Okay, so you're staring at your taxes, right? (Join the club!) And you see something called "Combined Federal/State Filing." Sounds... official. And maybe a little intimidating? Don't worry, we're gonna break it down. Think of this as tax filing for dummies, but with caffeine and less judgement.

Basically, Combined Federal/State Filing (CF/SF) is like a one-stop shop for filing both your federal and state income taxes at the same time. Simultaneously, even! Well, kinda. The important thing is, instead of wrestling with separate forms and deadlines, some states let you do it all in one go through the IRS. Convenient, right? (When has anything tax-related ever been truly convenient? But we digress...)

So, What's the Deal with CF/SF?

Alright, let’s get a little more detailed. But just a little. I promise, no snoozing.

The Basic Idea

The core concept is pretty simple: you electronically file your federal income tax return, and along with it, you include your state income tax information. The IRS then forwards your state info to the relevant state tax agency. Think of the IRS as a really efficient postal worker, except instead of delivering junk mail, they're delivering your tax data. (And hopefully not delivering you an audit notice... fingers crossed!)

Who Can Use It?

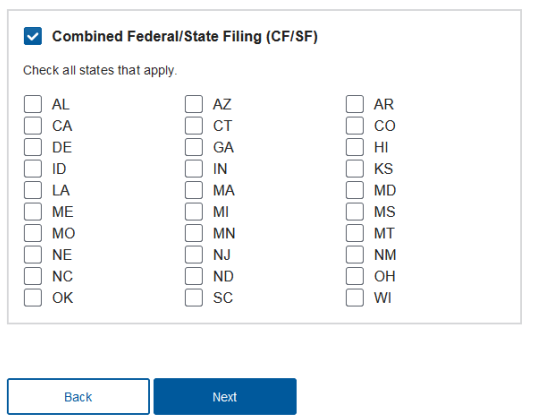

Now, here's the catch (there's always a catch, isn't there?). CF/SF isn't available everywhere. It's only offered in certain states. Think of it as a VIP club... but for tax filing. Not quite as glamorous, I know. Check your state's tax agency website to see if they participate. It's usually pretty easy to find with a quick google search like "Does [Your State] offer combined federal state filing?".

Another important detail: It's generally used for individual income tax returns. So, if you own a business and file business taxes, this probably won't apply (sorry!). Although, many business accounting software packages can help you generate the forms you need, so make sure you are looking at all options.

How Does It Work?

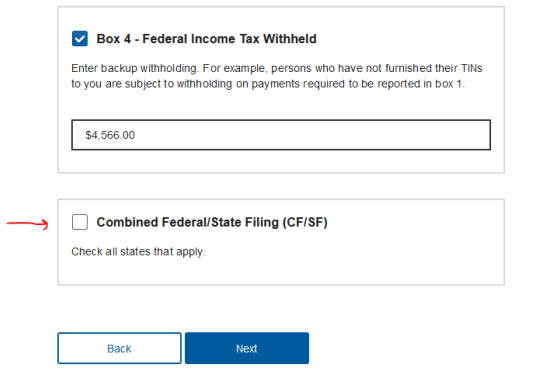

Okay, let's say your state *does* offer CF/SF. Awesome! How does it actually work? Well, it's all done electronically through authorized e-file providers. These are usually tax software programs or professional tax preparers (like CPAs). When you prepare your federal return using the software, it will guide you through the process of including your state tax information as well.

The software basically creates a special electronic file that contains both your federal and state returns. You then submit this file to the IRS. The IRS processes the federal part and then sends the state part to your state's tax agency. Voila! One and done (hopefully!).

Why Bother with CF/SF?

Good question! Why should you even care about this? Is it worth the effort? (Spoiler alert: it probably is.)

Convenience, Baby!

The biggest benefit is definitely the convenience. Filing both your federal and state taxes in one go saves you time and effort. You don't have to juggle multiple websites, forms, and deadlines. It's like getting two birds with one stone... except the birds are your taxes, and the stone is a really good tax software.

Accuracy (Potentially)

Using tax software can also help improve accuracy. The software often pre-fills information from your federal return into your state return, reducing the risk of errors. Plus, it can catch mistakes that you might otherwise miss. Nobody wants a tax audit caused by a simple typo! (Trust me on this.)

Faster Refunds? Maybe!

