High Yield Savings Accounts (HYSAs) have become increasingly popular financial tools, offering consumers a way to maximize the interest earned on their savings. Among the various financial institutions offering these accounts, Mountain America Credit Union provides a HYSA option designed to appeal to a broad range of savers. This article will delve into the specifics of Mountain America's High Yield Savings Account, exploring its features, benefits, and potential drawbacks, offering a comprehensive overview for anyone considering this savings option.

What is a High Yield Savings Account?

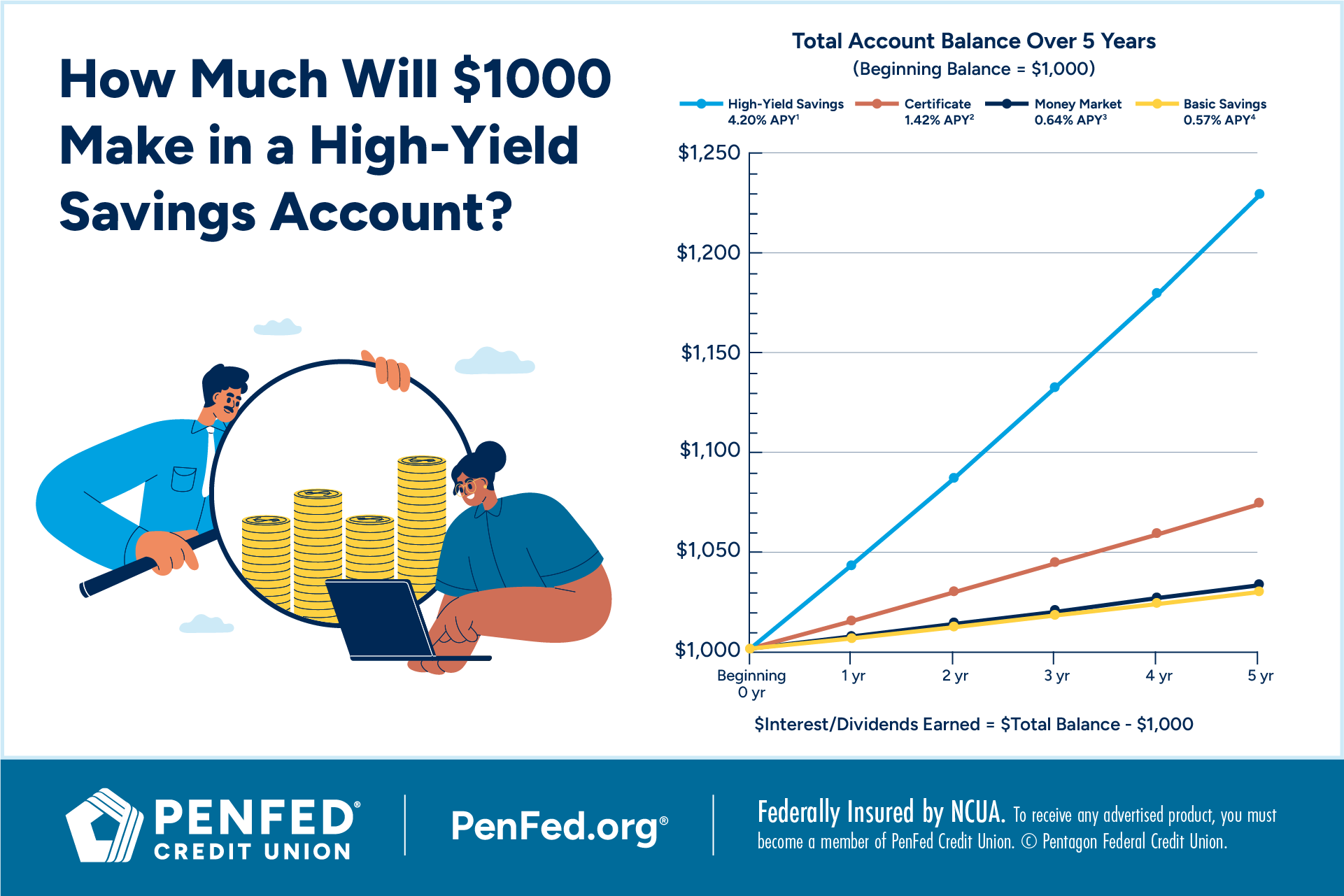

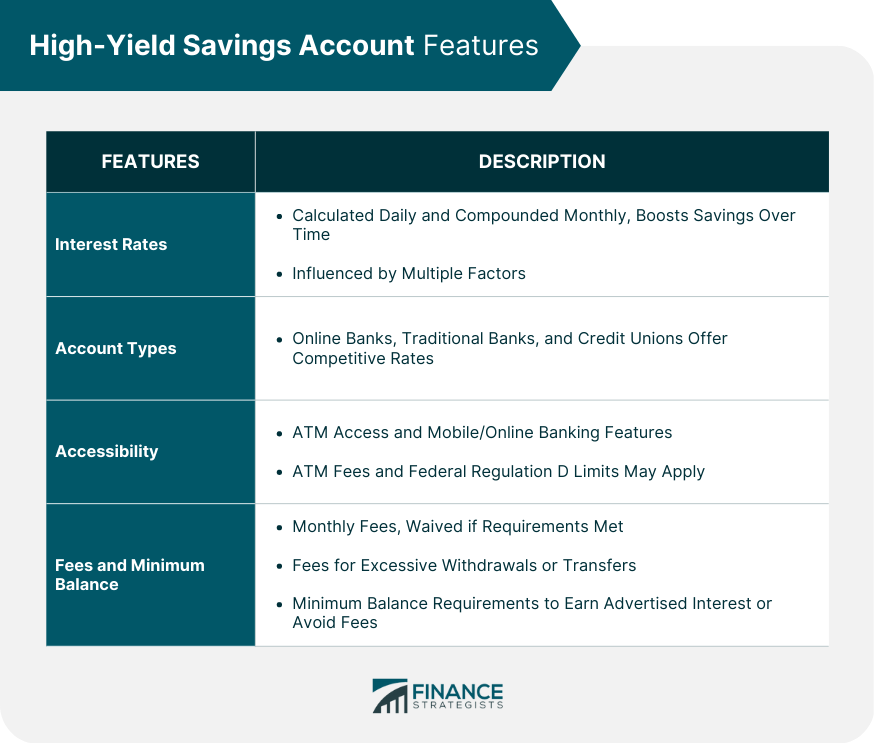

Before examining Mountain America's offering, it's essential to understand the fundamentals of a High Yield Savings Account. Unlike traditional savings accounts, HYSAs offer significantly higher interest rates, often expressed as Annual Percentage Yield (APY). This higher APY allows your money to grow at a faster pace, making it an attractive option for those looking to save for specific goals, build an emergency fund, or simply maximize their returns on idle cash.

The higher interest rates are typically offered because these accounts are often managed online, reducing overhead costs for the financial institution. This, in turn, allows them to pass on some of those savings to the consumer in the form of higher interest rates. It's important to note that while HYSAs offer higher returns, they are still savings accounts and are therefore subject to certain limitations, such as withdrawal limits and potential fees for excessive transactions.

Mountain America's High Yield Savings Account: Features and Benefits

Mountain America Credit Union offers a High Yield Savings Account designed to provide members with competitive interest rates and convenient access to their funds. While specific details can change, some common features and benefits typically associated with this account include:

Competitive Interest Rates

The primary appeal of Mountain America's HYSA is its competitive APY. The specific rate will fluctuate based on market conditions and the credit union's internal policies, so it's crucial to check the current rate directly on their website or by contacting a representative. However, the goal is to consistently offer a rate that is significantly higher than the national average for traditional savings accounts.

FDIC Insurance

Like most reputable savings accounts, Mountain America's HYSA is typically insured by the Federal Deposit Insurance Corporation (FDIC). This means that your deposits are protected up to $250,000 per depositor, per insured bank. This insurance provides peace of mind knowing that your savings are safe, even in the unlikely event of a bank failure.

