Okay, let's talk about something that might sound boring but actually affects your wallet: Fannie Mae, Freddie Mac, and some new legislation swimming around in Congress. Don't click away just yet! Think of it like understanding the secret ingredient in your favorite cookie recipe – knowing about this stuff can help you bake a better financial future. We're not diving into the deep end of finance jargon; we're keeping it simple, like explaining baseball to your grandma. Ready?

Fannie Mae and Freddie Mac: Who are these Guys Anyway?

Imagine Fannie and Freddie as the reliable, slightly quirky, uncles of the mortgage world. They don't directly give you a mortgage (that's your bank or credit union), but they buy mortgages from lenders. Why? Because it frees up those lenders to give more mortgages to more people. It's like Uncle Freddie buying your old bike so you can afford a new one! They then package these mortgages into securities and sell them to investors. This keeps the money flowing and makes homeownership more accessible.

Think of it like this: your local bakery makes amazing cupcakes. They need to buy more ovens to make more cupcakes for everyone. Fannie and Freddie are like the companies that buy the “cupcake loans” from the bank that lent the bakery the money for the ovens. This allows the bank to lend to other bakeries (or people buying houses!).

They're officially known as Government Sponsored Enterprises (GSEs). That means they operate with a government backing, which provides a level of stability to the housing market. However, they're not directly run by the government in the same way as, say, the post office. This unique structure also leads to interesting debates, which we'll get to.

The "Fees" Fiasco: What Are We Talking About?

