Alright, folks, gather 'round! Let's talk about something that sounds about as exciting as watching paint dry: a Home Equity Line of Credit, or HELOC, in Dexter, Missouri. But trust me, it can be surprisingly interesting. I mean, relatively speaking. We're not talking rollercoaster rides here, but it's definitely more thrilling than alphabetizing your spice rack.

So, picture this: you’re sitting on your porch in Dexter, sippin' sweet tea, watchin' the fireflies, and suddenly *BOOM!* inspiration strikes! You decide you need… a giant inflatable T-Rex for your front lawn. Or maybe something more practical, like, I don't know, fixing that leaky roof that’s been serenading you with a watery symphony every time it rains. Either way, you need cash. And that, my friends, is where a HELOC waltzes in, lookin' all sophisticated and helpful.

What in Tarnation is a HELOC?

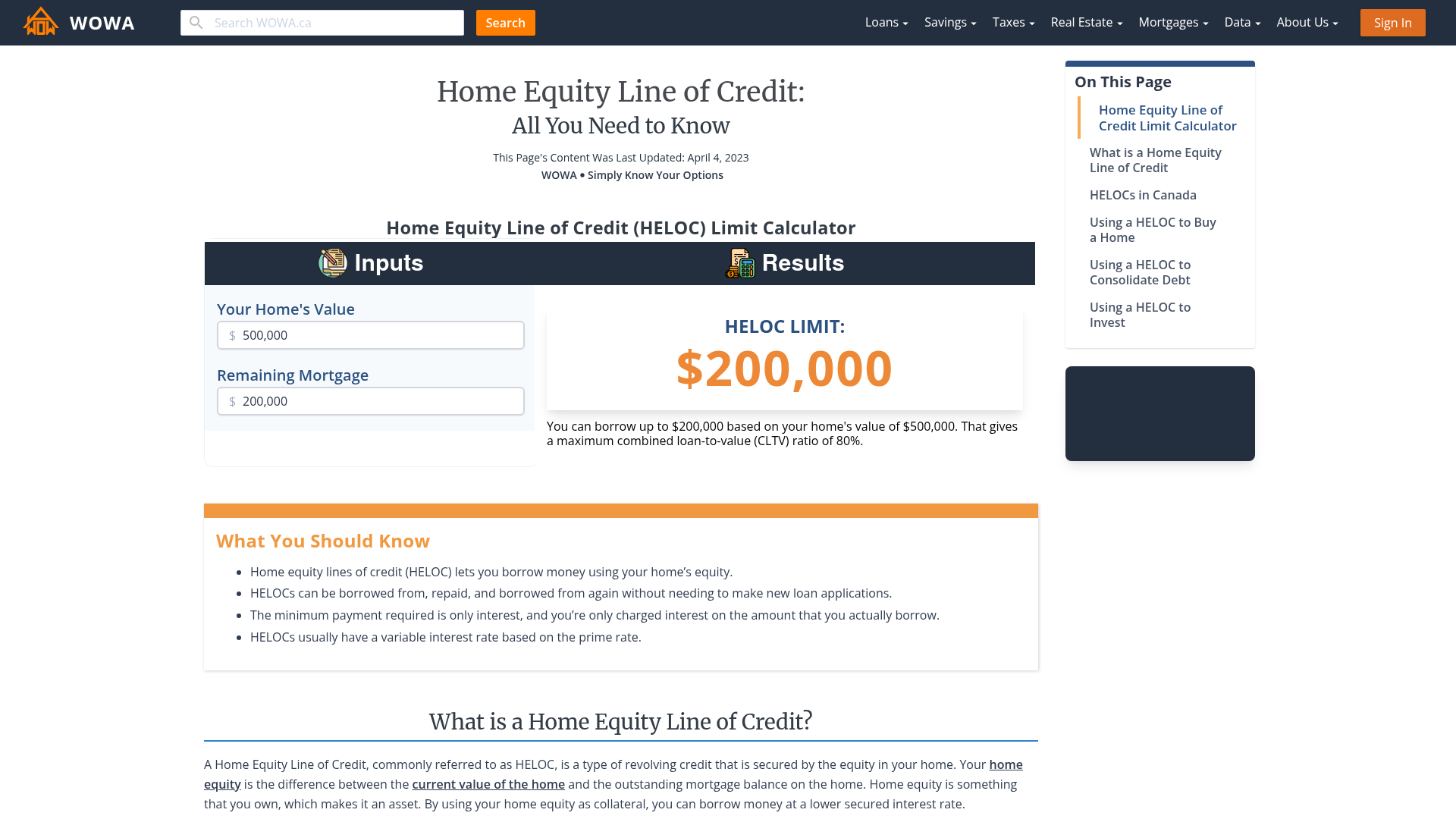

Simply put, a HELOC is like a credit card, but instead of being backed by, say, your amazing credit score (which, let's be honest, might need a little help after that inflatable T-Rex idea), it’s backed by the equity you have in your home. Equity, for those who skipped that day in Econ 101, is the difference between what your home is worth and what you still owe on your mortgage. Think of it as the pot of gold at the end of the rainbow…a rainbow that leads directly to your house.

