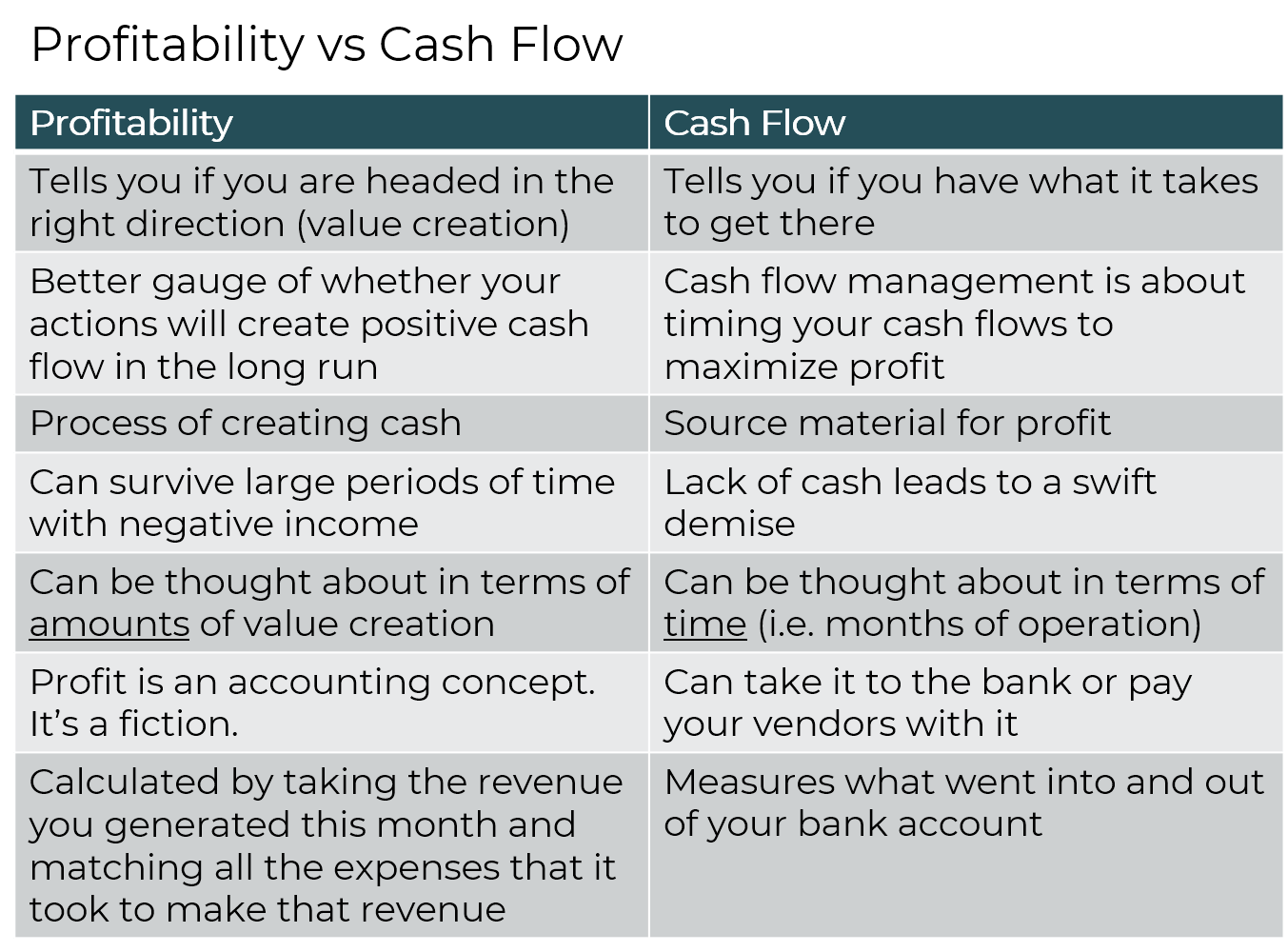

The terms revenue and cash flow are frequently used in the business world, often interchangeably, but they represent distinct financial concepts. While both are crucial for understanding a company's financial health, confusing the two can lead to misinformed decisions. Revenue, at its core, reflects the income generated from sales, while cash flow depicts the movement of actual cash both into and out of a business. Understanding the nuanced differences between these metrics is paramount for investors, managers, and anyone seeking a clear picture of a company's performance.

