Understanding the City of Los Angeles Deferred Compensation Plan

The City of Los Angeles offers a Deferred Compensation Plan (DCP) as a retirement savings option for its employees. This plan, governed by Section 457 of the Internal Revenue Code, allows eligible employees to defer a portion of their salary on a pre-tax or after-tax (Roth) basis. These contributions, along with any earnings, grow tax-deferred until withdrawal, typically during retirement.

Eligibility and Enrollment

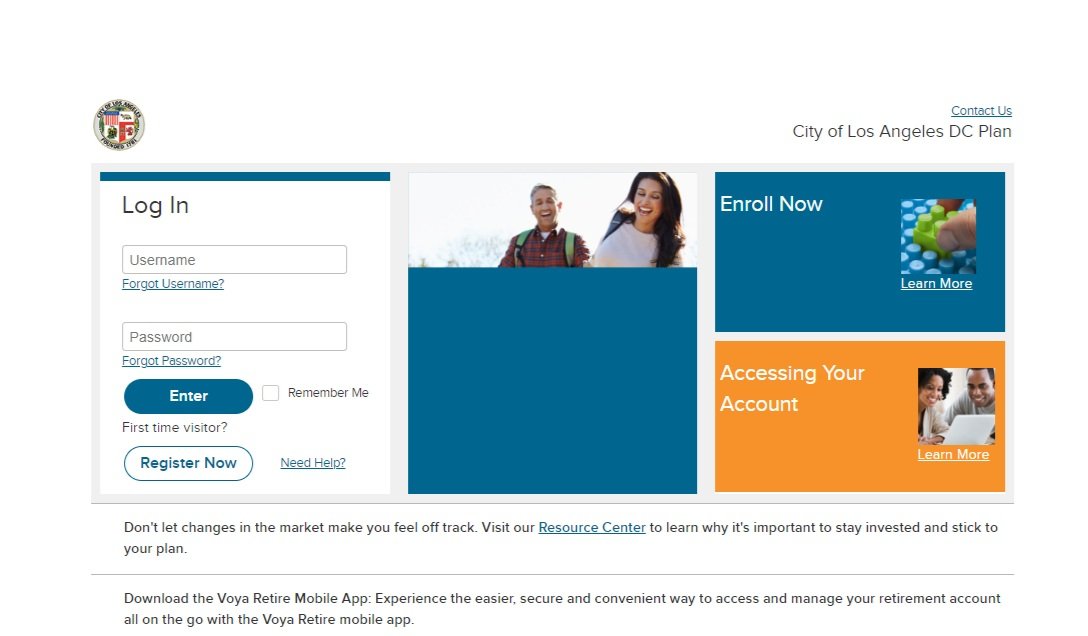

Most City of Los Angeles employees are eligible to participate in the DCP. Specific eligibility requirements are outlined in the official plan documents, available through the City's Human Resources department or the DCP's administrative website. Enrollment is generally ongoing, allowing employees to join the plan at any time. Information sessions and enrollment materials are frequently provided to new hires as part of their onboarding process.

Interested employees can typically enroll online or through paper forms. The enrollment process involves designating a contribution percentage or dollar amount, selecting investment options, and naming beneficiaries. It's crucial to carefully review all plan documents and consider consulting with a financial advisor before making any investment decisions.

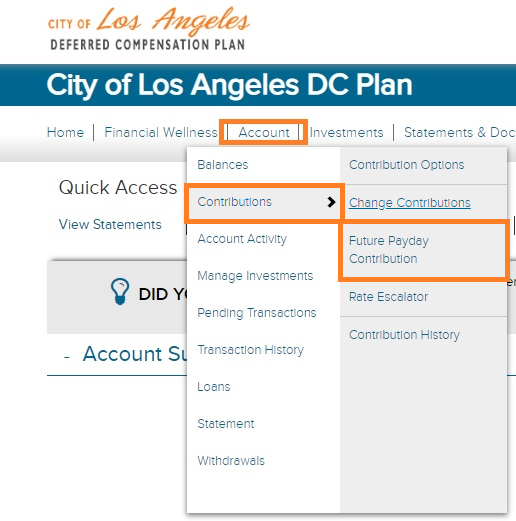

Contribution Limits and Types

The DCP adheres to IRS regulations regarding contribution limits. These limits are subject to annual adjustments, so it's essential to stay informed about the current year's maximum contribution allowed. Employees can typically elect to contribute a percentage of their salary or a specific dollar amount per pay period, up to the IRS limit.

