Hey there! Ever wondered about using checks with your savings account? Sounds kinda weird, right? Like putting ketchup on ice cream. But, hey, let’s dive in! This is more interesting than you think!

Savings Accounts & Checks: The Plot Thickens

So, can you actually write checks from a savings account? The short answer is: it depends! Mind. Blown.

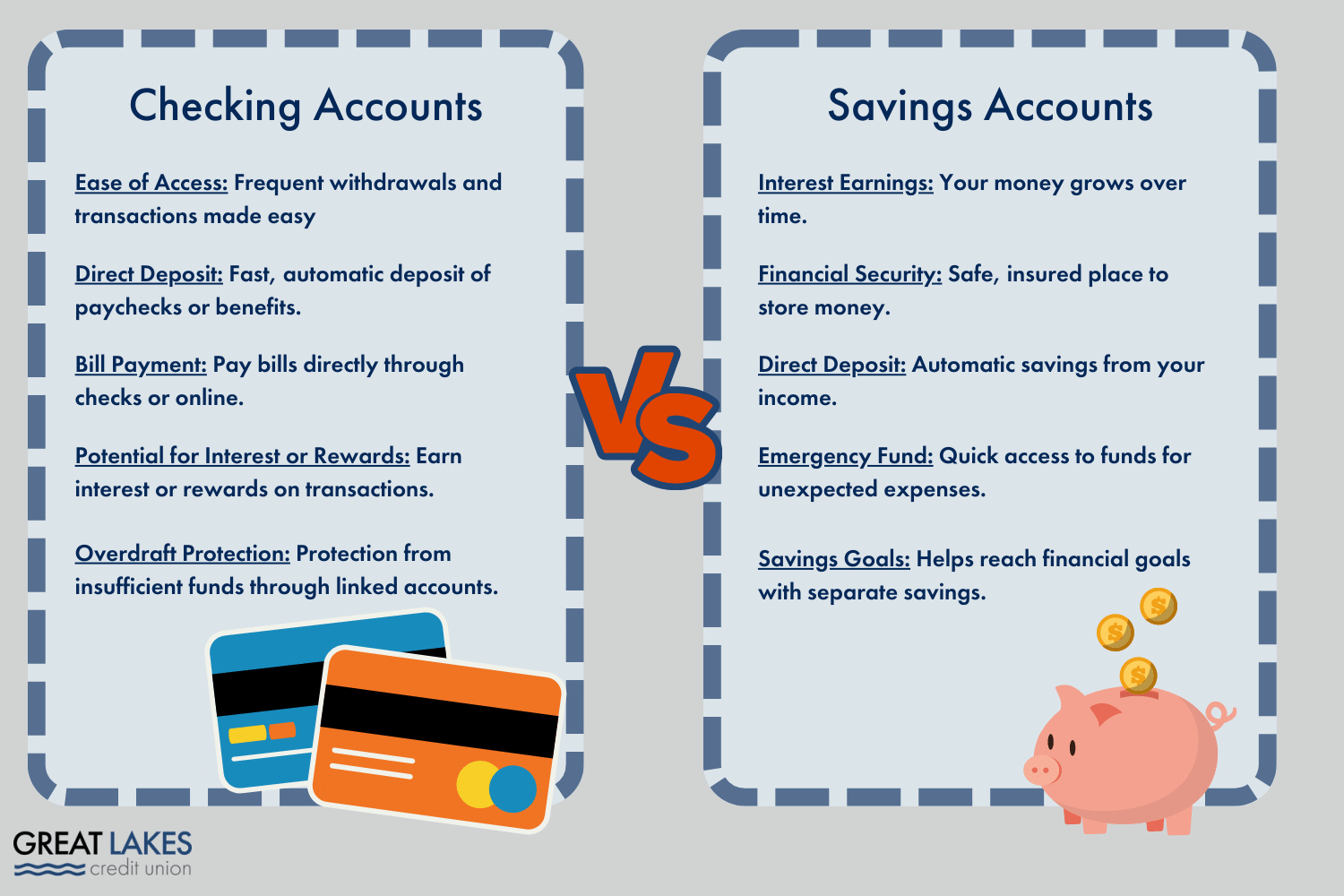

Typically, no, you can't write checks directly from a "traditional" savings account. Think of a regular savings account as a little piggy bank, but digital. Designed for saving, not spending. It’s where your emergency fund chills, or your vacation fund dreams. Checks and piggy banks? Not exactly BFFs.

