Okay, let's talk credit scores. Specifically, let's talk about that 520 credit score chilling in the corner. Is it a *party crasher* at the loan application table? Or is there still hope? Think of your credit score like your dating profile. A high score is like having a picture-perfect profile with glowing references. A low score, well, it's like having a profile pic from ten years ago and a bio that just says "Ask me." Not ideal, right?

The 520 Credit Score: What's the Vibe?

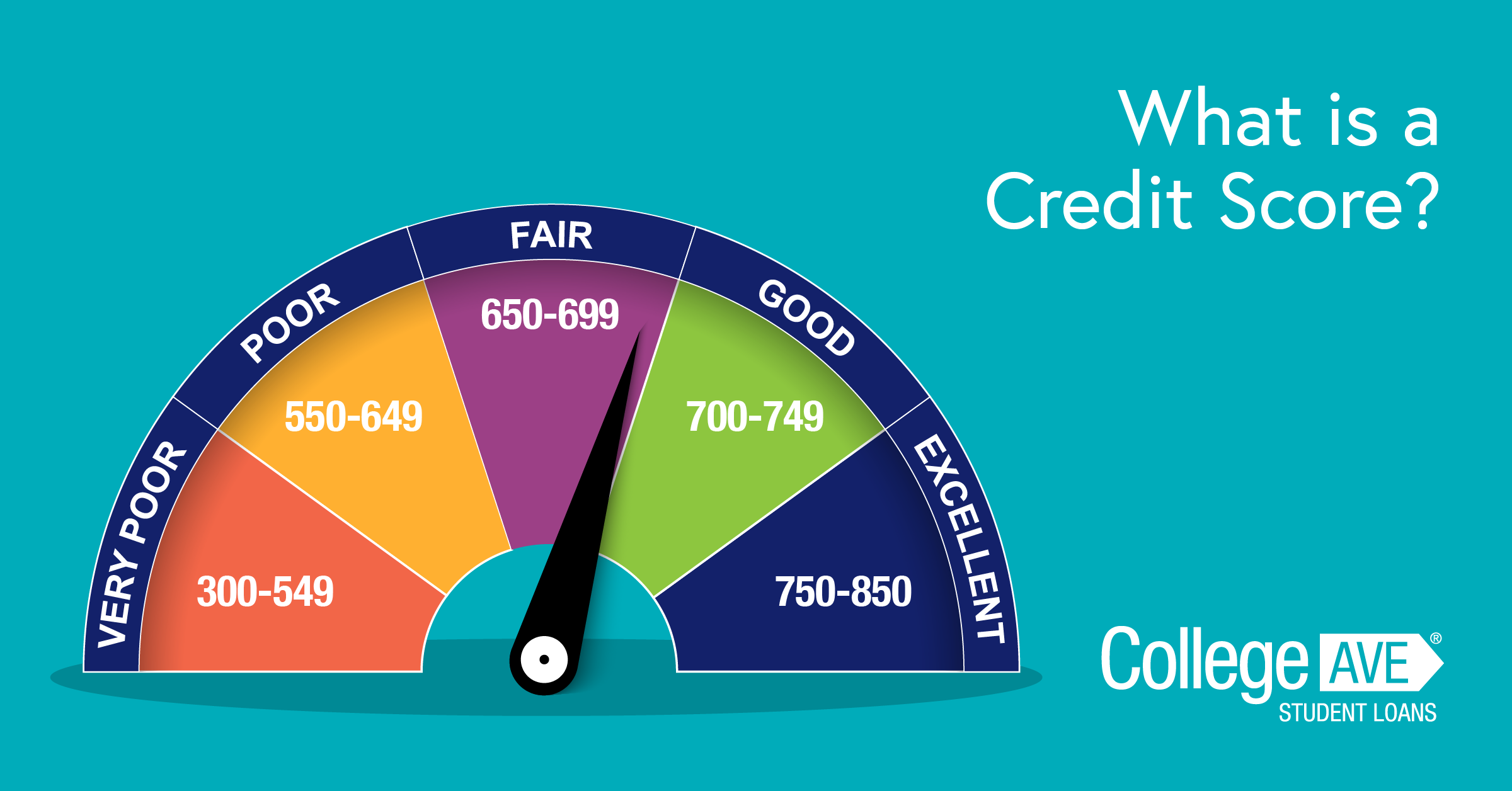

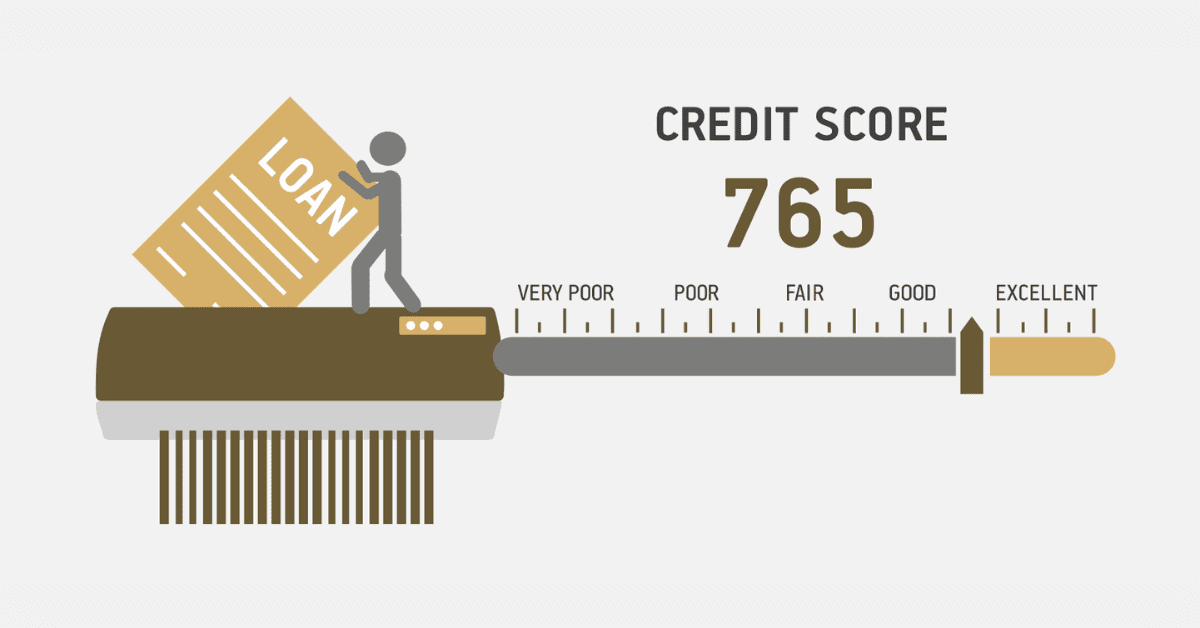

So, what does a 520 really mean? Generally speaking, it falls into the "poor" or "very poor" category. It's not the end of the world, but it *does* signal to lenders that you might be a riskier borrower. Imagine trying to convince someone to lend you their brand-new sports car when your driving record looks like a demolition derby. That's kind of what a 520 credit score is doing.

Why is it important to know your score?

Knowing your credit score is like knowing your own body temperature. It gives you a crucial baseline. If it's too high or too low, you know something needs attention. Ignoring your credit score is like ignoring that persistent cough – it might just go away, but it could also be something serious! And when it comes to loans, ignorance isn't bliss. It's just…expensive.

Think about it this way: Your credit score is a key. It unlocks doors to financial opportunities. A higher score unlocks better interest rates, more loan options, and easier approvals. A lower score? Well, it's like having the wrong key – you might still get in, but it’s going to be a lot harder, and probably involve more frustration.

