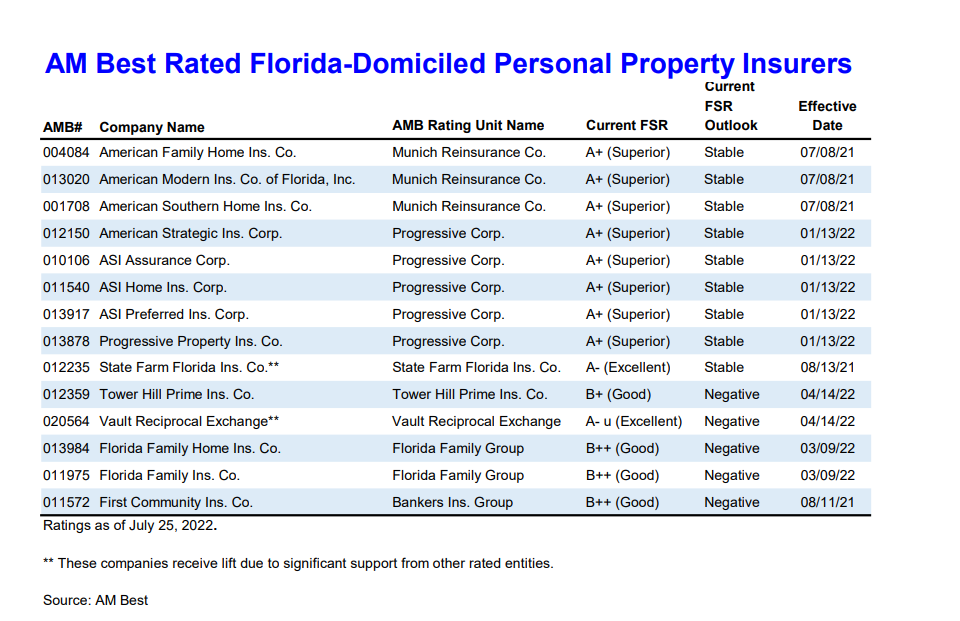

Federal Insurance Company and its Am Best Rating

Federal Insurance Company is a subsidiary of Chubb Limited, a global insurance organization known for its comprehensive range of insurance products and services. A critical element in understanding the financial strength and stability of any insurance company, including Federal Insurance Company, is its rating from independent rating agencies like AM Best. These ratings provide an assessment of an insurer’s ability to meet its ongoing obligations to policyholders.

Understanding AM Best Ratings

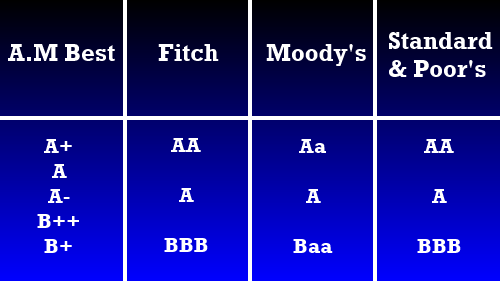

AM Best is a highly respected credit rating agency specializing in the insurance industry. Their ratings are widely used as benchmarks for evaluating the financial strength of insurance companies. The AM Best rating system uses a scale ranging from A++ (Superior) to D (Poor), with various intermediate levels. These ratings are based on a comprehensive analysis of a company's balance sheet strength, operating performance, and business profile.

The rating assigned by AM Best is not simply a measure of past performance but a forward-looking assessment of the insurer’s ability to withstand future economic and industry-specific challenges. The rating process involves a thorough review of financial statements, underwriting practices, investment strategies, and management expertise.

Federal Insurance Company’s AM Best Rating

Federal Insurance Company consistently maintains a high AM Best rating, typically within the "Superior" range. As of my last knowledge update, Federal Insurance Company holds an A++ (Superior) rating from AM Best. This rating reflects AM Best's opinion that Federal Insurance Company has a superior ability to meet its ongoing insurance obligations.

This high rating is indicative of the company's strong capitalization, conservative underwriting practices, and prudent investment management. Chubb's overall financial strength further supports Federal Insurance Company's ability to weather adverse market conditions and fulfill its commitments to policyholders.

Factors Contributing to the High Rating

Several key factors contribute to Federal Insurance Company's consistently high AM Best rating:

Strong Capitalization

A robust capital base is essential for an insurance company to absorb unexpected losses and maintain its financial stability. Federal Insurance Company benefits from Chubb's strong capitalization, which provides a significant buffer against potential underwriting and investment losses. The company maintains a conservative approach to capital management, ensuring that it has sufficient resources to meet its obligations even in challenging economic environments.

Conservative Underwriting Practices

Underwriting is the process of assessing and pricing risk. Federal Insurance Company employs disciplined and conservative underwriting practices, carefully evaluating the risks it assumes and setting premiums accordingly. This approach helps to minimize underwriting losses and maintain profitability over the long term.

The company's underwriting expertise extends across a wide range of insurance lines, including property, casualty, and specialty risks. By diversifying its portfolio and managing risks effectively, Federal Insurance Company reduces its exposure to any single line of business or geographic region.

