Okay, let's talk about something a lot of us avoid like the plague: credit. It's like that awkward family photo we try to hide in the attic, but it really matters. Why? Because good credit can be the key to unlocking awesome things, like a better interest rate on a car loan, that dream home you've been eyeing, or even just getting approved for a credit card with sweet rewards points.

But life happens, right? Sometimes we overspend (hello, impulse online shopping!), or unexpected bills pop up. Suddenly, managing debt feels like trying to juggle chainsaws while riding a unicycle. That's where companies like Navicore Solutions come in. They offer help with debt management, but a big question mark hangs over them: Will using their services hurt my credit score? Let's dive in and find out!

What Exactly Does Navicore Solutions Do?

Imagine you have a bunch of different bills, each with its own due date and interest rate. It's like trying to keep track of a dozen different cats – chaotic! Navicore Solutions acts as a sort of debt-taming superhero. They help you consolidate your debt into a Debt Management Plan (DMP). Think of it as putting all those unruly cats into a nice, organized basket.

They work with your creditors to potentially lower your interest rates and set up a single monthly payment that you make to Navicore. They then distribute the money to your creditors. In theory, this makes things more manageable and helps you pay off your debt faster. Sounds pretty good, doesn’t it?

The Nitty-Gritty: How a DMP Can Affect Your Credit

Here's where things get a little nuanced, like trying to perfectly frost a cake. While a DMP can ultimately help you get out of debt and potentially improve your credit in the long run, there can be some short-term impacts. Let's break it down:

