Hey there, budget buddies! Ever wondered if your Discover card and Rocket Money are, like, actually friends? Or are they locked in some sort of financial feud we didn't know about? Let's dive into this surprisingly juicy topic!

The Great Fintech Face-Off (Maybe Not?)

So, the question is: Does Discover *actually* work with Rocket Money? Short answer: It can be a bit...complicated. Think of it as that friend who *says* they're coming to the party, but then you're not entirely sure if they will show up. You know the type!

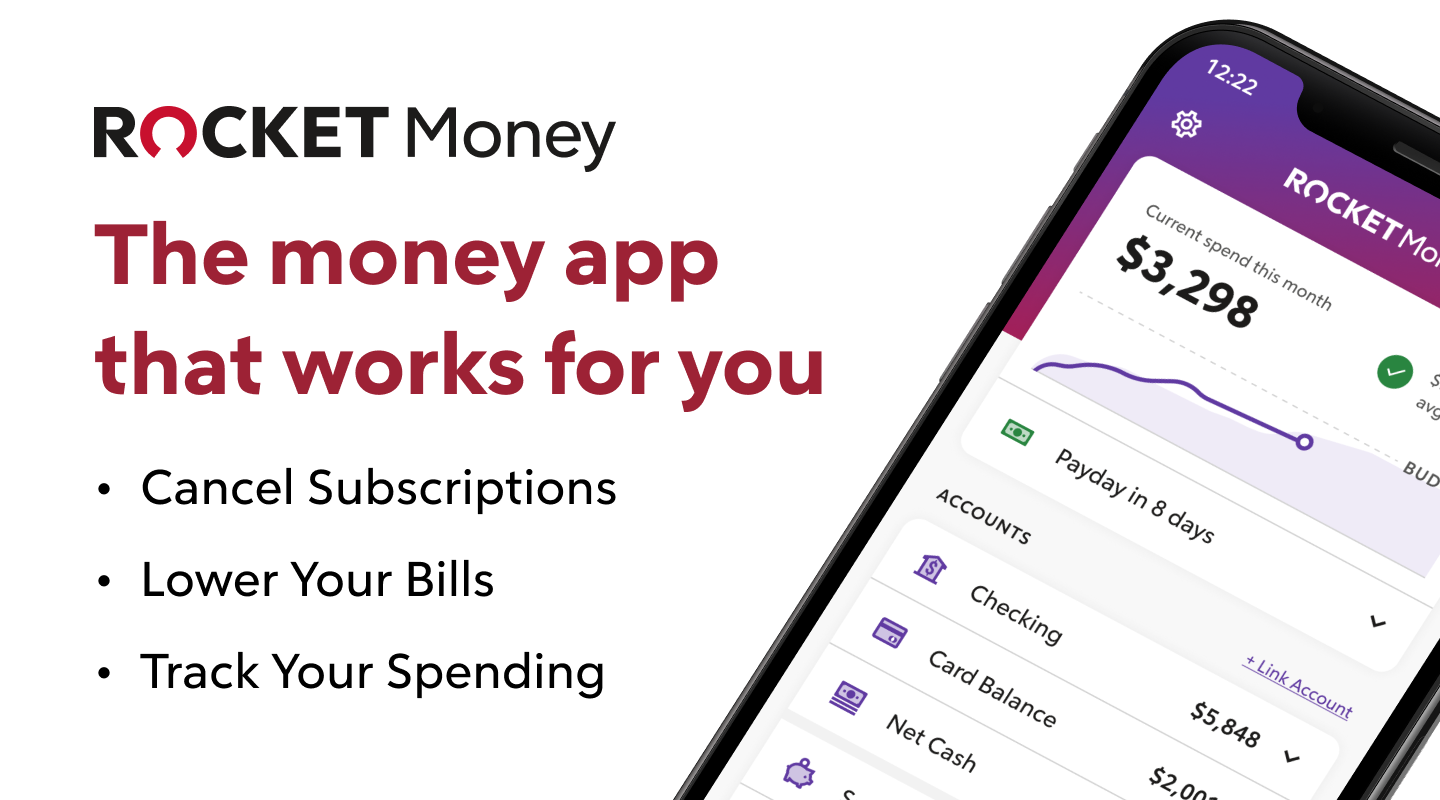

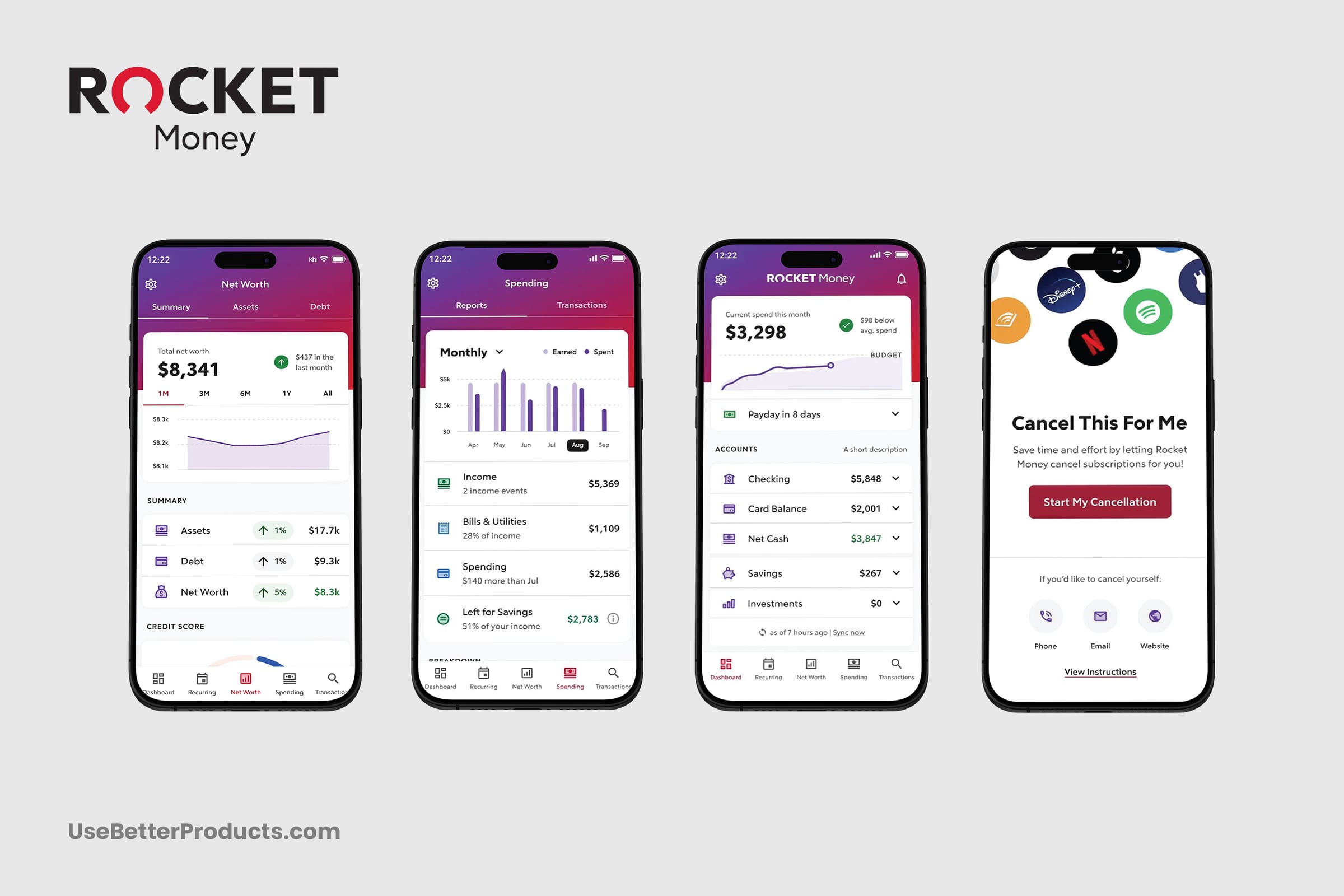

Rocket Money, for those playing at home, is that handy app that helps you track your spending, cancel unwanted subscriptions (goodbye, free trials gone wrong!), and generally get a grip on your finances. Discover, of course, is the card that promises you cashback and maybe even a friendly robot voice when you call customer service. (Okay, maybe not a robot *voice*.)

