Okay, so you're in a *pickle*, huh? Need some quick cash but your direct deposit situation is… well, let's just say it's not exactly cooperating. Don't sweat it! We've all been there (or at least, I *swear* I have!). The good news? You're not totally stranded in the financial desert. There are cash advance apps out there that don't necessarily demand direct deposit as their one true love. Let's dive in, shall we?

What's the Deal with Direct Deposit Anyway?

First things first, why is direct deposit such a big deal for most of these apps? Basically, it's all about risk. Direct deposit gives them a relatively easy and reliable way to verify your income and, more importantly, to get their money back. It's like a financial safety net for them. Makes sense, right? They’re not exactly giving away free money – they want to be *reasonably* sure they’ll see it again.

But life isn't always neat and tidy. Maybe you're a freelancer with income streams scattered like confetti. Or perhaps you're just starting a new job and haven't gotten the direct deposit sorted yet. Whatever the reason, direct deposit isn't always an option *right now*. So, what now?

Cash Advance Apps That Play a Little…Differently

Alright, buckle up! We're about to explore some options that are a bit more flexible. Keep in mind – and this is *super* important – that terms and conditions can change faster than my mood on a Monday morning. Always double-check the details before you commit!

Apps That Use Alternative Verification Methods

These apps are the cool kids on the block. They understand that direct deposit isn't the *only* way to prove you're a responsible human being who earns money. They might use things like:

- Bank Account Linking: They'll securely connect to your bank account to analyze your transaction history. This lets them see your income patterns, even if it's not a regular direct deposit. Think of it as letting them peek at your financial habits to see if you're good for it.

- Proof of Income Documents: Sometimes, they'll ask you to upload things like pay stubs, tax returns (gulp!), or even screenshots of your online payment platforms (if you're a freelancer, you know the drill). It's a bit more work for you, but hey, desperate times, right?

- Transaction History Analysis: They are looking for consistency, which shows your ability to repay the borrowed sum.

