Hey there, friend! Ever feel like you're drowning in debt? Like a cartoon character buried under a mountain of bills? Well, let's talk personal loans. Specifically, can you ditch 'em in bankruptcy? It's a question more exciting than watching paint dry, I promise! (Okay, maybe not. But close!).

Bankruptcy: Your Financial Escape Hatch?

So, what *is* bankruptcy anyway? Think of it as a financial reset button. A chance to start fresh. A legal way to say, "Okay, debt, we need to break up. It's not you, it's... well, it *is* you. You're expensive and demanding!"

Bankruptcy comes in a few flavors. The main ones you'll hear about are Chapter 7 and Chapter 13. They both help you deal with debt, but in different ways. Imagine them as two different routes on the same mountain, each with its own scenic views (or, uh, bureaucratic hurdles).

Chapter 7: The Quick Exit

Chapter 7 is like ripping off the band-aid. Fast and potentially furious. It involves liquidating (selling) some of your assets to pay off creditors. The goal? To wipe out most of your unsecured debt. What's unsecured debt? Think credit cards, medical bills... and yup, often personal loans! It's the kind of debt that's not tied to a specific asset, like a car or house.

Here's the quirky part: not everyone qualifies for Chapter 7. There's a "means test" to make sure you really *need* it. It's like a financial IQ test, only instead of intelligence, it measures your income and expenses. If you make too much moolah, you might be steered towards Chapter 13.

Chapter 13: The Repayment Plan

Chapter 13 is more like a marathon than a sprint. It involves setting up a repayment plan, usually lasting three to five years. You make monthly payments to a bankruptcy trustee, who then distributes the money to your creditors. It's like a forced savings plan, only instead of saving for a vacation, you're paying off debt. Slightly less fun, I admit.

The upside? You get to keep your assets! Your house, your car, your prized collection of rubber duckies... safe and sound. It's a good option if you're behind on your mortgage or car payments and want to catch up. And guess what? Personal loans can often be included in your Chapter 13 plan.

So, Can You Bankruptcy Away Those Personal Loans?

The short answer? Probably, yes. But it's not a guaranteed thing. It depends on several factors:

- The type of loan: Most personal loans are unsecured, meaning they're dischargeable in bankruptcy. But there are exceptions.

- Your individual circumstances: Your income, assets, and other debts all play a role.

- The bankruptcy court's decision: Ultimately, the bankruptcy court decides whether to discharge your debts.

Let's say you took out a personal loan to buy a life-sized statue of a garden gnome. A *very* expensive garden gnome. And now you can't afford to pay it back. In most cases, that loan *could* be discharged in bankruptcy. But if you fraudulently obtained the loan (like, lied on your application), that's a whole different ballgame. Bankruptcy courts don't like fraud. They take it more seriously than a garden gnome convention.

Here's a fun fact: even if the loan is *technically* dischargeable, your lender might try to object. They might argue that you can afford to pay it back, or that you acted in bad faith. It's like a financial tug-of-war, and you might need a lawyer to help you win.

Things to Consider Before Filing

Bankruptcy isn't a magic wand. It's a serious decision with long-term consequences. Before you file, consider these things:

- Your credit score: Bankruptcy will trash your credit score. It'll be harder to get loans, credit cards, or even rent an apartment in the future.

