Calculating the loss on selling shares is a fundamental concept in finance, crucial for investors of all levels. It involves a straightforward calculation: comparing the purchase price of the shares to the selling price. If the selling price is lower than the purchase price, a loss is incurred. While the calculation itself is simple, the underlying causes, effects, and implications are multifaceted and warrant a deeper exploration.

Causes of Selling Shares at a Loss

Several factors can lead an investor to sell shares at a loss. These can be broadly categorized into market-related causes, company-specific causes, and investor-related causes.

Market-Related Causes

Market downturns, often referred to as bear markets, are a primary cause of widespread losses. These periods are characterized by a general decline in stock prices across various sectors. For instance, the 2008 financial crisis and the 2020 COVID-19 pandemic both triggered significant market declines, forcing many investors to sell their holdings at a loss to mitigate further damage. During these times, even fundamentally sound companies can experience a temporary dip in their stock prices due to investor fear and uncertainty.

Economic indicators, such as rising interest rates or inflation, can also negatively impact stock prices. Higher interest rates can make borrowing more expensive for companies, potentially slowing down growth and profitability. Similarly, inflation can erode consumer spending and company earnings, leading to lower stock valuations. The tech stock sell-off in 2022, driven by rising inflation and interest rate hikes by the Federal Reserve, serves as a recent example. Many investors who had purchased tech stocks at inflated valuations during the pandemic boom were forced to sell at a loss as the market corrected.

Sector-specific downturns can also contribute to losses. For example, a decline in oil prices can negatively impact energy stocks, while changes in regulations can affect pharmaceutical or healthcare companies. The rise of renewable energy and the subsequent decline in demand for fossil fuels have put pressure on traditional energy companies, leading to losses for investors holding their stock.

Company-Specific Causes

Poor company performance is another significant cause of share losses. This can include declining revenues, decreasing profits, increased debt, or mismanagement. A company that consistently underperforms its peers or fails to meet market expectations will likely see its stock price decline. Consider the case of Enron in the early 2000s. Accounting fraud and corporate malfeasance led to the company's collapse, wiping out shareholder value and causing massive losses for investors.

Negative news events, such as product recalls, lawsuits, or scandals, can also trigger a sell-off and lead to losses. Johnson & Johnson's stock price faced significant pressure following lawsuits related to asbestos in its talc products, forcing some investors to sell their shares at a loss. Similarly, data breaches or cybersecurity incidents can damage a company's reputation and financial performance, leading to stock price declines.

Changes in a company's competitive landscape can also impact its stock price. The emergence of new technologies or competitors can disrupt existing business models and erode market share. For example, the rise of streaming services like Netflix has negatively impacted traditional media companies, leading to losses for investors who held onto their stock.

Investor-Related Causes

Investor behavior and decision-making can also contribute to losses. Panic selling, driven by fear and herd mentality, can exacerbate market downturns and lead to investors selling shares at the worst possible time. The tendency to "buy high and sell low" is a common mistake made by inexperienced investors.

Lack of diversification is another factor. Investors who put all their eggs in one basket, by investing heavily in a single stock or sector, are more vulnerable to losses if that particular investment performs poorly. Diversification across different asset classes, industries, and geographies can help mitigate risk.

Failure to conduct thorough research and due diligence before investing can also lead to losses. Investing in companies without understanding their business model, financial health, and competitive position is a recipe for disaster. Relying on rumors or speculation instead of credible information can also lead to poor investment decisions.

Finally, using excessive leverage or margin can amplify both gains and losses. While margin trading can potentially increase returns, it also significantly increases the risk of losses, especially during market downturns. Investors who are overleveraged may be forced to sell their shares at a loss to cover their margin calls.

Effects of Selling Shares at a Loss

The effects of selling shares at a loss can be both financial and psychological.

