Understanding tax transcripts and their contents is crucial for managing your financial records and tracking the status of your tax filings. A common question many taxpayers have is whether their tax transcript will display the date their tax refund was issued. This article will clarify what information tax transcripts contain, specifically addressing the presence of refund dates, and provide guidance on how to interpret the information available to you.

What is a Tax Transcript?

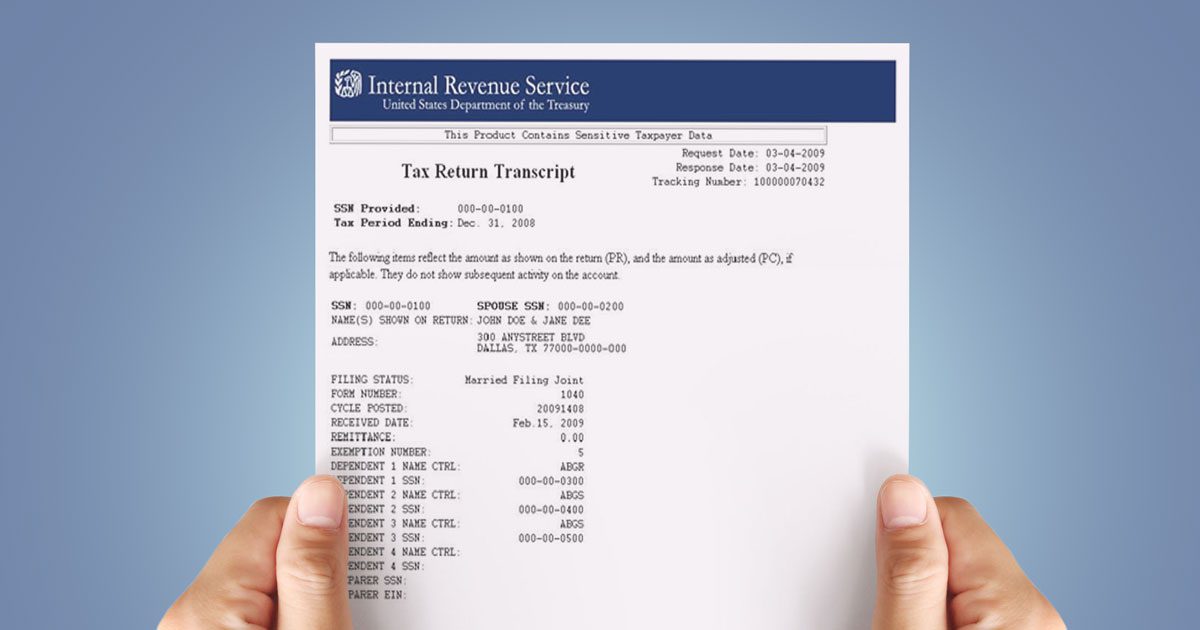

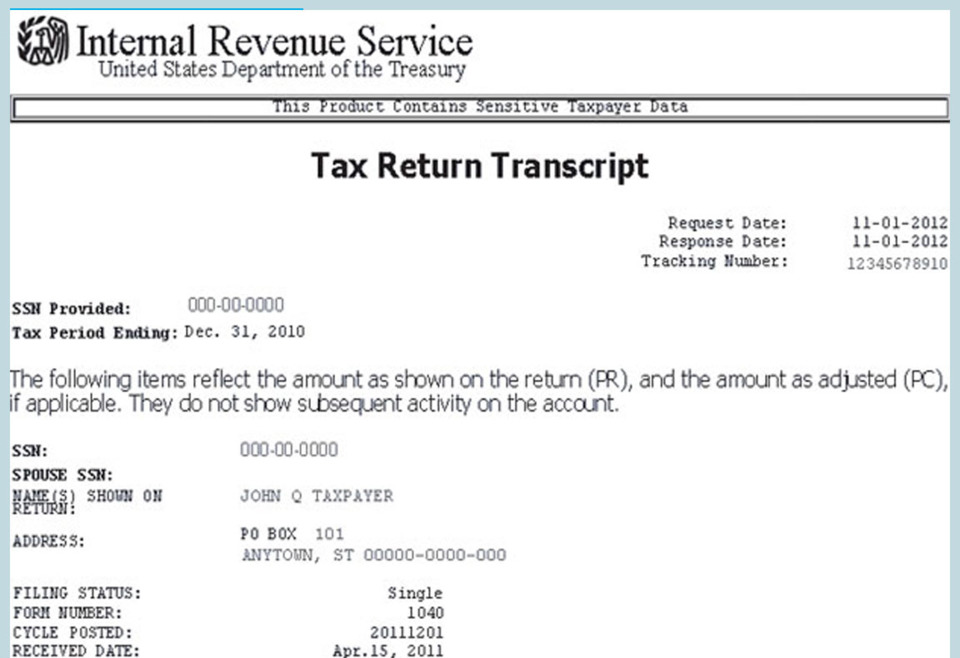

A tax transcript is an official record of your tax account maintained by the Internal Revenue Service (IRS). It summarizes your tax return information, including income, deductions, credits, and payments. It's important to understand that a tax transcript is not a copy of your tax return; rather, it’s a condensed version focusing on key data points.

The IRS provides several types of transcripts, each serving a different purpose. The most common types include:

- Tax Return Transcript: Shows most line items from your original tax return (Form 1040, 1040A, or 1040EZ) as filed. It does not reflect any changes made after the return was filed.

- Tax Account Transcript: Provides information on the status of your account, including any penalties, interest assessed, or payments applied. This is the transcript most relevant when looking for refund information.

- Record of Account Transcript: Combines features of both the Tax Return and Tax Account Transcripts.

- Wage and Income Transcript: Displays data from information returns the IRS receives, such as Forms W-2, 1099, and other forms reporting income.

- Verification of Non-filing Letter: Proves that the IRS has no record of a filed tax return for a specific year.

