Ever ordered a "gourmet" sandwich that turned out to be just… bread and disappointment? Yeah, we’ve all been there. Imagine that feeling, but amplified a thousandfold and with legal ramifications. That's kind of like getting hit with a Civil Investigative Demand (CID) in the context of a False Claims Act (FCA) investigation.

What's a Civil Investigative Demand Anyway?

Think of a CID as the government's way of saying, "Hey, we've got our eye on you. Show us your receipts!" It’s like when your mom suspected you ate the last cookie and demanded to see your mouth. Only, instead of cookies, it's potentially millions (or billions!) of dollars in government funds at stake.

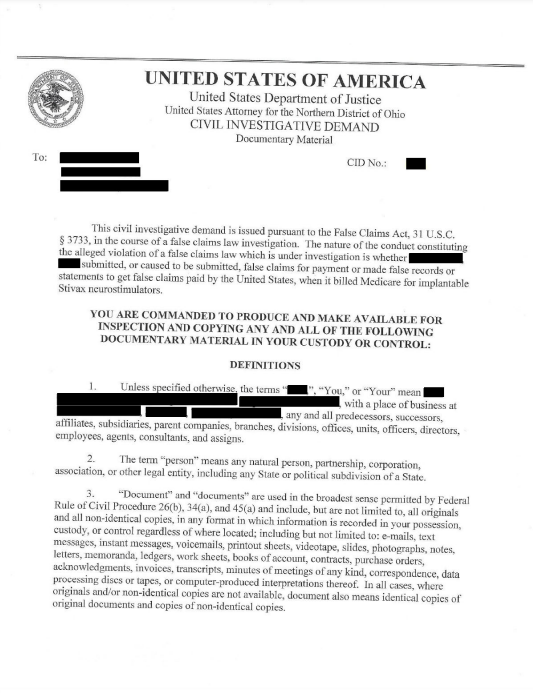

A CID is basically a formal request for information. It's not an accusation of guilt, per se, but it's definitely a sign that someone thinks you might have been a bit *too* creative with your billing or claims. The government (usually the Department of Justice, or DOJ) sends it out when they suspect someone's been ripping off the government – maybe knowingly submitting false claims to Medicare, Medicaid, or other federal programs.

Think of it this way: you're at a potluck, and someone brought a suspiciously delicious casserole. Everyone loves it, but rumors start swirling that the secret ingredient is, say, illegally obtained truffles. A CID is like the potluck organizer politely (but firmly) asking the casserole maker to share the recipe and show where they got those truffles. No one's saying they're definitely a truffle thief, but… they're definitely asking questions.

