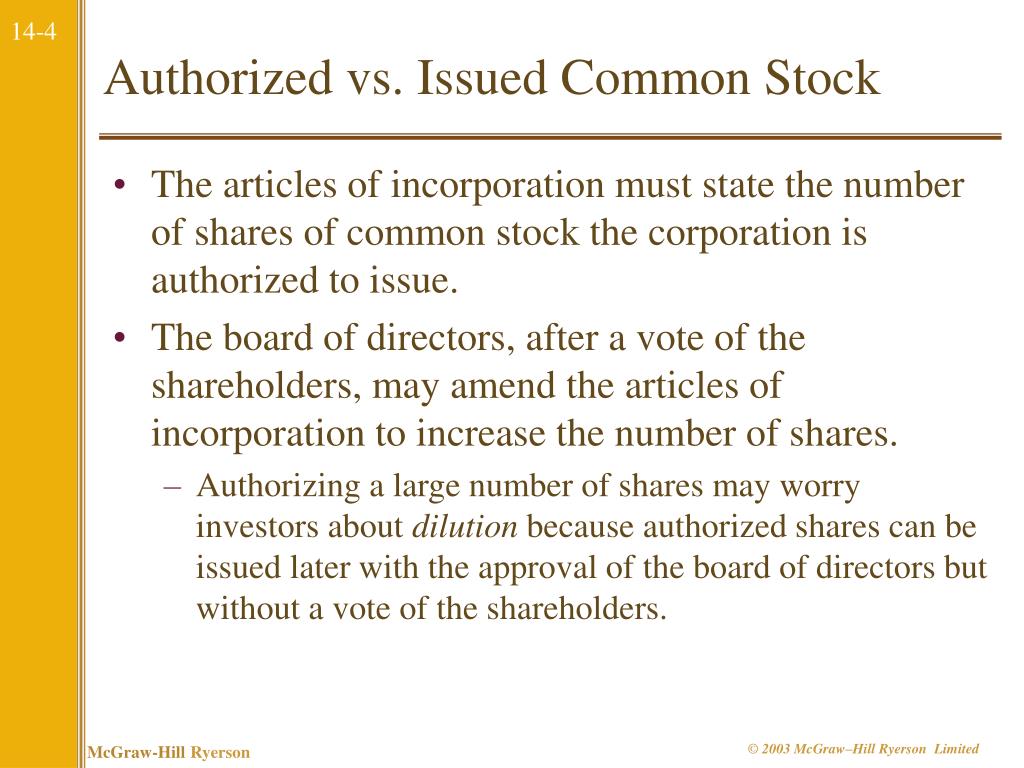

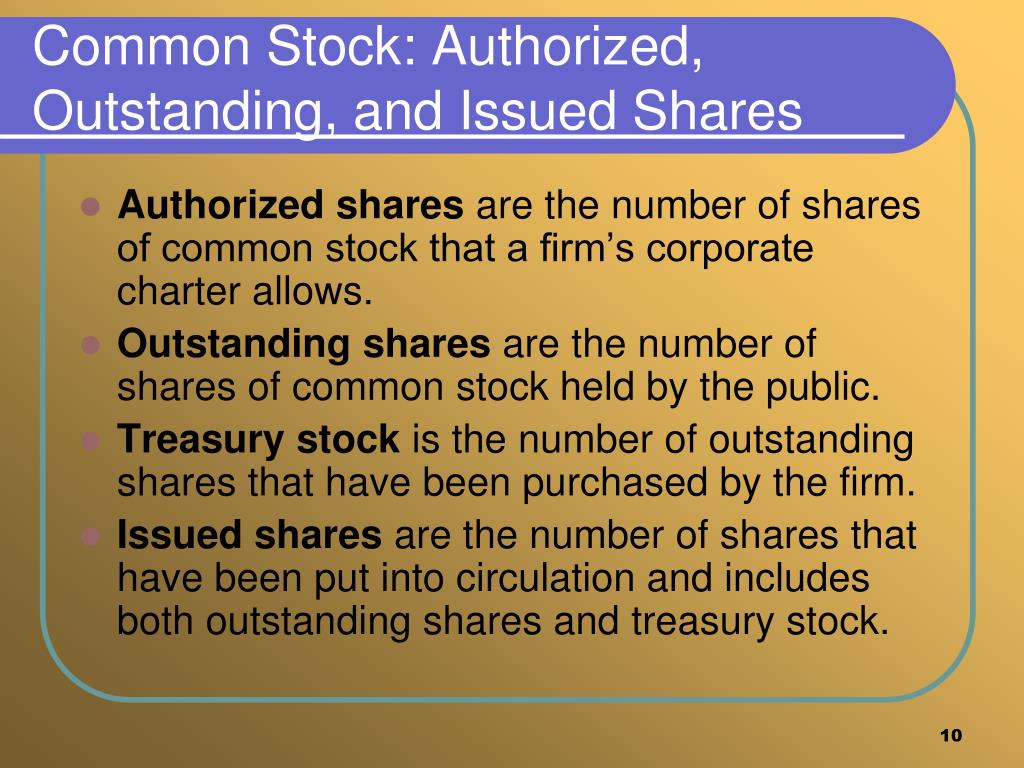

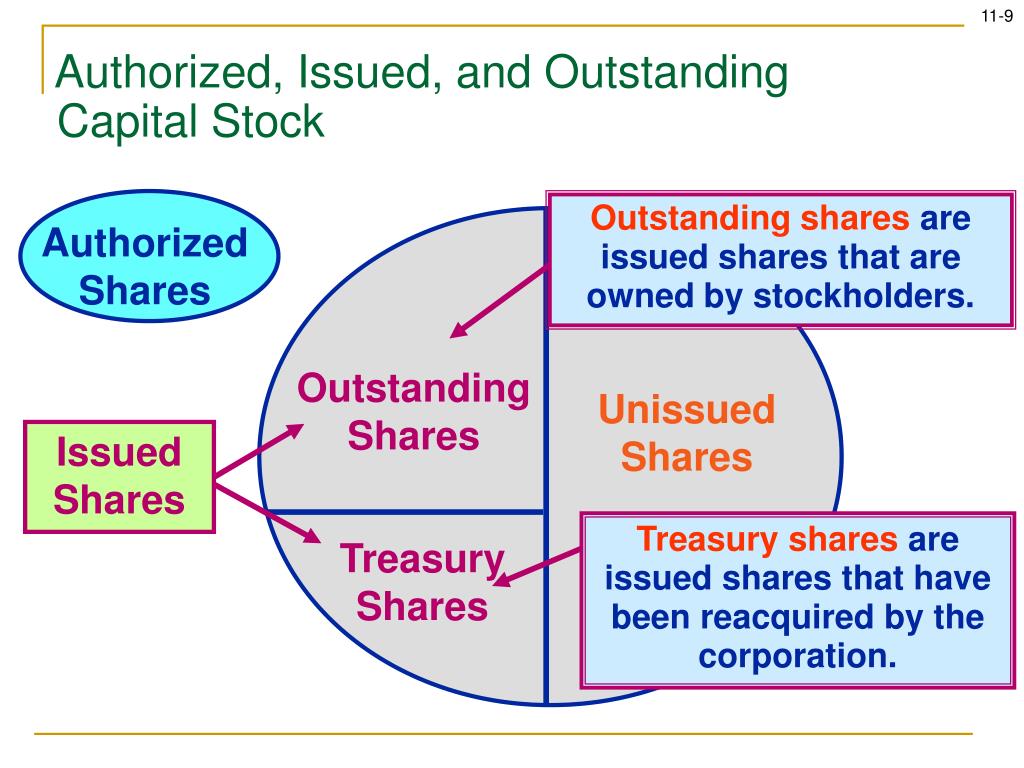

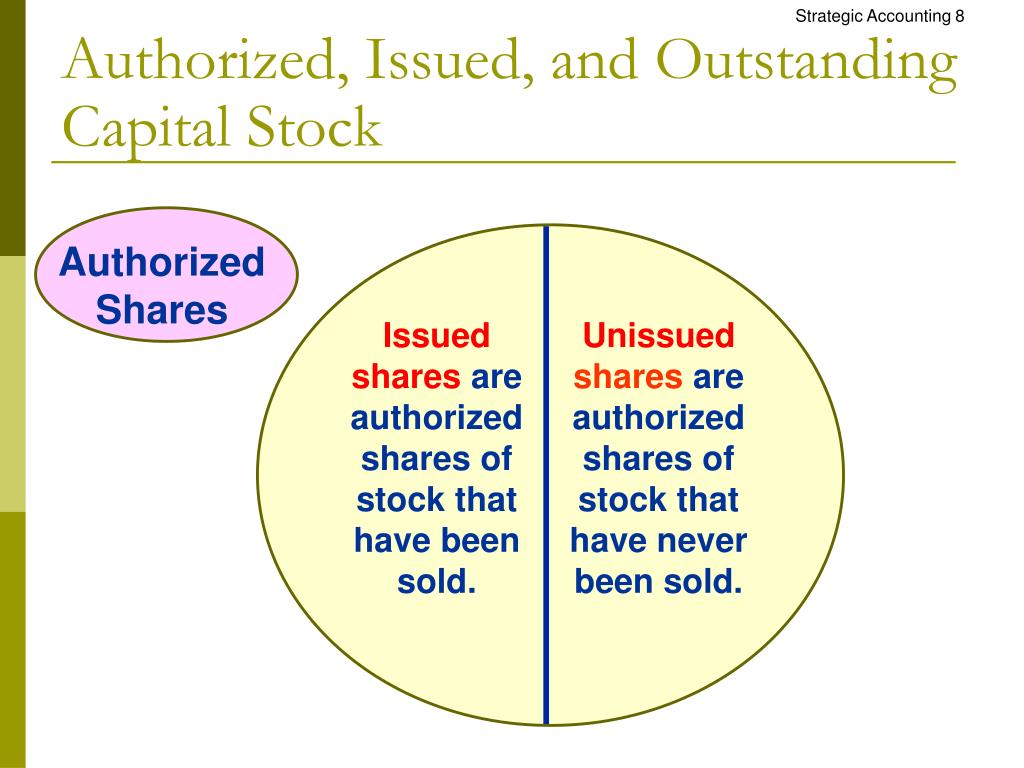

Authorized common stock, a fundamental concept in corporate finance, represents the maximum number of shares a company is legally permitted to issue to investors. This figure is established in the company's charter during its initial incorporation or through subsequent amendments. Understanding the authorized share count is crucial for investors, stakeholders, and the company itself, as it impacts everything from capital raising to corporate governance and potential future dilutions.

Causes of Establishing an Authorized Share Count

The authorized share count isn't a random number; it's determined based on a company's current and anticipated future needs. Several factors influence this decision during the initial incorporation and any subsequent amendments:

Initial Capital Needs

When a company is formed, it needs capital to finance operations, research and development, marketing, and other startup expenses. The authorized share count must be large enough to facilitate the initial sale of shares to raise this capital. A company needs to project its capital needs accurately. Underestimating can lead to difficulties later, while overestimating can signal a lack of focus or potential over-dilution to potential investors.

Future Growth and Expansion

A forward-looking company considers its future growth trajectory when setting the authorized share count. They might plan acquisitions, new product development, or international expansion. These initiatives often require substantial capital, and issuing new shares is a common way to finance them. Setting a higher authorized share count initially provides flexibility to raise funds as needed without the time and expense of amending the corporate charter each time.

