Farmers and Merchants Bank in Weeping Water, Nebraska, stands as a community bank deeply rooted in the agricultural heartland. Established in 1902, the institution has weathered economic fluctuations and technological advancements, adapting its services while maintaining a commitment to local customers. Its history reflects the evolution of banking practices in rural America.

History and Founding Principles

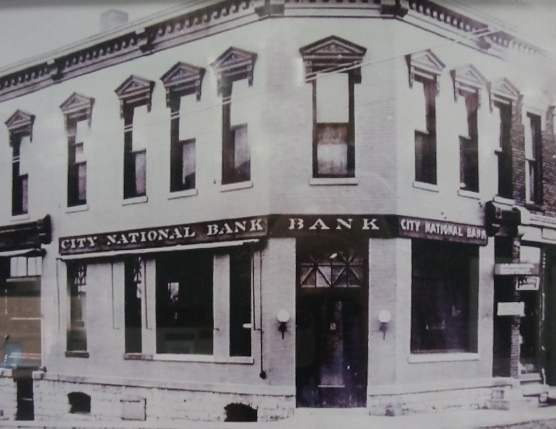

The early 20th century saw a surge in community bank formations, driven by the need for localized financial services to support growing agricultural sectors. Farmers and Merchants Bank of Weeping Water was founded amidst this movement. Its initial focus was providing loans and deposit accounts tailored to the needs of farmers, merchants, and other local businesses.

The bank's founding principles emphasized trust, integrity, and a long-term commitment to the Weeping Water community. This commitment is reflected in its sustained presence over a century, demonstrating a resilience that contrasts with the consolidation seen in the broader banking industry.

Early Operations and Growth

In its early years, Farmers and Merchants Bank operated primarily with traditional banking methods, relying on face-to-face interactions and a deep understanding of its customers' financial situations. Loan decisions were often based on personal relationships and a comprehensive knowledge of the local economy. The bank's growth was intrinsically linked to the prosperity of the surrounding agricultural community. Successive generations of local families have entrusted their financial well-being to the bank.

During the Great Depression, the bank faced significant challenges, as did many financial institutions across the nation. However, Farmers and Merchants Bank managed to navigate this period by working closely with its customers, offering flexible loan repayment options, and maintaining a conservative lending approach. This period solidified its reputation for stability and community support.

Services and Products

Farmers and Merchants Bank offers a range of financial services designed to meet the diverse needs of its customer base. These services encompass both personal and commercial banking, with a particular emphasis on supporting agricultural enterprises.

Personal Banking

The personal banking services include checking and savings accounts, mortgage loans, personal loans, and credit cards. These services are designed to provide convenient and accessible banking options for individuals and families within the Weeping Water community. Online and mobile banking platforms offer convenient access to accounts and services.

Commercial Banking

For businesses, Farmers and Merchants Bank offers a comprehensive suite of commercial banking products and services. These include commercial loans, lines of credit, business checking accounts, and cash management services. The bank's expertise in agricultural lending is a key differentiator, providing specialized financial support to local farmers and ranchers.

“We understand the unique challenges and opportunities faced by agricultural businesses,” states a representative from the bank. “Our commitment is to provide tailored financial solutions that help them thrive.”

Agricultural Lending

Agricultural lending forms a significant portion of the bank's business. Loans are available for various purposes, including farm equipment purchases, livestock financing, crop production, and farm real estate. The bank's lending officers possess a deep understanding of agricultural practices and market conditions, enabling them to provide informed and relevant financial advice to their customers.

The bank actively participates in government-sponsored agricultural lending programs, such as those offered by the Farm Service Agency (FSA), to further support its agricultural customers. This participation allows the bank to provide access to a wider range of financing options and favorable loan terms.

Community Involvement

Farmers and Merchants Bank is deeply invested in the well-being of the Weeping Water community. Its involvement extends beyond providing financial services to encompass various philanthropic and community support initiatives. Active participation in local events, sponsorships of community organizations, and employee volunteerism are hallmarks of the bank's community engagement.

