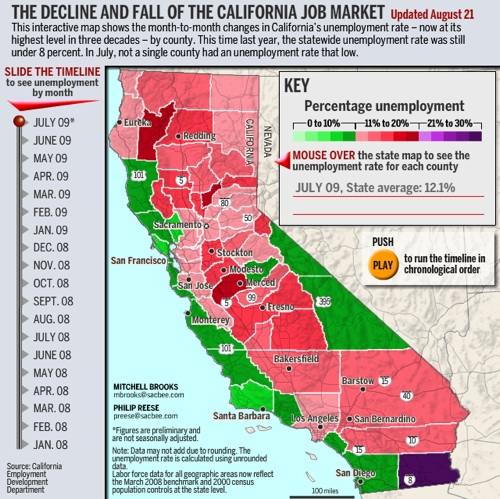

Alright, gather 'round, folks! Let's talk about something near and dear to the hearts of anyone who's ever been unexpectedly gifted with free time: unemployment. Specifically, in the land of sunshine, avocados, and crippling housing costs – California! And to make it even more fun, we're going to toss in severance pay, that bittersweet parting gift that's kinda like getting a consolation prize after losing the office chili cook-off. Does that severance check mess with your unemployment benefits? Buckle up, because it's about to get… mildly complicated.

The California Unemployment Game: Rules of Engagement

First things first, let's establish the basics. Getting unemployment in California isn't just about walking into the EDD (Employment Development Department, or as I like to call it, the "Endless Documentation Dungeon") and demanding free money. There are hoops to jump through, my friends. More hoops than a circus trained seal!

To even qualify, you generally need to:

- Have worked and earned enough wages during your "base period" (a specific 12-month period the EDD uses to calculate your benefits). Think of it as the EDD's way of saying, "Show us the receipts!"

- Be unemployed through no fault of your own. This usually means you were laid off, not that you decided to quit because your boss's tie collection offended your sensibilities.

- Be actively looking for work. Proof, people, proof! You can't just sit at home binging Netflix and expect the EDD to believe you're hustling.

- Be able and available to work. So, if you're recovering from a sudden allergy to work or simultaneously pursuing a PhD in interpretive dance in Bali, it might be a tough sell.

See? Easy peasy. Only about as easy as parallel parking a monster truck in downtown San Francisco.

Severance Pay: The Plot Thickens (and Hopefully Pays)

