Okay, picture this: I'm at a barbecue last summer, flipping burgers (badly, I might add – burnt on the outside, raw in the middle, a true culinary disaster), and someone starts talking about their investments. Inevitably, right? This guy, let's call him Dave, is going on and on about this thing called Dividend Growth Split Corp. He's practically glowing, talking about steady income and potential capital appreciation. At the time, I just nodded politely, spatula in hand, mentally calculating how many antacids I'd need later. But honestly, it stuck with me. "Dividend Growth Split Corp," I mumbled to myself while scraping charcoal off the grill. It sounded intriguing... and maybe a little too good to be true?

So, naturally, I had to dive down the rabbit hole and do some digging. And let me tell you, it's a complex beast. Which brings us to the real point: what are the *key debates* surrounding Dividend Growth Split Corp. and similar split share structures? Because, trust me, there's a lot more to it than just Dave's sun-kissed enthusiasm.

What's the Deal with Dividend Growth Split Corp. Anyway? (A Very Quick Primer)

Before we get into the debates, let's make sure we're all on the same page. Dividend Growth Split Corp. (and similar funds) are a type of investment that splits its capital structure into two main classes of shares: preferred shares and capital shares. Think of it like splitting a pizza. One person gets the predictably cheesy (boring?) slices (preferred shares), and the other gets the weird anchovy-covered ones that *might* be amazing or might be terrible (capital shares).

- Preferred Shares: These are designed to provide a relatively high and stable dividend income. They often have a fixed yield, and their holders get paid first. They're generally considered less risky than the capital shares. Think of them as the "bond" portion of the equation. You know, steady eddies.

- Capital Shares: These shares get whatever’s left over *after* the preferred shareholders get their cut. This means they have the potential for greater capital appreciation if the underlying portfolio performs well. But, and it's a BIG but, they also carry significantly more risk. If the portfolio tanks, capital shareholders are the first to feel the pain. This is where the potential for gains and losses is magnified.

The idea is to appeal to two different types of investors: those seeking income (preferred shares) and those seeking growth (capital shares). It sounds like a brilliant plan, and it can be... but (again with the "buts"!), there are some serious considerations to keep in mind. And this is what gets the investment forums buzzing.

The Great Debates: Let's Get Down to Business

Alright, buckle up, because this is where things get interesting. These are some of the major points of contention when it comes to Dividend Growth Split Corps.

1. The Risk of Leverage (and its Impact on Capital Shares)

This is probably the biggest, loudest, and most persistent debate. Split corps are inherently *leveraged*. Think of it like this: the preferred shares are essentially "borrowing" from the capital shares to provide their fixed dividend. If the underlying portfolio doesn't generate enough income to cover those preferred share dividends, the capital shareholders are on the hook. This leverage *amplifies* both gains and losses for the capital shares.

So, what's the debate? Well, some argue that this leverage is a fantastic way to boost returns, especially in a rising market. Others see it as a ticking time bomb, ready to explode if the market takes a nosedive. Imagine being Dave from the BBQ when the market crashes and his beloved capital shares get decimated. Not so sunny anymore, is it?

Side note: Remember, leverage isn't free. There are costs associated with it, which can eat into your returns. It's like using a credit card to invest – you might make more money, but you're also paying interest.