Causes of Discrepancies Between Revenue and Cash Flow

Several factors contribute to the differences between revenue and cash flow. These stem from accounting methods, operational realities, and strategic choices a company makes.

Accrual Accounting vs. Cash Accounting

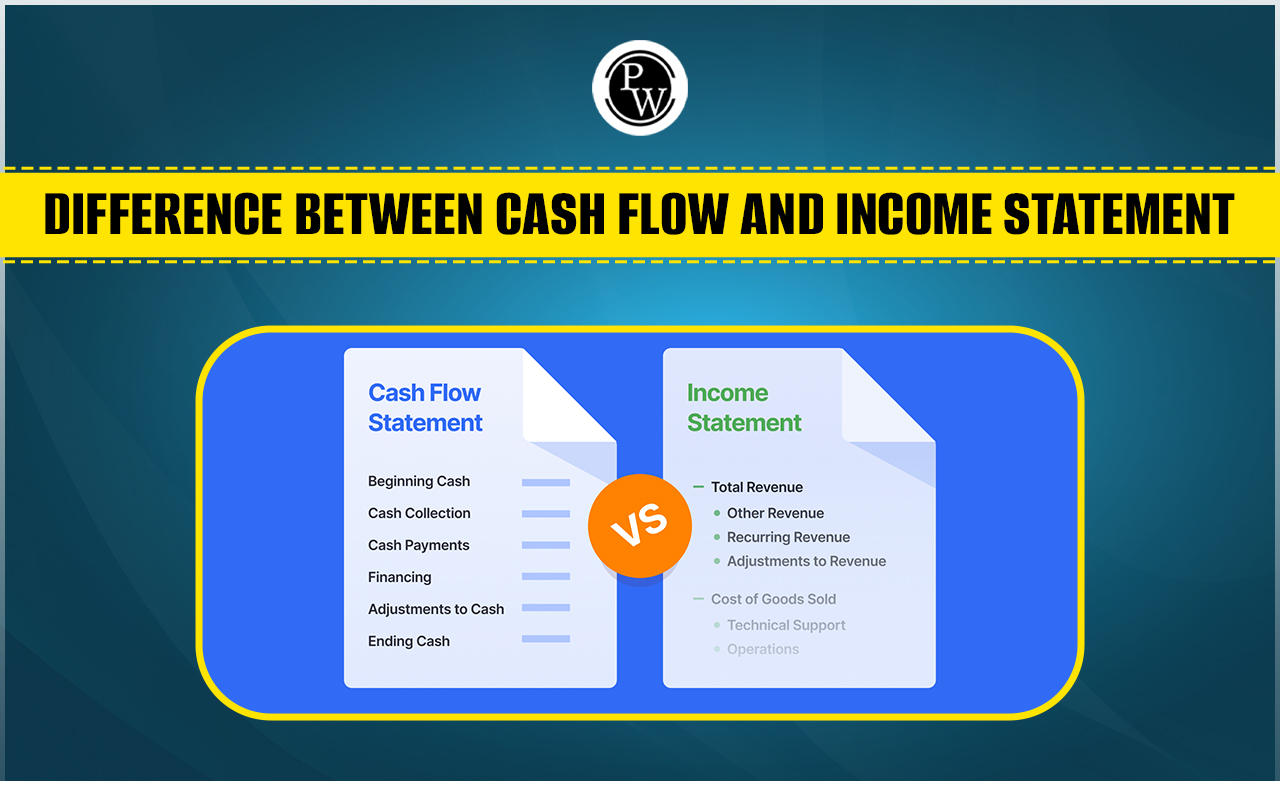

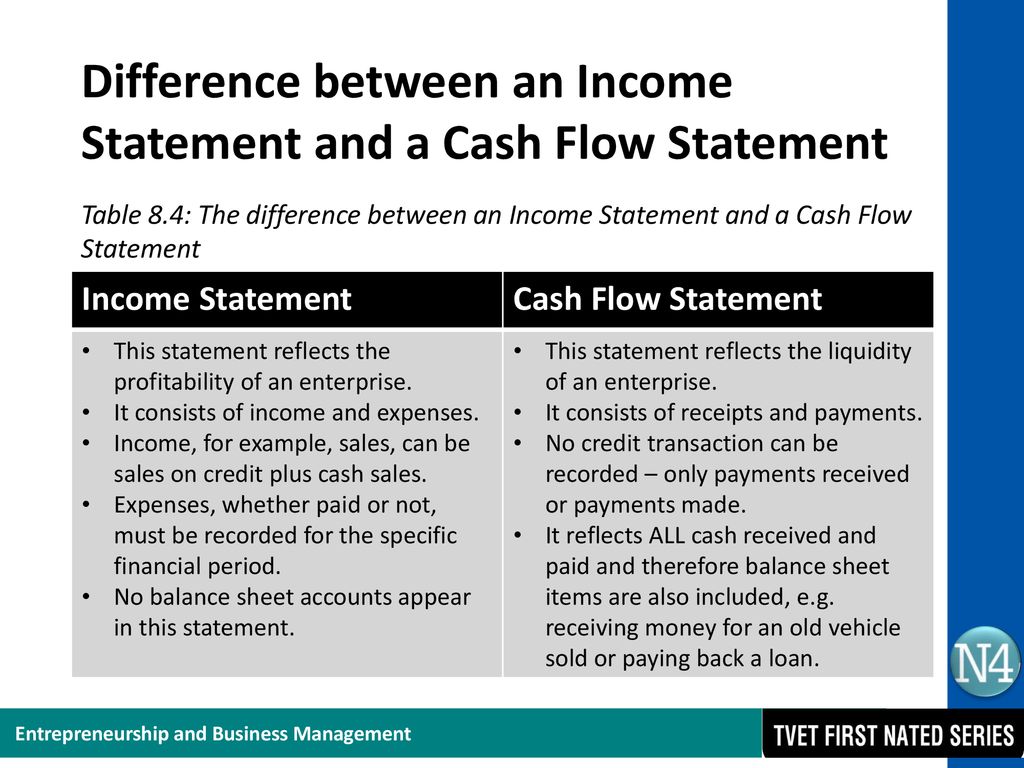

The primary driver of discrepancies is the adoption of accrual accounting, the standard practice for most businesses. Accrual accounting recognizes revenue when it is earned, regardless of when cash is received. Similarly, expenses are recognized when they are incurred, regardless of when cash is paid out. This contrasts with cash accounting, which recognizes revenue only when cash is received and expenses only when cash is paid. For instance, a company might record revenue in December for a large order but not receive payment until January. Under accrual accounting, the revenue is recognized in December, creating a difference between reported revenue and actual cash on hand in that period.

Timing Differences in Payments

Beyond the accounting method, the timing of payments significantly impacts cash flow. A business might offer credit terms to its customers (e.g., Net 30), which means revenue is recognized immediately, but cash isn't received for 30 days. Conversely, a company might purchase inventory on credit, delaying cash outflow but immediately incurring an expense. This mismatch between the recognition of revenue/expense and the actual cash movement creates a divergence between the two figures. Furthermore, large capital expenditures, such as purchasing equipment, can significantly impact cash flow in the short term, even though the expense is depreciated over several years, affecting net income and revenue indirectly through depreciation expense.