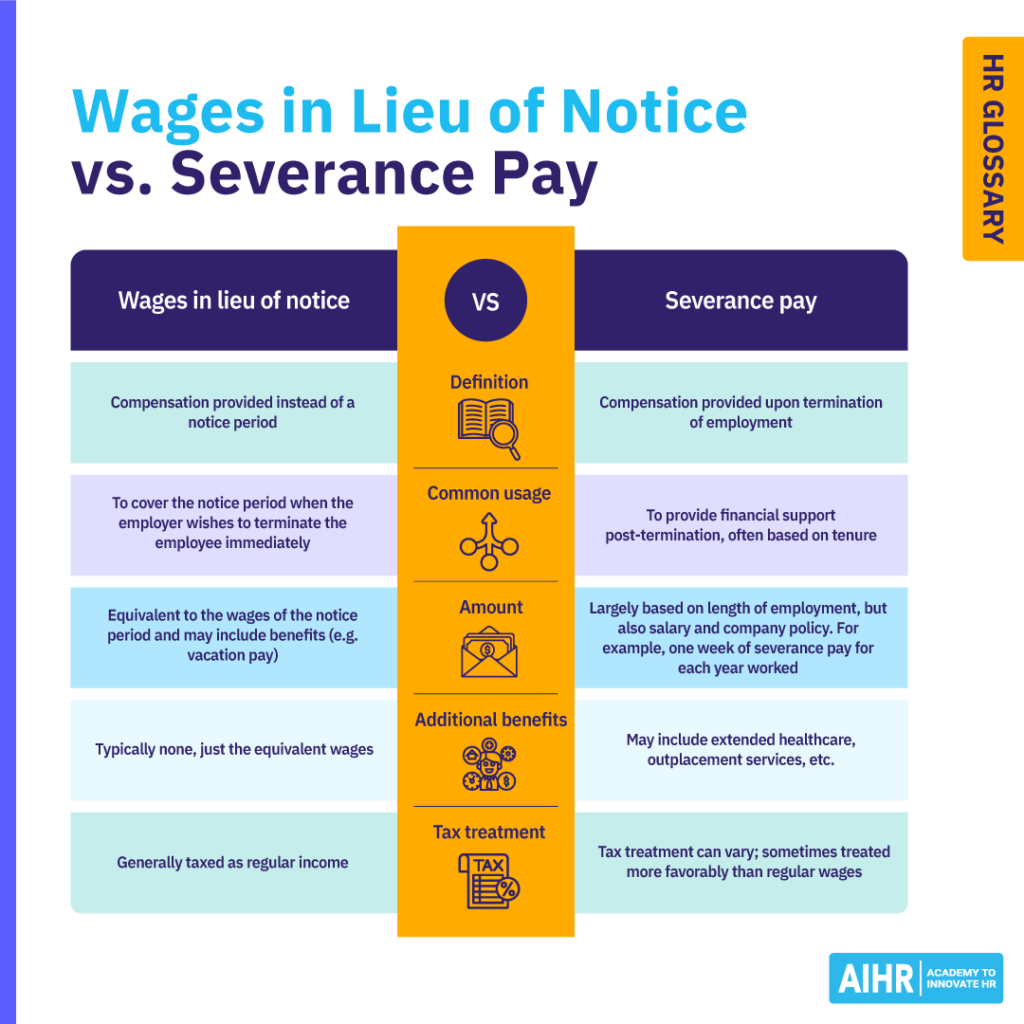

Now, let's throw severance pay into the mix. Severance is essentially a parting gift from your former employer. It's often based on your tenure, salary, and maybe even how much the company liked your cat pictures during Zoom meetings. It’s like winning the lottery… a small, corporate lottery that only happens when you’re losing your job.

Here's where things get interesting. In California, severance pay *can* affect your unemployment benefits, but not in the way you might immediately think. It's not a straight-up "Oh, you got severance? No unemployment for you!" situation. The EDD is a little more nuanced (and by "nuanced," I mean "possibly designed by a team of mischievous squirrels").

The Million-Dollar (Well, More Like Hundred-Dollar) Question: How Does It Impact Benefits?

The key is when your severance is paid. In California, the EDD looks at severance pay as a form of wage continuation. Think of it this way: if your severance is structured to cover a specific period of time after you leave the company, the EDD may consider it wages for that period. This can delay or reduce your unemployment benefits for that duration.

Let's break it down with some (totally hypothetical and not-legal-advice-giving) examples:

Example 1: The "Wage Continuation" Whammy

Let's say you get laid off on January 1st and receive a severance package that pays you your regular salary for the next two months. The EDD might say, "Hold up! You're still getting paid like you're working, so we'll hold off on unemployment benefits until March 1st." Essentially, they’re seeing it as you being employed during that two-month period, even though you're spending that time perfecting your sourdough starter recipe.

Example 2: The "Lump Sum" Loophole (Sort Of)

Now, let's say you receive your severance as a lump sum payment. This is where it gets a little grayer than a San Francisco fog. Generally, a lump-sum severance payment is less likely to directly impact your immediate unemployment benefits. The EDD is primarily concerned with wages covering specific periods after your job ends.

However, don't go spending that lump sum on a solid gold bathtub just yet! The EDD will still look at the circumstances of your separation and might ask for more details about your severance agreement. They're like the nosy neighbors of the employment world. They just want to know everything.

Important Considerations (Because Life Isn't Always Sunshine and Rainbows)

Here are a few extra nuggets of wisdom to keep in mind when navigating the severance-unemployment labyrinth:

- Accrued Vacation and Sick Pay: Any accrued vacation or sick pay you receive when you leave is generally treated as wages and will likely affect your unemployment benefits. It's like the EDD is saying, "You should have taken those vacations while you had them!"

- Pension or Retirement Plans: Payments from a pension or retirement plan typically don't affect your unemployment benefits. You earned that money, baby! Treat yourself to that gold bathtub after all (but maybe consult a financial advisor first).

- Don't Be Afraid to Ask (Nicely): The EDD has people who can answer your questions (eventually, after hours of waiting on hold and listening to elevator music that sounds suspiciously like rejected film scores). Be polite, be prepared to provide all the necessary documentation, and be patient. Channel your inner zen master.

- Honesty is the Best Policy: Always be truthful and accurate when applying for unemployment. Trying to pull a fast one on the EDD is generally a bad idea. They have ways of finding out. Ways that involve paperwork and possibly a sternly worded letter.

The Bottom Line: It Depends! (Of Course)

So, does severance pay affect unemployment in California? The answer, as with most things in life, is a resounding… it depends! It depends on how your severance is structured, when it's paid, and the specific circumstances of your job separation.

The best advice? Read your severance agreement carefully, understand the details, and don't hesitate to contact the EDD (with a healthy dose of patience) if you have questions. And maybe, just maybe, invest in a good book to read while you're on hold. After all, you've got some free time now, right? Might as well learn a new language. Or finally figure out how to knit. The possibilities are endless… almost as endless as the EDD's paperwork.

Good luck out there, and may the odds (and the EDD) be ever in your favor!

:max_bytes(150000):strip_icc()/severance-pay-1918252-v2-5bad472e46e0fb0026e9e6c5.png)