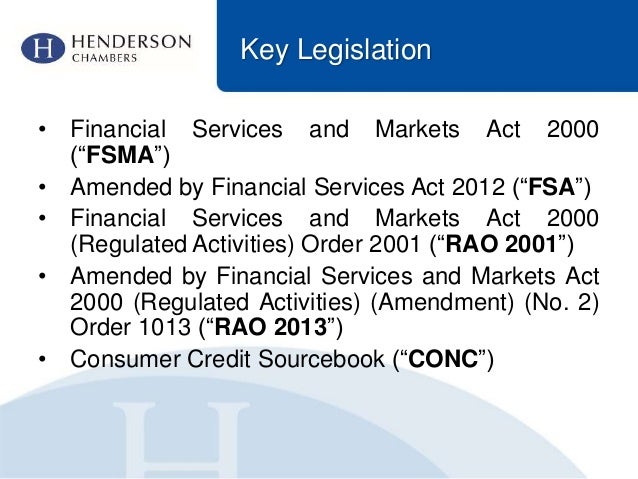

The Financial Services and Markets Act 2000 (FSMA 2000) represents a watershed moment in the regulation of the UK's financial services industry. Its enactment fundamentally reshaped the landscape, consolidating and modernizing a previously fragmented system. To fully appreciate its significance, we must delve into the causes that necessitated its creation, the profound effects it has had, and the long-term implications for the UK economy and its standing in the global financial arena.

Causes: The Need for Reform

Prior to FSMA 2000, the regulation of financial services in the UK was characterized by a multiplicity of regulatory bodies, each with its own distinct remit and approach. Key players included the Securities and Investments Board (SIB), along with various self-regulatory organizations (SROs) like the Securities and Futures Authority (SFA) and the Investment Management Regulatory Organisation (IMRO). This decentralized structure suffered from several critical weaknesses.

Firstly, regulatory overlap and gaps created confusion and potential loopholes. Firms could exploit these ambiguities, leading to inconsistent enforcement and a lack of clarity for both businesses and consumers. The sheer number of agencies also made it difficult to coordinate regulatory responses to emerging risks and challenges. For example, the collapse of Barings Bank in 1995, partly attributed to inadequate oversight, highlighted the systemic risks inherent in the existing framework.

Secondly, the SRO system lacked sufficient independence and accountability. These organizations were funded and governed by the firms they were meant to regulate, raising concerns about conflicts of interest and the potential for regulatory capture. This perceived lack of impartiality undermined public confidence in the regulatory regime and its ability to effectively protect consumers.

Thirdly, the existing legislation was outdated and ill-equipped to deal with the rapid pace of innovation and globalization in financial markets. The emergence of new financial products and services, coupled with the increasing interconnectedness of financial institutions across borders, demanded a more flexible and adaptable regulatory framework. The old rules were simply not designed to address these new complexities.

Finally, there was a growing recognition of the need for a more consumer-focused approach to financial regulation. The existing regime placed insufficient emphasis on protecting the interests of retail investors and ensuring fair treatment by financial firms. The increasing complexity of financial products made it even more crucial to empower consumers with the information and protection they needed to make informed decisions.

In essence, FSMA 2000 was born out of a desire to create a more robust, coherent, and forward-looking regulatory framework that could better protect consumers, maintain market integrity, and promote the stability of the UK financial system.

