Okay, let's talk about financial statements! I know, I know, it might sound about as exciting as watching paint dry. But trust me, understanding how these things are put together is like unlocking a secret cheat code to understanding… well, pretty much everything about a business. And *that* is definitely something to get excited about!

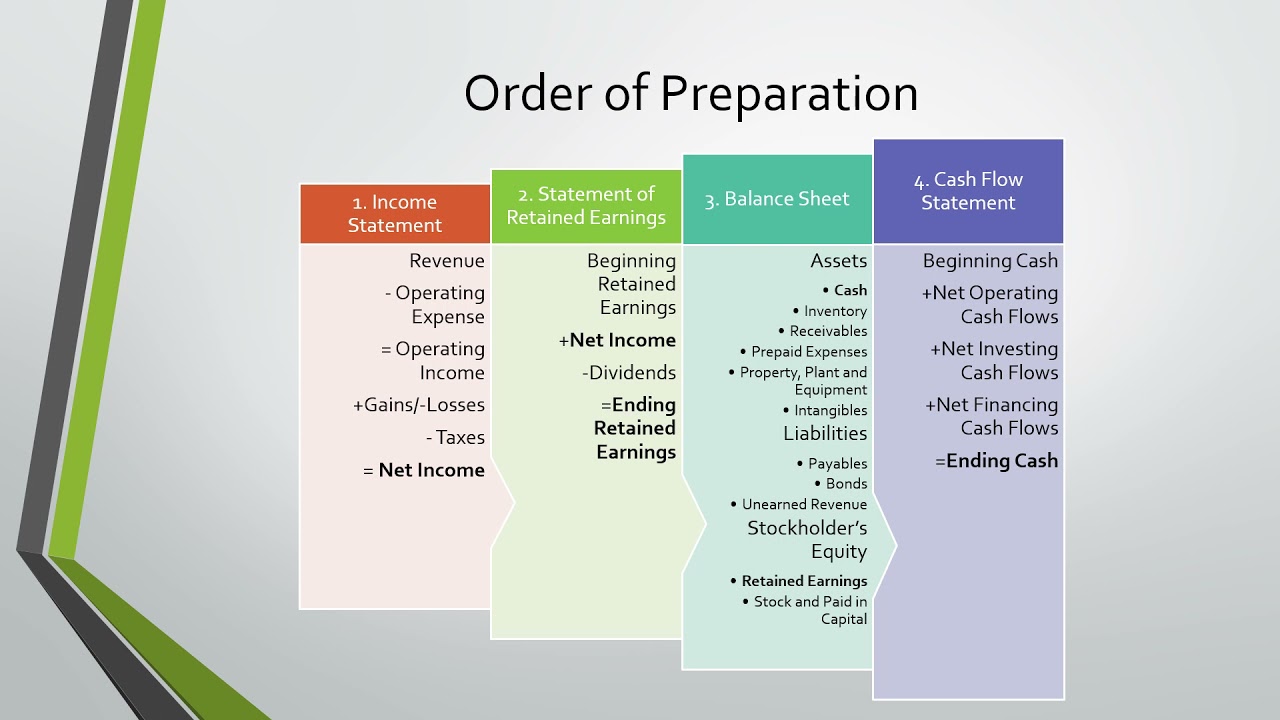

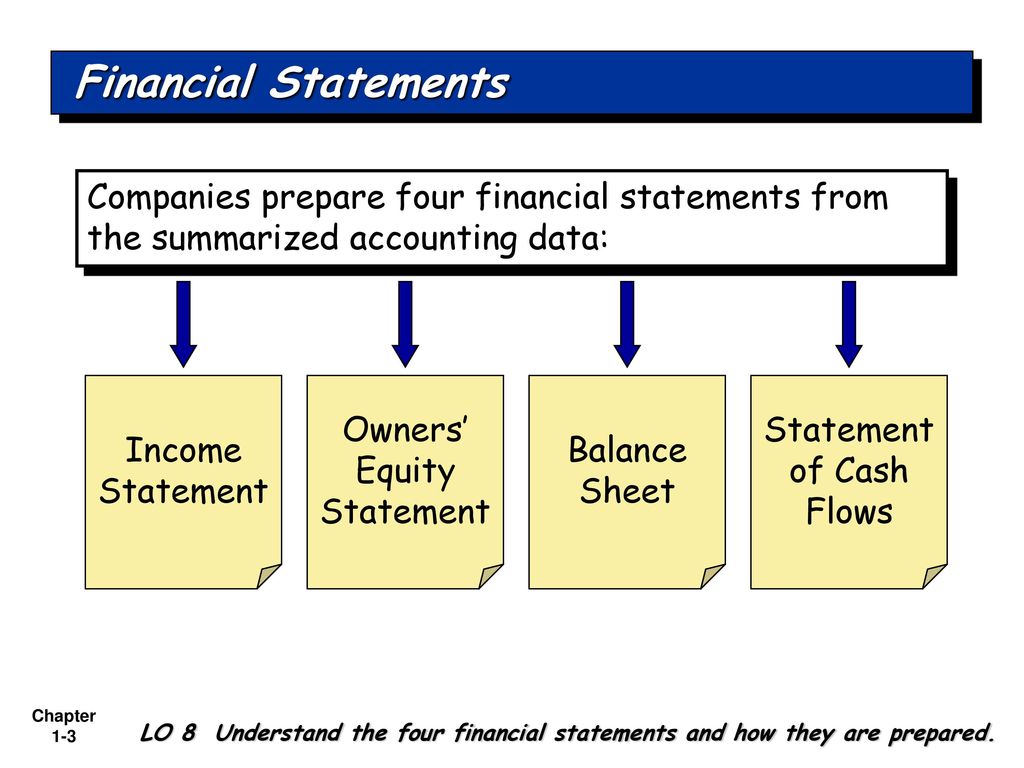

We're going to focus on the order in which these statements are typically prepared. Why does the order matter? Because each one feeds into the next! Think of it like baking a cake – you can't put the frosting on before you bake the cake, right? Same principle here.