Prudent Investment Management

An insurance company's investment portfolio plays a crucial role in its overall financial performance. Federal Insurance Company follows a prudent investment strategy, focusing on high-quality, liquid assets. This approach minimizes investment risk and ensures that the company has ready access to funds to pay claims.

The company's investment portfolio is diversified across various asset classes, including fixed income securities, equities, and real estate. This diversification helps to reduce volatility and enhance long-term returns.

Chubb’s Support and Reputation

As a subsidiary of Chubb, Federal Insurance Company benefits from the financial strength, brand recognition, and operational expertise of its parent company. Chubb is a global leader in the insurance industry, with a long history of financial stability and underwriting excellence. This association provides Federal Insurance Company with a significant competitive advantage and enhances its ability to attract and retain customers.

Chubb's strong reputation for claims handling and customer service also contributes to Federal Insurance Company's overall success. Policyholders can have confidence in the company's ability to respond promptly and fairly to claims, providing peace of mind in times of need.

Implications of the AM Best Rating for Policyholders

The AM Best rating of Federal Insurance Company has significant implications for policyholders:

Financial Security

The A++ (Superior) rating indicates that Federal Insurance Company has a very strong ability to meet its financial obligations to policyholders. This provides policyholders with assurance that the company will be able to pay claims, even in the event of large-scale losses or economic downturns.

Competitive Pricing

A strong financial rating allows Federal Insurance Company to offer competitive pricing on its insurance products. Because the company is financially stable and well-managed, it can afford to offer lower premiums without sacrificing its ability to pay claims.

Access to a Wide Range of Products and Services

Federal Insurance Company offers a comprehensive range of insurance products and services, catering to the needs of individuals, families, and businesses. The company's strong financial rating allows it to invest in product development and innovation, ensuring that it can continue to meet the evolving needs of its customers.

Peace of Mind

Perhaps the most important benefit of the AM Best rating is the peace of mind it provides to policyholders. Knowing that their insurance company is financially sound and well-managed allows policyholders to focus on their lives and businesses without worrying about the financial security of their insurance coverage.

Monitoring and Updates to the Rating

It's crucial to remember that AM Best ratings are not static. They are subject to ongoing monitoring and review by the rating agency. Changes in a company's financial performance, underwriting results, investment portfolio, or business strategy can lead to changes in its AM Best rating. Therefore, it's recommended that stakeholders periodically check for updates to the rating to stay informed about the company's financial strength.

AM Best typically announces rating changes through press releases and updates on its website. Insurance professionals and policyholders should stay informed about these updates to assess the ongoing financial stability of Federal Insurance Company.

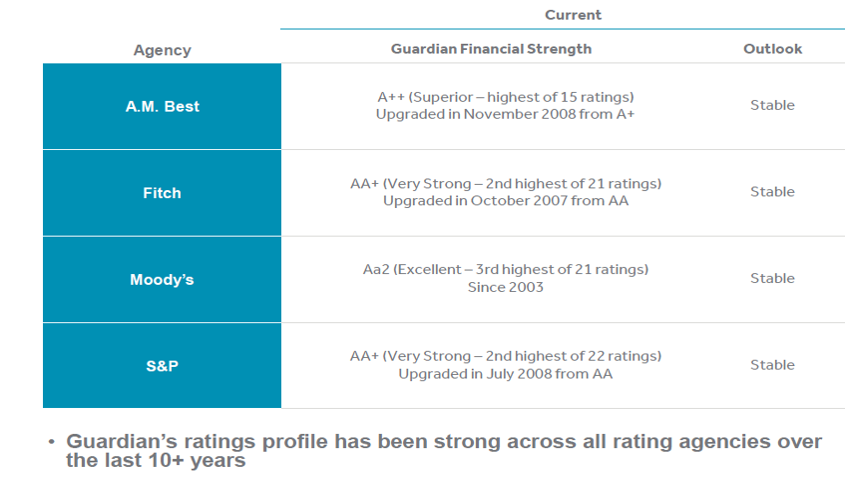

Alternative Rating Agencies

While AM Best is the most widely recognized rating agency for the insurance industry, other agencies also provide ratings for insurance companies. These include Standard & Poor's (S&P), Moody's, and Fitch Ratings. While the methodologies and rating scales may differ slightly, all these agencies aim to assess the financial strength and stability of insurance companies.

It's generally considered beneficial to consider ratings from multiple agencies to gain a more comprehensive understanding of an insurance company's financial condition. However, AM Best is often considered the gold standard in the insurance industry due to its long history and specialized focus.

Conclusion

The A++ (Superior) rating from AM Best for Federal Insurance Company is a testament to its financial strength, conservative underwriting practices, and prudent investment management. As a subsidiary of Chubb, the company benefits from the resources and expertise of a global leader in the insurance industry. This high rating provides policyholders with assurance that Federal Insurance Company has a superior ability to meet its obligations, offering financial security and peace of mind.

Key Takeaways:

- Federal Insurance Company holds an A++ (Superior) rating from AM Best.

- This rating reflects the company's strong capitalization, conservative underwriting, and prudent investment strategy.

- The high rating provides policyholders with confidence in the company's ability to pay claims.

- The rating is continuously monitored and subject to change.

- Federal Insurance Company benefits from the financial strength and reputation of its parent company, Chubb.