Okay, so it's that time of year again, right? Mariah Carey is defrosting, tinsel is twinkling, and your bank account is… well, let's just say it's looking a little less festive than the rest of your house. We've all been there. The holiday season is magical, but it can also be a major strain on the wallet. So, you're wondering: "How can I get a loan for Christmas?" Let's dive into that! But first, let's be honest, is taking out a loan for Christmas really the best option? We'll cover that too.

Why Even Consider a Christmas Loan?

Before we jump into the "how," let's briefly touch on the "why." Look, there's no shame in admitting you need a little extra help. Maybe your family is bigger this year, or maybe unexpected expenses popped up. Perhaps you just want to make this Christmas extra special after a tough year. Whatever the reason, a loan can sometimes bridge the gap between your holiday dreams and your current financial reality. Think of it like a short-term energy boost for your Christmas cheer!

However, it's crucial to remember that loans aren't free money. They come with interest rates and repayment schedules. It's like borrowing your friend's car: you get to use it, but you have to fill it up with gas and return it in good condition! So, is a loan the only option? Absolutely not! Let's explore some alternatives before we get down to the loan specifics.

Alternatives to Christmas Loans: Think Outside the Box

Before you start applying for loans left and right, consider these alternatives. They might save you a lot of money and stress in the long run.

- Cut Back on Spending: This might seem obvious, but take a hard look at your Christmas list. Do you really need to buy everyone a super expensive gift? Could you bake cookies instead of buying them? Consider a Secret Santa or white elephant gift exchange to reduce the number of gifts you need to buy. It's like dieting for your wallet!

- Tap into Savings: Do you have a small emergency fund or a savings account you can dip into? While it's usually best to avoid touching your savings, a small withdrawal might be better than accruing interest on a loan. Think of it as using your rainy-day fund for a slightly less rainy day.

- Sell Unwanted Items: That old exercise bike gathering dust in the garage? That pile of clothes you haven't worn in years? Now's the time to declutter and sell those items online or at a consignment shop. It’s like turning trash into treasure!

- Negotiate Payment Plans: If you're buying from smaller businesses, ask if they offer payment plans. Many are willing to work with you, especially during the holiday season. It never hurts to ask!

- Delay Christmas: Okay, hear me out! What if you celebrated "Christmas in January" instead? You could take advantage of post-holiday sales and spread out your spending. It might not be traditional, but it could save you a ton of money. Plus, you'd have something to look forward to after the holiday rush!

Okay, I Still Need a Loan. What Are My Options?

Alright, so you've considered the alternatives and decided that a loan is the best option for your situation. Let's look at the different types of loans available and what to keep in mind.

Types of Christmas Loans: A Quick Overview

- Personal Loans: These are unsecured loans, meaning you don't need to put up any collateral (like your car or house). They typically have fixed interest rates and repayment terms. Personal loans are like the vanilla ice cream of loans: a solid, reliable choice.

- Credit Cards: Using a credit card for Christmas expenses can be tempting, but be careful! Interest rates on credit cards are usually much higher than personal loans. Only use a credit card if you're confident you can pay it off quickly. Think of it as a high-risk, high-reward strategy.

- Payday Loans: Avoid these like the plague! Payday loans have incredibly high interest rates and fees, making them a very expensive option. They're like a tempting candy bar that gives you a massive sugar rush followed by a terrible crash.

- Secured Loans: These loans require you to put up collateral, such as your car or home. While they might have lower interest rates than unsecured loans, you risk losing your asset if you can't repay the loan. It’s like betting your house on a game of poker – risky business!

- Borrowing from Family or Friends: This can be a good option if you have a supportive network. Just make sure to treat it like a formal loan agreement, with clear terms and repayment schedules, to avoid damaging relationships. Think of it as borrowing from a bank, but with potentially lower interest rates and more flexible terms.

Key Considerations When Applying for a Christmas Loan

Before you sign on the dotted line, keep these factors in mind:

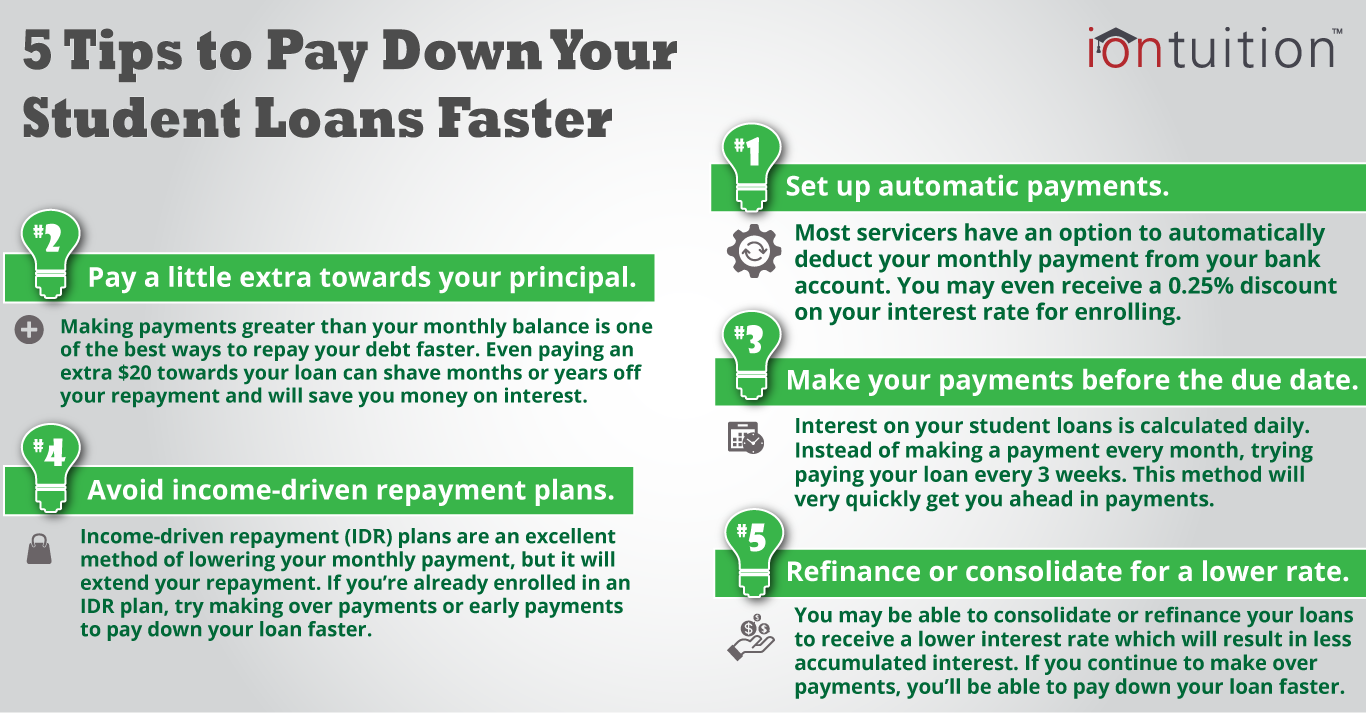

- Interest Rates: Compare interest rates from different lenders. Even a small difference in the interest rate can save you a significant amount of money over the life of the loan. It's like shopping for the best price on groceries – every penny counts!

- Fees: Look out for origination fees, prepayment penalties, and other hidden fees. These fees can add up and make the loan more expensive than it initially appears.

- Repayment Terms: Choose a repayment term that you can comfortably afford. A longer repayment term will result in lower monthly payments, but you'll pay more interest overall. A shorter repayment term will result in higher monthly payments, but you'll pay less interest overall.