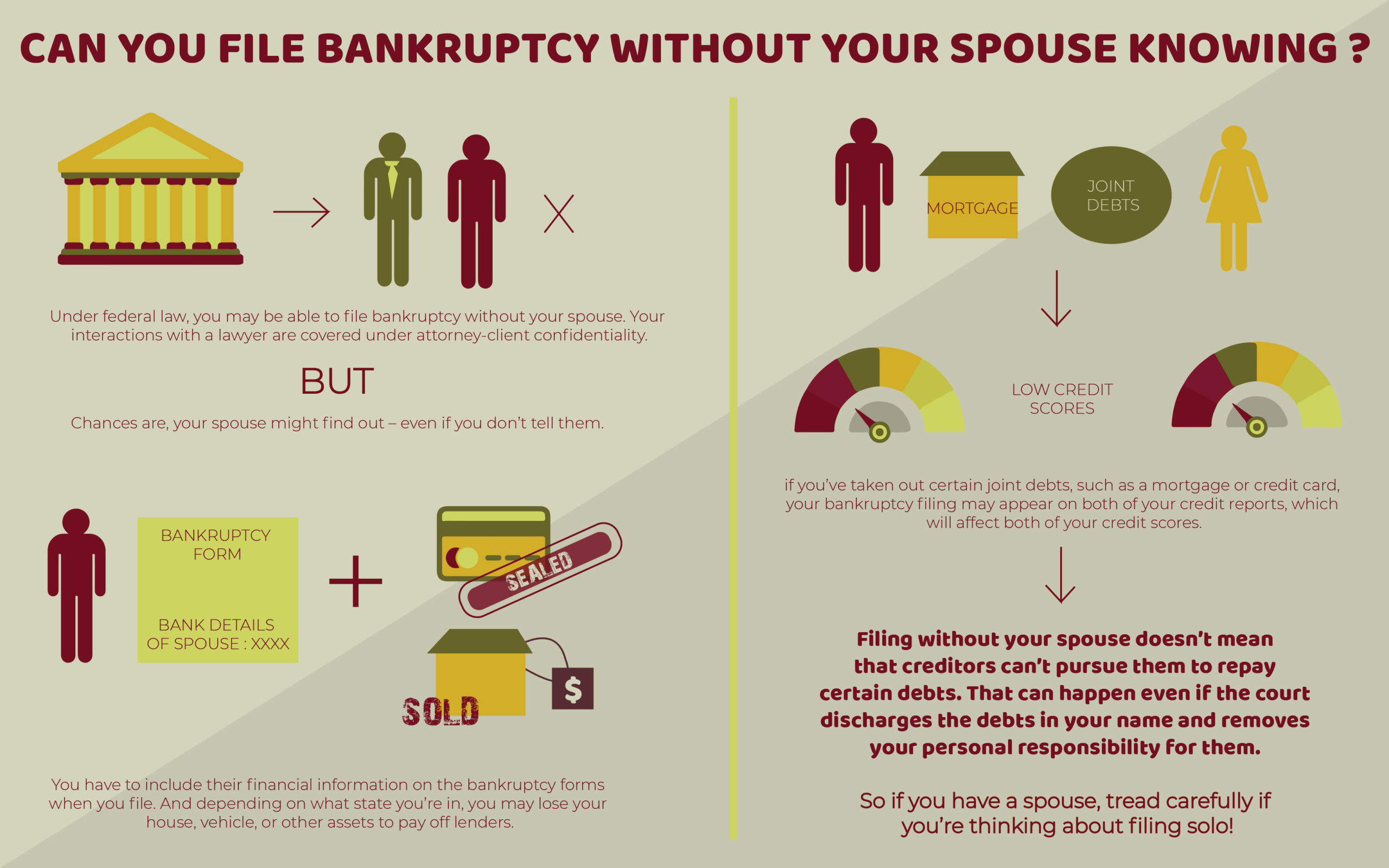

- Your relationships: If you co-signed a personal loan with a friend or family member, they'll be responsible for paying it back if you file bankruptcy. Awkward!

- The alternatives: Have you tried negotiating with your lenders? Consolidating your debt? Creating a budget? Sometimes, there are less drastic solutions.

Imagine this: you're planning a surprise party for your best friend, but you accidentally CC'd them on the email invitation. Oops! Bankruptcy is a bit like that. Once you file, everyone knows about it. It's public record.

Also, remember the emotional toll. Dealing with debt can be stressful. Filing bankruptcy can be even more stressful. It's important to take care of your mental health. Treat yourself to that extra-large pizza (just maybe don't put it on a credit card!).