The Financial Statement Lineup: A Step-by-Step Guide

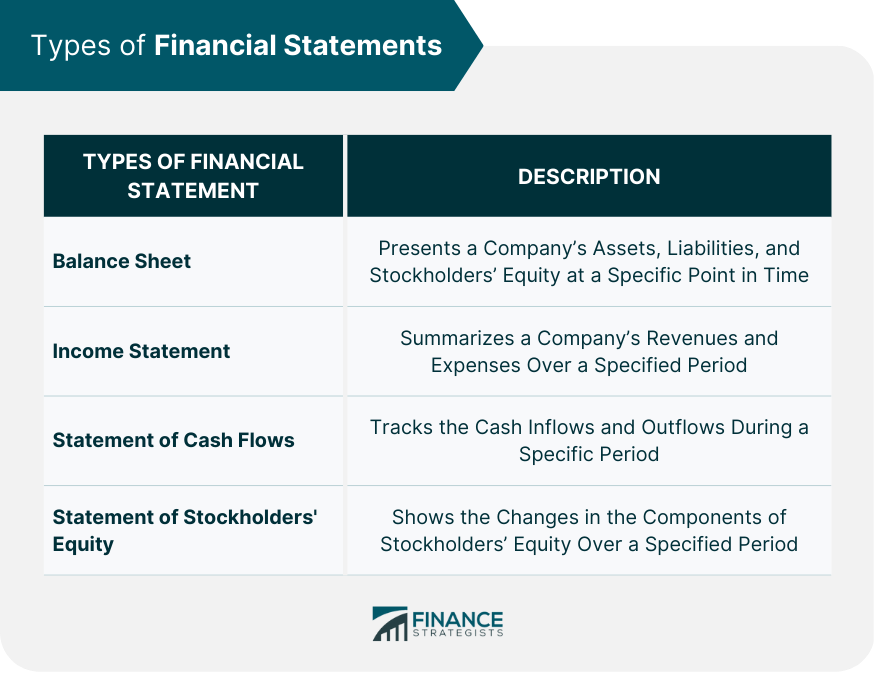

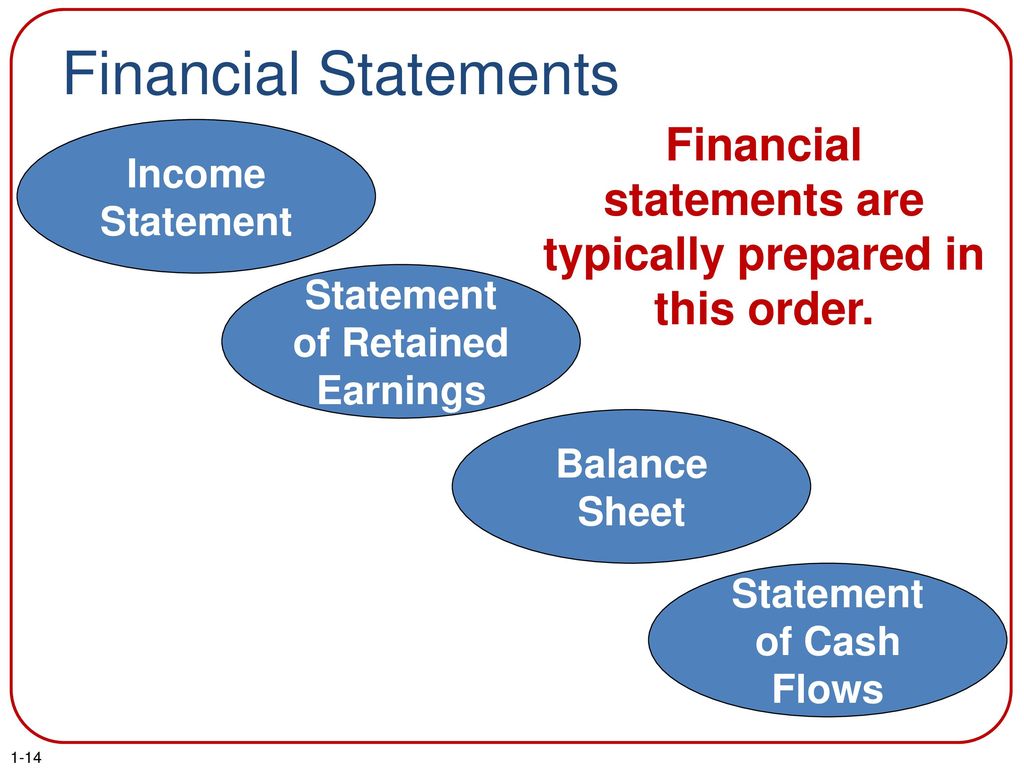

So, what are these financial statements we're talking about? The main ones are the Income Statement, the Statement of Retained Earnings (or Statement of Changes in Equity), and the Balance Sheet. Oh, and we can't forget the Statement of Cash Flows! Don't worry, we'll break them down.

And guess what? They're not just for bean counters! Understanding these statements can help *you* make better decisions, whether you're investing in the stock market, starting your own business, or even just trying to manage your personal finances better. Pretty cool, huh?

Step 1: The Income Statement – Where the Magic Happens (aka Revenue Meets Expenses)

