Certificate of Deposit (CD) accounts are a popular savings vehicle, particularly appealing to individuals seeking a fixed interest rate and a predictable return on their investment. Hingham Institution for Savings, a Massachusetts-based bank, offers a range of CD options. Understanding the rates associated with these CDs is crucial for prospective investors.

Understanding Certificate of Deposit (CD) Accounts

Before delving into the specifics of Hingham Institution for Savings' CD rates, it's essential to understand the fundamentals of CDs. A CD is a type of savings account that holds a fixed amount of money for a fixed period, known as the term. In exchange for keeping your money locked away for that term, the bank pays you a predetermined interest rate.

Key Features of CDs

- Fixed Interest Rate: The interest rate remains constant throughout the term of the CD, providing predictable returns.

- Fixed Term: CDs have a specific term, ranging from a few months to several years. You agree to keep your money in the CD for the duration of the term.

- Penalty for Early Withdrawal: Withdrawing funds before the CD matures typically results in a penalty, often a portion of the earned interest. This penalty discourages early access to the funds.

- FDIC Insurance: CDs held at FDIC-insured banks like Hingham Institution for Savings are insured up to $250,000 per depositor, per insured bank. This provides security for your investment.

Hingham Institution for Savings: An Overview

Hingham Institution for Savings is a community-focused bank with a history spanning over 180 years. The bank emphasizes personalized service and offers a variety of banking products, including checking accounts, savings accounts, mortgage loans, and, importantly, Certificates of Deposit.

Analyzing Hingham Institution for Savings CD Rates

Hingham Institution for Savings offers various CD options with varying terms and interest rates. The specific rates available at any given time are subject to change based on market conditions and the bank's internal policies. Therefore, it is crucial to consult the bank's official website or contact a bank representative for the most up-to-date information.

Factors Influencing CD Rates

Several factors influence the CD rates offered by Hingham Institution for Savings and other financial institutions:

- Federal Reserve Policy: The Federal Reserve (the Fed) sets the federal funds rate, which influences the interest rates that banks charge each other for overnight lending. Changes in the federal funds rate often lead to changes in CD rates.

- Market Interest Rates: Overall market interest rates, including those for Treasury bonds and other fixed-income securities, play a significant role in determining CD rates.

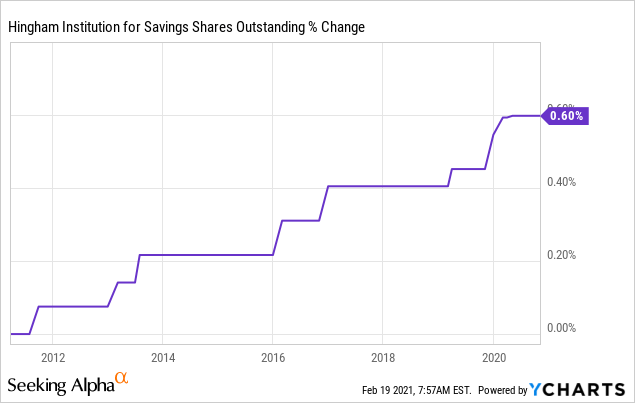

- Bank's Funding Needs: A bank's need for deposits can influence the rates it offers on CDs. If a bank needs to attract more deposits, it may offer higher CD rates.

- Competition: The rates offered by competing banks and credit unions also influence a bank's CD rates. Banks often adjust their rates to remain competitive in the market.

- CD Term: Generally, longer-term CDs offer higher interest rates than shorter-term CDs. This is because the bank has access to your funds for a longer period.

- CD Type: Some banks offer specialty CDs with higher rates but specific requirements.

Where to Find Current CD Rates

The most reliable sources for obtaining current CD rates from Hingham Institution for Savings are:

- Hingham Institution for Savings Website: Visit the official Hingham Institution for Savings website. The rates for various CD terms are usually displayed on the deposit accounts or CD pages. Look for terms like "Current Rates," "CD Rates," or "Deposit Account Rates."

- Contacting a Bank Representative: Call or visit a local branch of Hingham Institution for Savings and speak with a bank representative. They can provide you with the most current CD rates and answer any questions you may have.