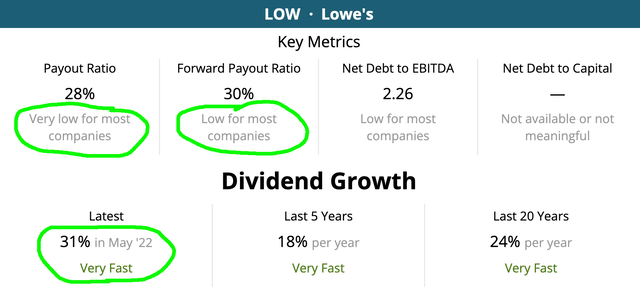

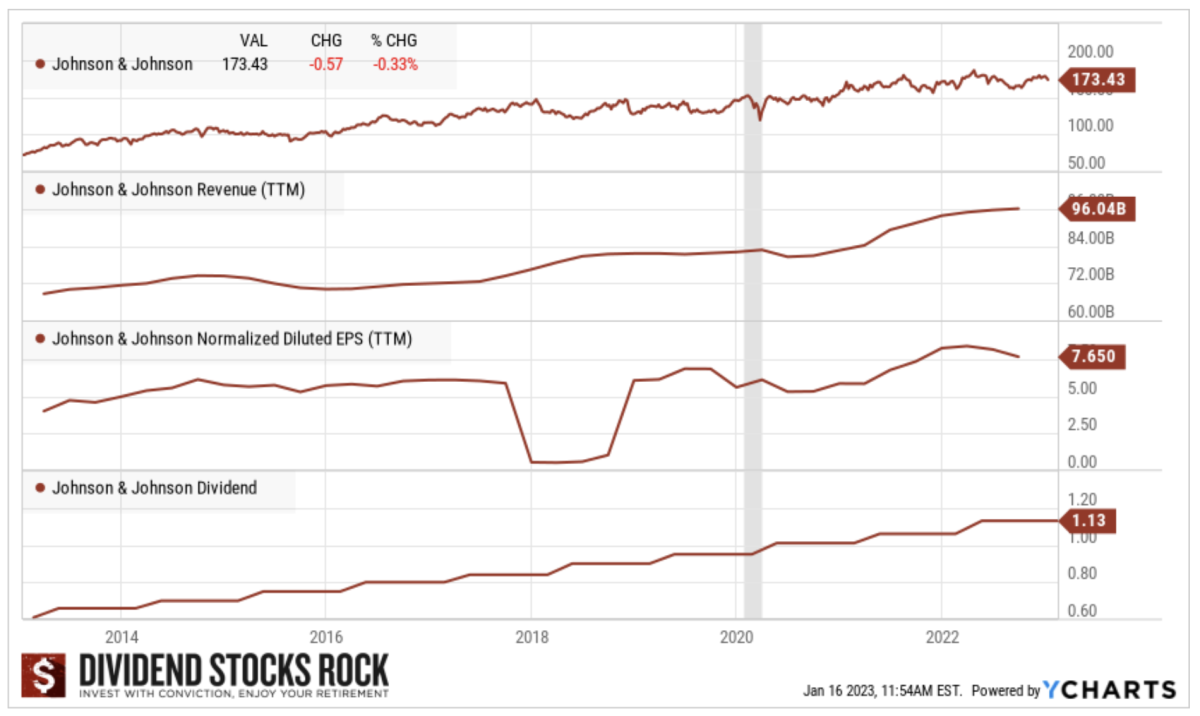

2. Sustainability of the Dividends (Especially for Preferred Shares)

One of the main selling points of these funds is the high dividend yield on the preferred shares. But how sustainable are those dividends, really? Are they truly "safe," as some promoters claim? That’s where the debate heats up.

The dividends paid on the preferred shares are only as sustainable as the underlying portfolio's ability to generate income. If the companies held within the portfolio cut their dividends, or if the portfolio's value declines significantly, the split corp might struggle to maintain its payouts. And guess who feels the pinch first? Capital share holders!

Critics argue that some split corps are overly reliant on a small number of holdings, making them vulnerable to concentration risk. If one or two major holdings cut their dividends, it could jeopardize the entire dividend stream. And no one wants to see their dividend check disappear, right?

Pro Tip: Always, always, look at the split corp's underlying portfolio and its dividend coverage ratio (the amount of income generated versus the amount needed to pay the preferred dividends). This will give you a better sense of how sustainable those dividends actually are.

3. The Management Fee Question (Are You Paying Too Much?)

Like any actively managed fund, Dividend Growth Split Corps charge management fees. These fees can eat into your returns, especially over the long term. The debate here is whether the benefits of active management (i.e., stock selection, risk management) outweigh the costs of the fees.

Some investors argue that the fees are justified if the fund consistently outperforms its benchmark. Others believe that you're better off investing in a low-cost index fund or ETF, which provides broad market exposure at a fraction of the price. Who wants to hand over a chunk of their potential gains to the fund manager, anyway?

My two cents: Be realistic about your expectations. Active management is hard, and it's rare for funds to consistently beat the market year after year. Do your research and compare the fund's fees to its performance history before you invest.

4. Redemption Dates and Termination Risk (The Clock is Ticking)

Many split corps have a fixed term, meaning they will eventually be terminated. At the termination date, the underlying assets are sold, and the proceeds are distributed to the shareholders. This creates a few potential risks and fuels some debate:

- Redemption at Net Asset Value (NAV): The preferred shares are typically redeemed at their net asset value (NAV). This is generally seen as a positive, as it provides a level of downside protection.

