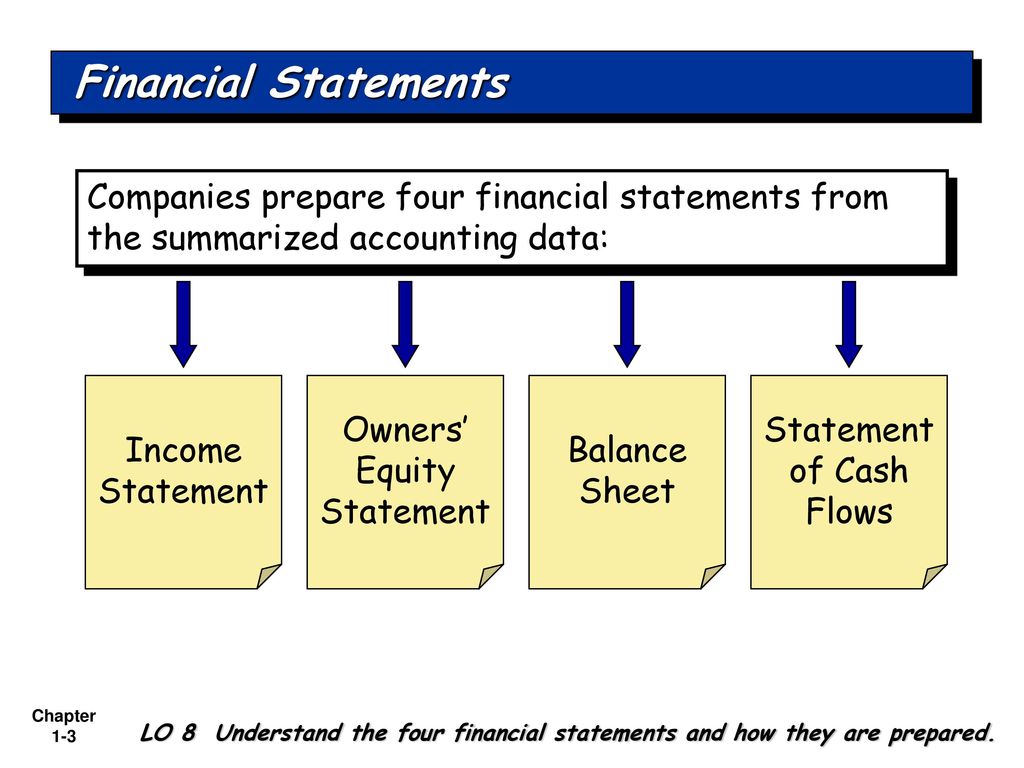

Okay, so financial statements. Sounds snoozeworthy, right? Wrong! Think of them as a company's secret diary, only instead of juicy gossip, it's all about the moolah. And like any good diary, there's a specific order to how it's written. Let’s dive in!

First Up: The Income Statement – Where the Magic Happens!