Effects: A New Regulatory Landscape

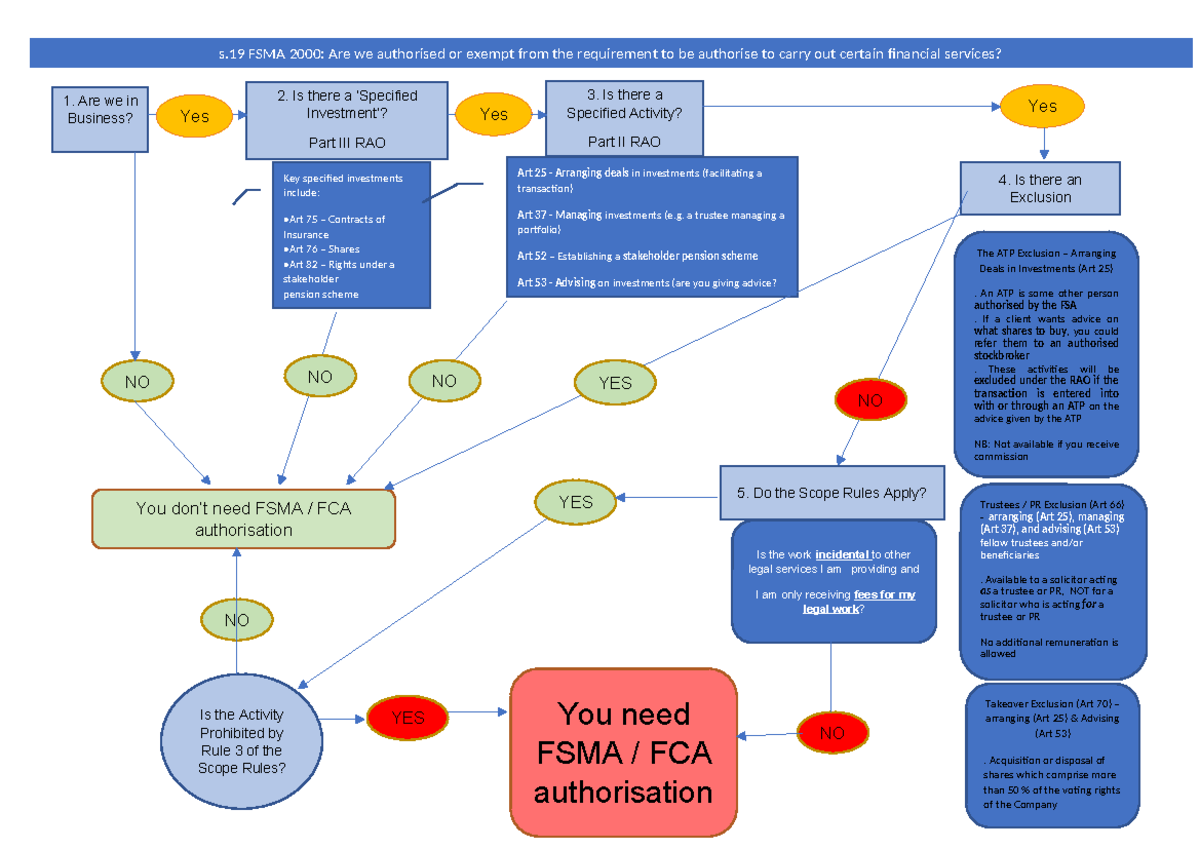

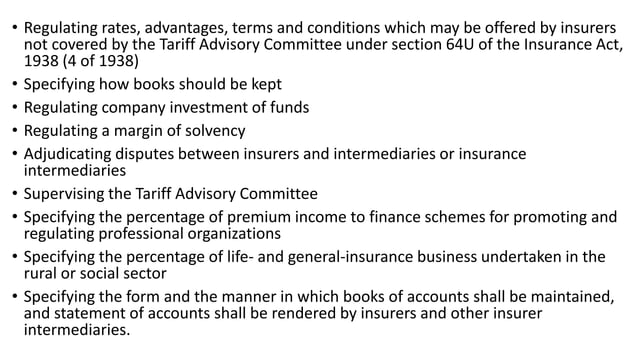

The immediate and most significant effect of FSMA 2000 was the establishment of the Financial Services Authority (FSA) as the single regulator for the entire UK financial services industry. This consolidation represented a radical departure from the previous fragmented system. The FSA assumed responsibility for regulating banks, building societies, insurance companies, investment firms, and other financial institutions.

The creation of the FSA led to greater consistency and clarity in regulation. With a single body responsible for setting and enforcing the rules, firms faced a more uniform and predictable regulatory environment. This reduced the potential for regulatory arbitrage and facilitated better compliance.