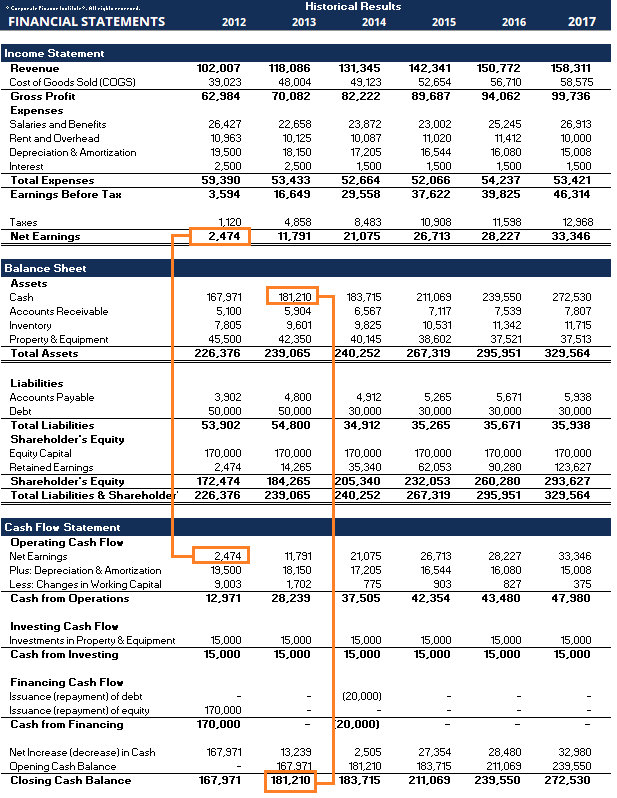

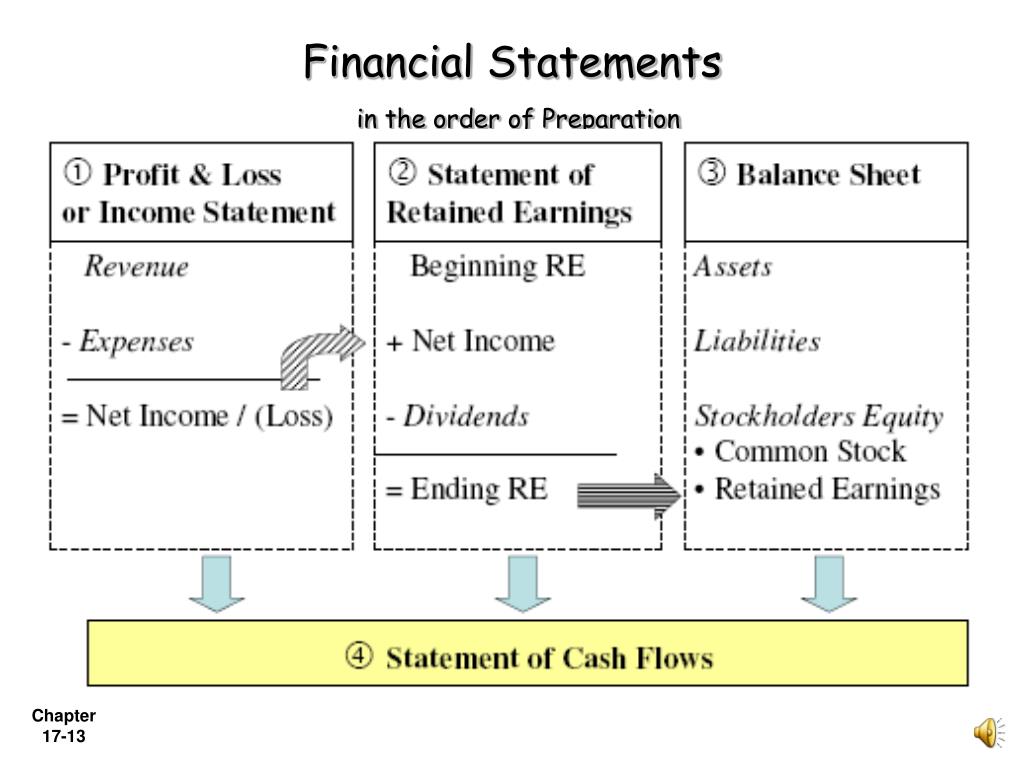

The first one up to bat is the Income Statement (sometimes called the Profit and Loss Statement, or P&L). This statement shows a company's financial performance over a specific period – usually a month, a quarter, or a year. Basically, it's a report card for how well the company did at making money! You want to know if a company is profitable, *this* is where you look.

It follows a pretty simple formula: Revenue - Expenses = Net Income (or Net Loss). Revenue is the money the company brought in from selling its products or services. Expenses are the costs the company incurred to generate that revenue.

Think of it like this: you're selling lemonade. Your revenue is all the money you made from selling cups of lemonade. Your expenses are the cost of the lemons, sugar, water, and maybe even those cute little paper cups. The difference between your revenue and expenses is your profit (or, if you spent too much on lemons, your loss!).

The Income Statement includes things like:

- Revenue: Sales, service revenue, etc.

- Cost of Goods Sold (COGS): The direct costs of producing the goods or services sold.

- Gross Profit: Revenue - COGS.

- Operating Expenses: Salaries, rent, utilities, marketing, etc.