Understanding the Fine Print

When reviewing CD rates, it's essential to pay attention to the fine print. Here are some key factors to consider:

- Annual Percentage Yield (APY): The APY is the actual rate of return you'll earn on your CD, taking into account the effect of compounding. Always compare CDs based on their APY.

- Minimum Deposit Requirements: Most CDs have a minimum deposit requirement, which is the minimum amount of money you need to deposit to open the CD.

- Early Withdrawal Penalties: Understand the penalties for withdrawing funds before the CD matures. These penalties can vary depending on the CD term. A common penalty is several months' worth of interest.

- Renewal Options: When your CD matures, you'll typically have the option to renew it for another term. Find out what the renewal options are and what the interest rate will be at the time of renewal.

- Compounding Frequency: The frequency with which interest is compounded (e.g., daily, monthly, quarterly) can affect the APY. More frequent compounding generally results in a higher APY.

Comparing Hingham Institution for Savings CD Rates to Other Options

Before investing in a CD at Hingham Institution for Savings, it's prudent to compare their rates to those offered by other banks, credit unions, and online banks. Use online comparison tools and rate aggregators to get a sense of the prevailing CD rates in the market. Consider the following factors when comparing CD rates:

- APY: As mentioned earlier, always compare CDs based on their APY.

- CD Term: Compare CDs with similar terms. A 1-year CD should be compared to other 1-year CDs.

- Bank Stability: Choose a financially stable bank that is FDIC-insured.

- Online vs. Brick-and-Mortar: Online banks often offer higher CD rates than brick-and-mortar banks due to lower overhead costs. Consider whether you value the convenience of online banking.

Strategies for Maximizing CD Returns

Here are some strategies for maximizing your returns on CD investments:

- Laddering: CD laddering involves investing in CDs with staggered maturities. For example, you might invest in a 1-year CD, a 2-year CD, a 3-year CD, a 4-year CD, and a 5-year CD. As each CD matures, you can reinvest the proceeds into a new 5-year CD. This strategy provides both liquidity and the potential to earn higher interest rates over time.

- Shop Around for the Best Rates: Don't settle for the first CD rate you see. Shop around and compare rates from multiple banks and credit unions.

- Consider Brokered CDs: Brokered CDs are offered through brokerage firms and can sometimes offer higher rates than CDs available directly from banks. However, be sure to research the brokerage firm and understand any fees involved.

- Take Advantage of Special Offers: Some banks occasionally offer promotional CD rates or bonuses to attract new customers. Keep an eye out for these opportunities.

Risks Associated with CD Investments

While CDs are generally considered a low-risk investment, there are still some risks to be aware of:

- Inflation Risk: If the inflation rate rises above the CD's interest rate, the real value of your investment will decrease.

- Interest Rate Risk: If interest rates rise after you lock in a CD rate, you may miss out on the opportunity to earn higher rates. This is less of a concern if you ladder your CDs.

- Early Withdrawal Penalties: As mentioned earlier, withdrawing funds before the CD matures can result in a penalty.

Conclusion

Understanding the CD rates offered by Hingham Institution for Savings, and comparing them to other options, is a crucial step in making informed financial decisions. By carefully considering factors such as the CD term, APY, minimum deposit requirements, and early withdrawal penalties, you can choose a CD that aligns with your savings goals and risk tolerance. Remember to always consult the bank's official website or contact a bank representative for the most current and accurate information. CDs offer a safe and predictable way to grow your savings, especially when interest rate security is paramount.

![Hingham Institution For Savings [HIFS] - by Ben Tewey - Hingham Institution For Savings Cd Rates](https://substackcdn.com/image/fetch/f_auto,q_auto:good,fl_progressive:steep/https://substack-post-media.s3.amazonaws.com/public/images/7749ef00-cb00-469f-9fd3-7a7f28f61546_1200x742.png)

![Hingham Institution For Savings [HIFS] - by Ben Tewey - Hingham Institution For Savings Cd Rates](https://substackcdn.com/image/fetch/f_auto,q_auto:good,fl_progressive:steep/https://bucketeer-e05bbc84-baa3-437e-9518-adb32be77984.s3.amazonaws.com/public/images/9b43a2e8-06a2-4f1e-8d36-fb51ccfd3205_990x812.png)