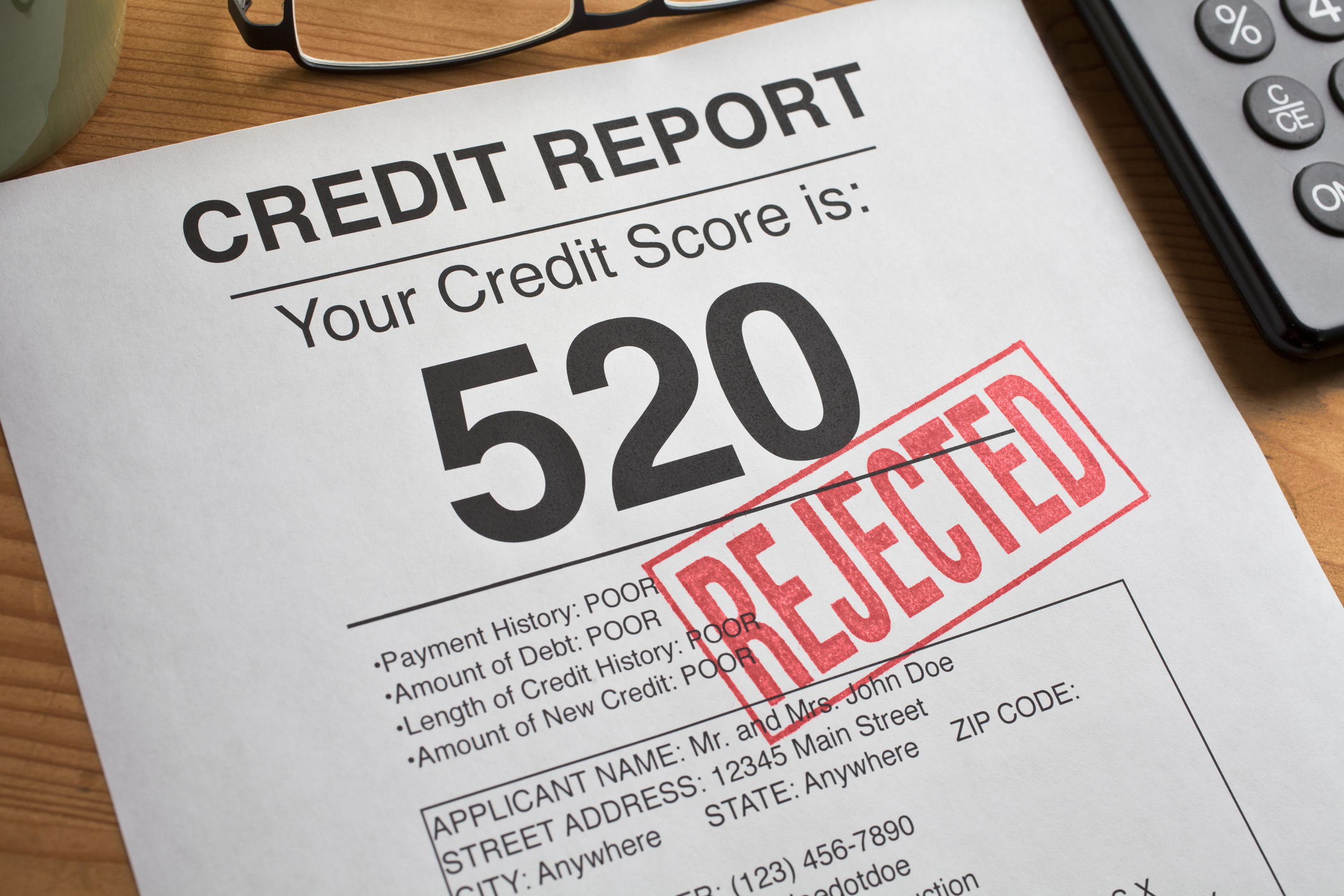

So, *Can* You Get a Loan with a 520 Credit Score?