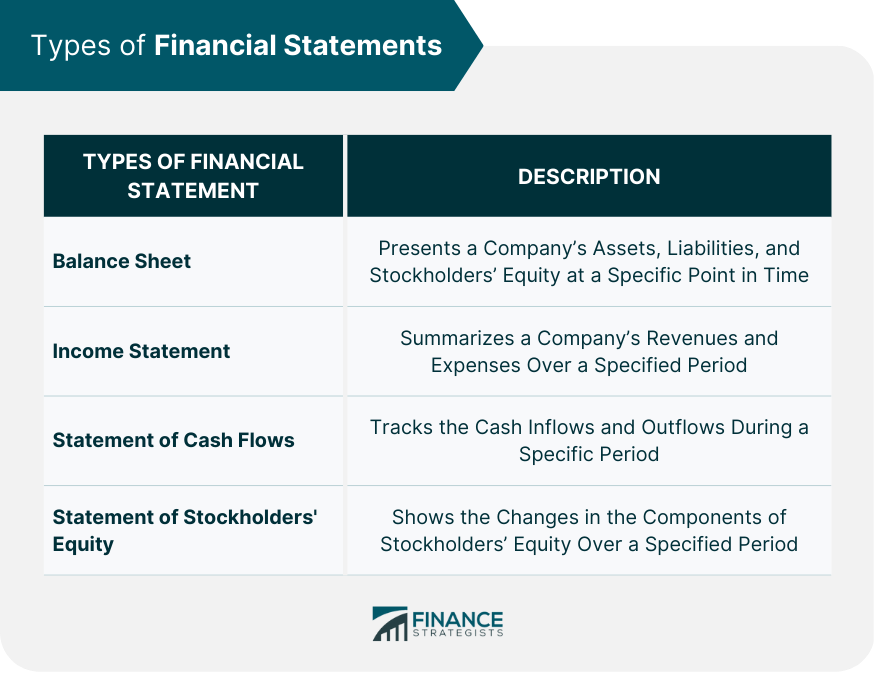

This is where the company shouts, "Look what I made!" It's like their annual performance review, only with more numbers and less awkward small talk. It’s also often called the Profit and Loss (P&L) statement. Fancy, huh?

What’s the Story?