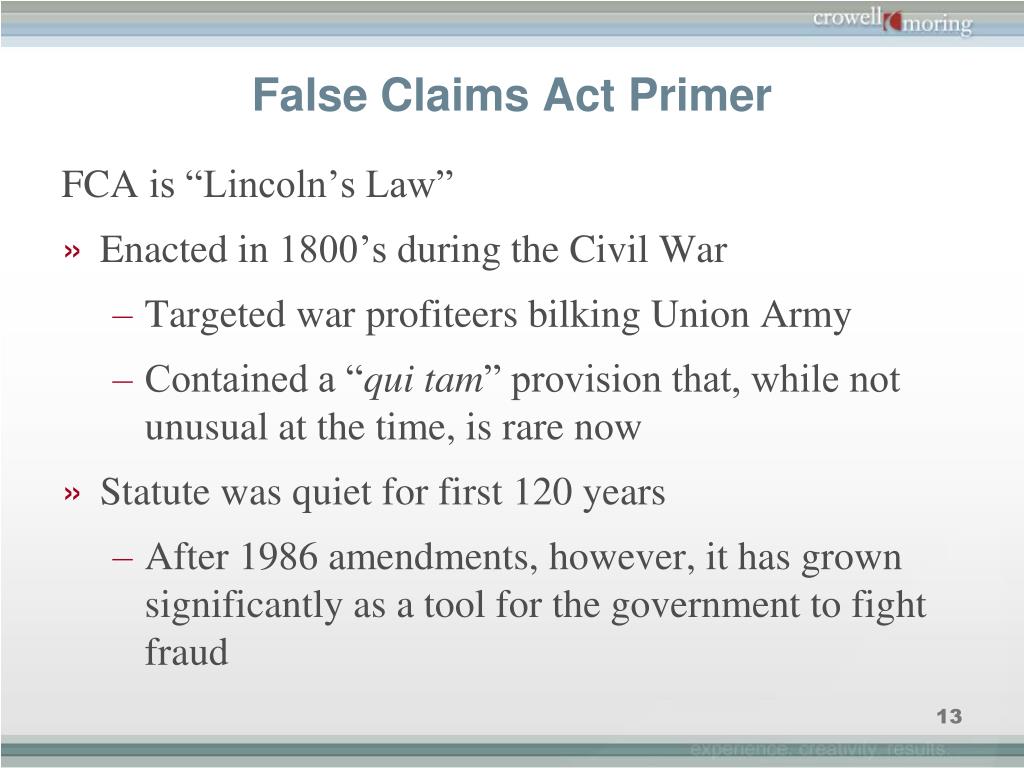

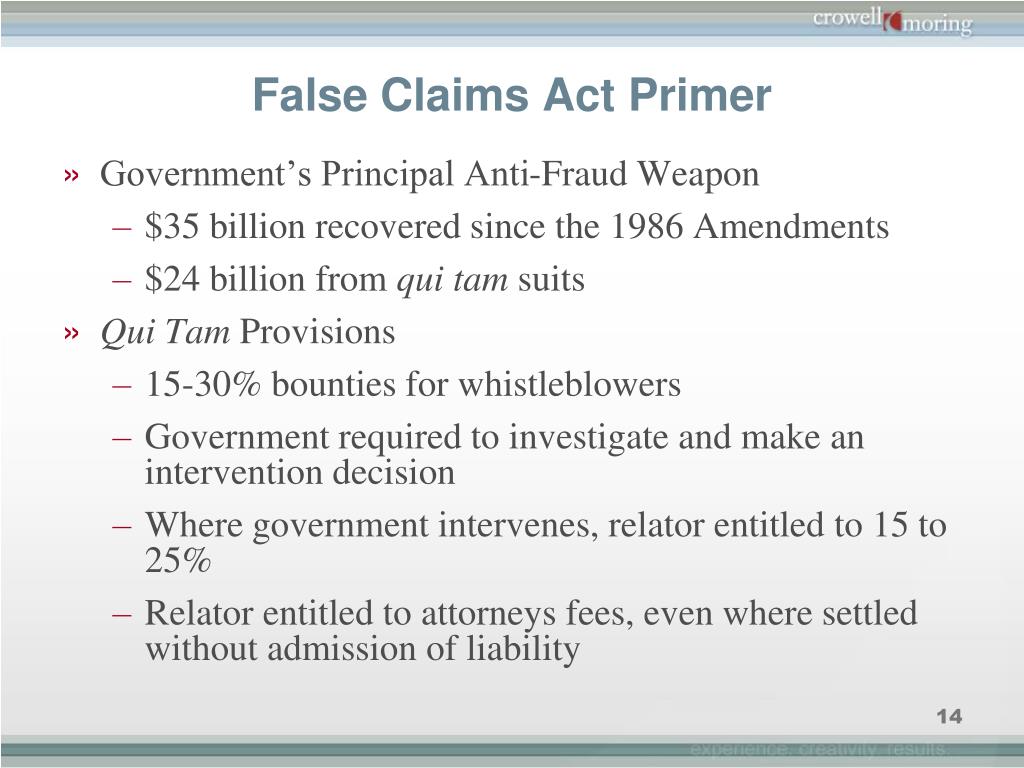

The False Claims Act: A Big Deal

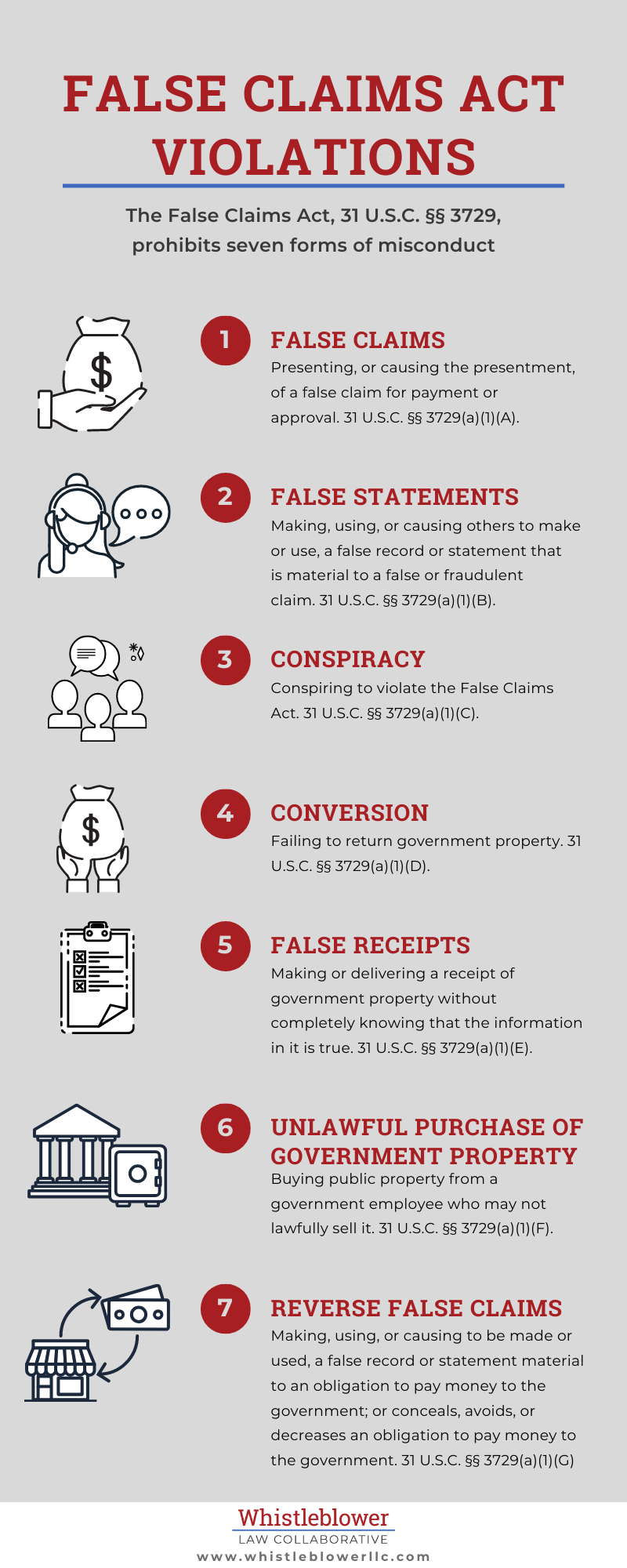

Now, let's talk about the False Claims Act (FCA), sometimes called the "Lincoln Law." It’s a really old law designed to prevent people from defrauding the government. It's been around since the Civil War, when unscrupulous contractors were selling the Union Army things like sawdust instead of gunpowder. Seriously! Talk about a bad surprise on the battlefield!