Online and Mobile Accessibility

Mountain America typically offers robust online and mobile banking platforms that allow you to easily manage your HYSA. You can check your balance, transfer funds, view transaction history, and perform other account-related tasks from your computer or mobile device. This accessibility makes it convenient to manage your savings from anywhere, at any time.

No Monthly Maintenance Fees (Potentially)

Many HYSAs, including Mountain America's, are designed to be fee-free. This means that there are typically no monthly maintenance fees to worry about. However, it's always important to confirm this with the credit union, as fee structures can vary and are subject to change. Be sure to inquire about any potential fees associated with specific transactions or account activity.

Easy Transfers

Moving money into and out of your HYSA should be a relatively straightforward process. Mountain America typically allows you to link external bank accounts to facilitate electronic transfers. This allows you to easily move funds from your checking account or other savings accounts into your HYSA to take advantage of the higher interest rates.

Potential Considerations and Drawbacks

While Mountain America's HYSA offers numerous benefits, it's important to consider potential drawbacks before opening an account:

Membership Requirements

Mountain America Credit Union is a member-owned financial institution. This means that you typically need to meet certain eligibility requirements to become a member and open an account, including the HYSA. These requirements may involve living, working, or attending school in a specific geographic area, or being affiliated with a particular organization. Be sure to review the membership requirements on the Mountain America website or contact a representative to determine if you are eligible.

Interest Rate Fluctuations

The APY on a HYSA is not fixed. It can fluctuate based on market conditions, the Federal Reserve's interest rate policies, and the credit union's internal decisions. This means that the interest rate you earn today may not be the same rate you earn tomorrow. While the rate is generally higher than traditional savings accounts, it can still go down.

Withdrawal Limitations

Like all savings accounts, Mountain America's HYSA is subject to Regulation D, which limits the number of certain types of withdrawals and transfers you can make per month. Exceeding these limits may result in fees or account closure. It's important to be aware of these limitations and plan your withdrawals accordingly.

Minimum Balance Requirements (Potentially)

While many HYSAs are designed to be accessible to a wide range of savers, some may have minimum balance requirements to earn the advertised APY or to avoid certain fees. Be sure to check the terms and conditions of Mountain America's HYSA to determine if there are any minimum balance requirements.

Comparison Shopping

It's always a good idea to compare the features and interest rates of different HYSAs before making a decision. Other financial institutions may offer higher APYs or different features that better suit your needs. Take the time to research and compare different options to ensure you are getting the best possible return on your savings.

Opening a Mountain America High Yield Savings Account

The process of opening a Mountain America High Yield Savings Account typically involves the following steps:

- Check Eligibility: Ensure you meet the membership requirements for Mountain America Credit Union.

- Gather Information: Have your Social Security number, driver's license or other form of identification, and funding information ready.

- Apply Online or In Person: Visit the Mountain America website or a local branch to complete the application.

- Fund the Account: Transfer funds from an existing bank account or deposit cash or a check to fund your new HYSA.

- Review Account Details: Carefully review the account terms and conditions, including interest rates, fees, and withdrawal limitations.

Conclusion

Mountain America's High Yield Savings Account offers a valuable opportunity to earn a higher return on your savings compared to traditional savings accounts. With competitive interest rates, FDIC insurance, and convenient online access, it can be an attractive option for those looking to maximize their savings potential. However, it's crucial to consider membership requirements, potential interest rate fluctuations, and withdrawal limitations before opening an account. By carefully evaluating your needs and comparing different options, you can determine if Mountain America's HYSA is the right choice for you.

The importance of High Yield Savings Accounts lies in their ability to combat the effects of inflation and provide a more substantial return on your savings. In a low-interest-rate environment, maximizing your savings potential is crucial for achieving your financial goals, whether it's building an emergency fund, saving for a down payment on a home, or simply growing your wealth over time.

![Best High Yield Savings Accounts [Rates Updated Daily] - High Yield Savings Account Mountain America](https://thecollegeinvestor.com/wp-content/uploads/2021/06/Best-High-Yield-Savings-Accounts-July-2024.png)

:max_bytes(150000):strip_icc()/how-to-open-a-high-yield-savings-account-4770631-final-c7f448b5c0bc48658a3c6a4c7afa0a3d.jpg)