Here's the million-dollar question! The answer is… maybe. It's not a resounding YES, but it's not a definite NO either. Think of it like trying to get into an exclusive club. A high credit score is your VIP pass. A 520? It's like knowing the bouncer *really* well. You might still get in, but you'll need to work for it.

It's all about understanding your options and managing expectations. Lenders see that 520 and think: "Okay, this person might have trouble repaying the loan." To counteract that, you need to show them you're serious and responsible. It's about building trust, even with less-than-perfect credit.

What Kind of Loans Are We Talking About?

Okay, let's get specific. While a traditional mortgage or a low-interest personal loan from your bank might be a tough sell, here are some possibilities:

- Secured Loans: Think of these as loans with training wheels. You're offering up something of value (like your car or savings account) as collateral. This reduces the lender's risk, making them more likely to approve you, even with a lower score.

- Credit-Builder Loans: These are designed specifically to *improve* your credit. You borrow a small amount of money, and the lender reports your payments to the credit bureaus. It's like a workout plan for your credit score!

- Payday Loans: *Proceed with extreme caution!* These are short-term, high-interest loans that can quickly trap you in a cycle of debt. They're like a sugar rush – they feel good at first, but you'll crash hard later.

- Loans from Credit Unions: Credit unions are often more willing to work with members who have less-than-perfect credit. They're like the friendly neighborhood lender, often offering more personalized service.

- Co-signed Loans: Have a friend or family member with great credit? They can co-sign the loan, guaranteeing repayment if you can't. This is like having a super-reliable wingman – but make sure you don't let them down!

Each of these options comes with its own set of pros and cons. Do your homework, compare interest rates, and read the fine print *very* carefully. Don't just jump at the first offer – shop around and find the best fit for your situation.

Interest Rates: Brace Yourself!

Here's the reality check: with a 520 credit score, you're going to pay higher interest rates. This is simply the price you pay for being a riskier borrower. Lenders need to compensate for the increased chance that you might default on the loan.

Think of it like insurance. If you have a history of reckless driving, your car insurance rates will be higher. Similarly, a lower credit score means lenders see you as a higher risk, and they'll charge you more for borrowing money.

Before you sign on the dotted line, make sure you understand the total cost of the loan, including interest and fees. Can you realistically afford the monthly payments? Don't let the desperation for a loan blind you to the long-term financial consequences.

Improving Your Credit Score: The Long Game

While getting a loan with a 520 score is possible, the best strategy is to *improve your credit score* so you don't have to rely on high-interest options. This is a marathon, not a sprint. It takes time, patience, and consistent effort.

Here are a few key steps you can take:

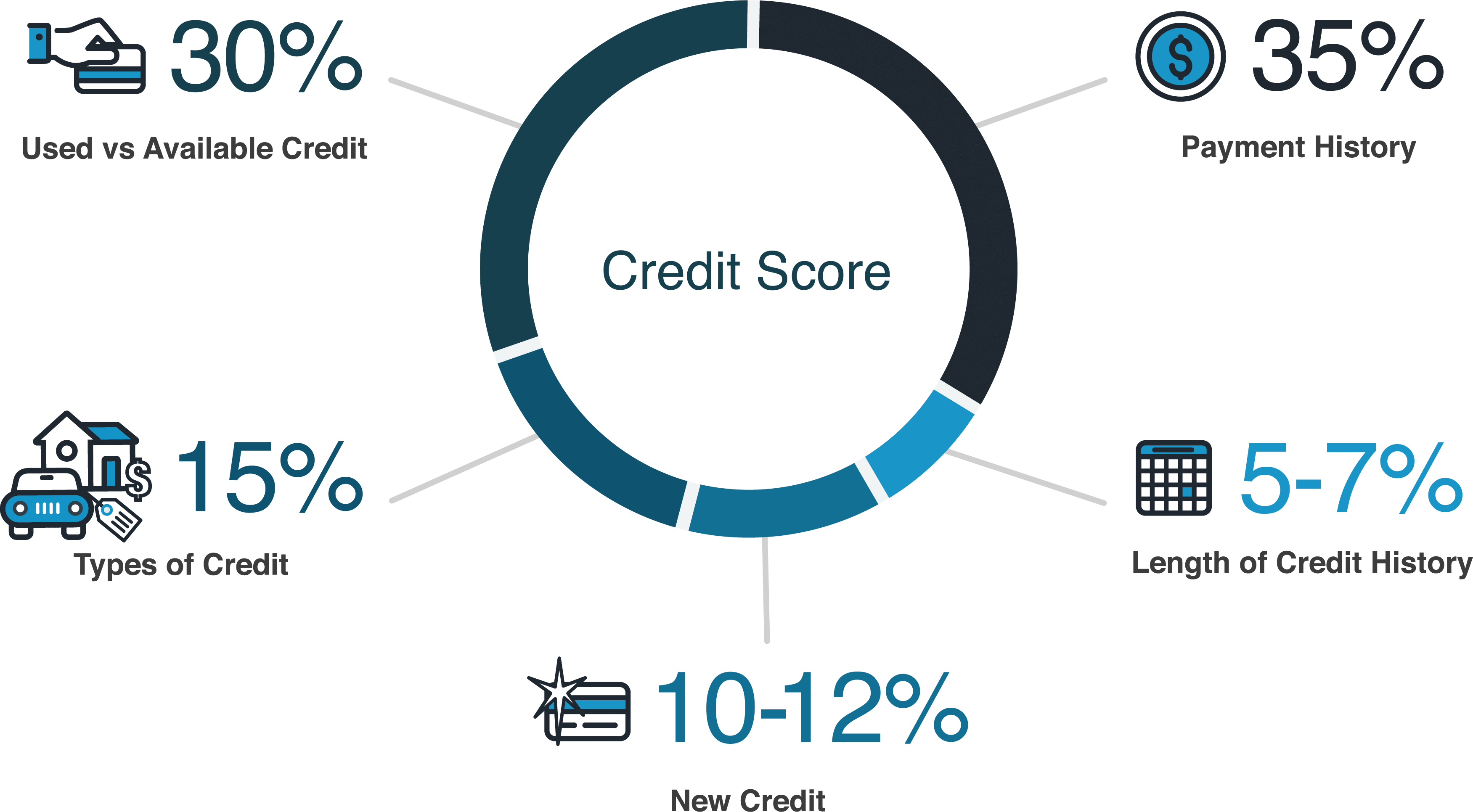

- Pay your bills on time, every time. This is the single most important thing you can do. Payment history makes up a huge chunk of your credit score.

- Keep your credit utilization low. This means using only a small portion of your available credit. Aim to keep your balances below 30% of your credit limits.

- Check your credit report regularly. Look for errors or inaccuracies that could be dragging down your score. You can get a free copy of your credit report from each of the three major credit bureaus (Equifax, Experian, and TransUnion) once a year at AnnualCreditReport.com.

- Become an authorized user on someone else's credit card. If you have a trusted friend or family member with good credit, ask if they'll add you as an authorized user. Their positive payment history can help boost your score.

- Consider a secured credit card. This is like a regular credit card, but you're putting down a cash deposit as collateral. It's a great way to rebuild your credit.

Think of improving your credit score like training for a race. You need to start slowly, be consistent, and gradually increase your efforts. There will be setbacks along the way, but don't give up! The reward – a higher credit score and access to better financial opportunities – is well worth the effort.

The Takeaway: Be Smart, Be Patient, Be Proactive

So, can you get a loan with a 520 credit score? It's complicated, but it's not impossible. However, it's *essential* to understand the risks, explore your options carefully, and prioritize improving your credit score for the long term.

Don't settle for being the person stuck with the high-interest loan. Take control of your financial future, build your credit, and unlock the doors to better opportunities. You got this!