- Capital Share Uncertainty: The capital shareholders, however, are subject to the *residual value* of the portfolio at termination. If the portfolio has performed well, they could receive a significant payout. But if the portfolio has underperformed, they could receive little or nothing. It's a high-stakes gamble.

- Roll-Over Risk: Sometimes, the split corp will "roll over" into a new term, with new terms and conditions. This can be good if the fund has performed well, but it can be bad if the fund has struggled. You're essentially being asked to re-up for another round.

The debate centers around how much weight to give to the termination date when making investment decisions. Some investors see it as a looming deadline that adds uncertainty to the equation. Others see it as an opportunity to potentially profit from the fund's liquidation. It's all about your risk tolerance and investment horizon.

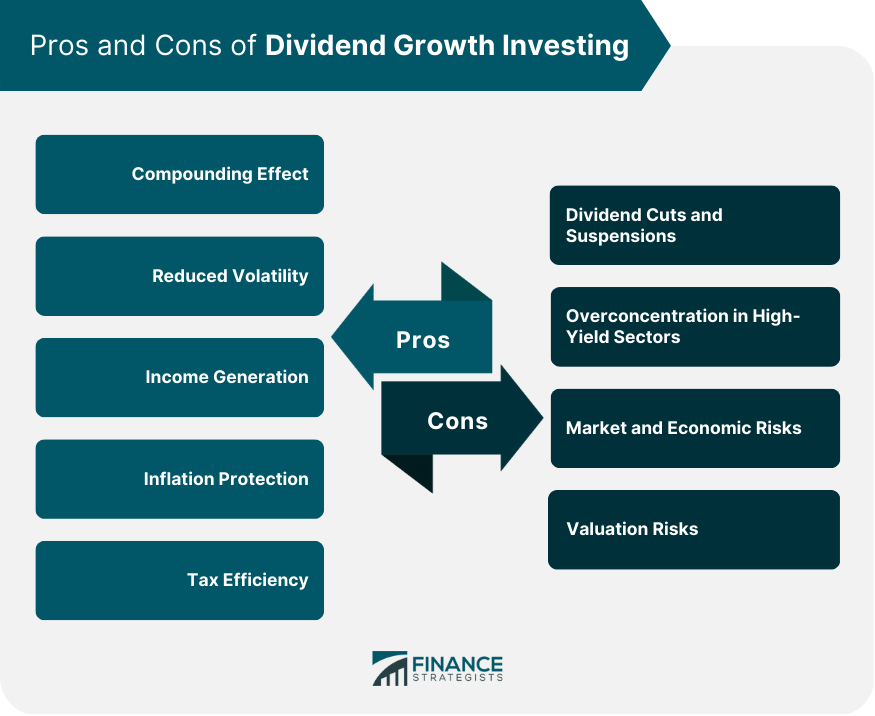

5. Alternative Investments (Are There Better Options?)

Finally, the biggest question of all: are Dividend Growth Split Corps the *best* way to achieve your investment goals? Or are there other, more attractive options out there? This is the ongoing debate among investment professionals.

Depending on your needs and risk tolerance, you might be better off investing in a diversified portfolio of individual dividend-paying stocks, a low-cost dividend ETF, or even a bond fund. Each of these options has its own advantages and disadvantages, so it's important to carefully consider your options before making a decision. Don't just jump on the bandwagon because Dave at the BBQ is raving about it. Do your homework!

Think about it: What are you really trying to achieve? Do you need income? Growth? A combination of both? And how much risk are you willing to take to get there? These are the questions you need to answer before you even start looking at specific investments.

The Bottom Line: Do Your Own Research!

So, there you have it – a whirlwind tour of the key debates surrounding Dividend Growth Split Corps. As you can see, it's not a simple "yes" or "no" answer. These investments can be attractive, but they also come with significant risks.

Before you even think about investing in one of these funds, do your own research. Read the prospectus carefully, understand the fund's strategy, and assess your own risk tolerance. Don't just rely on the advice of some guy at a barbecue (no offense, Dave!). And remember, past performance is not indicative of future results. In other words, just because it worked in the past doesn't mean it will work in the future.

Investing is a personal journey. What works for one person might not work for another. So, take your time, do your homework, and make informed decisions that are right for *you*. Happy investing!

:max_bytes(150000):strip_icc()/Dividend-44d29cb374a34b1391ec3d48b08ecab6.jpg)