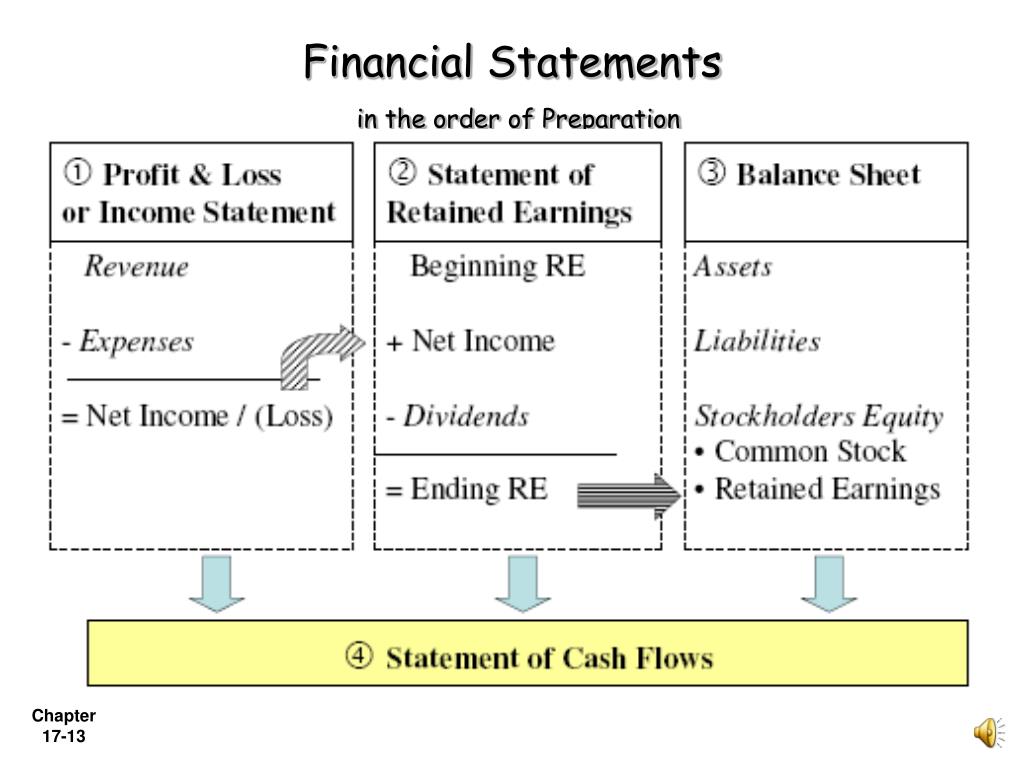

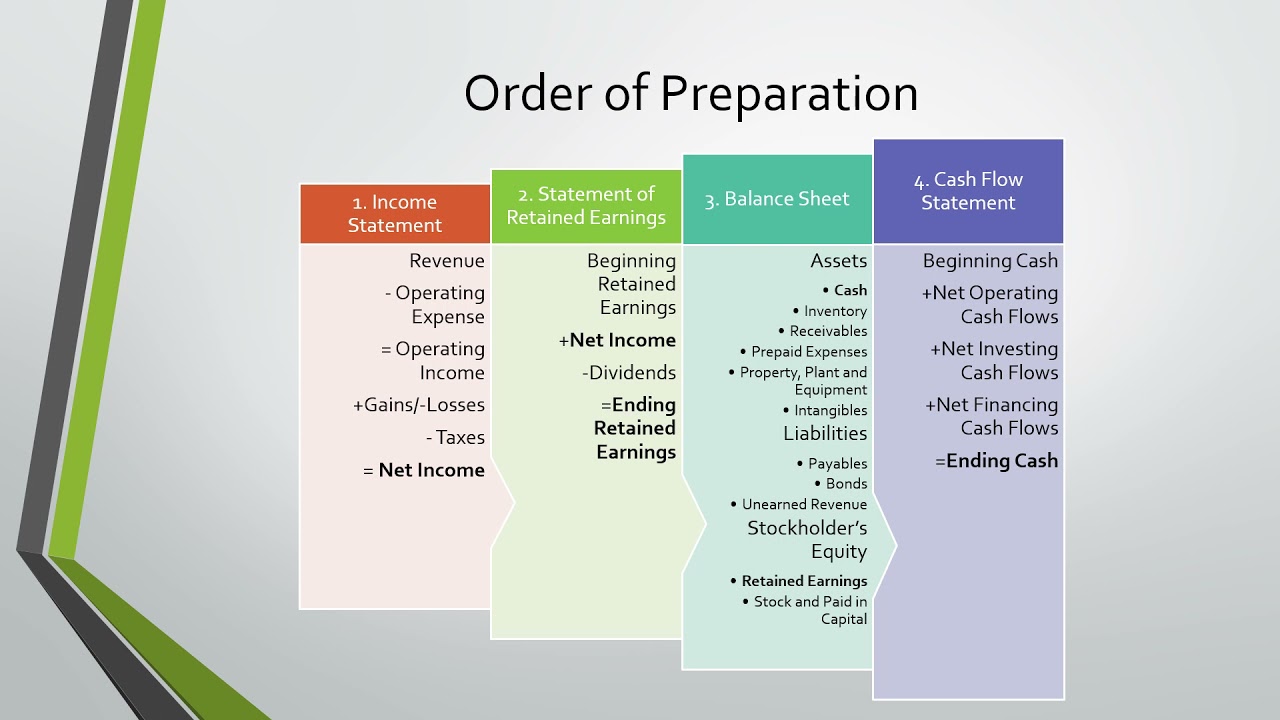

The Income Statement shows the company’s revenue (all the cash coming in) minus its expenses (all the cash going out) over a specific period, like a quarter or a year. Simple, right?

Think of it like this: You sell lemonade for $100 (revenue). You spent $20 on lemons and sugar (expenses). Your income statement shows you made a sweet $80 profit! (Net Income). BOOM! Lemonade empire in the making!

Did you know some companies spend *more* on coffee for their employees than they do on marketing? Okay, maybe not, but it's fun to imagine! This would seriously impact their Net Income!

Next! The Statement of Retained Earnings – Where the Profits Go to Hide (Kinda)

Okay, so you made all this money, great! But where does it *go*? This statement tracks how much of that profit the company keeps (retains) to reinvest in the business, and how much they give back to shareholders (dividends). It's like deciding whether to buy a new lemonade stand or pay yourself a bonus (or both!).

The Retention Game

Companies retain earnings for all sorts of reasons: expansion, research and development, paying off debt, or just having a safety net. It's basically their piggy bank for future awesomeness.

Ever wonder why some companies never seem to pay dividends? They might be hoarding those retained earnings for a big, secret project. Maybe they're building a rocket to sell lemonade on Mars!

The formula is super straightforward: Beginning Retained Earnings + Net Income - Dividends = Ending Retained Earnings. See? No rocket science here! Just good old-fashioned financial wizardry.