You get a line of credit, meaning you can borrow money, pay it back, and then borrow it again, all within a specific timeframe, known as the draw period. It's like having a never-ending piggy bank…a very serious, legally binding piggy bank with interest rates and fine print.

Why Would I Want One in Dexter, MO?

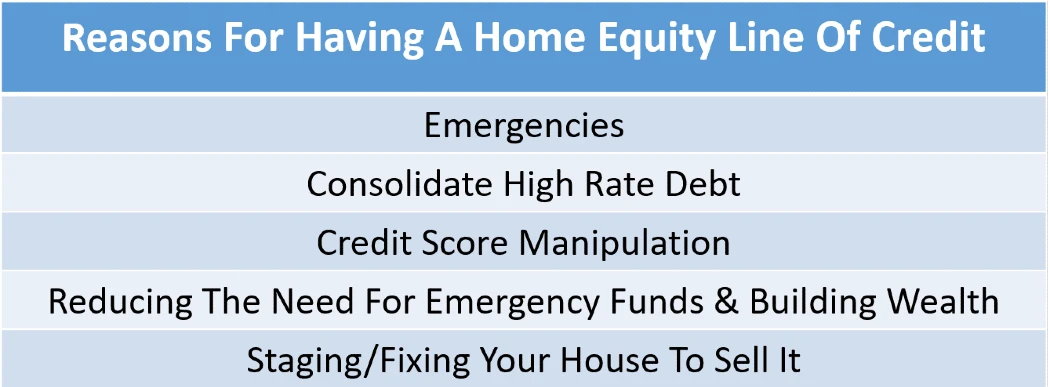

Okay, so inflatable dinosaurs aside, why would a Dexter resident actually consider a HELOC? Well, lots of reasons! Here are a few, presented with my signature blend of accuracy and slight exaggeration:

- Home Improvements: That leaky roof? The outdated kitchen that’s stuck in the 1970s? A HELOC can be your superhero, swooping in to finance those renovations and turn your house into a Pinterest-worthy paradise. Just try not to add too many gnome statues. Please.

- Debt Consolidation: Maybe you've got a pile of high-interest credit card debt looming over you like a menacing shadow. A HELOC, with its potentially lower interest rate, could help you consolidate those debts and breathe a little easier. It’s like herding all those unruly credit card sheep into one manageable pen.

- Unexpected Expenses: Life throws curveballs. Sometimes those curveballs are small, like a flat tire. Sometimes they’re big, like needing to replace your entire HVAC system in the middle of a Dexter summer. A HELOC can provide a financial cushion to soften the blow of those unexpected expenses. Think of it as your emergency fund that you didn't actually have to *save* for. Sort of.

- That Really, Really Big Fishing Boat: Hey, I’m not judging. Dexter is near some great fishing spots, and maybe you’ve always dreamed of owning a fishing boat the size of a small yacht. A HELOC could potentially help make that dream a reality. Just remember to invite me out for a ride!

The Nitty-Gritty: How Does it Actually Work?

Alright, let's dive into the slightly less humorous (but still important!) details.

The Application Process

Applying for a HELOC is similar to applying for a mortgage. You'll need to provide financial information, including:

- Proof of Income: Pay stubs, tax returns, the usual suspects. They want to make sure you can actually pay them back.

- Credit Score: Your credit score will play a big role in determining your interest rate and whether you get approved at all. So, maybe lay off the impulse purchases for a while before you apply.

- Home Appraisal: The lender will want to assess the value of your home to determine how much equity you have. Hopefully, your inflatable T-Rex hasn't depreciated the value *too* much.

Draw Period vs. Repayment Period

Remember that draw period I mentioned earlier? That's the time when you can borrow money from your HELOC. It typically lasts for 5 to 10 years. During the draw period, you usually only have to make interest payments on the amount you've borrowed.