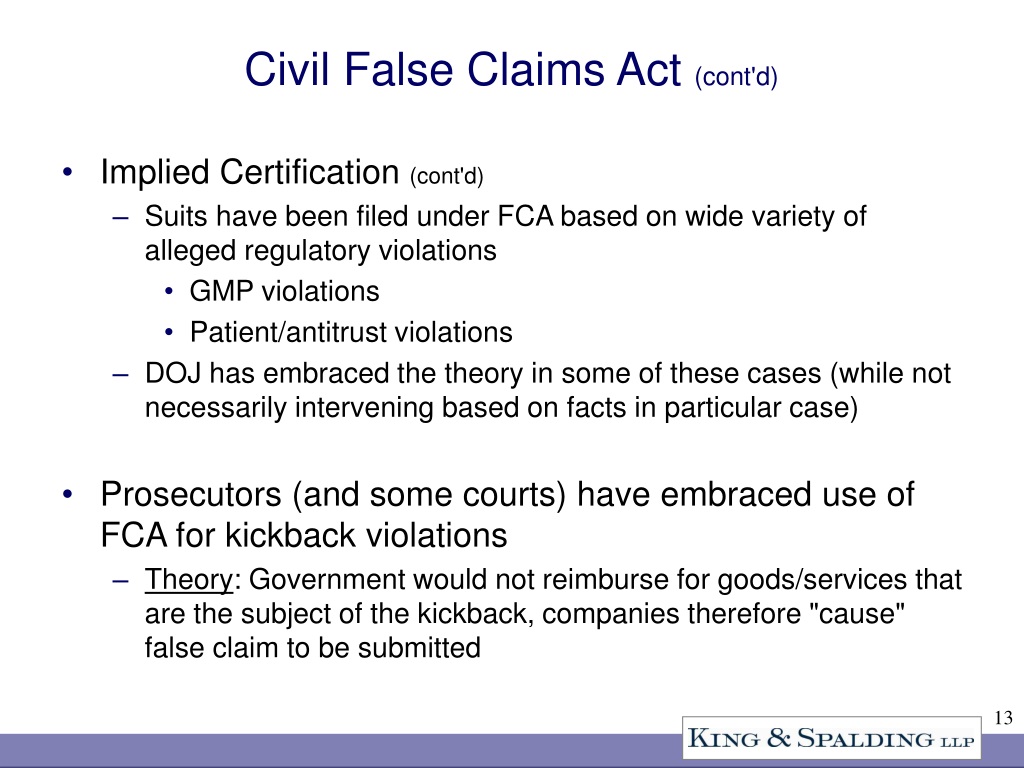

The FCA makes it illegal to knowingly submit false claims for payment to the government. "Knowingly" doesn't necessarily mean you *meant* to defraud the government. It can also mean you were deliberately ignorant or reckless about the truth. Imagine accidentally ordering 500 pizzas instead of 50 for a party, and then trying to bill the government for all 500, hoping they won't notice. Even if you didn’t *intend* to swindle, that's a problem.

Here's the kicker: the FCA has teeth. Big, sharp, "I'll eat your profits" teeth. If you're found liable under the FCA, you can face:

- Massive fines: We're talking potentially thousands of dollars *per false claim*.

- Treble damages: The government can recover *three times* the amount of the actual damages. Ouch.

- Exclusion from government programs: Kiss your future government contracts goodbye.

The FCA also has a cool (and slightly terrifying) feature called qui tam, or "whistleblower" provisions. This means that private citizens, often called relators, who know about the fraud can sue on behalf of the government and, if successful, get a cut of the recovered money. It’s like being a bounty hunter, but instead of tracking down outlaws, you're tracking down fraud. Think of it as incentivizing people to rat out companies who are being naughty with taxpayer dollars.

CID + FCA = Potential Headache

So, you've received a CID, and it mentions the FCA. This isn't just a friendly request for information. It's a serious matter that could lead to significant financial and legal consequences. It's like finding out that the IRS wants to "chat" – you suddenly remember every questionable deduction you've ever taken.

A CID in the context of an FCA investigation usually means the government believes you might have violated the FCA by submitting false claims. They're digging around for evidence to support their suspicions. This could involve anything from reviewing your billing records to interviewing your employees.

What kind of activities might trigger a CID?

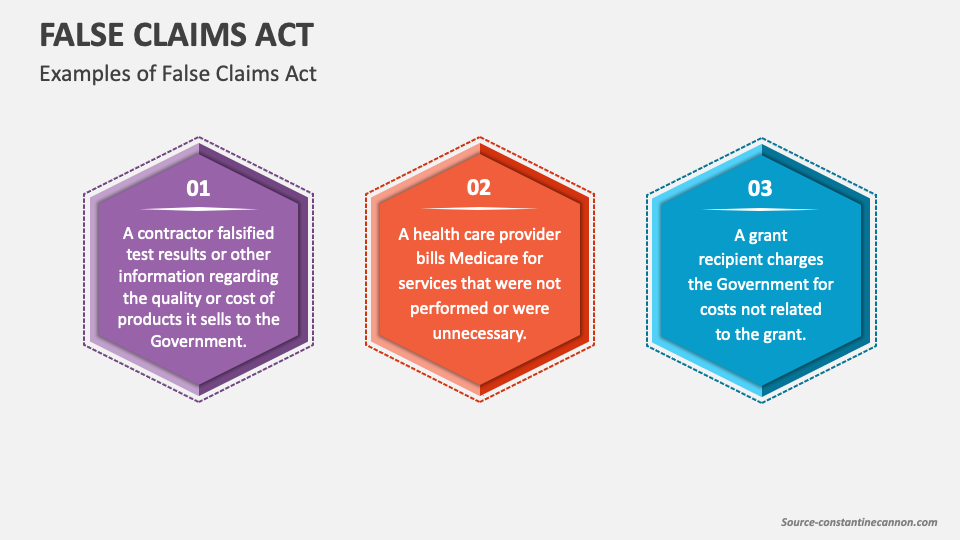

- Healthcare Fraud: This is a big one. Billing for services not rendered, upcoding (billing for more expensive services than were actually provided), and submitting false claims for medically unnecessary procedures are all common examples. Imagine a doctor billing Medicare for performing surgery on a patient who was actually just there for a checkup. Bad news bears.

