Okay, so you're getting your first car! Woohoo! Freedom awaits, right? But before you picture yourself cruising down the highway, hair blowing in the wind (safely, of course!), there's that little hurdle called car insurance. Ugh, I know, not exactly the most thrilling part of car ownership. But trust me, it's super important.

Think of it like this: insurance is your car's bodyguard. You wouldn't go into a dodgy nightclub without one, would you? (Okay, maybe you would, but that's a story for another time!). Point is, you need protection, and car insurance is it.

So, where do you even start? It can all seem like alphabet soup – PIP, collision, comprehensive… What does it all MEAN?! Don't worry, I got you. Let's break down the basics of choosing the best car insurance for a first-time car buyer, without all the jargon that makes your eyes glaze over.

First Things First: What Kind of Coverage Do You Need?

This is the big question, isn't it? It's not a one-size-fits-all kind of deal. Your coverage needs depend on a few factors. Let's peek at some different types.

Liability Coverage: The Legal Must-Have

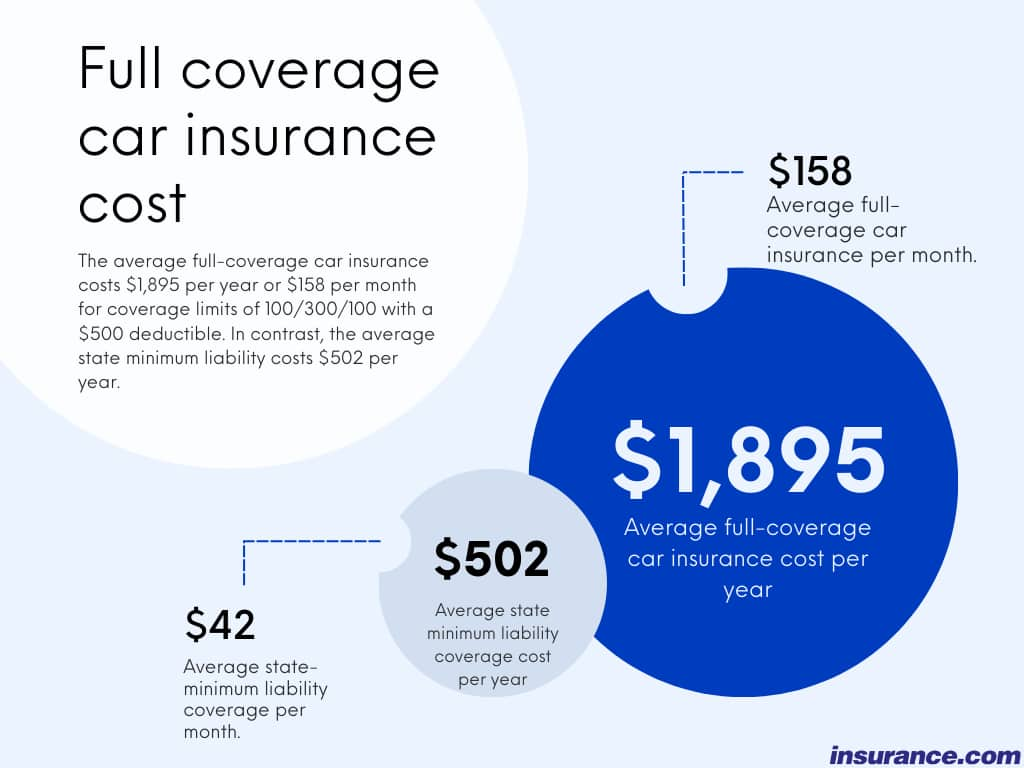

This is the absolute bare minimum most states require. Think of it as covering everyone *else* if you cause an accident. If you rear-end someone, liability insurance pays for *their* car repairs and medical bills. Not yours, though! Just theirs. Important to note, right?

Why is this important? Well, without it, you're personally on the hook for those costs. And believe me, those bills can add up FAST. We're talking bankruptcy-level fast. So, yeah, liability is a must-have.

Pro Tip: Don't just get the state minimum. Seriously. It's usually not enough. Imagine causing a *serious* accident. The minimum might only cover a fraction of the costs. You'd be left paying the rest out of pocket. Aim for higher limits if you can afford it. It's worth the peace of mind, trust me.

Collision Coverage: Your Car's Boo-Boo Insurance

Okay, so *you* crash your car. Maybe you backed into a pole (we've all been there, right?). Maybe you had an, uh, *encounter* with a rogue shopping cart. Collision coverage helps pay to repair or replace *your* car, regardless of who's at fault.

Is it necessary? Well, it depends. If you have a brand-new car that you're still paying off, your lender probably requires it. But even if you own your car outright, it's worth considering. Can you afford to replace your car out of pocket if something happens? If not, collision coverage is your friend.

Deductible Alert! Collision coverage usually comes with a deductible. That's the amount you pay before the insurance kicks in. Higher deductible means lower premiums, but you'll have to pay more out of pocket if you have an accident. Weigh your options carefully!