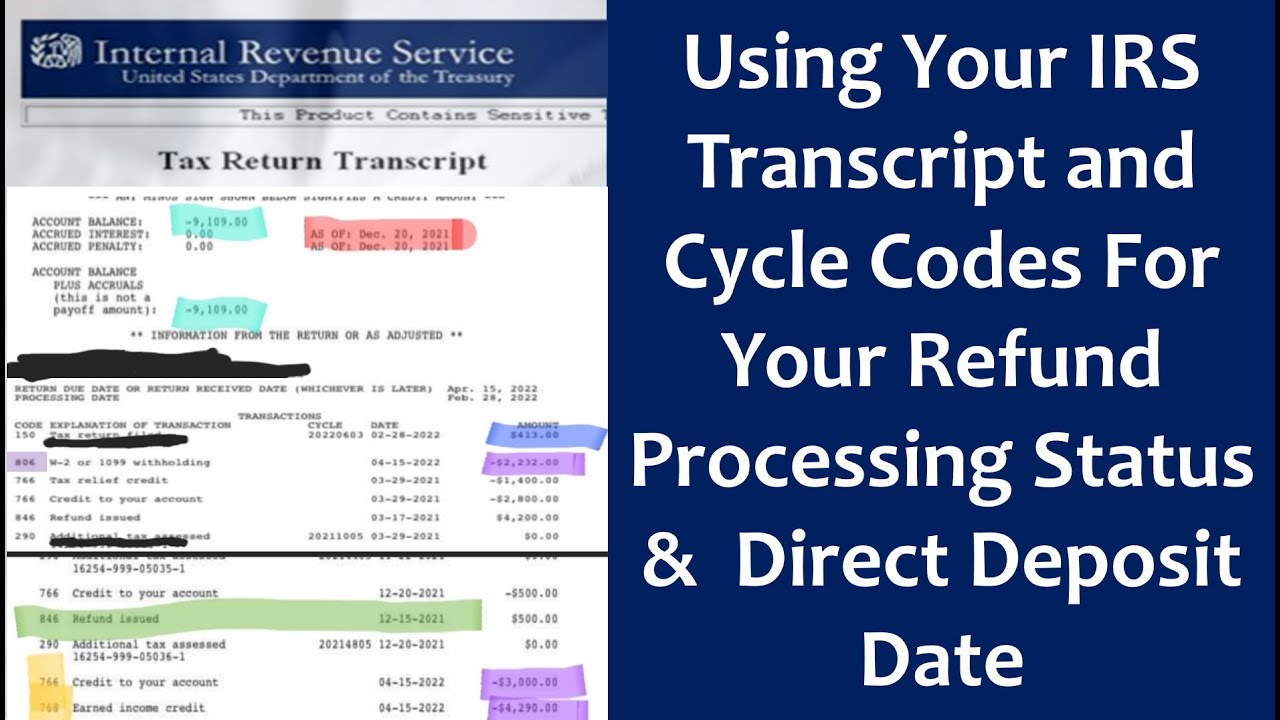

Where to Find the Refund Date on Your Tax Transcript

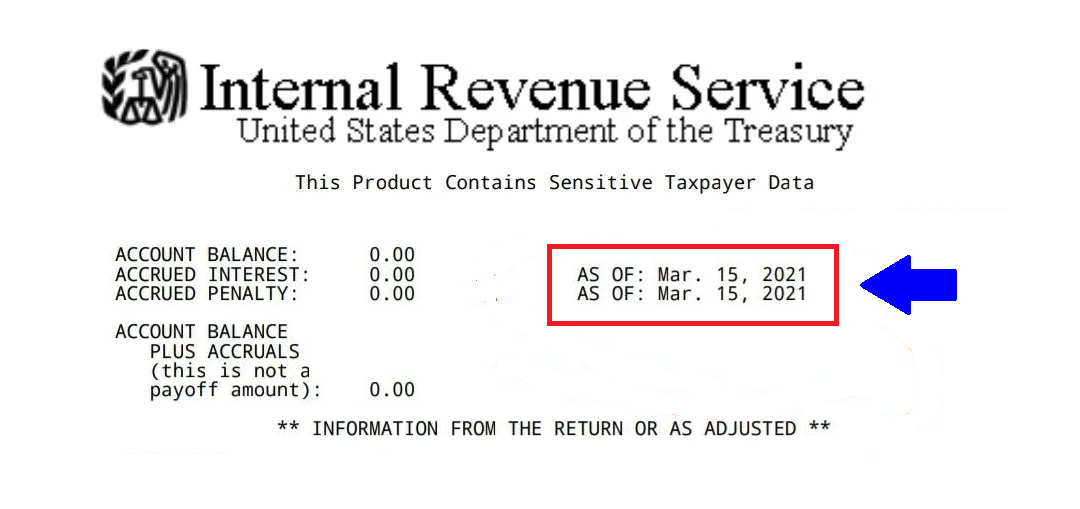

The Tax Account Transcript is the type of transcript that potentially shows information related to your refund, including the refund date. However, the refund date is not always explicitly labeled as "Refund Date." Instead, you need to look for specific transaction codes that indicate the refund's issuance.

Here's how to locate refund information on your Tax Account Transcript:

- Obtain Your Tax Account Transcript: You can access your tax transcripts online through the IRS