The City of Los Angeles DCP offers both traditional pre-tax contributions and Roth after-tax contributions. Pre-tax contributions reduce taxable income in the year they are made, but withdrawals in retirement are taxed as ordinary income. Roth contributions are made with after-tax dollars, but qualified withdrawals in retirement are tax-free. The choice between pre-tax and Roth contributions depends on individual circumstances and tax planning strategies.

Understanding the tax implications of each contribution type is crucial for maximizing the benefits of the DCP. Consider your current and projected future tax bracket when making this decision.

Catch-up contribution provisions are also available for employees nearing retirement. These provisions allow eligible employees to contribute additional amounts beyond the standard annual limit, helping them to accelerate their savings in the years leading up to retirement. The specific eligibility requirements and catch-up contribution limits are outlined in the plan documents.

Investment Options

The City of Los Angeles DCP provides a range of investment options to suit different risk tolerances and investment goals. These options typically include mutual funds, exchange-traded funds (ETFs), and possibly a stable value fund. The specific investment lineup is regularly reviewed and may be updated periodically.

Common investment categories available in the DCP often include:

- Target Date Funds: These funds automatically adjust their asset allocation over time, becoming more conservative as the target retirement date approaches.

- Equity Funds: These funds primarily invest in stocks, offering the potential for higher growth but also carrying higher risk.

- Fixed Income Funds: These funds primarily invest in bonds, providing a more stable income stream but typically with lower growth potential.

- Balanced Funds: These funds invest in a mix of stocks and bonds, providing a balance between growth and income.

Employees are responsible for selecting their investment options and managing their asset allocation. It's important to diversify investments across different asset classes to mitigate risk. The DCP provider typically offers resources and tools to help employees make informed investment decisions, but seeking professional financial advice is always recommended.

Fees and Expenses

The City of Los Angeles DCP is subject to fees and expenses, which can impact the overall return on investment. These fees typically include administrative fees, investment management fees, and other expenses associated with operating the plan. The specific fee structure is disclosed in the plan documents.

Employees should carefully review the fee disclosure information to understand the impact of fees on their account balance. Comparing the fees of different investment options can help in making cost-effective investment decisions. While fees are an important consideration, it's also crucial to evaluate the performance and risk profile of each investment option.

Withdrawals and Distributions

Withdrawals from the City of Los Angeles DCP are generally permitted upon retirement, termination of employment, or other qualifying events as defined by the plan and IRS regulations. Early withdrawals may be subject to penalties and taxes.

Distributions from pre-tax accounts are taxed as ordinary income in the year they are received. Qualified distributions from Roth accounts are tax-free. The plan typically offers various distribution options, such as lump-sum payments, installment payments, or rollovers to other qualified retirement accounts.

It's essential to carefully plan your withdrawal strategy to minimize taxes and ensure that your retirement savings last throughout your retirement years. Consulting with a financial advisor can help you develop a personalized withdrawal plan that aligns with your financial goals and circumstances.

Plan Administration and Resources

The City of Los Angeles DCP is administered by a third-party provider, who is responsible for managing the plan's investments, processing contributions and distributions, and providing customer service to participants. Contact information for the plan administrator is available through the City's Human Resources department or the DCP's website.

The plan administrator typically provides a range of resources to help employees manage their accounts, including online account access, educational materials, and customer service support. Regular statements are provided to participants, showing their account balance, contributions, and investment performance.

Employees are encouraged to take advantage of the resources available to them to stay informed about the plan and make informed decisions about their retirement savings. Attending information sessions, reviewing plan documents, and consulting with a financial advisor are all valuable ways to enhance your understanding of the DCP.

Key Takeaways

The City of Los Angeles Deferred Compensation Plan is a valuable tool for building a secure retirement. Here are some key points to remember:

- Eligibility: Most City employees are eligible to participate.

- Contribution Types: Choose between pre-tax and Roth contributions based on your tax situation.

- Investment Options: Diversify your investments across different asset classes.

- Fees and Expenses: Understand the impact of fees on your returns.

- Withdrawals: Plan your withdrawals carefully to minimize taxes.

- Resources: Utilize the resources provided by the plan administrator.

By actively participating in the DCP and making informed decisions about your contributions and investments, you can increase your chances of achieving a comfortable and financially secure retirement. Remember to regularly review your account and make adjustments as needed to align with your changing financial goals and circumstances.