Once the draw period ends, you enter the repayment period. This is when you start paying back the principal balance of your loan, in addition to the interest. The repayment period can last for another 10 to 20 years. So, buckle up, because you’re in it for the long haul.

Interest Rates

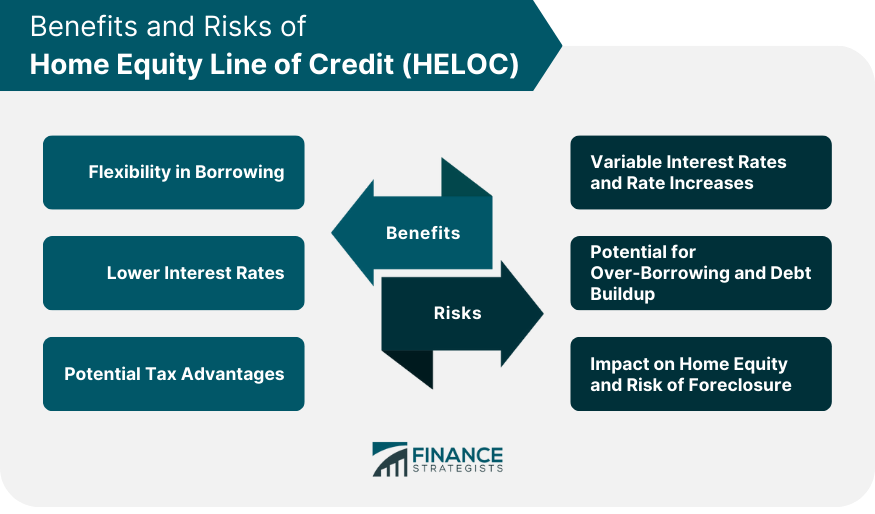

HELOCs usually have variable interest rates, meaning the rate can fluctuate based on market conditions. This can be a good thing (if rates go down) or a bad thing (if rates go up). It’s like riding a financial seesaw – sometimes you’re up, sometimes you’re down, and sometimes you feel slightly nauseous.

Keep an eye on the Prime Rate. This is a benchmark interest rate that many HELOCs are tied to. When the Prime Rate goes up, your HELOC interest rate will likely go up as well. So, become best friends with your local financial news provider!

The Fine Print: Things to Watch Out For

Like any financial product, HELOCs come with potential pitfalls. Here are a few things to keep in mind:

- Risk of Foreclosure: Since your home is used as collateral, you could lose your home if you can't repay the loan. So, don't go overboard with the inflatable dinosaurs!

- Variable Interest Rates: As mentioned earlier, those variable interest rates can be a double-edged sword. Make sure you can afford the payments even if the interest rate increases.

- Fees: HELOCs can come with various fees, such as application fees, annual fees, and early termination fees. Be sure to read the fine print and understand all the costs involved.

- Temptation: It’s easy to overspend when you have access to a large line of credit. Be disciplined and only borrow what you truly need. Don't use it to fund a trip to Branson to see Yakov Smirnoff. (Is he even still performing?).

Finding a HELOC in Dexter, MO

So, where can you find a HELOC in Dexter? Your best bet is to start by talking to your local banks and credit unions. Here are a few places to check out:

- First Midwest Bank of Dexter: A local bank with a personal touch.

- Southern Bank: Another reliable bank serving the Dexter community.

- Credit Unions: Don't forget to explore credit unions in the area. They often offer competitive rates and fees.

Talk to multiple lenders and compare their terms and conditions before making a decision. Don’t be afraid to ask questions! It's their job to explain everything clearly and in a way you understand. If they start speaking in complicated financial jargon, politely ask them to translate into plain English…or maybe even offer them some sweet tea. That usually works.

Is a HELOC Right for You?

Ultimately, the decision of whether or not to get a HELOC is a personal one. Consider your financial situation, your goals, and your risk tolerance. If you’re disciplined with your finances, need to finance a major project, and are comfortable with variable interest rates, a HELOC might be a good option for you.

But if you’re prone to impulse purchases (I’m still looking at you, giant inflatable T-Rex enthusiast), or if you’re not comfortable with the risk of potentially losing your home, then a HELOC might not be the right choice.

So, there you have it! A (hopefully) entertaining and informative overview of HELOCs in Dexter, Missouri. Now go forth, armed with knowledge, and make wise financial decisions. And maybe, just maybe, reconsider that inflatable T-Rex.

Disclaimer: I am not a financial advisor. This article is for informational purposes only and should not be considered financial advice. Consult with a qualified financial professional before making any financial decisions. And please, for the love of all that is holy, think twice before buying a second inflatable dinosaur.