But, BUT! There are exceptions! Things get interesting when you throw money market accounts (MMAs) into the mix. These are like savings accounts on steroids. They often offer higher interest rates, BUT sometimes come with check-writing privileges. Sneaky, huh?

Money Market Accounts: The Check-Writing Wildcards

Imagine a savings account wearing a little disguise… that's kinda what an MMA is! It's still a place to stash your cash, earn interest, and generally be financially responsible. But it also lets you write checks! Think of it as a savings account that secretly moonlights as a checking account. Shhh! Don't tell the other savings accounts!

However, there's usually a catch (isn't there always?). MMAs often require a higher minimum balance than a regular savings account. So, you might need to keep a chunk of change parked there to avoid fees. Think of it as the price of admission to the check-writing party.

Also, many MMAs limit the number of checks you can write per month. It's not meant to be your everyday spending account. It's more like a "special occasion" check-writing account. Birthday presents, paying the pizza guy a *really* big tip... you know, the important stuff.

Why the "No Checks" Rule for Regular Savings?

Good question! Banks want to keep savings accounts as havens for your cash. Allowing unlimited check-writing could blur the lines between saving and spending, potentially encouraging impulse buys. Banks are trying to save you from yourself! (Maybe.)

Plus, savings accounts are subject to something called Regulation D, which limits the number of certain types of withdrawals and transfers you can make per month (usually six). This includes electronic transfers and, in some cases, check-like transactions. It’s the government’s way of gently reminding you to *save*, not splurge. Think of it as a financial timeout chair.

This regulation is designed to ensure banks have enough cash on hand to cover withdrawals and maintain financial stability. So, it's not just about you and your spending habits – it's about the whole financial system!

Checking Accounts: The Check-Writing Champs

Of course, if you *really* want to write checks all the time, a checking account is your best bet. That's what they're designed for! No limits (usually) on the number of checks you can write, debit cards for everyday purchases, and generally more freedom to move your money around.

Checking accounts are like the social butterflies of the banking world. Always out and about, making transactions, and generally living their best financial lives. Savings accounts are more like introverts, preferring to stay home and watch their balances grow.

So, Should YOU Write Checks from a "Savings" Account?

Let's break it down! Ask yourself these questions:

- Do you really *need* to write checks from your savings? If you're just looking for a convenient way to pay bills, a checking account is probably a better fit.

- Are you okay with maintaining a higher minimum balance? MMAs often require more cash upfront.

- Will you exceed the transaction limits? Exceeding those limits can lead to fees. Ouch!

- Have you compared interest rates? Sometimes the higher interest rate of an MMA doesn't outweigh the hassle of minimum balance requirements and transaction limits.

Think of it like this: If you only occasionally need to write a check from your savings, an MMA might be a good option. But if you're writing checks all the time, stick with a checking account. It's like choosing the right tool for the job. A hammer isn't great for painting, and a paintbrush isn't great for building a house. (Unless you're an *abstract* house painter... then maybe!)