Employee Stock Options and Compensation

Employee stock options (ESOPs) are a common way to attract and retain talent. These options grant employees the right to purchase shares of the company at a predetermined price in the future. The authorized share count needs to be sufficient to cover the potential dilution caused by the exercise of these options. Companies often reserve a significant portion of their authorized shares for employee compensation plans. Many Silicon Valley companies, for instance, have used generous stock option plans to attract and retain talent, contributing to their rapid growth and success. Consider that in 2023, stock-based compensation was a significant component of compensation packages in tech, representing as much as 15-20% of total compensation for some employees.

Potential Mergers and Acquisitions

Mergers and acquisitions (M&A) are frequently financed through the issuance of new shares. A company looking to acquire another may offer its stock as part of the purchase price. A sufficiently high authorized share count makes it easier to execute these transactions, positioning the company as an attractive acquirer. Many large corporations maintain a large number of authorized shares to be ready for any acquisition opportunities that might present themselves. For example, in 2022, Broadcom's acquisition of VMware involved a significant stock component, underscoring the importance of authorized shares in M&A deals.

Defensive Measures

In some cases, a company may increase its authorized share count as a defensive measure against hostile takeovers. By having a large number of unissued shares, the company can issue these shares to friendly parties (often referred to as "white knights") to dilute the ownership stake of the potential acquirer. This strategy is often controversial and can be viewed negatively by shareholders if not executed carefully.

Effects of the Authorized Share Count

The authorized share count has several significant effects on a company and its shareholders:

Flexibility in Raising Capital

A larger authorized share count provides greater flexibility to raise capital through equity offerings. Companies can issue new shares as needed to fund growth, acquisitions, or other strategic initiatives without having to go through the often lengthy and expensive process of amending their corporate charter. This allows the company to react quickly to market opportunities or address unexpected financial needs. This is especially critical for companies in fast-paced industries where speed and agility are essential for survival.