Why the Fuss? It's All About the Connection!

The whole shebang boils down to data connectivity. Rocket Money needs to *talk* to Discover to pull in your transaction history, your spending habits, and all that good (and sometimes scary) financial stuff. If they can't connect, it's like trying to order pizza with a broken phone. Frustrating!

Sometimes, Discover plays nice. Other times, it's like pulling teeth to get the connection to work. Why? Well, fintech partnerships can be tricky. There are security protocols, API integrations (techy stuff!), and sometimes just plain old glitches in the system. Imagine trying to build a Lego castle, but some of the pieces just don't quite fit.

And here's a quirky fact: The reliability of these connections can fluctuate! What worked last week might not work today. It's the financial equivalent of a temperamental houseplant. You just never know.

So, What's a Budgeteer to Do?

Don't fret! Even if Discover and Rocket Money are having a "moment," there are ways around it. Think of yourself as a financial MacGyver, ready to solve the connectivity conundrum!

- Manual Input: Old-school, but reliable. You can manually enter your Discover transactions into Rocket Money. It's a bit more work, but hey, at least you're in control. Think of it as a mindful budgeting exercise.

- Check for Updates: Both Rocket Money and Discover are constantly updating their apps and systems. Make sure you're running the latest versions. It's like hoping a software update will magically fix your computer. Sometimes it actually works!

- Contact Support: Don't be afraid to reach out to customer support for both Rocket Money and Discover. They might have some secret troubleshooting tips or know about any known issues. It's like calling in the tech cavalry!

- Explore Alternatives: There are other budgeting apps out there! Maybe another one will play nicer with Discover. Think of it as dating different apps until you find "the one."

And here's a funny detail: Sometimes, the problem isn't even Discover or Rocket Money. It might be your *own* settings! Double-check that you've granted Rocket Money the necessary permissions to access your Discover account. It's like accidentally leaving your car keys at home and then wondering why you can't drive anywhere.

Data Security: A Serious Note (But Still Fun!)

Okay, let's get real for a second. When you're connecting your financial accounts to any app, security is paramount. Make sure Rocket Money (or any other app you're using) has robust security measures in place. Look for things like encryption, two-factor authentication, and a solid privacy policy. It's like putting extra locks on your financial fortress!

Don't just blindly trust any app with your financial data. Do your research, read reviews, and make sure you're comfortable with their security practices. Think of it as vetting a babysitter before leaving them alone with your precious…financial data.

The Bottom Line: It's a Maybe...With a Chance of Sun

So, does Discover work with Rocket Money? The answer is a resounding "maybe." It can be a bit hit-or-miss, depending on a variety of factors. But don't let that discourage you from using both tools to manage your finances. Just be prepared to troubleshoot, be patient, and maybe have a backup plan in place. Think of it as a financial adventure!

And remember, even if things don't always go smoothly, the goal is to gain control of your money and make informed financial decisions. So, keep experimenting, keep learning, and keep having fun with your finances! (Yes, you can have fun with finances. It's like a puzzle, but with money!)

Ultimately, the relationship between Discover and Rocket Money is a reminder that fintech partnerships can be complex and ever-evolving. But with a little bit of persistence and a dash of humor, you can navigate the financial landscape and achieve your budgeting goals.

And that's the tea! Now go forth and conquer your budget! Remember to always double-check your subscriptions. You don't want to be paying for a streaming service you haven't used in three years. Trust me, we've all been there. 😉

One final quirky fact: Did you know that the average person spends around $348 on forgotten subscriptions each year? That's like a mini vacation that you're not even taking! So, go forth, check those subscriptions, and reclaim your financial freedom!

Happy budgeting!

![Rocket Money App Review [Is Rocket Money Safe?] - Frugal Rules - Does Discover Not Work With Rocket Money](https://www.frugalrules.com/wp-content/uploads/2023/06/FB-Is-Rocket-Money-Worth-it.jpg)

![Rocket Money Review [2025] Is Rocket Money Safe? – The Money Manual - Does Discover Not Work With Rocket Money](https://cdn.themoneymanual.com/wp-content/uploads/2024/04/22081440/image-24-600x207.png)