- Defense Contractor Fraud: Overcharging the government for supplies or services, providing substandard goods, or failing to meet contract specifications can land you in hot water. Think of a company selling the military boots that fall apart after a week.

- Procurement Fraud: Rigging bids, submitting false invoices, or violating conflict of interest rules during the government procurement process. Basically, cheating to win government contracts.

- Grant Fraud: Misusing grant funds, submitting false progress reports, or failing to comply with grant requirements. Using grant money for a personal yacht instead of cancer research? That's a no-no.

Here's a scenario: A small medical supply company gets a CID alleging they've been billing Medicare for more expensive wheelchairs than they actually provided to patients. The government suspects they've been pocketing the difference. The company now has to scramble to gather all their records, interview employees, and potentially face a lengthy and expensive investigation.

So, You Got a CID. Now What?

Okay, deep breaths. Getting a CID is definitely not a good thing, but it's not necessarily a death sentence. Here's what you should do:

- Don't panic (easier said than done, right?): Freaking out won't solve anything.

- Contact a lawyer immediately: Seriously, this is not a DIY situation. You need an experienced attorney who specializes in FCA and white-collar defense. They can help you understand the CID, protect your rights, and develop a strategy for responding.

- Preserve everything: Do not delete, alter, or destroy any documents or electronic data that might be relevant to the investigation. This is obstruction of justice, and it will make things much, much worse. Think of it as accidentally "losing" the cookie jar when your mom asked to see it. It only makes you look more guilty.

- Review the CID carefully: Understand what information the government is seeking and the timeframe they're interested in.

- Respond strategically: Your lawyer will help you prepare a response to the CID. This might involve producing documents, answering interrogatories (written questions), or providing testimony.

- Cooperate (carefully): While you have a right to defend yourself, being completely uncooperative can make the government suspicious and lead to further scrutiny. Your lawyer can help you strike the right balance between cooperation and protecting your interests.

Think of it like this: you're pulled over by the police. You don't want to admit guilt, but you also don't want to be belligerent. You politely provide your license and registration, and let your lawyer do the talking.

Avoiding the CID in the First Place

Of course, the best way to deal with a CID is to avoid getting one in the first place. Here are a few tips:

- Compliance is key: Implement a robust compliance program that ensures you're following all applicable laws and regulations. This includes regular training for employees and internal audits to identify and correct any potential problems.

- Be transparent: Don't try to hide anything from the government. If you make a mistake, admit it and correct it.

- Maintain accurate records: Keep meticulous records of all your transactions and communications. This will make it much easier to respond to a CID if you ever receive one.

- Seek expert advice: Don't hesitate to consult with lawyers, accountants, and other professionals who can help you navigate the complex world of government contracting and compliance.

It's like regularly servicing your car. You might not *want* to spend the money, but it's much cheaper than dealing with a major breakdown down the road. Proactive compliance is an investment in your future.

The Takeaway

Receiving a Civil Investigative Demand related to the False Claims Act is a serious event that can have significant legal and financial implications. Understanding what it is, what it means, and what to do about it is crucial. Remember, it's always better to be proactive than reactive. A strong compliance program and a good lawyer can be your best defenses against the potentially devastating consequences of an FCA investigation. And maybe, just maybe, double-check that you really did order only 50 pizzas for the party.

It all boils down to this: be honest, be compliant, and don't try to pull a fast one on Uncle Sam. He's got a lot of lawyers and a really big checkbook. And he doesn't like being ripped off.

![PPT - The GOOD, the BAD, and the UGLY The Federal [Civil] False Claims - Civil Investigative Demand False Claims Act](https://image1.slideserve.com/3016124/the-bad-presenting-false-or-fraudulent-claims-l.jpg)