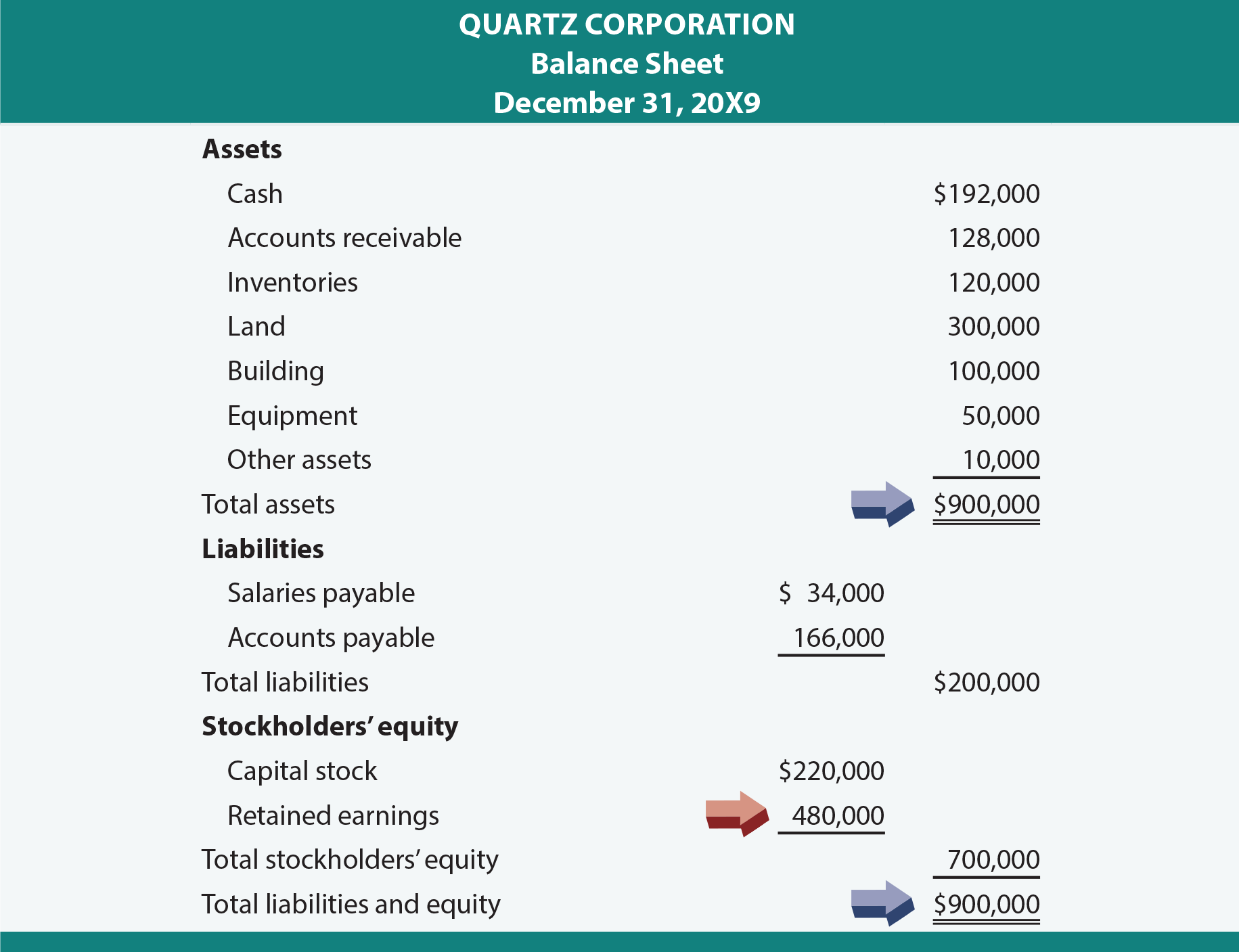

Then Comes the Balance Sheet – A Snapshot of What You Own and Owe

The Balance Sheet is a company’s photo album. At a single point in time, it showcases what the company owns (assets), what it owes (liabilities), and the owners' stake in the company (equity). It's all about balance, hence the name!

Assets, Liabilities, and Equity – Oh My!

Assets are things like cash, buildings, equipment, and even those ridiculously expensive coffee machines. Liabilities are things like loans, bills, and that awkward IOU you signed for your friend’s birthday present. Equity is essentially what's left over for the owners after you subtract liabilities from assets. It's the company's net worth.

The fundamental accounting equation: Assets = Liabilities + Equity. This has to ALWAYS be true. If it isn't, Houston, we have a problem! It means someone fudged the numbers (hopefully by accident!).

Fun Fact: Companies with massive stockpiles of cash are sometimes seen as boring. Investors want to see that money being put to work, not just sitting in a vault like Scrooge McDuck's!