FSMA 2000 also introduced a principles-based approach to regulation. Rather than relying solely on detailed rules, the FSA emphasized a set of overarching principles that firms were expected to adhere to. This allowed for greater flexibility and adaptability in responding to changing market conditions and emerging risks. For instance, Principle 6 of the FSA's Handbook required firms to "pay due regard to the interests of its customers and treat them fairly."

Furthermore, the Act strengthened consumer protection. It established a statutory framework for regulating the sale of financial products and services, requiring firms to provide clear and accurate information to customers and to ensure that products were suitable for their needs. The Financial Ombudsman Service (FOS) was also created to provide an independent and accessible mechanism for resolving disputes between consumers and financial firms.

The Act also had a significant impact on market integrity. It introduced new powers to combat market abuse, including insider dealing and market manipulation. The FSA was given the authority to investigate and prosecute offenders, sending a clear message that such behavior would not be tolerated. The increased focus on market integrity helped to maintain investor confidence and promote the efficient functioning of financial markets.

However, the FSA's reign was not without its criticisms. In the wake of the 2008 financial crisis, the FSA was widely criticized for its perceived failings in regulating the banking sector. Critics argued that the FSA had been too light-touch in its approach and had failed to adequately address the risks building up in the financial system. This ultimately led to the abolition of the FSA in 2013 and the creation of a new regulatory structure, comprising the Financial Conduct Authority (FCA) and the Prudential Regulation Authority (PRA).

Implications: A Lasting Legacy

Despite the subsequent dismantling of the FSA, FSMA 2000 has had a lasting impact on the UK financial services industry. The fundamental principles and structures it established continue to shape the regulatory landscape today.

The focus on principles-based regulation and consumer protection remains a cornerstone of the FCA's approach. The FCA continues to emphasize the importance of treating customers fairly and ensuring that financial products are suitable for their needs. The FOS also continues to play a vital role in resolving disputes and providing redress to consumers.

The emphasis on market integrity and the prevention of market abuse also remains a priority. The FCA has continued to invest in surveillance and enforcement capabilities to detect and prosecute offenders, sending a strong deterrent message.

Perhaps the most significant long-term implication of FSMA 2000 is the increased level of regulatory scrutiny and accountability that financial firms now face. The Act established a culture of compliance and transparency that has fundamentally changed the way financial institutions operate.

However, the regulatory landscape continues to evolve. The rise of fintech and the increasing digitalization of financial services present new challenges for regulators. The UK must adapt its regulatory framework to keep pace with these changes and ensure that it remains effective in protecting consumers, maintaining market integrity, and promoting financial stability.

Furthermore, Brexit has added another layer of complexity to the UK financial regulatory landscape. The UK is no longer bound by EU financial regulations and has the opportunity to develop its own distinct approach. However, it is crucial that the UK maintains close cooperation with international regulators to ensure that its financial system remains globally competitive and that it can effectively address cross-border risks.

The data supports the significance of FSMA 2000. Studies from organizations such as the Bank of England have shown a marked increase in regulatory compliance costs for financial institutions following the Act's implementation, indicating a greater emphasis on adherence to rules and principles. Furthermore, while difficult to directly attribute, consumer confidence in financial institutions has shown a gradual improvement since the Act's inception, suggesting a positive impact on trust, even with periods of decline following crises.

Broader Significance

The Financial Services and Markets Act 2000 stands as a testament to the ongoing effort to balance innovation and regulation in the financial services sector. It reflects a continuous search for the optimal framework to promote economic growth, protect consumers, and maintain the stability of the financial system. While subsequent events and evolving market dynamics have necessitated adjustments and reforms, the core principles enshrined in FSMA 2000 – transparency, accountability, and consumer protection – remain fundamental to the UK's approach to financial regulation. The Act's legacy serves as a reminder that effective regulation is not a static endpoint, but rather a dynamic process of adaptation and refinement in response to the ever-changing complexities of the global financial landscape. It underlines the critical role of robust oversight in ensuring a fair and stable financial system that benefits both individuals and the broader economy.