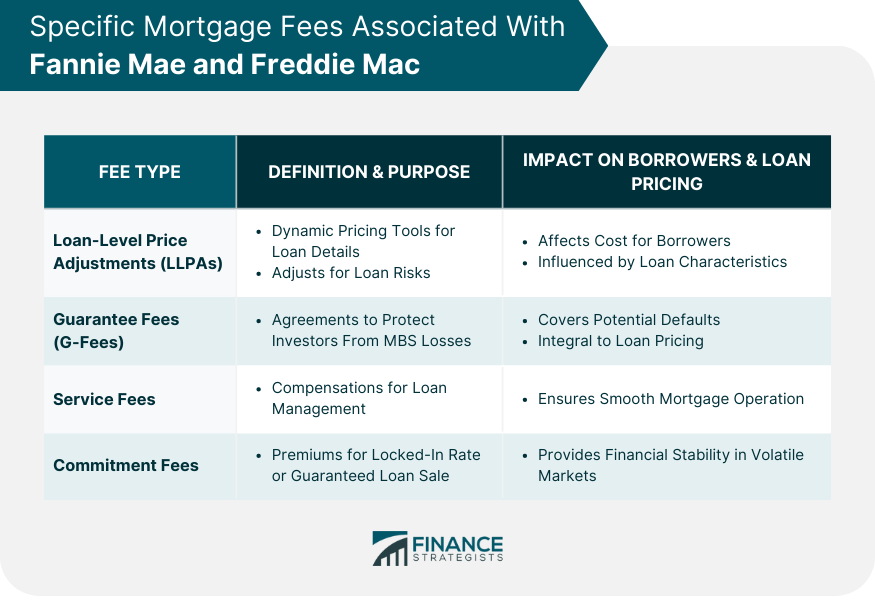

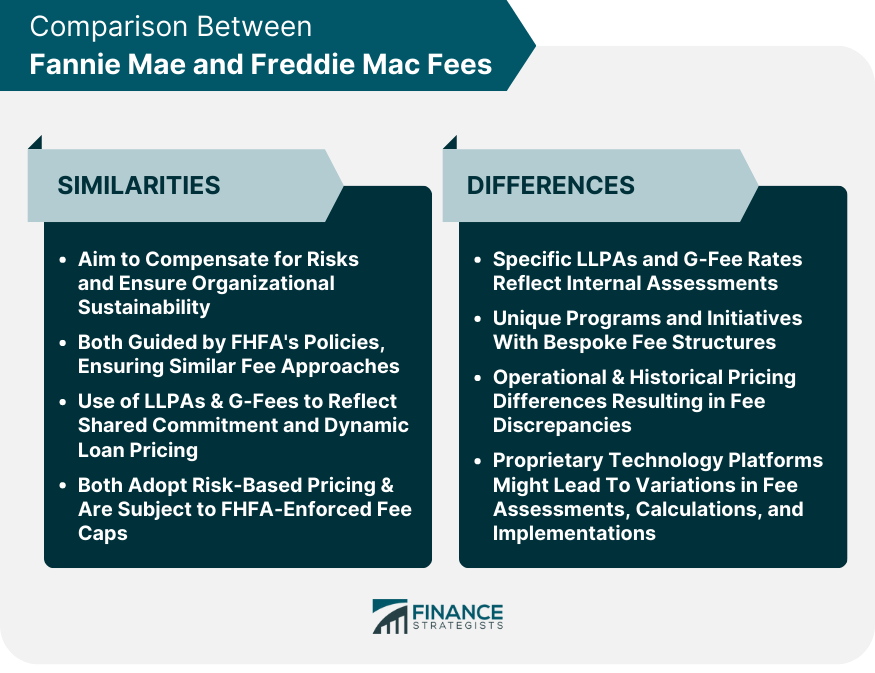

Now, about those fees. Fannie and Freddie charge lenders guarantee fees, often called "g-fees". Think of it as a small processing fee when you buy something online. These fees are ultimately passed on to you, the borrower, usually through a slightly higher interest rate on your mortgage. It's like the bakery adding a small charge for the fancy sprinkles on your cupcake – you're paying a little extra for the enhanced experience (or, in this case, the assurance of a mortgage).

These fees are used to cover Fannie and Freddie's operating costs and to compensate them for the risk they take in guaranteeing mortgages. They argue these fees are essential to keep the system running smoothly and to protect taxpayers. Others argue that these fees are too high and unnecessarily increase the cost of homeownership, making it harder for people, especially first-time buyers, to afford a home.

Imagine your friend offers to co-sign a loan for you so you can buy that dream car. They're taking a risk! They might charge you a small fee for the favor, right? That's similar to what Fannie and Freddie are doing with these guarantee fees.