- Operating Income: Gross Profit - Operating Expenses.

- Interest Expense: The cost of borrowing money.

- Income Tax Expense: Taxes owed on the company's income.

- Net Income: The bottom line! Revenue - All Expenses. *This is what everyone is looking for.*

Why is this first? Because the net income figure from the Income Statement is a crucial ingredient for the next statement: The Statement of Retained Earnings!

Step 2: The Statement of Retained Earnings – Where Profits Go to Grow (or Not!)

Next up is the Statement of Retained Earnings (or, more broadly, the Statement of Changes in Equity). This statement shows how much of a company's past earnings have been kept (retained) in the business, rather than paid out to shareholders as dividends. It essentially tracks the changes in the company’s retained earnings account over a specific period.

Think of it like your personal savings account. You start with a balance, you add to it with your income (or, in this case, the company's net income), and you might take some out for expenses (or, in this case, dividends). The Statement of Retained Earnings shows how that account has changed over time.

The basic formula is:

Beginning Retained Earnings + Net Income - Dividends = Ending Retained Earnings

So, where does that Net Income come from? You guessed it: the Income Statement! See how they're all connected?

Key components of the Statement of Retained Earnings:

- Beginning Retained Earnings: The amount of retained earnings at the start of the period.

- Net Income: As calculated on the Income Statement. *Important connection here!*

- Dividends: Payments made to shareholders.

- Ending Retained Earnings: The amount of retained earnings at the end of the period. *This figure is crucial for the next statement.*

The ending retained earnings balance becomes a crucial component of the Balance Sheet. So, you're starting to see how the order is completely crucial.

Step 3: The Balance Sheet – A Snapshot of What You Own (and Owe!)

Now we're ready for the Balance Sheet! This statement is like a financial snapshot of a company at a specific point in time. It shows what the company *owns* (its assets), what it *owes* (its liabilities), and the owners' stake in the company (its equity). Think of it as a picture taken at a specific moment, showing the company's financial position.

The Balance Sheet is based on the fundamental accounting equation:

Assets = Liabilities + Equity

Assets are things the company owns that have value, like cash, accounts receivable (money owed to the company), inventory, equipment, and buildings. Liabilities are what the company owes to others, like accounts payable (money the company owes to suppliers), loans, and salaries payable. Equity represents the owners' stake in the company. It includes things like common stock and, you guessed it, retained earnings!

Key components of the Balance Sheet include:

- Assets:

- Cash

- Accounts Receivable

- Inventory

- Property, Plant, and Equipment (PP&E)

- Liabilities:

- Accounts Payable

- Salaries Payable

- Loans Payable

- Equity:

- Common Stock

- Retained Earnings (from the Statement of Retained Earnings!)

The Balance Sheet provides a crucial overview of a company's financial health and stability. Lenders, investors, and management all use this statement to assess the company's ability to meet its obligations and grow its business.

Step 4: The Statement of Cash Flows – Following the Money Trail

Finally, we have the Statement of Cash Flows. This statement tracks the movement of cash both *into* and *out of* a company over a specific period. It breaks down cash flows into three main categories:

- Operating Activities: Cash flows from the company's core business activities, like selling goods or services.

- Investing Activities: Cash flows from buying or selling long-term assets, like property, plant, and equipment (PP&E).

- Financing Activities: Cash flows from borrowing money, repaying debt, issuing stock, or paying dividends.

Think of it as following the money trail. Where did the company get its cash? Where did it spend its cash? The Statement of Cash Flows answers these questions.

While the Income Statement uses accrual accounting (recognizing revenue when it's earned and expenses when they're incurred, regardless of when cash changes hands), the Statement of Cash Flows focuses solely on *actual cash transactions*. This makes it a crucial tool for assessing a company's liquidity (its ability to meet its short-term obligations).

The Statement of Cash Flows utilizes information from both the Income Statement and the Balance Sheet (specifically, changes in balance sheet accounts) to determine the cash flows from operating, investing, and financing activities. So, technically, the Statement of Cash Flows is usually prepared *after* those two key statements.

Why Does This Order Matter So Much?