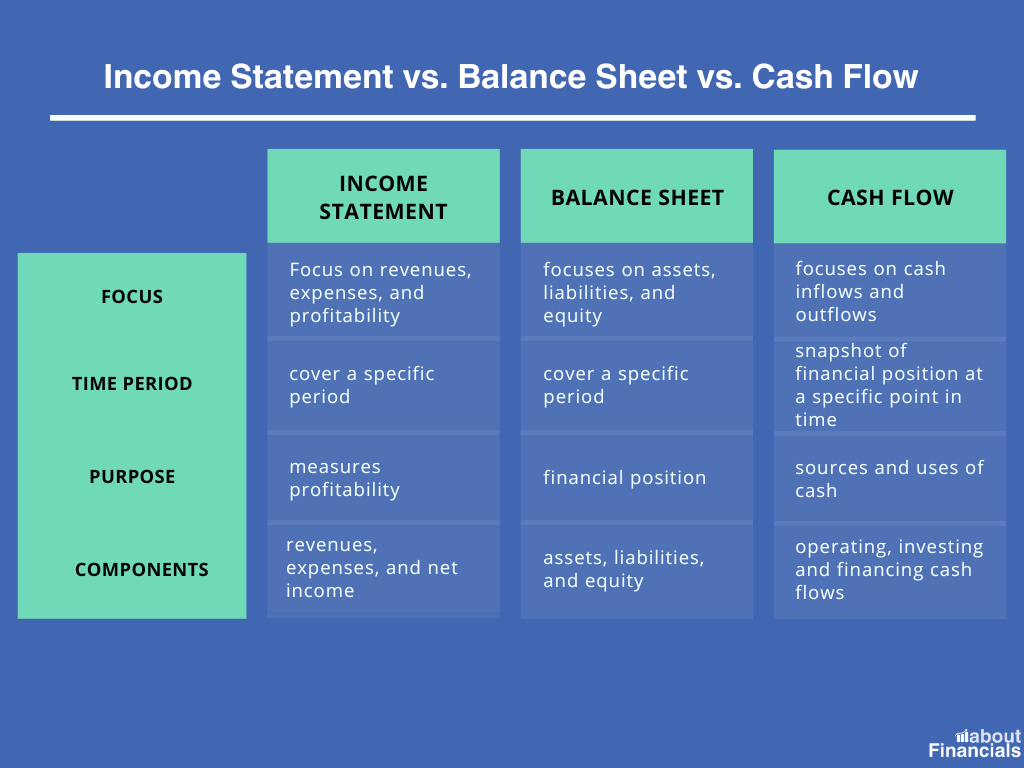

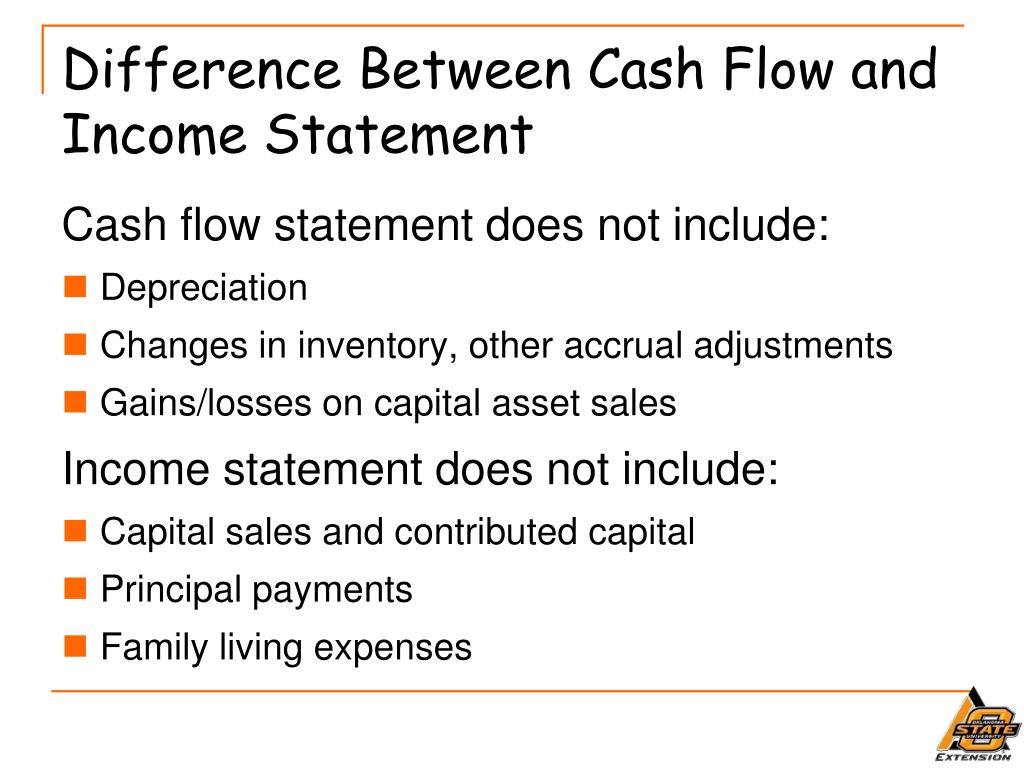

Non-Cash Expenses

Certain expenses are recorded on the income statement but don't involve an actual outflow of cash. Depreciation, amortization, and stock-based compensation are prime examples. Depreciation, for instance, reflects the reduction in the value of an asset over time. While it lowers net income (and therefore retained earnings, a component of equity), it doesn't involve a direct cash payment. Similarly, stock-based compensation, while diluting equity, doesn’t immediately affect cash flow. These non-cash expenses contribute to the difference between revenue and cash flow because they lower net income, which is often used as a starting point for calculating cash flow from operations.

