid accidents. * Disclose, Disclose, Disclose!: If you're offered anything that could be perceived as a kickback, disclose it to your supervisor or compliance officer immediately. Honesty is always the best policy. * Ask Questions: If something seems suspicious, don't be afraid to ask questions. It's better to be safe than sorry. * Document Everything: Keep detailed records of all transactions and communications with vendors. This can help you prove your innocence if you're ever accused of wrongdoing. * Be Aware of Red Flags: Watch out for signs of kickbacks, such as inflated invoices, unusual payment arrangements, and pressure to use a specific vendor. If you see something, say something. * Seek Legal Advice: If you're unsure whether something is legal, consult with an attorney. It's always better to get professional advice than to take a gamble.Think of it this way: staying ethical isn’t just the right thing to do, it's also the smart thing to do. You sleep better at night, and you avoid ending up on the wrong side of the law.

The Bottom Line: Don't Be That Guy (or Gal)

Kickbacks in private business are a complicated issue with a lot of gray areas. While some arrangements are perfectly legal, others can land you in serious trouble. The key is to be transparent, avoid conflicts of interest, and always act in the best interest of your company.

So, the next time someone offers you a "little something" in exchange for your business, remember the green lawn, the shady doctor, and the potential for jail time. And just say no. Your conscience (and your bank account) will thank you.