Hey there! Ever wondered if your friendly neighborhood payday loan place spills the beans to the credit bureaus? Like, does taking out that emergency cash advance actually *affect* your credit score? Grab your coffee (or tea, no judgment!), because we're diving in. It's a bit of a "yes, but also no" situation, kinda like trying to assemble IKEA furniture.

The Murky Waters of Payday Loans and Credit Reports

So, here's the thing. Not all payday lenders report to the big three credit bureaus: Experian, Equifax, and TransUnion. Think of them as the gossip girls of the credit world. Some just... don't care. They're more focused on the here and now, on getting that loan repaid, often with astronomical interest rates (we'll get to that!). It's like they're living in a pre-credit score era. Totally wild, right?

But Wait, There's a Catch! (Of Course There Is)

Now, don't go thinking you're off scot-free if you snag a payday loan. Even if the lender doesn't report the *good* news (i.e., you paid it back on time), they *definitely* might report the *bad* news. We're talking about those missed payments, defaults, and accounts sent to collections. Ouch. That's like your embarrassing childhood photos showing up on the internet – you can't unsee it (or un-credit-score-it!).

Think of it this way: imagine you borrowed your friend money, and they promised to keep it a secret. Cool, right? But then you didn't pay them back, and they started telling *everyone*. That's kinda how it works with payday loans and credit reports.

The key takeaway? Assume the worst. Act like they *are* reporting. Because even if they don't initially, a default could end up on your credit report eventually, and nobody wants that. Trust me.

Why Some Don't Report (The Plot Thickens!)

Why *don't* some payday lenders report? Well, there are a few reasons. For starters, reporting to credit bureaus costs money. Seriously! These lenders are often dealing with smaller loan amounts and slimmer margins. They might figure, "Hey, why bother paying to report when we can just focus on getting the money back, one way or another?" It’s all about the Benjamins, baby!

Also, a lot of payday loan customers have less-than-stellar credit to begin with. So, these lenders may not see the benefit of reporting positive payment history. It's like saying, "Oh, your credit score is already in the basement? Never mind!" Harsh, I know, but that's the reality.

Some payday lenders just cater to high-risk borrowers and are not concerned about the credit rating system. They know that many of their customers are in a tough spot and are willing to take on the risk (and charge accordingly). It’s a niche market, and they’re playing the game.

What Happens if a Payday Loan *Does* Show Up? (Brace Yourself)

Okay, so let's say a payday loan *does* pop up on your credit report. What's the damage? Well, it depends. A single, on-time payment probably won't do much to boost your score (sorry!). But a late payment? A default? That can seriously ding your credit. We’re talking about potentially dropping your score by a significant amount. Think of it like accidentally liking your ex's photo from five years ago - regrettable, and with consequences!

Late payments are like little red flags waving at potential lenders. They scream, "Hey, this person struggles to pay their bills on time!" Which, unsurprisingly, makes it harder to get approved for other loans, credit cards, and even apartments. Nobody wants to rent to someone who's known for being a late-payer, right? It's all about trust, or in this case, the lack thereof.

And a default? That's like setting off the alarm bells. A default says, "This person completely failed to repay their debt." That's a major red flag that can stay on your credit report for *years*. Years, I tell you! It's like a bad tattoo you can't get rid of. Okay, maybe not *that* bad, but you get the picture.

How to Protect Your Credit (The Knight in Shining Armor)

Alright, enough doom and gloom. What can you *do* to protect your credit when dealing with payday loans? First and foremost: avoid them if you possibly can! Seriously. Explore other options, like asking friends or family for help, getting a side hustle, or negotiating with your creditors. Payday loans are often a very expensive solution to a short-term problem. It’s like using a bazooka to crack a walnut – way overkill, and likely to make a mess.

If you *do* need to take out a payday loan, make absolutely sure you can repay it on time. Set reminders, automate payments, do whatever it takes to avoid late fees and defaults. Your credit score will thank you for it! Treat it like a precious egg that needs to be carefully protected. It might seem fragile, but it can have a big impact on your financial future.