Get Professional Help!

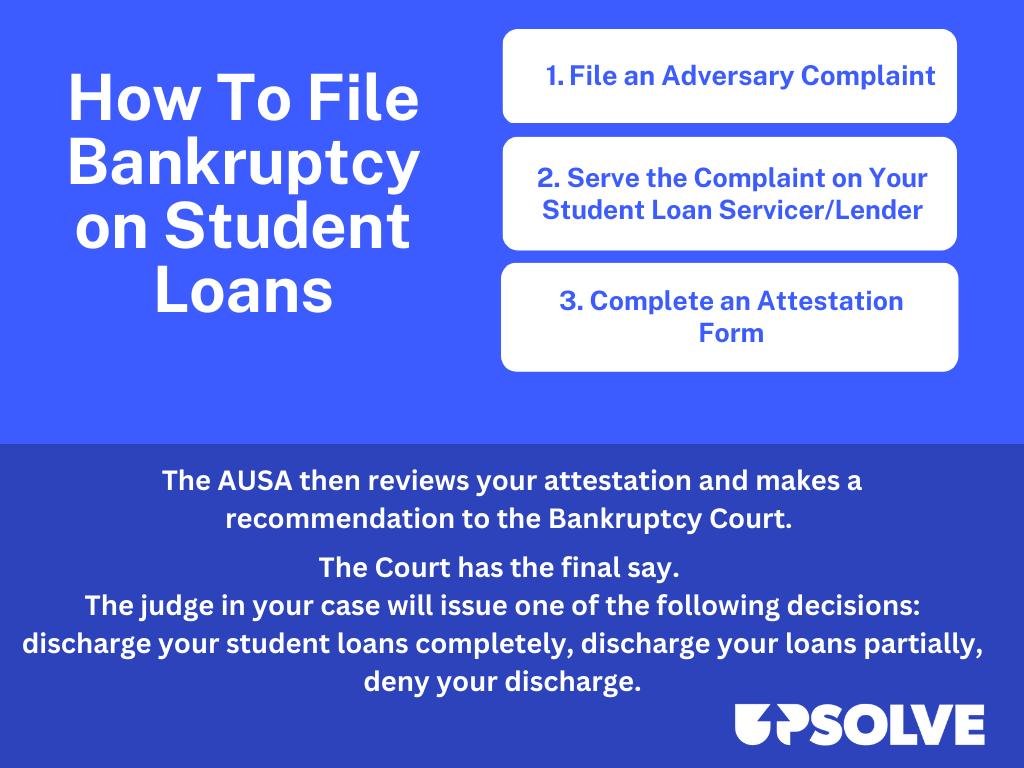

I'm just a friendly AI, not a financial advisor. This information is for entertainment purposes only (and hopefully a little bit of education!). If you're considering bankruptcy, talk to a qualified attorney or credit counselor. They can assess your situation and help you make the best decision.

Think of it like this: you wouldn't try to perform brain surgery on yourself, right? (Please say no!). Dealing with bankruptcy is complex, and it's best left to the experts.

They can explain the intricacies of bankruptcy law, help you navigate the paperwork, and represent you in court. It's an investment in your financial future. Plus, they probably have some good stories to tell about other people who filed bankruptcy (hopefully not involving life-sized garden gnomes).

So, there you have it! A whirlwind tour of personal loans and bankruptcy. It's not the most glamorous topic, but it's an important one. Remember, you're not alone. Millions of people struggle with debt. There is hope, and there are options. And hey, at least you learned something new today. Go forth and conquer your financial fears! Or at least, make a plan to conquer them. Baby steps!

One last thought: before you take out a personal loan, ask yourself, "Do I *really* need this?" Maybe you can find a cheaper alternative. Or maybe you can just live without that life-sized garden gnome. Just a thought!

Now go forth and prosper... responsibly!