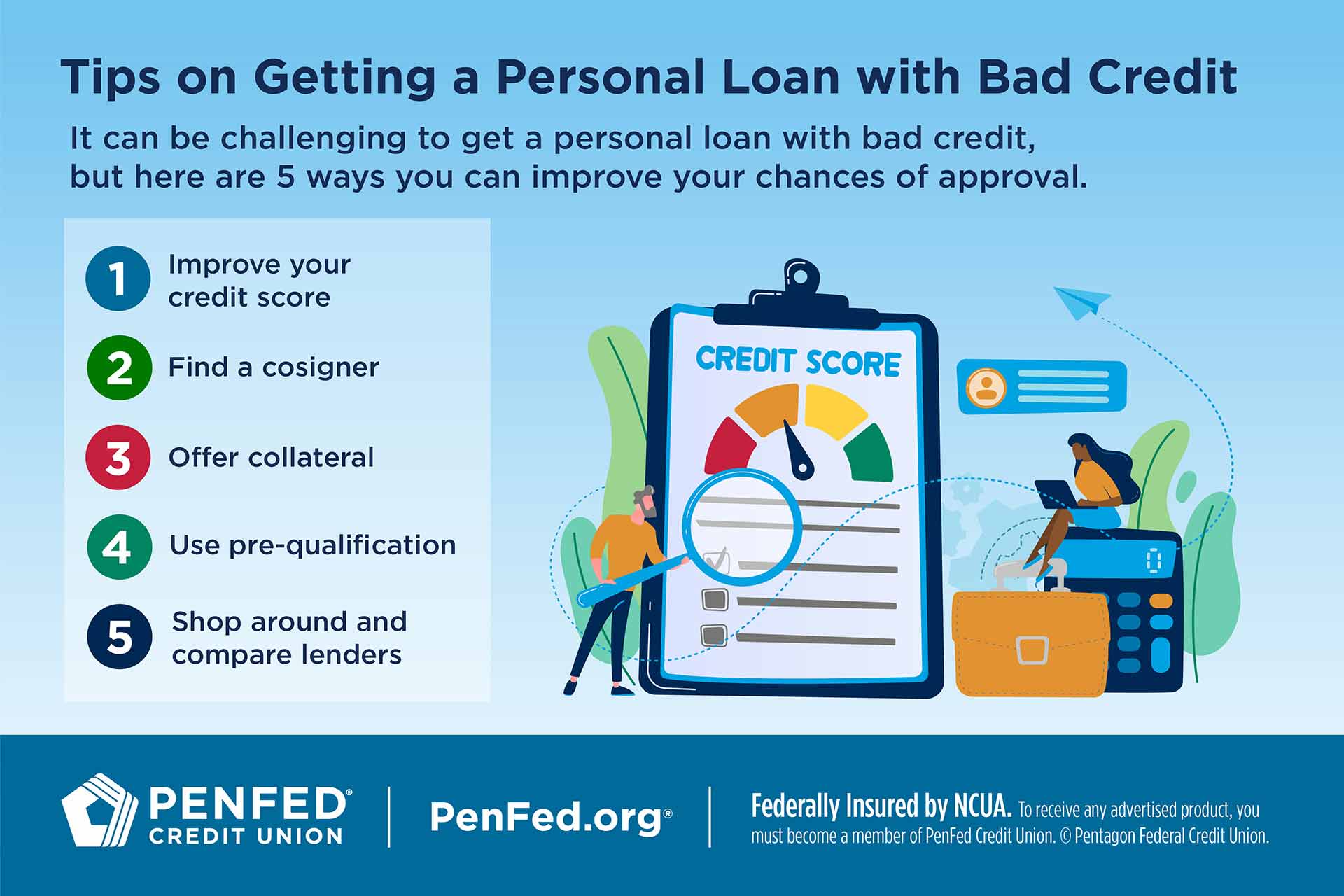

- Your Credit Score: Your credit score plays a major role in determining your eligibility for a loan and the interest rate you'll receive. The higher your credit score, the better your chances of getting approved for a loan with a low interest rate. Check your credit score before applying for a loan so you know where you stand.

- Lender Reputation: Research the lender before applying for a loan. Read online reviews and check with the Better Business Bureau to make sure they're reputable and trustworthy.

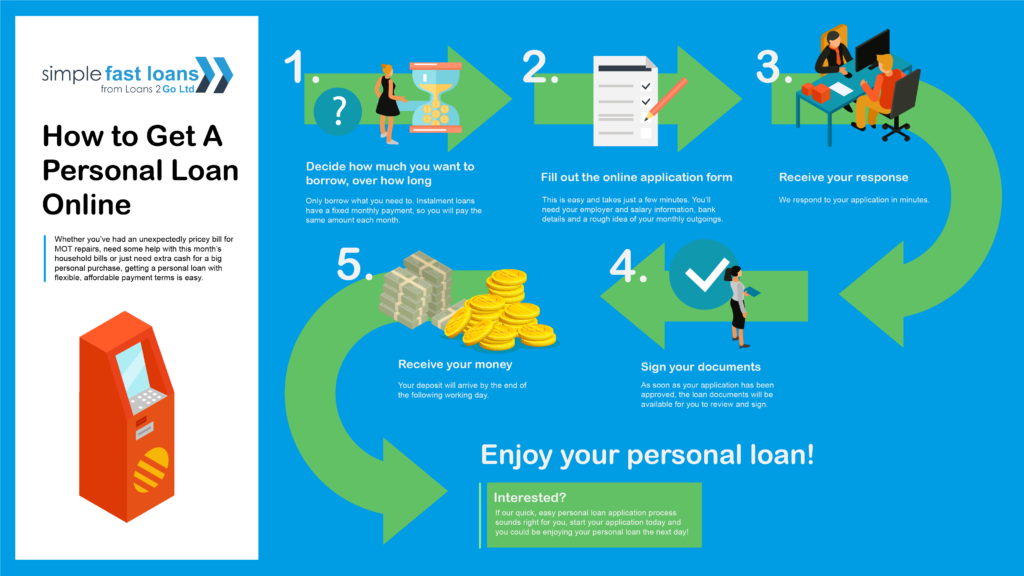

The Application Process: What to Expect

Once you've chosen a loan and a lender, you'll need to gather some information and complete the application process. Here's what you can typically expect:

- Gather Your Documents: You'll typically need to provide proof of income (pay stubs, tax returns), identification (driver's license, passport), and bank statements.

- Complete the Application: Fill out the application form accurately and honestly. Be prepared to answer questions about your employment history, income, and expenses.

- Submit Your Application: Submit your application online or in person.

- Wait for Approval: The lender will review your application and make a decision. This process can take anywhere from a few hours to a few days.

- Review the Loan Agreement: If your application is approved, the lender will send you a loan agreement. Read it carefully before signing it. Make sure you understand the interest rate, fees, repayment terms, and any other conditions.

- Receive Your Funds: Once you sign the loan agreement, the lender will deposit the funds into your bank account.

A Word of Caution: Responsible Borrowing

Taking out a loan for Christmas can be a helpful solution, but it's essential to borrow responsibly. Don't borrow more than you can afford to repay. Create a budget and track your spending to make sure you're on track to meet your repayment obligations. And remember, Christmas is about more than just gifts. It's about spending time with loved ones and creating lasting memories. Don't let debt ruin your holiday cheer!

So, there you have it! A comprehensive guide to getting a loan for Christmas. Remember to weigh your options carefully, consider the alternatives, and borrow responsibly. Happy holidays!