Comprehensive Coverage: Protection from the Unexpected

Comprehensive coverage protects you from things that *aren't* collisions. We're talking theft, vandalism, fire, hail, falling trees, and even hitting a deer (or, you know, having a deer hit *you*). Basically, anything that isn't a crash.

Again, is it necessary? Think about where you live. Are you in an area prone to hailstorms? Are car thefts common? Do you park your car outside? If the answer to any of those questions is yes, comprehensive coverage might be a good idea.

Like collision, comprehensive coverage also usually has a deductible. So keep that in mind. I know, so many things to keep in mind!

Uninsured/Underinsured Motorist Coverage: Protection from… Well, You Get It

This is a big one, especially if you live in a state with a lot of uninsured drivers (and some states have a *lot*). It covers you if you're hit by someone who either doesn't have insurance or doesn't have *enough* insurance to cover your damages.

Imagine this: you're hit by a driver who's texting and driving (grrr!). They're at fault, but they only have the state minimum liability coverage, which isn't enough to cover your medical bills and car repairs. Uninsured/underinsured motorist coverage steps in to fill the gap.

Seriously, consider this one. It's often relatively inexpensive, and it can save you a *ton* of money and headache down the road. You never know who you're sharing the road with, right?

Personal Injury Protection (PIP): Medical Bills, Covered

PIP, sometimes called "no-fault" insurance, covers your medical expenses and lost wages after an accident, regardless of who's at fault. It can also cover your passengers. It's required in some states and optional in others.

If you have good health insurance, you might not need PIP. But if you don't, or if your health insurance has a high deductible, PIP can be a lifesaver.

Finding the Best Deals: Tips and Tricks for First-Time Buyers

Okay, now that you know what kind of coverage you need, let's talk about saving some cash. Because let's face it, being a first-time car buyer is expensive enough, right?

Shop Around! Shop Around! Shop Around!

I can't stress this enough. Don't just go with the first insurance company you see. Get quotes from multiple companies. Use online comparison tools, talk to independent insurance agents (they can get quotes from multiple companies for you!), and ask your friends and family for recommendations.

Prices can vary *wildly* between companies. You could save hundreds of dollars a year just by shopping around. That's money you could be using for, you know, important things like gas and snacks!

Take Advantage of Discounts

Insurance companies offer a surprising number of discounts. Here are a few common ones:

- Good Student Discount: If you're a student with good grades, you can often get a discount. Time to dig out those report cards!

- Defensive Driving Course Discount: Taking a defensive driving course can not only make you a safer driver, but it can also lower your insurance premiums. Win-win!

- Multi-Policy Discount: If you bundle your car insurance with your home or renters insurance, you can usually get a discount.

- Safe Driver Discount: Obviously, if you have a clean driving record, you'll pay less. So, you know, try not to get any tickets!

- Anti-Theft Device Discount: Installing an anti-theft device in your car can also lower your premiums.

- Low Mileage Discount: If you don't drive very much, you might qualify for a low mileage discount.

Always ask about discounts! Insurance companies aren't always going to volunteer them. You have to be proactive.

Consider a Higher Deductible

As I mentioned earlier, a higher deductible means lower premiums. But make sure you can actually afford to pay that deductible if you have an accident! There's no point in having a low premium if you can't afford to fix your car when something goes wrong.

Think about your risk tolerance. Are you a super careful driver? Or are you a little… let's just say "adventurous" behind the wheel? If you're confident in your driving skills, a higher deductible might be a good option. But if you're prone to fender-benders, a lower deductible might be better.

Check Your Credit Score

In many states, insurance companies use your credit score to determine your premiums. A good credit score can lower your rates significantly. So, make sure you're paying your bills on time and keeping your credit utilization low.

It's not fair, I know, but it's the reality. So, work on building and maintaining good credit. It'll save you money on more than just car insurance.

Don't Be Afraid to Negotiate

Once you've gotten a few quotes, don't be afraid to call the insurance companies and try to negotiate a better deal. Tell them you've gotten a lower quote from another company and see if they can match it or beat it. You might be surprised at how willing they are to work with you.

The worst they can say is no, right? And if they say no, you can just go with the other company. It's worth a shot!

Choose Your Car Wisely

Okay, this one's a bit late if you already have your car, but for future reference, the type of car you drive can affect your insurance rates. Sports cars and luxury cars are typically more expensive to insure than sedans and SUVs. So, if you're looking to save money on insurance, choose a car that's known for being safe and reliable, not flashy and fast.

Also, older cars are often cheaper to insure because they're not worth as much. Just something to keep in mind!

Final Thoughts: Don't Procrastinate!

Getting car insurance is not the most fun thing in the world, but it's a necessary part of being a responsible car owner. Don't put it off until the last minute! Start shopping around for quotes as soon as you know you're getting a car. The sooner you start, the more time you'll have to compare rates and find the best deal.

And remember, don't just focus on the price. Make sure you're getting the right coverage for your needs. It's better to pay a little more for better coverage than to save a few bucks and be underinsured when something goes wrong.

Okay, I think that covers it! Now go forth and conquer the world of car insurance! You got this!