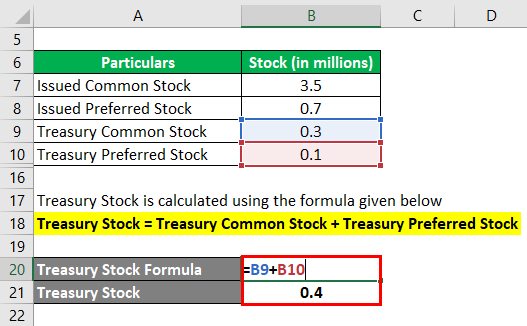

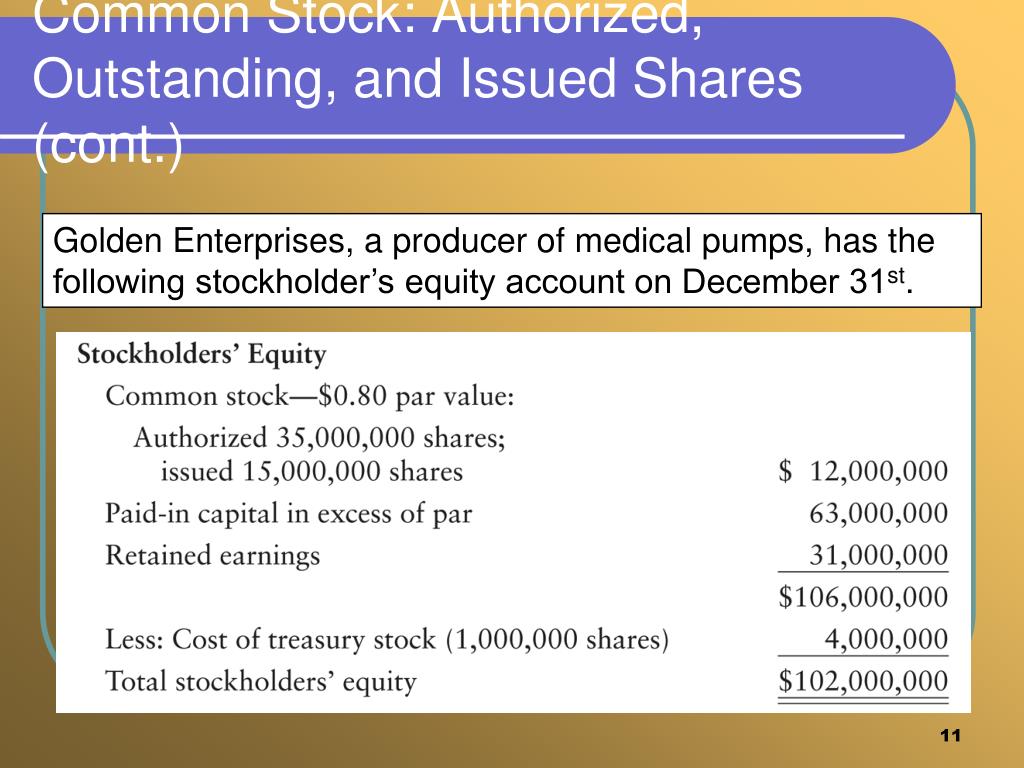

Potential Dilution of Existing Shareholders

The issuance of new shares dilutes the ownership stake of existing shareholders. Dilution occurs because each shareholder now owns a smaller percentage of the company's outstanding shares. This can negatively impact earnings per share (EPS) and voting power. Existing shareholders need to be aware of the potential for dilution and carefully evaluate the company's plans for using the additional authorized shares. The impact of dilution can be mitigated if the capital raised from the issuance of new shares is used to generate increased profits, thereby offsetting the negative impact on EPS.

Impact on Stock Price

The announcement of an increase in the authorized share count can sometimes negatively impact the stock price. Investors may interpret this as a signal that the company plans to issue new shares in the future, leading to concerns about dilution. The extent of the impact depends on various factors, including the company's financial performance, the intended use of the new shares, and overall market conditions. However, if the company clearly articulates its plans for using the additional shares and demonstrates a strong track record of profitable growth, the negative impact can be minimized or even reversed.

Corporate Governance Implications

A large authorized share count can give management more power and potentially reduce shareholder control. With more unissued shares, management can issue shares to friendly parties to entrench themselves or make it more difficult for activist investors to gain influence. Therefore, shareholders need to carefully monitor the company's use of its authorized shares and ensure that management is acting in their best interests. Mechanisms such as shareholder voting rights and independent board oversight are crucial for maintaining good corporate governance.

Implications and Considerations

Understanding the implications of authorized common stock is essential for investors, analysts, and company management. Several factors should be considered when evaluating a company's authorized share count:

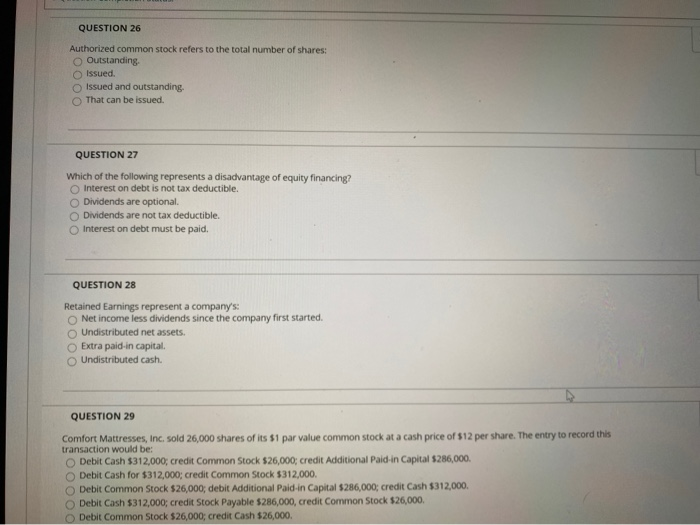

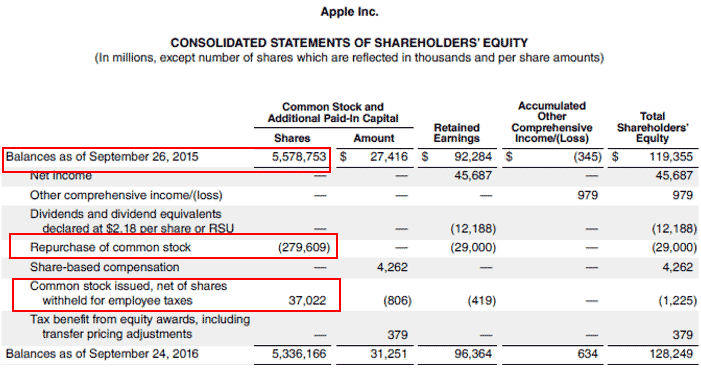

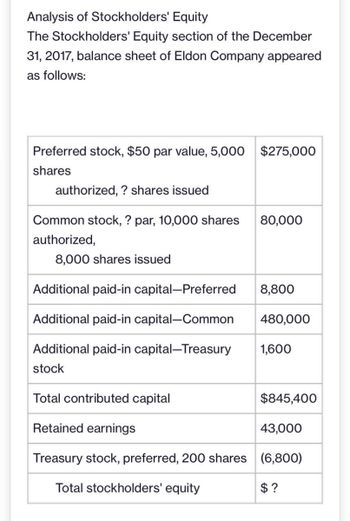

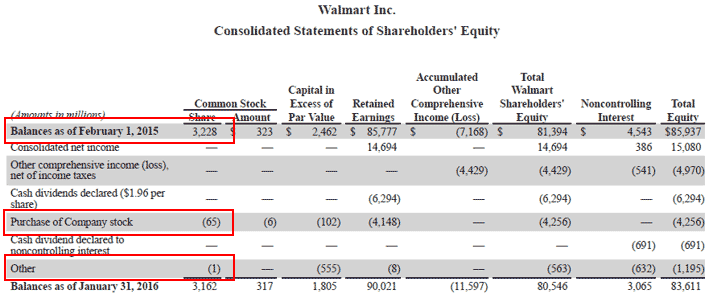

The relationship between authorized and outstanding shares: A wide gap between the number of authorized shares and the number of outstanding shares might suggest that the company has significant plans for future equity offerings or acquisitions. Conversely, a small gap could indicate that the company is nearing its maximum capacity for issuing new shares and may need to seek shareholder approval to increase the authorized share count in the future.

The company's track record of share issuance: Has the company historically issued shares frequently and for what purposes? Understanding the company's past behavior can provide insights into its future plans.

The company's industry and growth stage: Fast-growing companies in capital-intensive industries often require a larger authorized share count than mature companies in less capital-intensive industries.

Shareholder rights and protections: Are there provisions in the company's charter that protect shareholders from excessive dilution or entrenchment of management?

The number of authorized shares, while a seemingly simple metric, holds a great deal of information about a company’s strategic outlook and capital needs. An informed understanding of this concept will equip investors with better judgement when evaluating an investment.

For example, in 2023, AMC Entertainment, facing significant debt and challenges from the streaming industry, sought shareholder approval to increase its authorized share count. This move sparked controversy, as some shareholders feared further dilution of their ownership. This case illustrates the critical role authorized shares play in a company's financial strategy and the potential impact on shareholder value.

Broader Significance

The concept of authorized common stock extends beyond the individual company and has broader implications for the financial markets and the economy as a whole. It plays a vital role in facilitating capital formation, which is essential for economic growth and innovation. By allowing companies to issue new shares, the authorized share count enables them to raise capital to invest in new projects, expand their operations, and create jobs. A healthy and well-functioning equity market relies on companies having the flexibility to access capital through the issuance of new shares. Overly restrictive regulations or limitations on authorized share counts could hinder capital formation and stifle economic growth. At the same time, appropriate oversight and safeguards are necessary to protect investors from excessive dilution and ensure that management is acting in their best interests.

In conclusion, authorized common stock is a fundamental element of corporate finance, with significant implications for companies, investors, and the broader economy. Understanding its causes, effects, and implications is crucial for making informed investment decisions and promoting sound corporate governance. It is a concept that reflects the delicate balance between fostering economic growth and protecting shareholder interests.