website using the "Get Transcript" tool. You can also request them by mail. Online access is generally faster and more convenient. You’ll need to authenticate your identity to access your information securely.

- Locate the Relevant Tax Year: Tax transcripts are organized by tax year. Ensure you're viewing the transcript for the year in which you filed the return for which you are expecting a refund.

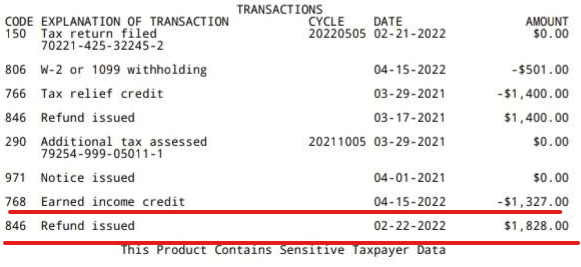

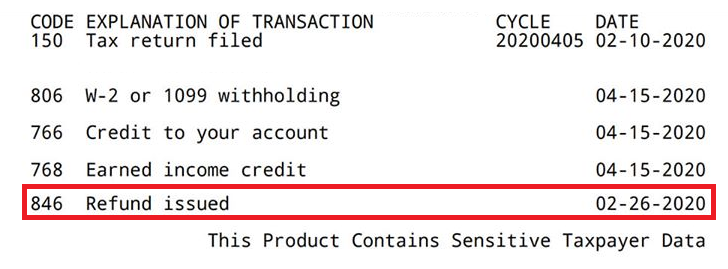

- Search for Transaction Codes: The key to finding your refund information lies in identifying the correct transaction code.