Some people believe that filing electronically can lead to faster refunds. While the IRS and state tax agencies don't guarantee it, it's generally accepted that e-filing is faster than paper filing. And with CF/SF, you're essentially e-filing both returns at the same time, which *could* speed things up. (But don't hold your breath waiting for that refund... it'll arrive when it arrives.)

Are There Any Downsides?

Okay, nothing's perfect, right? So, are there any potential drawbacks to using CF/SF?

Not Available Everywhere

As we mentioned earlier, the biggest limitation is that it's not available in all states. If your state doesn't participate, you're out of luck. (Sorry!) You'll have to file your federal and state taxes separately. But don't worry, you'll survive. People have been doing it for years!

Reliance on E-file Providers

You have to use authorized e-file providers to use CF/SF. This means you'll need to use tax software or work with a professional tax preparer. If you prefer to file your taxes on paper, CF/SF isn't an option for you. (Although, seriously, who *prefers* paper filing in this day and age? It's like using a rotary phone... possible, but not exactly efficient.)

Potential Complexity

While CF/SF is designed to be convenient, it can still be complex if you have a complicated tax situation. If you have multiple sources of income, deductions, or credits, you might need the help of a tax professional to ensure that you're filing correctly. (Sometimes, it's worth paying a little extra to avoid a major headache later.)

CF/SF vs. Separate Filing: Which is Right for You?

So, how do you decide whether to use CF/SF or file your federal and state taxes separately? Let's weigh the pros and cons:

CF/SF: Pros

- Convenience: Filing both returns at the same time saves you time and effort.

- Accuracy: Tax software can help reduce errors.

- Potential for faster refunds: E-filing is generally faster than paper filing.

CF/SF: Cons

- Not available in all states: This is the biggest limitation.

- Requires e-filing: You have to use tax software or a tax professional.

- Potential complexity: Can be complicated if you have a complex tax situation.

Separate Filing: Pros

- Available in all states: You can always file your federal and state taxes separately.

- More flexibility: You have more control over the filing process.

- Can file on paper: If you prefer paper filing, this is your only option.

Separate Filing: Cons

- Less convenient: Filing two separate returns takes more time and effort.

- Higher risk of errors: You have to manually transfer information between returns.

- Potentially slower refunds: Paper filing is generally slower than e-filing.

Ultimately, the best option for you depends on your individual circumstances. If your state offers CF/SF and you're comfortable using tax software, it's probably the way to go. But if you prefer to file on paper or you have a complex tax situation, separate filing might be a better choice.

Okay, I'm Convinced. How Do I Get Started?

Alright, let's say you're ready to give CF/SF a try. Here's what you need to do:

1. Check Your State's Eligibility

First things first, make sure your state actually offers CF/SF. You can usually find this information on your state's tax agency website. (Google is your friend!) Just search for "[Your State] combined federal state filing" and see what comes up.

2. Choose a Tax Software or Tax Professional

Next, you'll need to choose a tax software or a tax professional who supports CF/SF. Most of the popular tax software programs (like TurboTax, H&R Block, and TaxAct) offer this option. If you're working with a tax professional, make sure they're familiar with CF/SF. Ask them questions and let them guide you.

3. Gather Your Tax Documents

Before you start filing, gather all of your necessary tax documents. This includes your W-2s, 1099s, and any other documents that show your income, deductions, and credits. Having everything organized beforehand will make the filing process much smoother. (Trust me, scrambling for documents at the last minute is no fun.)

4. Follow the Instructions

Once you're ready to file, follow the instructions provided by your tax software or tax professional. The software will guide you through the process of entering your information and completing both your federal and state returns. Be sure to double-check everything before you submit it!

5. E-file Your Return

Finally, e-file your return through the tax software or your tax professional. The IRS will process your federal return and then forward your state information to your state's tax agency. And that's it! You've successfully filed your federal and state taxes using CF/SF. Give yourself a pat on the back (and maybe treat yourself to some ice cream... you deserve it!).

Final Thoughts

Combined Federal/State Filing can be a real time-saver, especially if you live in a participating state and have a relatively straightforward tax situation. It simplifies the filing process and can potentially improve accuracy. However, it's not for everyone. If you have a complex tax situation or prefer to file on paper, separate filing might be a better option. In the end, the best approach is the one that works best for *you*. Happy filing (as happy as tax filing can be, anyway)!

Disclaimer: I'm not a tax professional, so this isn't tax advice. Always consult with a qualified tax advisor for personalized guidance. Now go forth and conquer those taxes!