Supporting Local Organizations

The bank provides financial support to numerous local organizations, including schools, churches, and civic groups. This support helps these organizations to provide essential services and programs to the community. The bank also encourages its employees to volunteer their time and talents to local causes.

Scholarship Programs

Farmers and Merchants Bank operates scholarship programs that support students pursuing higher education. These scholarships provide financial assistance to deserving students from the Weeping Water area, helping them to achieve their academic goals and contribute to the future of the community. These scholarships often prioritize students pursuing degrees in agriculture or related fields.

The bank also sponsors financial literacy programs in local schools, teaching students about the importance of saving, budgeting, and responsible financial management. This education helps to prepare students for financial success in their adult lives. Education is a key component of their investment in the future of Weeping Water.

Technology and Innovation

While maintaining its traditional values, Farmers and Merchants Bank has embraced technology and innovation to enhance its services and improve customer experience. The bank offers online and mobile banking platforms, allowing customers to access their accounts and conduct transactions from anywhere with an internet connection. These platforms provide a range of features, including bill payment, funds transfer, and account balance monitoring.

Online and Mobile Banking

The online and mobile banking platforms are designed to be user-friendly and secure, providing customers with a convenient and reliable way to manage their finances. The bank employs robust security measures to protect customer data and prevent fraud. Regular updates and enhancements are made to the platforms to ensure they remain current with the latest technological advancements.

Adapting to Changing Customer Needs

The bank recognizes the importance of adapting to changing customer needs and preferences. It continually evaluates its services and products to ensure they meet the evolving demands of its customer base. This adaptability is essential for the bank to remain competitive in the ever-changing financial landscape.

Challenges and Opportunities

Farmers and Merchants Bank, like all community banks, faces a number of challenges and opportunities in today's financial environment. These include increased regulatory scrutiny, competition from larger banks and non-bank financial institutions, and the need to attract and retain talented employees. The bank must also continue to adapt to the rapid pace of technological change.

Regulatory Compliance

Regulatory compliance is a significant challenge for all banks, but particularly for smaller community banks that may lack the resources of larger institutions. Farmers and Merchants Bank dedicates significant resources to ensuring it complies with all applicable laws and regulations. This includes investments in compliance technology and training for its employees.

Competition

The banking industry has become increasingly competitive, with larger banks and non-bank financial institutions vying for customers. Farmers and Merchants Bank differentiates itself by providing personalized service, local expertise, and a strong commitment to the community. This focus on customer relationships and community involvement helps the bank to maintain its competitive edge. *Personalized service* is a core tenet of their value proposition.

Attracting and Retaining Talent

Attracting and retaining talented employees is essential for the long-term success of any organization. Farmers and Merchants Bank offers competitive compensation and benefits packages, as well as opportunities for professional development and advancement. The bank also fosters a positive and supportive work environment that encourages employee engagement and loyalty.

Conclusion

Farmers and Merchants Bank of Weeping Water has demonstrated remarkable resilience and adaptability throughout its history. By focusing on its core values of trust, integrity, and community commitment, the bank has navigated economic challenges and technological advancements while maintaining a strong presence in the Weeping Water community.

Key takeaways:

- Long-standing Commitment: The bank's 120+ year history underscores its deep roots and dedication to the community.

- Agricultural Focus: Specialized lending and expertise in agriculture are key differentiators.

- Community Involvement: Active participation in local initiatives strengthens the bank's relationship with its customers.

- Adaptability: Embracing technology while maintaining traditional values allows the bank to meet evolving customer needs.

Farmers and Merchants Bank continues to play a vital role in the financial well-being of the Weeping Water community, supporting local businesses, families, and agricultural enterprises. Its future success will depend on its ability to maintain its core values while adapting to the ever-changing financial landscape.