Financial Effects

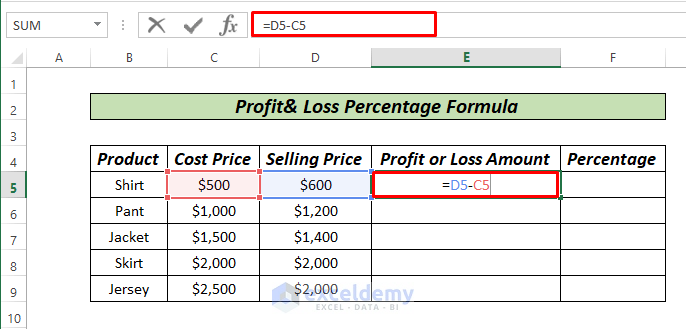

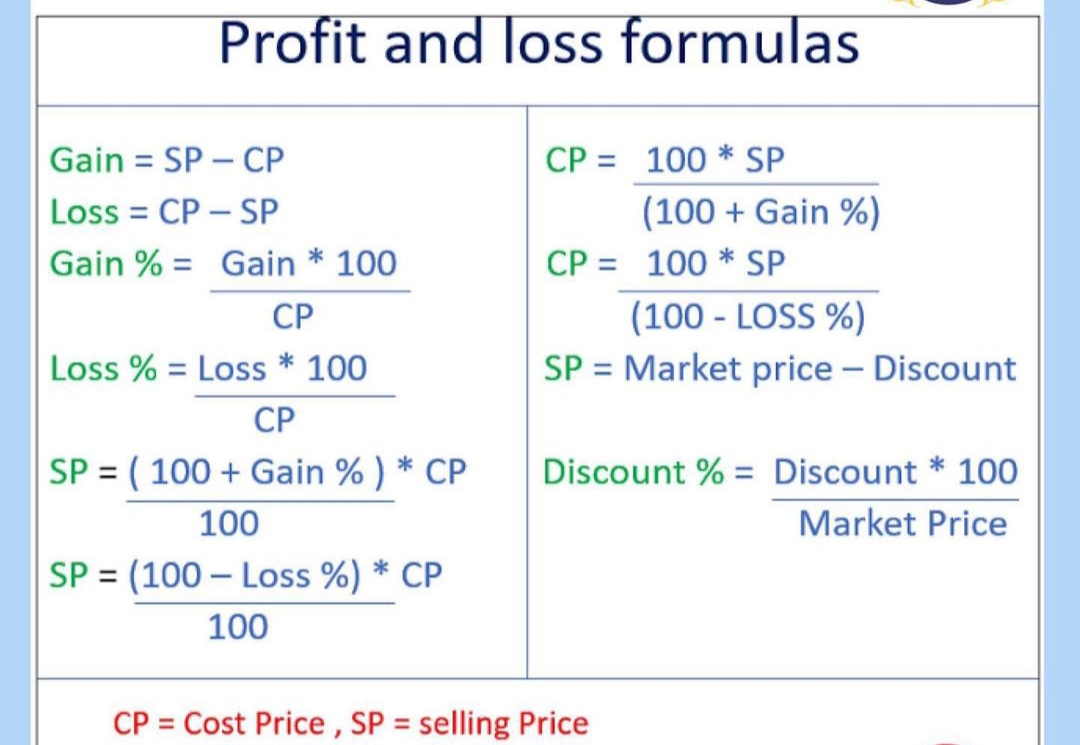

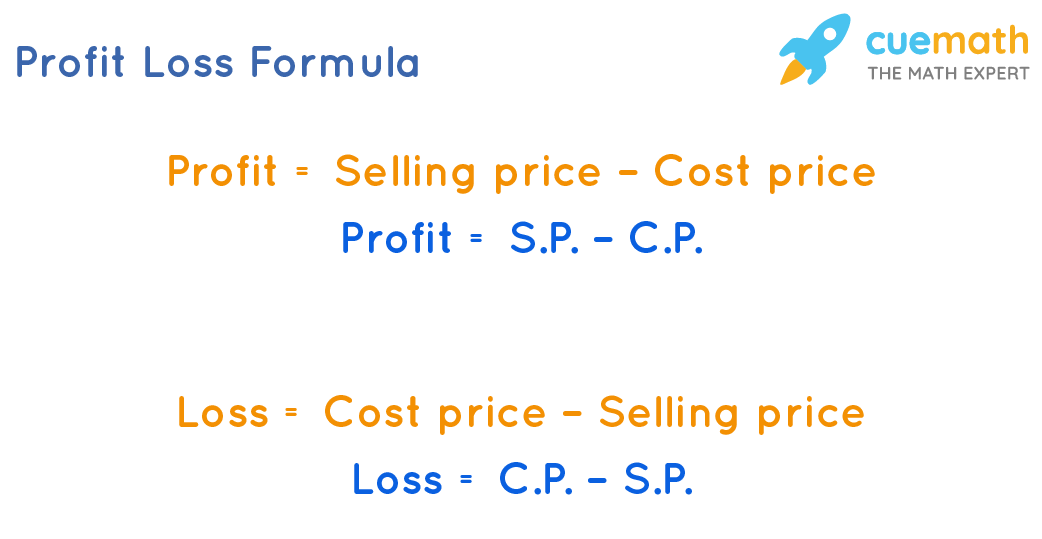

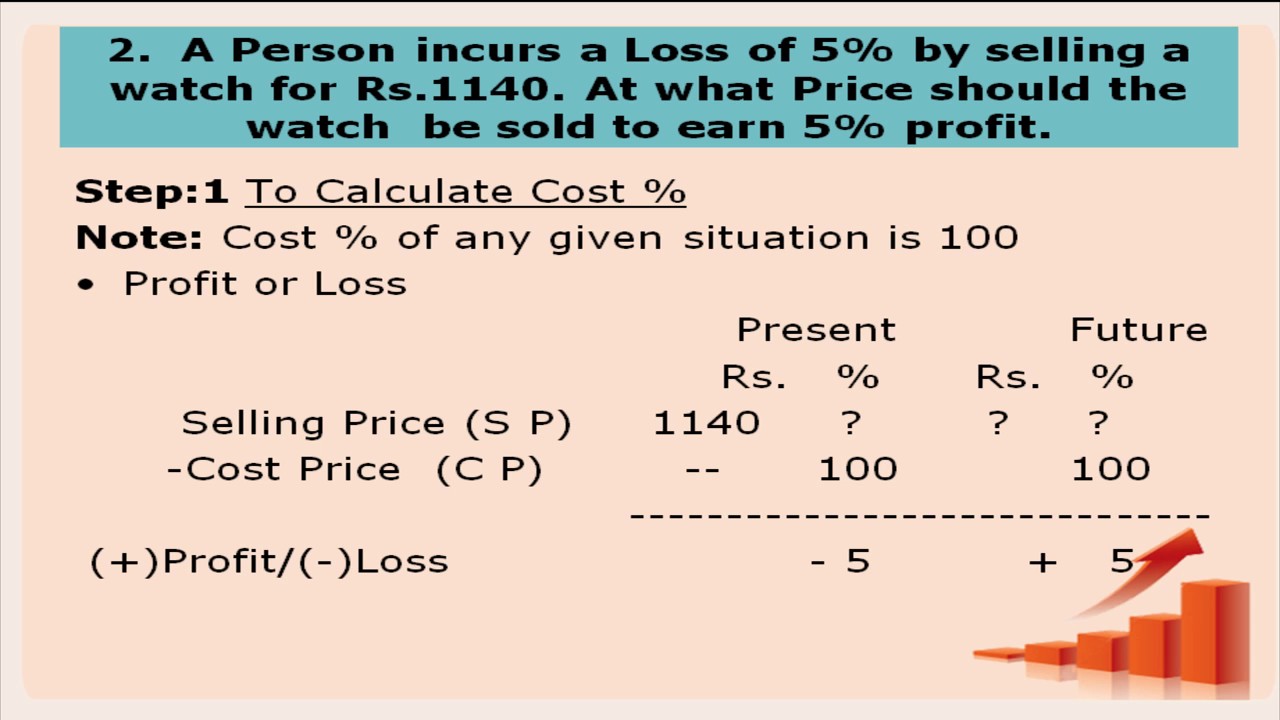

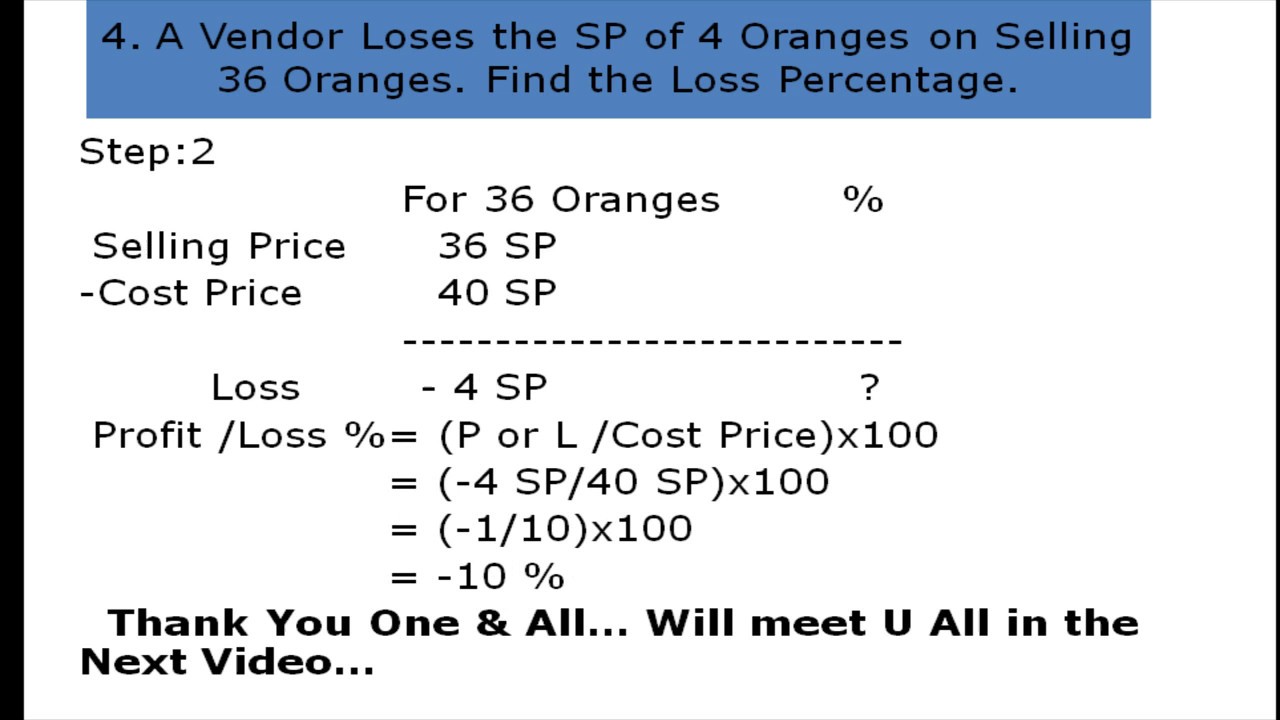