How These Fees Impact You

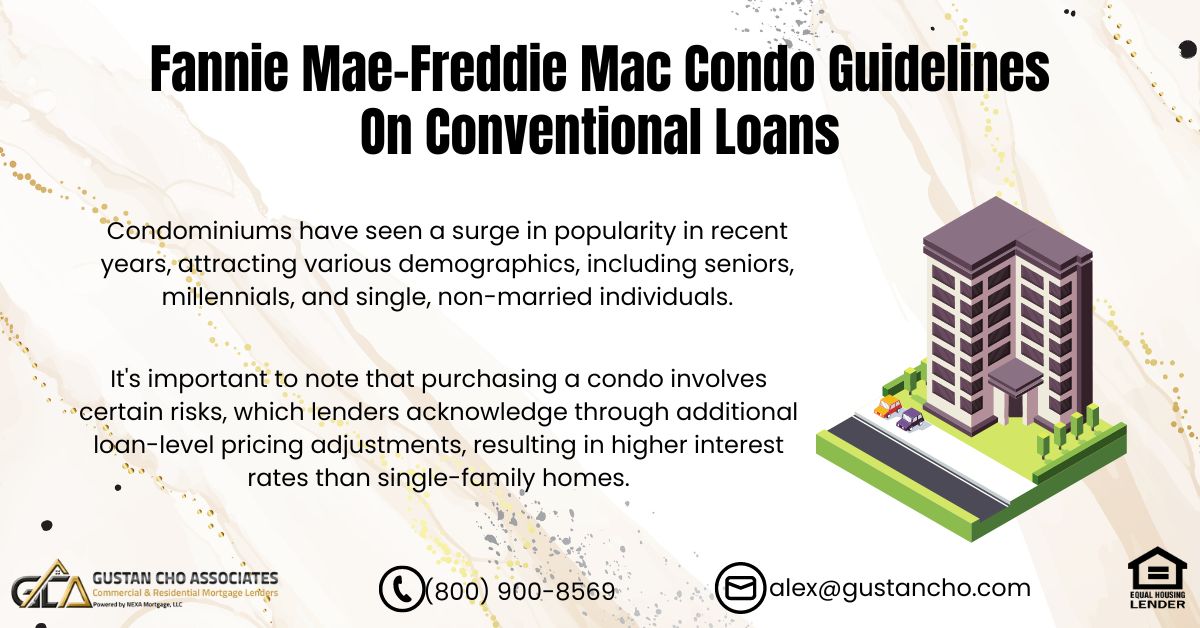

Let’s break it down further. Even a small increase in these fees can add up to a significant amount over the life of a 30-year mortgage. We’re talking potentially thousands of dollars! It's like those "optional" extras on your car that suddenly double the price. That heated steering wheel seemed cool at first, but now you're paying for it for the next five years!

Higher fees also make it harder for people with lower incomes or less-than-perfect credit to qualify for a mortgage. This can limit access to homeownership and exacerbate existing inequalities. Think of it as raising the price of concert tickets - suddenly, some people can’t afford to go anymore, even though they love the band just as much.

For example, let’s say Fannie and Freddie increase their fees by just 0.1%. On a $300,000 mortgage, that’s an extra $300 up front. Over 30 years, that extra 0.1% could mean paying several thousand dollars more in interest. That’s a vacation, a new car, or a significant contribution to your retirement fund – all potentially gone because of a seemingly small fee increase.

The Legislation: What's the Buzz About?

Now, here’s where the legislation comes in. Lawmakers are constantly debating whether these fees are too high, too low, or just right. There are proposals to regulate how Fannie and Freddie set these fees, to ensure they’re fair and transparent. Some want to lower the fees to make mortgages more affordable, while others argue that lowering fees could jeopardize the financial stability of Fannie and Freddie and, ultimately, the entire housing market.

It's like Congress is trying to decide whether to put more or less sugar in your favorite cereal. Too much sugar, and it's unhealthy; not enough, and it's bland. Finding the right balance is key!

This legislation can take many forms. Some proposals aim to create a more level playing field for smaller lenders, who may struggle to compete with larger banks that can absorb fee increases more easily. Others focus on providing targeted assistance to first-time homebuyers or those in underserved communities. The specifics vary, but the underlying goal is often the same: to ensure that homeownership remains accessible and affordable for as many people as possible.

Why Should You Care? Seriously!

Okay, you might be thinking, "This is all interesting, but why should *I* care?" Here's the deal: this impacts your wallet, your community, and the overall economy.

If you’re a homeowner: These fees can affect your mortgage interest rate, which means you’re paying more or less each month. Over the long term, that can add up to a significant chunk of change.

If you’re a prospective homeowner: Higher fees can make it harder to qualify for a mortgage, pushing your dream of homeownership further out of reach. It’s like the bouncer at the club raising the dress code standards – suddenly, you can’t get in!

If you're just generally interested in a healthy economy: A stable housing market is crucial for a strong economy. When more people can afford to buy homes, it stimulates economic growth, creates jobs, and strengthens communities. Think of it as planting seeds – a healthy housing market helps the whole garden flourish.

Imagine the housing market as a giant game of dominoes. If Fannie and Freddie aren't doing their job correctly (or if they're burdened by unfair regulations), the whole chain can fall apart, impacting everyone from builders to real estate agents to homeowners to renters.

So, What Can You Do?

Now that you're armed with this newfound knowledge, what can you do? Don’t just sit back and let the legislative winds blow you around!

- Stay informed: Keep an eye on news about Fannie Mae, Freddie Mac, and any related legislation. Knowledge is power!

- Contact your representatives: Let your elected officials know your thoughts on these issues. Tell them how these fees impact you and your community. Your voice matters!

- Talk to a financial advisor: A financial advisor can help you understand how these changes might affect your specific financial situation and help you plan accordingly.

Think of it as voting with your wallet and your voice! By staying informed and engaged, you can help shape the future of the housing market and ensure that homeownership remains a viable option for everyone.

In conclusion, understanding Fannie Mae, Freddie Mac, and the legislation surrounding their fees might not be the most exciting topic in the world, but it's undeniably important. It's about more than just mortgages; it's about financial stability, community development, and the American dream of homeownership. So, go forth, be informed, and make your voice heard!