- Code 846 - Refund Issued: This is the most important code. It indicates that a refund has been issued to you. The date associated with this code is the date the IRS processed and sent your refund.

Example: If you see "Code 846" with a date of "March 15, 2024" and an amount of "$1,200.00," it means the IRS issued a refund of $1,200.00 on March 15, 2024.

- Code 846 - Refund Issued: This is the most important code. It indicates that a refund has been issued to you. The date associated with this code is the date the IRS processed and sent your refund.

- Review Transaction Details: Along with the transaction code and date, the transcript will show the amount of the refund issued. Make sure this amount aligns with the refund amount you were expecting.

Understanding Transaction Codes

Transaction codes are numerical codes used by the IRS to identify specific actions or events related to your tax account. Understanding these codes is essential for interpreting your tax transcript accurately. Here are a few more commonly encountered codes:

- Code 150 - Tax Assessed: This indicates the initial assessment of your tax liability based on the information you provided on your tax return.

- Code 570 - Additional Account Action Pending: This code suggests that the IRS is reviewing your account and may need additional information or clarification. It can sometimes delay your refund.

- Code 571 - Resolved/Closed Additional Account Action: This code generally means the issue related to code 570 has been resolved.

- Code 971 - Notice Issued: This indicates that the IRS sent you a notice regarding your tax return or account. The notice may contain important information about your refund or any actions you need to take.

Note: While the Tax Account Transcript *should* show the refund date via Code 846, it's not always guaranteed. Factors such as offsets (where your refund is used to pay other debts) or errors in processing could affect the information displayed. If you don't see Code 846 or if the information seems incorrect, you should contact the IRS directly.

What to Do If You Can't Find the Refund Date

If you are unable to find the refund date on your tax transcript, here are some steps you can take:

- Check the IRS "Where's My Refund?" Tool: The IRS provides an online tool and a mobile app called "Where's My Refund?" which allows you to track the status of your refund. You will need your Social Security number, filing status, and the exact amount of your expected refund.

- Review Your Tax Return: Ensure that you entered your bank account information correctly on your tax return if you requested direct deposit. Errors in your banking information can delay your refund.

- Contact the IRS: If you have checked both the "Where's My Refund?" tool and your tax transcript and still cannot determine the status of your refund, you can contact the IRS directly. Be prepared to provide your Social Security number, tax year, and other relevant information. You can find the IRS phone number on their website.

Important: Be aware that wait times for phone assistance can be long, especially during peak tax season.

- Check for Offsets: Your refund may be reduced or offset if you owe money to certain federal or state agencies, such as for unpaid student loans, child support, or state taxes. The IRS will usually send you a notice if your refund has been offset.

Practical Advice and Insights

Understanding your tax transcript is a valuable skill for managing your financial life. Here are some practical tips:

- Keep Your Tax Transcripts Organized: Download and save your tax transcripts for each year you file. This can be useful for future reference, loan applications, or other financial transactions.

- Monitor Your Tax Account Regularly: Periodically check your tax transcripts to ensure that the information is accurate and that there are no unexpected changes or discrepancies.

- Protect Your Identity: Tax transcripts contain sensitive information, so be sure to protect your IRS online account credentials and keep your transcripts secure.

- Use the "Where's My Refund?" Tool Wisely: While the "Where's My Refund?" tool is helpful, avoid checking it multiple times a day. The IRS updates the information periodically, so frequent checks won't speed up the process.

In conclusion, while your Tax Account Transcript *should* display the refund date via Transaction Code 846, understanding how to interpret the transcript and what other factors can influence refund processing is crucial. By using the IRS resources available and taking proactive steps to manage your tax records, you can stay informed and address any issues that may arise.