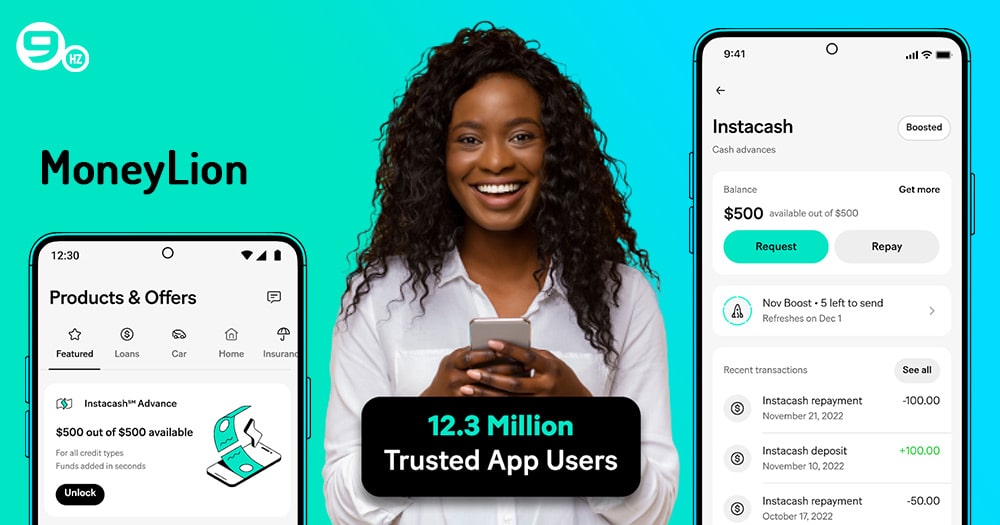

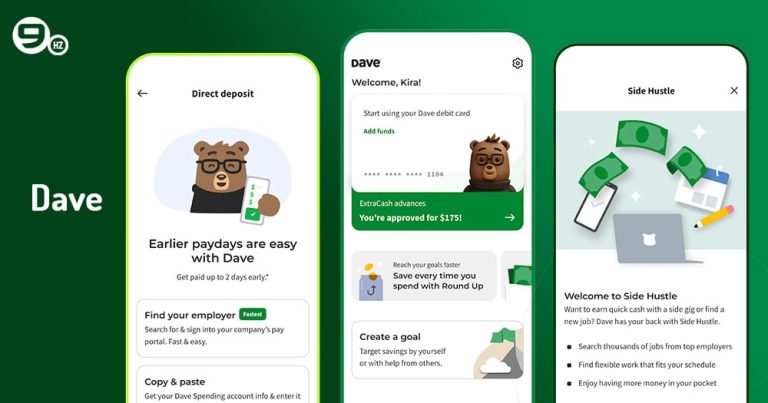

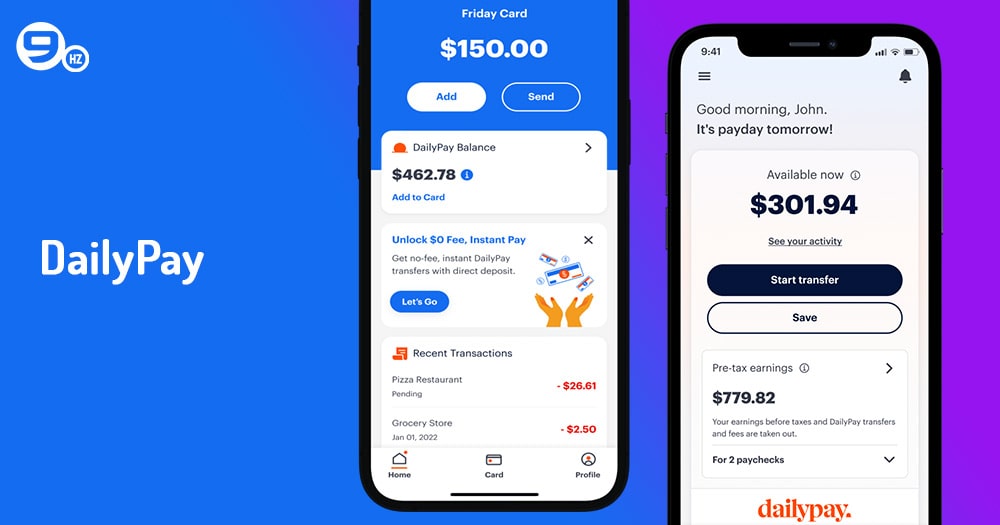

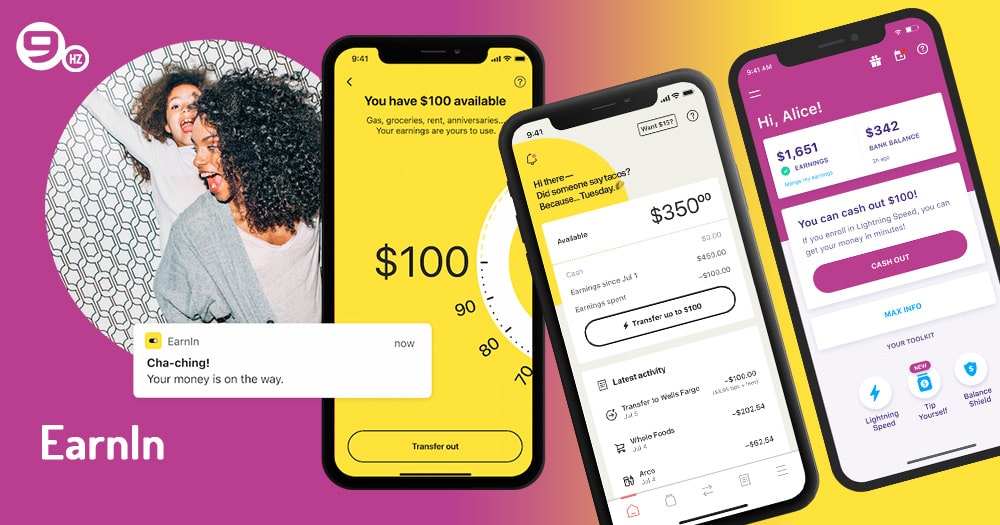

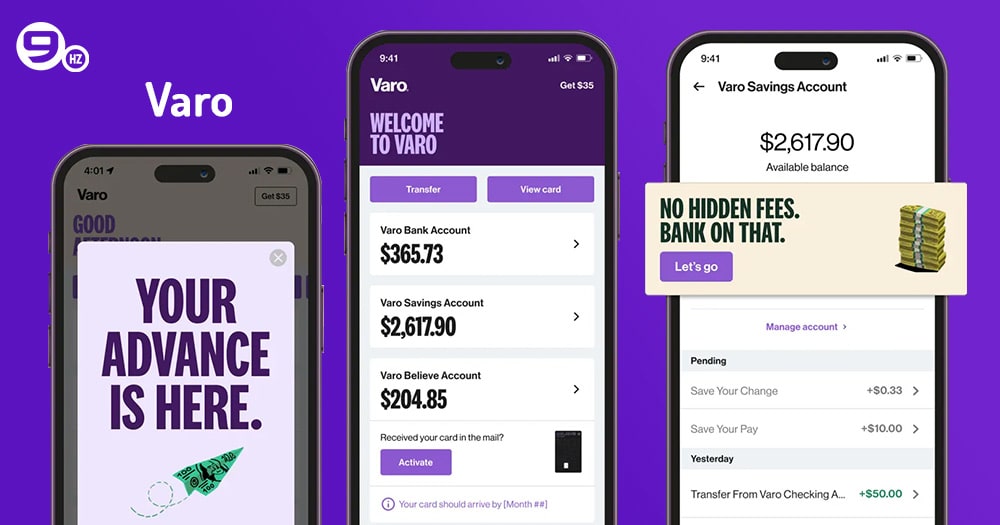

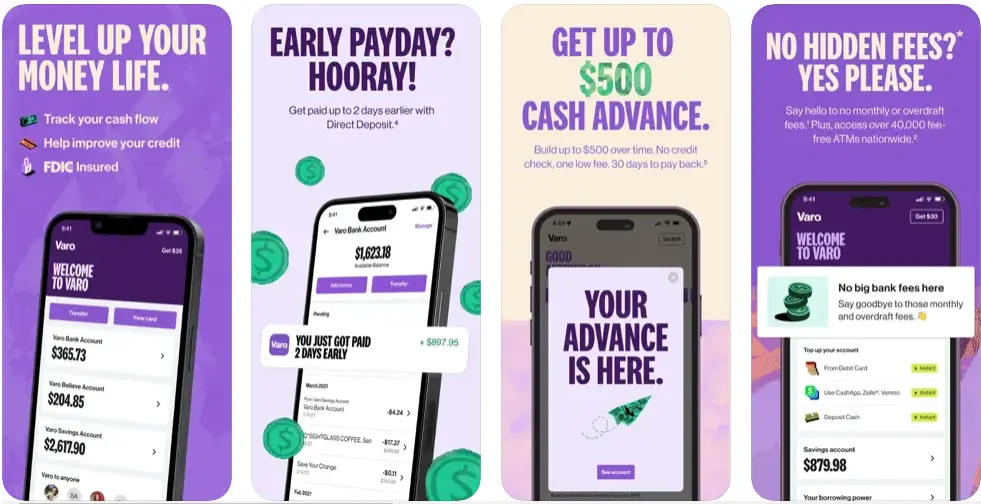

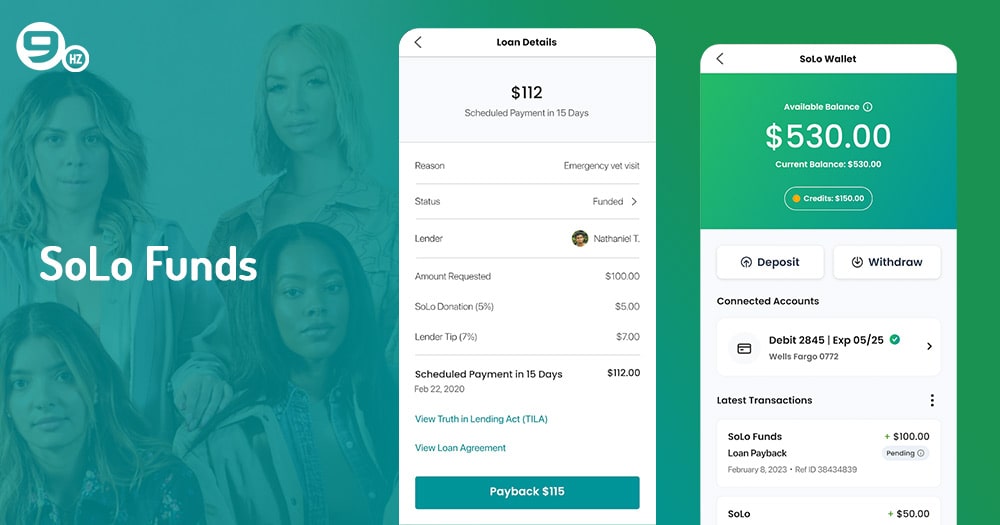

So, which apps are we talking about? Well, a few names often pop up, but remember, do your own research! I'm just a friendly voice offering suggestions, not a financial guru with all the answers. Consider these possibilities (but always check the fine print!):

- Possible Apps: There are a few apps that sometimes offer alternatives, but the landscape changes quickly. I cannot endorse specific apps as availability and terms shift frequently.