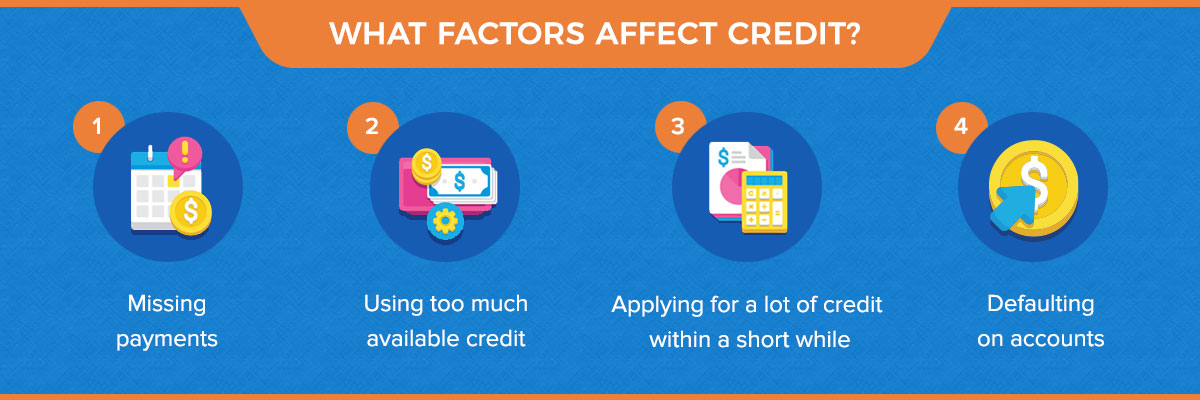

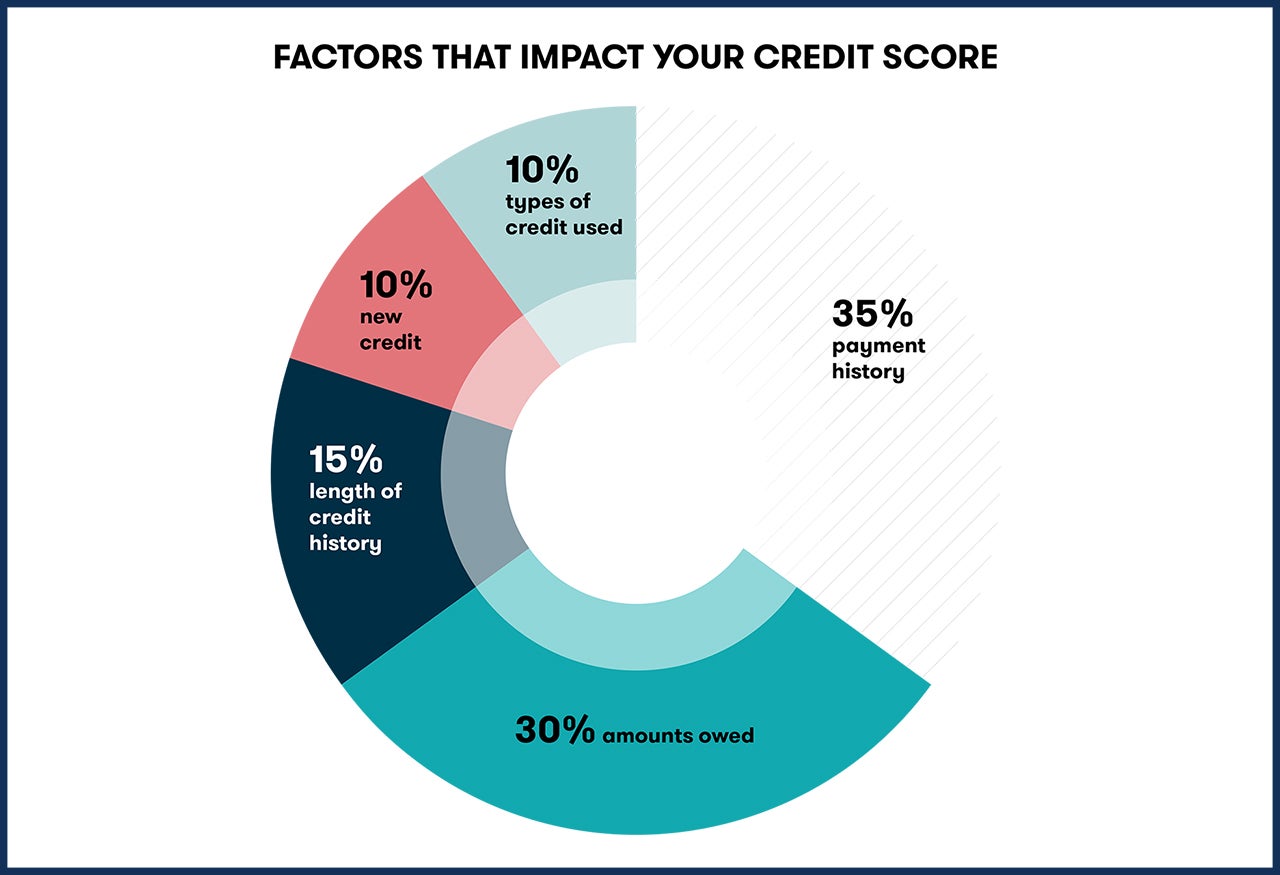

- Account Closures: This is a biggie. As part of the DMP agreement, you'll likely have to close the credit card accounts included in the plan. Closing accounts reduces your overall available credit. Think of it like this: if you have a credit card with a $5,000 limit and you close it, that $5,000 disappears from your available credit. This can increase your credit utilization ratio, which is the amount of credit you're using compared to your total available credit. High credit utilization (above 30%) can ding your score.

- Reporting to Credit Bureaus: When you enroll in a DMP, Navicore, or your creditors, might report this to the credit bureaus. This isn't necessarily a negative mark, but it can show up on your credit report. Some creditors may flag your accounts as "in debt management," which could slightly lower your score, especially initially. It's like a tiny bump in the road on your credit journey.

- Late Payments (If You've Had Them): If you've been struggling to make payments before starting the DMP, those late payments will already be on your credit report. A DMP won't magically erase them. However, by consistently making payments through the DMP, you can start building a positive payment history, which is a huge factor in improving your credit score over time.

So, the short answer is that a DMP *can* initially hurt your credit score, primarily due to account closures and potentially how the DMP is reported. It’s like taking a step back to take a leap forward.

The Brighter Side: Long-Term Credit Benefits

Don't despair! While there might be some initial hiccups, a DMP can be a powerful tool for improving your credit in the long run. Think of it as planting a seed – it takes time and care to grow, but eventually, you'll reap the rewards.

- Consistent Payments: The biggest benefit is the consistent payment history you'll build. Payment history is the most important factor in your credit score. By making on-time payments through the DMP, you're demonstrating responsible credit management, which lenders love to see.

- Lower Debt Levels: As you pay down your debt, your credit utilization ratio will decrease. This is a major win for your credit score. It shows that you're managing your debt effectively.

- Getting Out of Debt: Ultimately, the goal is to eliminate your debt. Once you've paid off your debts included in the DMP, you'll be in a much stronger financial position, which will reflect positively on your credit score.

Imagine finally being able to breathe freely without the weight of debt hanging over you. That's the power of a DMP when used effectively.

So, Should You Use Navicore Solutions?

That's the million-dollar question! It really depends on your individual situation. Here are some things to consider:

- Are you struggling to manage your debt? If you're missing payments, maxing out credit cards, and feeling overwhelmed, a DMP might be a good option. It's like calling in a professional organizer to declutter your financial life.

- Can you commit to the DMP? A DMP requires discipline and commitment. You'll need to stick to the payment plan and avoid accumulating new debt. It's not a magic bullet, but a tool that requires effort.

- Are you aware of the potential downsides? Understand the potential short-term impact on your credit score and the fact that you'll likely have to close credit card accounts.

Before signing up for a DMP, talk to a credit counselor at Navicore Solutions (or any reputable credit counseling agency) to discuss your specific situation and understand the potential impact on your credit. It's like getting a second opinion from a doctor before undergoing surgery.

Alternatives to a DMP

A DMP isn't the only option for managing debt. Here are a few other things to consider:

- Budgeting and Spending Cuts: Sometimes, simply creating a budget and cutting back on unnecessary expenses can make a big difference. It's like going on a financial diet.

- Debt Consolidation Loan: This involves taking out a new loan to pay off your existing debts. The goal is to get a lower interest rate and a single monthly payment.

- Balance Transfer Credit Cards: If you have good credit, you might be able to transfer your balances to a credit card with a 0% introductory APR. This can give you some breathing room to pay down your debt without accruing interest.

- Negotiating with Creditors: You can try to negotiate directly with your creditors to lower your interest rates or set up a payment plan.

The Bottom Line: Knowledge is Power!

Ultimately, deciding whether or not to use Navicore Solutions (or any debt management service) is a personal decision. There are pros and cons to consider. While there might be a temporary dip in your credit score, the long-term benefits of getting out of debt and building a positive payment history can be significant.

Do your research, talk to a qualified professional, and make the choice that's right for you. Think of it as charting your own course to a brighter financial future. And remember, knowledge is power! The more you understand about credit and debt management, the better equipped you'll be to make informed decisions and achieve your financial goals.

Don't be afraid to ask questions and seek help when you need it. There are plenty of resources available to support you on your journey to financial freedom. You've got this!