Finally! The Statement of Cash Flows – Follow the Money!

This statement tracks the movement of cash both into and out of the company. It’s not just about profit; it’s about cold, hard cash. A company can be profitable but still run out of cash, which is, like, a major bummer.

Cash is King (or Queen!)

The Statement of Cash Flows has three main sections:

- Operating Activities: Cash flow from the company's core business operations (selling lemonade, making widgets, etc.).

- Investing Activities: Cash flow from buying and selling long-term assets, like equipment or investments.

- Financing Activities: Cash flow from borrowing money, issuing stock, or paying dividends.

Imagine a business that's showing a profit on paper, but all its customers are paying on credit. They're technically making money, but they don't have the cash to pay their bills! The Statement of Cash Flows would reveal this potential crisis.

It's like knowing how much is in your bank account versus how much you think you have based on your budget. The Statement of Cash Flows brings you back to reality!

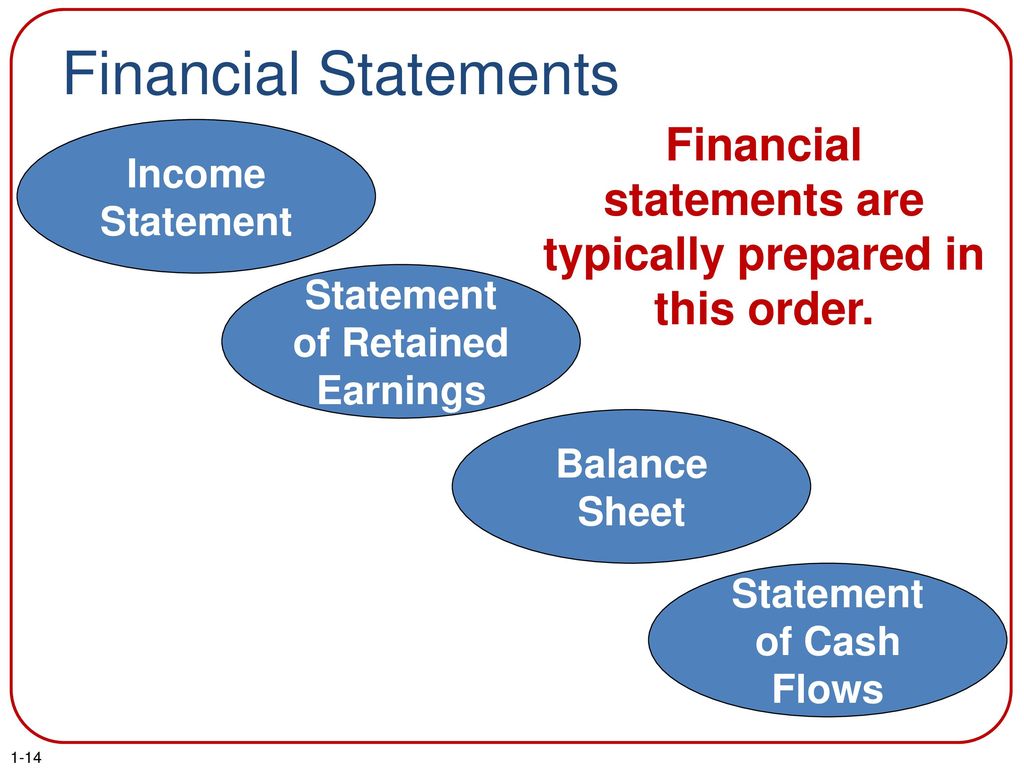

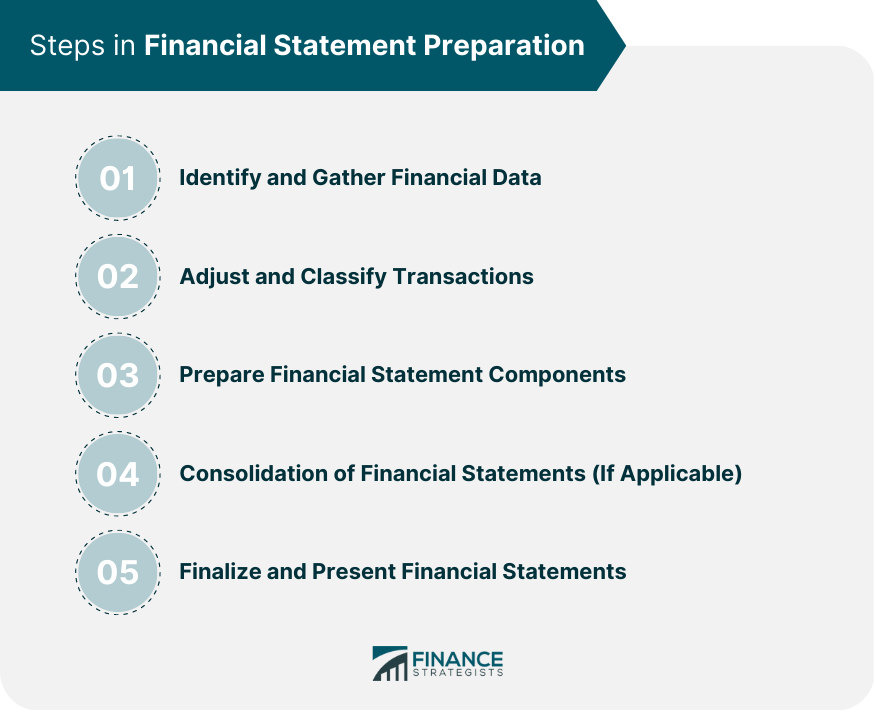

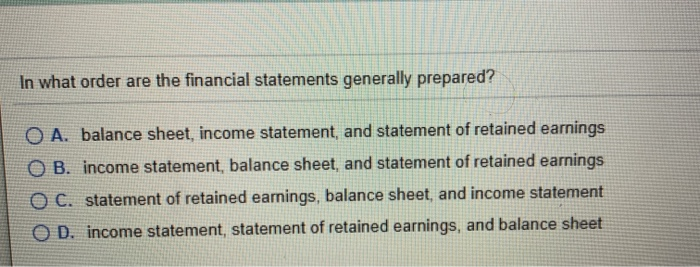

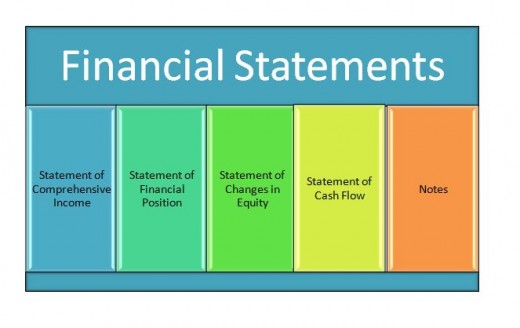

Why This Order Matters (and Why You Should Care!)

The order isn't random. Each statement feeds into the next, creating a logical flow of information. It's like a financial relay race!

The Net Income from the Income Statement flows into the Statement of Retained Earnings.

The Ending Retained Earnings flows into the Equity section of the Balance Sheet.

The Cash Balance on the Balance Sheet is reconciled with the Statement of Cash Flows.

Understanding this order gives you a holistic view of a company's financial health. You can see how profits are generated, where they go, and how they translate into actual cash. Pretty cool, huh?

Plus, knowing the order can help you spot potential red flags. For example, if a company is showing consistent profits but struggling with cash flow, it might be a sign of trouble. Think excessive borrowing, poor credit management, or just plain old bad luck.

Learning about financial statements is like unlocking a secret code to understanding the business world. It empowers you to make smarter investment decisions, evaluate companies more effectively, and impress your friends at parties (okay, maybe not parties, but you get the idea!).

So, the next time you hear someone mention "financial statements," don't run for the hills! Embrace the numbers, explore the stories they tell, and remember – it's all about the order!

One more thing. Always remember to check the footnotes, which are found at the bottom of each financial statement. This is where the company hides all its secrets. Okay, maybe not *all* its secrets, but the important ones that are material in making financial decisions.

Now go forth and conquer the financial world! Or at least, understand it a little bit better. You got this!

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-01-3998c75d45bb4811ad235ef4eaf17593.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-03-aac8341b98da4fd3a4f13ed3ee7fa053.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-02-6a82acc4cf2d4434a77899c09d49e737.jpg)