Important Caveats! Just because an app *can* work without direct deposit doesn't mean it's a walk in the park. They might have stricter requirements in other areas, like:

- Lower Advance Limits: They might be more cautious and offer you a smaller amount to start with. Makes sense, right? Less risk for them.

- Higher Fees or Interest Rates: This is where things can get a little tricky. Some apps might charge higher fees or interest if you don't have direct deposit. Make sure you understand the costs before you borrow! Is that "convenience" really worth it?

- Stricter Repayment Schedules: They might want you to repay the advance sooner, or they might require more frequent payments. Read the repayment terms *very* carefully.

Other Options (When Cash Advance Apps Aren't the Answer)

Look, cash advance apps can be a lifesaver in a pinch, but they're not always the *best* solution. Sometimes, it's worth exploring other avenues, especially if you're worried about those fees and interest rates. Consider these:

- Borrowing from Friends or Family: Okay, I know, it can be awkward. But sometimes, a heartfelt conversation with a trusted friend or family member can be a much better option than racking up fees. Just make sure you're clear about the repayment terms and stick to them! Don't be the reason Thanksgiving dinner gets tense.

- Negotiating with Creditors: If you're struggling to pay bills, don't be afraid to reach out to your creditors. You might be surprised at how willing they are to work with you, especially if you explain your situation. They might offer a payment plan or even temporarily reduce your interest rate.

- Selling Unused Items: We all have stuff lying around that we don't use anymore. Dust off those old gadgets, clothes, or furniture and see if you can sell them online or at a local consignment shop. One person's trash is another person's treasure, right?

- Side Hustles: This might not be an instant fix, but it can be a great way to boost your income in the long run. Think about your skills and interests – can you offer tutoring, pet-sitting, freelance writing, or something else? The possibilities are endless!

- Local Charities and Assistance Programs: Don't be afraid to seek help from local charities or assistance programs. Many organizations offer financial assistance, food banks, and other resources to people in need. There's no shame in asking for help when you need it.

The Bottom Line: Do Your Homework!

Seriously, I can't stress this enough. Before you download any cash advance app or explore any of these options, do your research! Read reviews, compare fees, and understand the terms and conditions. Don't just blindly click "agree" – you could be setting yourself up for a world of financial pain.

Questions to Ask Yourself:

- What are the fees and interest rates? (Don't just look at the numbers; understand how they're calculated.)

- What are the repayment terms? (Can you realistically afford to repay the advance on time?)

- What happens if you can't repay the advance? (Are there late fees? Will they report you to a credit bureau?)

- Is the app reputable? (Read reviews and check its rating on the app store.)

- Is there a better alternative? (Have you considered borrowing from friends or family, negotiating with creditors, or selling unused items?)

Protecting Your Financial Health:

- Budgeting: Start creating a realistic budget to track your income and expenses. Knowing where your money goes can help you identify areas where you can cut back.

- Emergency Fund: Aim to build an emergency fund to cover unexpected expenses. Even a small amount saved each month can make a big difference in the long run.

- Financial Literacy: Educate yourself about personal finance. There are tons of free resources available online and at your local library. The more you know, the better equipped you'll be to make informed financial decisions.

A Word of Caution:

Be wary of apps that seem too good to be true. If an app promises instant cash with no credit check and no questions asked, it's probably a scam. Protect your personal and financial information and avoid apps that ask for excessive amounts of data.

Final Thoughts

Finding cash advance apps that don't require direct deposit can be a bit of a treasure hunt, but it's not impossible. Just remember to do your research, compare your options, and prioritize your financial well-being. And hey, maybe this whole situation is a sign that it's time to finally organize that budget you've been putting off. Good luck, and may the financial odds be ever in your favor!