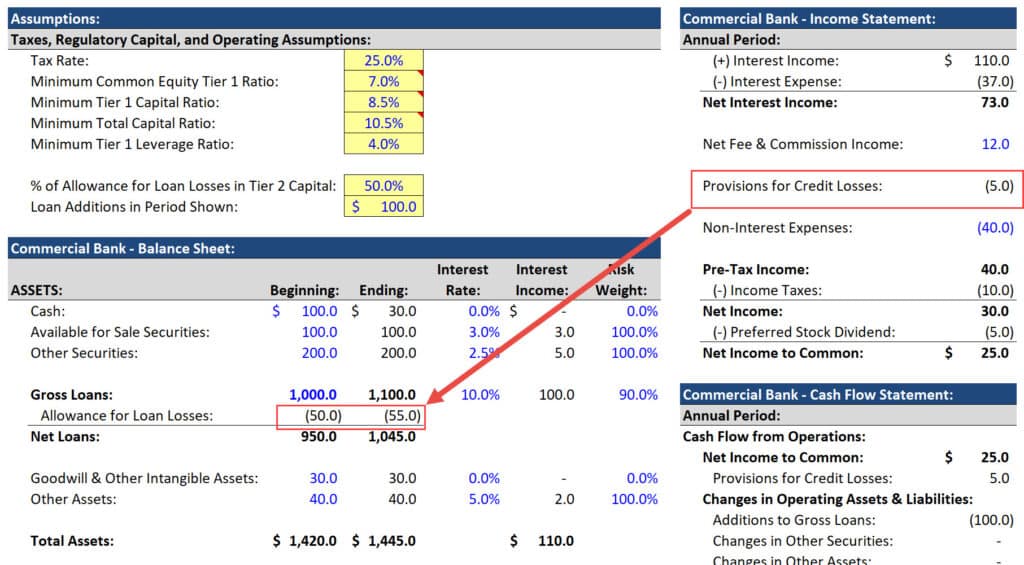

The most obvious effect is the direct financial loss incurred by the investor. This loss reduces the investor's overall portfolio value and can impact their ability to achieve their financial goals. For example, if an investor sells 50 shares of a company for $20 each, having bought them for $30 each, they incur a loss of $10 per share, totaling $500. This $500 loss directly reduces their available capital for future investments.