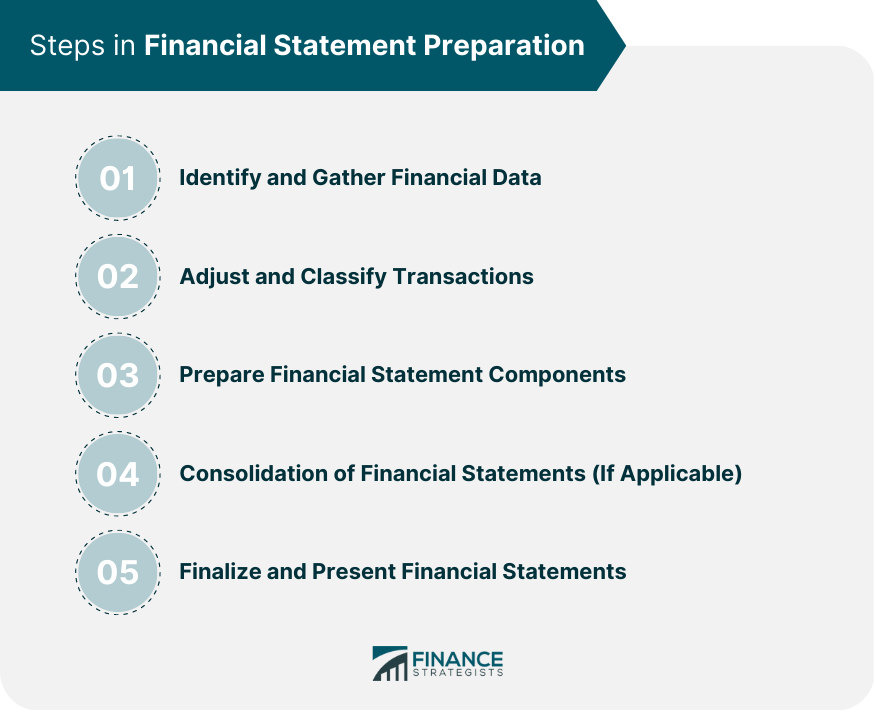

Okay, let's recap why the order in which these financial statements are prepared is so important. It all comes down to the flow of information:

- Income Statement provides the net income figure, which is needed for the Statement of Retained Earnings.

- Statement of Retained Earnings provides the ending retained earnings balance, which is needed for the Balance Sheet.

- Statement of Cash Flows uses information from both the Income Statement and Balance Sheet.

Without this sequential flow, the financial statements wouldn't be accurate or reliable. It's like trying to build a house without a foundation! *Everything needs to build off the previous statement.*

Beyond the Basics: Diving Deeper

Now that you understand the order in which financial statements are prepared, you're well on your way to becoming a financial whiz! But this is just the beginning. There's a whole world of financial analysis waiting to be explored.

Consider learning about:

- Financial Ratios: Using financial statement data to calculate key ratios that can help you assess a company's profitability, liquidity, solvency, and efficiency.

- Trend Analysis: Comparing financial statement data over time to identify trends and patterns.

- Benchmarking: Comparing a company's financial performance to that of its competitors.

These tools can help you make even more informed decisions about investing, lending, and managing your own finances.

Ready to Take the Plunge?

See? Financial statements aren't so scary after all! They're just a way to tell a company's story in numbers. And the more you understand these numbers, the better equipped you'll be to make smart financial decisions. It's empowering!

Learning about finance doesn't have to be boring. There are tons of resources available online, in libraries, and even through online courses. Embrace the challenge, and who knows? Maybe you'll discover a hidden passion for numbers! Seriously, knowing how money works can be incredibly liberating. It lets you take control and build the financial future you want.

So, go forth and explore the wonderful world of finance! You've got this! You can demystify this topic, become more financially literate, and feel amazing knowing you're mastering a skill that will benefit you forever. Start small, be consistent, and most importantly, have fun learning!

![[Solved] The following is the complete set of fina | SolutionInn - Financial Statements Are Typically Prepared In The Following Order](https://s3.amazonaws.com/si.question.images/image/images9/524-B-A-I-S(1384)-1.png)

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-01-3998c75d45bb4811ad235ef4eaf17593.jpg)