Inventory Management

The way a company manages its inventory also impacts the difference between revenue and cash flow. A company may produce goods and recognize the cost of goods sold (COGS) when the products are sold, but the cash outflow for raw materials and production costs may have occurred months earlier. If a company builds up a large inventory, it represents a significant cash outlay that isn't immediately reflected in revenue until the goods are sold. Efficient inventory management, therefore, aims to minimize the time between cash outflow for inventory and cash inflow from sales.

Effects and Implications of the Discrepancy

The discrepancies between revenue and cash flow can have several significant effects and implications for a business.

Distorted View of Financial Health

Relying solely on revenue can provide a misleading picture of a company's financial health. A company can report high revenue growth but still struggle with cash flow problems, potentially leading to an inability to pay its bills or invest in future growth. A classic example is a rapidly growing startup that generates substantial revenue but struggles to manage its working capital, resulting in a "cash crunch." Conversely, a company with declining revenue might still have healthy cash flow due to efficient cost management or asset sales. Therefore, analyzing both revenue and cash flow provides a more complete understanding of a company's true financial state.

Impact on Investment Decisions

Investors need to carefully consider both revenue and cash flow when making investment decisions. While strong revenue growth might be attractive, sustainable growth depends on the ability to generate sufficient cash flow to fund operations and future expansion. Companies with consistently positive cash flow are generally viewed as more stable and less risky investments. Conversely, companies that consistently rely on external financing to cover cash shortfalls may be more vulnerable to economic downturns or changes in investor sentiment. *Consider the dot-com bubble of the late 1990s, where many companies boasted impressive revenue growth but lacked sustainable business models and positive cash flow, ultimately leading to their demise.*

Operational Challenges

Discrepancies between revenue and cash flow can create operational challenges for businesses. For instance, a company might need to borrow money to bridge the gap between revenue recognition and cash collection. This can increase interest expenses and reduce profitability. Effective cash flow management, including strategies for accelerating cash inflows and delaying cash outflows, is essential for mitigating these challenges. This includes negotiating favorable payment terms with suppliers and implementing efficient collection processes with customers.

Strategic Implications

The difference between revenue and cash flow also has strategic implications. Companies may need to adjust their pricing strategies, payment terms, or inventory management practices to improve cash flow. For example, offering discounts for early payment can incentivize customers to pay faster, improving cash flow. Alternatively, companies might decide to focus on higher-margin products or services that generate more cash per dollar of revenue. Understanding the relationship between revenue and cash flow is crucial for making informed strategic decisions that support long-term financial sustainability.

Broader Significance

The distinction between revenue and cash flow extends beyond the individual business level and has broader implications for the economy as a whole. Financial markets rely on accurate and transparent financial reporting, including both revenue and cash flow information, to allocate capital efficiently. Misinterpreting or misrepresenting these metrics can lead to market inefficiencies, investment bubbles, and ultimately, economic instability. The 2008 financial crisis, in part, was fueled by a lack of transparency and understanding of complex financial instruments, many of which had revenue streams that were divorced from actual cash flows.

Furthermore, understanding the difference between revenue and cash flow is essential for promoting sound corporate governance and ethical business practices. Companies that prioritize short-term revenue growth at the expense of long-term cash flow sustainability may be engaging in unsustainable or even fraudulent practices. By focusing on both revenue and cash flow, stakeholders can hold companies accountable for responsible financial management and promote a more stable and sustainable economic environment. In conclusion, while revenue indicates sales performance, cash flow reflects the actual liquidity and operational efficiency. A balanced view of both revenue and cash flow paints a more accurate picture of a company's overall financial wellbeing and its potential for sustained success.