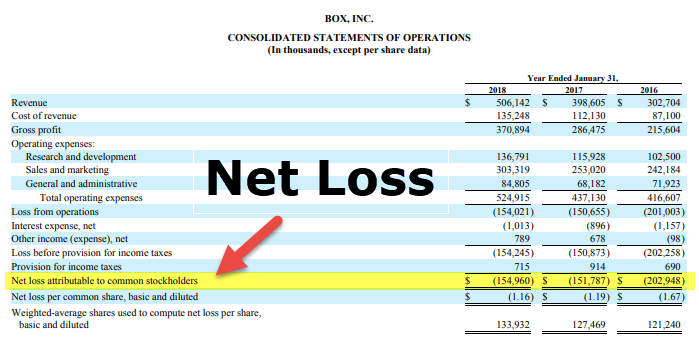

Capital losses can be used to offset capital gains for tax purposes, potentially reducing an investor's tax liability.

Beyond the immediate financial loss, selling shares at a loss can also have tax implications. In many jurisdictions, capital losses can be used to offset capital gains, potentially reducing an investor's tax liability. However, there are often limits on the amount of capital losses that can be deducted in a given year. Unused capital losses can typically be carried forward to future years.

Selling shares at a loss can also trigger wash-sale rules, which prevent investors from claiming a tax loss if they repurchase substantially identical securities within a specific timeframe (typically 30 days before or after the sale). The intention of these rules is to prevent investors from artificially generating tax losses without actually reducing their investment exposure.

Psychological Effects

The psychological effects of selling shares at a loss can be significant. Investors may experience feelings of regret, disappointment, and anxiety. These negative emotions can lead to poor decision-making in the future, such as avoiding risk altogether or chasing quick profits to recoup losses. This is known as loss aversion, the tendency to feel the pain of a loss more strongly than the pleasure of an equivalent gain.

Selling shares at a loss can also damage an investor's confidence and self-esteem. They may question their investment skills and abilities, leading to a reluctance to invest in the future. It's crucial for investors to learn from their mistakes and develop a more rational and disciplined approach to investing.

Implications of Selling Shares at a Loss

The implications of selling shares at a loss extend beyond the individual investor and can impact the broader market.

Market Implications

Widespread selling of shares at a loss can contribute to market volatility and downward pressure on stock prices. Panic selling can create a self-fulfilling prophecy, where falling prices lead to more selling, further exacerbating the decline. The 1987 Black Monday crash serves as a stark reminder of how quickly markets can collapse due to panic selling.

Increased selling pressure can also affect a company's ability to raise capital through stock offerings. If investors are unwilling to buy shares at a reasonable price, the company may be forced to postpone or cancel its offering, which can hinder its growth plans.

Furthermore, substantial losses in the stock market can have a negative impact on consumer confidence and economic activity. People who have lost money in the market may reduce their spending, leading to lower demand for goods and services.

Regulatory Implications

Large-scale losses in the stock market can prompt regulatory scrutiny and calls for reforms. Regulators may investigate potential market manipulation or fraudulent activities that contributed to the losses. The Sarbanes-Oxley Act, passed in response to the Enron scandal, is an example of how major corporate collapses can lead to stricter regulations and oversight.

Regulators may also consider implementing measures to protect investors from excessive risk-taking, such as stricter margin requirements or enhanced disclosure requirements. These measures aim to prevent future market crashes and safeguard investor confidence.

Broader Significance

Calculating and understanding the loss on selling shares is more than just a mathematical exercise. It's a crucial aspect of financial literacy and risk management. By understanding the causes, effects, and implications of selling shares at a loss, investors can make more informed decisions, mitigate risks, and ultimately achieve their financial goals. The ability to analyze potential losses allows for a more realistic assessment of investment opportunities and fosters a more disciplined approach to market participation. Ignoring the possibility of losses is akin to navigating without a map; while success may be possible, the likelihood of getting lost increases exponentially. In a dynamic and unpredictable market, a thorough understanding of loss calculation is an indispensable tool for navigating the complexities of investing and building long-term financial security.