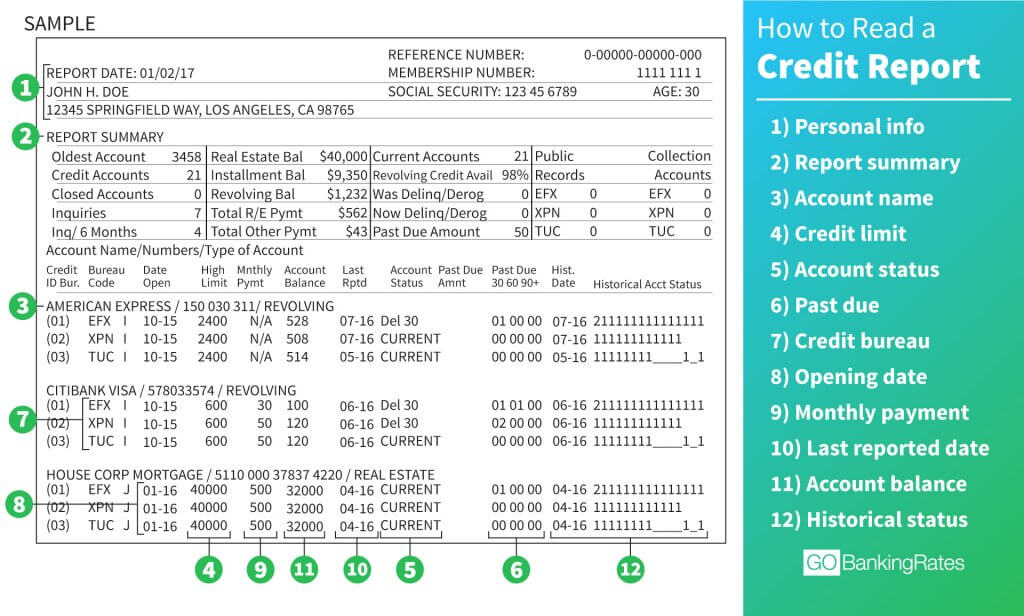

Keep a close eye on your credit report. You're entitled to a free copy from each of the three major credit bureaus every year. Review it carefully for any errors or inaccuracies. If you spot something suspicious, dispute it immediately. It's like being a detective, searching for clues in a mystery. And in this case, the mystery is your financial health!

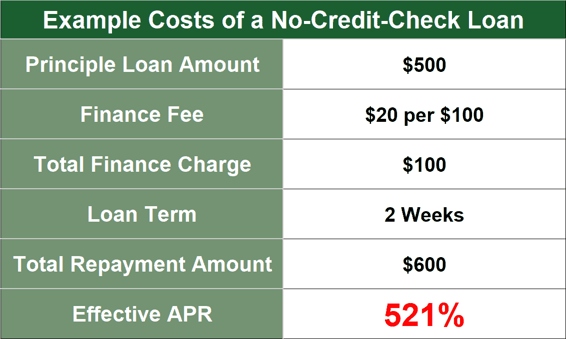

Also, be wary of payday lenders who promise "no credit check" loans. While it might sound appealing if you have bad credit, it's often a sign that they're not reporting to the credit bureaus. And as we've already discussed, that might seem like a good thing, but it could actually hurt you in the long run if you default. It’s like walking into a dark alley – you might think you’re getting away with something, but it’s usually not a good idea.

The Bottom Line (The Grand Finale!)

So, can payday loans report to credit bureaus? The answer is a resounding "maybe." It's not a guarantee, but it's definitely a possibility. And even if they don't report positive payment history, they almost certainly will report negative payment history. Which means you need to be extra careful when dealing with payday loans.

Treat payday loans like the financial equivalent of spicy food. A little bit might be okay, but too much can cause serious heartburn. So, proceed with caution, be smart about your borrowing, and always prioritize protecting your credit. Your future self will thank you for it!

In short, assume payday lenders *will* report. Play it safe. Your credit score is worth more than a little bit of quick cash that could cost you big time later.

Remember, understanding your credit and how it works is key to financial well-being. So, keep learning, keep asking questions, and keep protecting your score! You got this!

Final Thoughts (One Last Sip of Coffee)

And one last thing: if you're struggling with debt, don't be afraid to seek help. There are plenty of reputable credit counseling agencies and non-profit organizations that can provide guidance and support. You don't have to go it alone! Think of it as calling in reinforcements when you're facing a tough battle. There's no shame in asking for help – in fact, it's a sign of strength.

Good luck out there, and happy borrowing! (Or, you know, happy *not* borrowing, if you can swing it!)

![When Does Discover Report to Credit Bureaus? [And Where?] - Can Payday Loans Report To Credit Bureau](https://creditbuildingtips.com/wp-content/uploads/2023/04/discover-card-when-and-where-do-they-report.jpg)