Fun Facts & Quirky Details

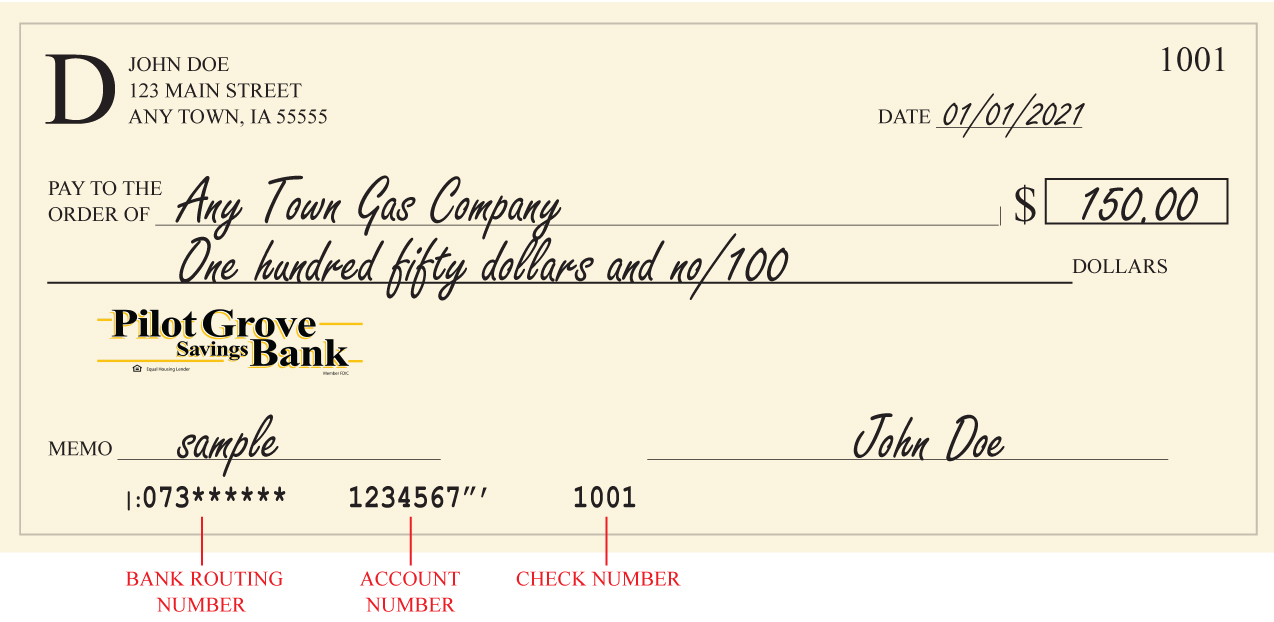

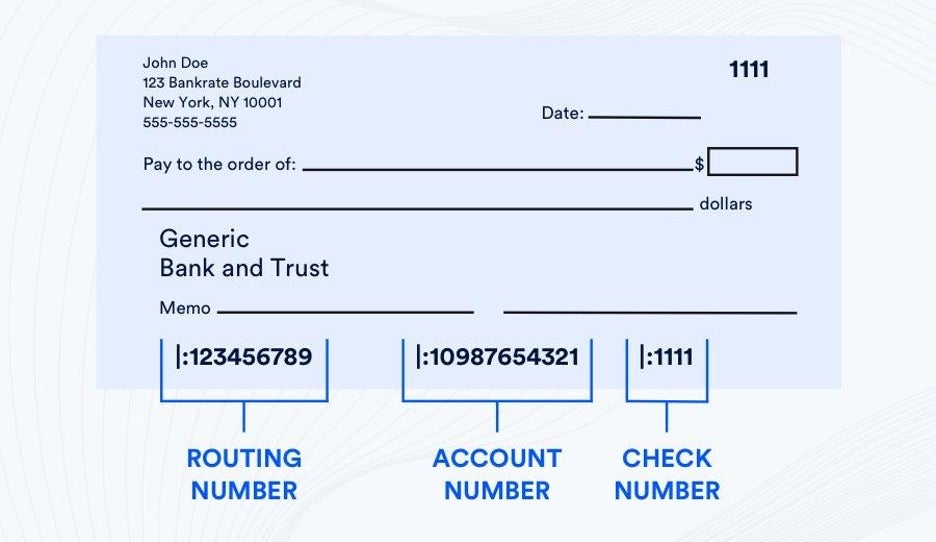

Did you know that the first checks were actually just written instructions? People would write letters to their banks, telling them to pay someone else a certain amount of money. Talk about old-school!

And get this: Back in the day, some banks even used to deliver checks *by horse*! Imagine that! "Excuse me, sir, I have a check for you... delivered fresh from the First National Equestrian Bank!"

Also, the word "check" comes from the Middle English word "chek," which meant "restraint" or "control." So, writing a check is basically an act of controlling your money. Power to the payer!

Finally, some people still use checks to pay for *everything*. Can you imagine? Grocery shopping, gas, even paying the babysitter! They're like the check-writing superheroes of the modern world. They probably have a special checkbook holster and everything.

The Takeaway: Know Your Accounts!

The world of banking can be confusing, but it doesn't have to be! Understanding the difference between savings accounts, checking accounts, and money market accounts is key to managing your money effectively. And knowing whether you can write checks from your savings is just one small (but important!) piece of the puzzle.

So, do your research, compare your options, and choose the accounts that best fit your needs. And don't be afraid to ask questions! Your bank is there to help you navigate the world of finance. They won't judge you for asking about checks and savings accounts (probably).

Now go forth and conquer your financial goals! Just remember to use the right tool for the job. And maybe avoid putting ketchup on ice cream. Unless you're into that sort of thing. No judgment here! (Okay, maybe a little.)

:max_bytes(150000):strip_icc()/checking-vs-savings-accounts-4783514-ADD-V3-8bb1de3ef0a848e0bd7b65ef146ab924.jpg)